Zydus Lifesciences || Consistently Performing Stocks #51

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI RA. The primary objective of this post is to understand how the business has been able to perform consistently over the years. This is an educational post and not a recommendation to buy the stock.

Let’s explore the business and fundamentals of Zydus Lifesciences.

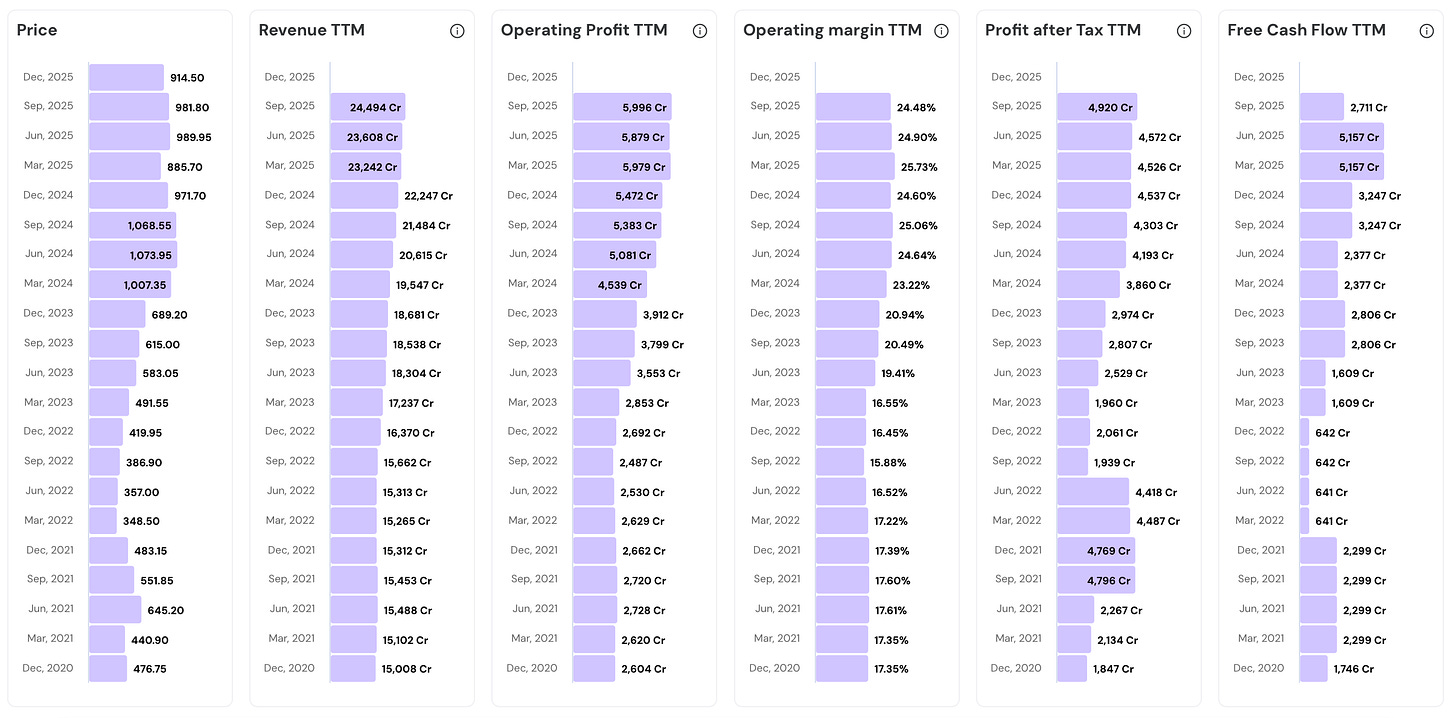

In the last 5 years…

- Stock price has grown 1.9 times (from 476.75 to 914.50)

- Revenue has grown 1.6 times (from 15,008 Cr to 24,494 Cr)

- Operating profit has grown 2.3 times (from 2,604 Cr to 5,996 Cr)

- PAT has surged 2.7 times (from 1,847 Cr to 4,920 Cr)

Take a look at the numbers below. Incredible Consistency.Their Road to Consistency

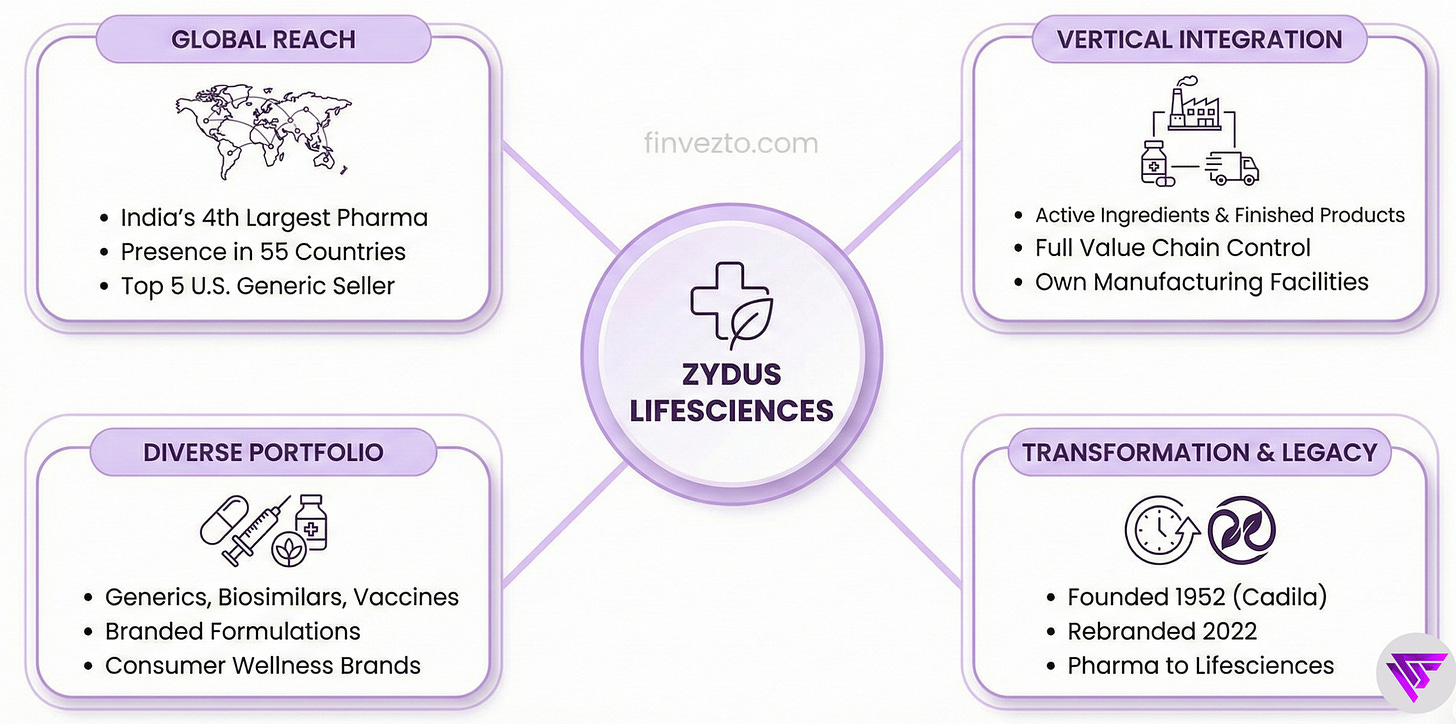

1. Company Overview & Business Model

Zydus Lifesciences makes medicines and health products spanning generics, branded formulations, biosimilars, vaccines, and consumer wellness brands. It ranks as India’s 4th largest pharma company and the 5th largest generic drug seller in the U.S by prescriptions dispensed.

Unlike most competitors, it manufactures both the active ingredients and finished products in its own facilities across multiple countries. Vertically integrated.

Revenue comes from selling these products to patients through doctors, hospitals, pharmacies, and retail channels in 55 countries.

Founded in 1952 in Ahmedabad, the company rebranded from Cadila Healthcare in 2022 to signal its transformation from a traditional pharma to a lifesciences company.

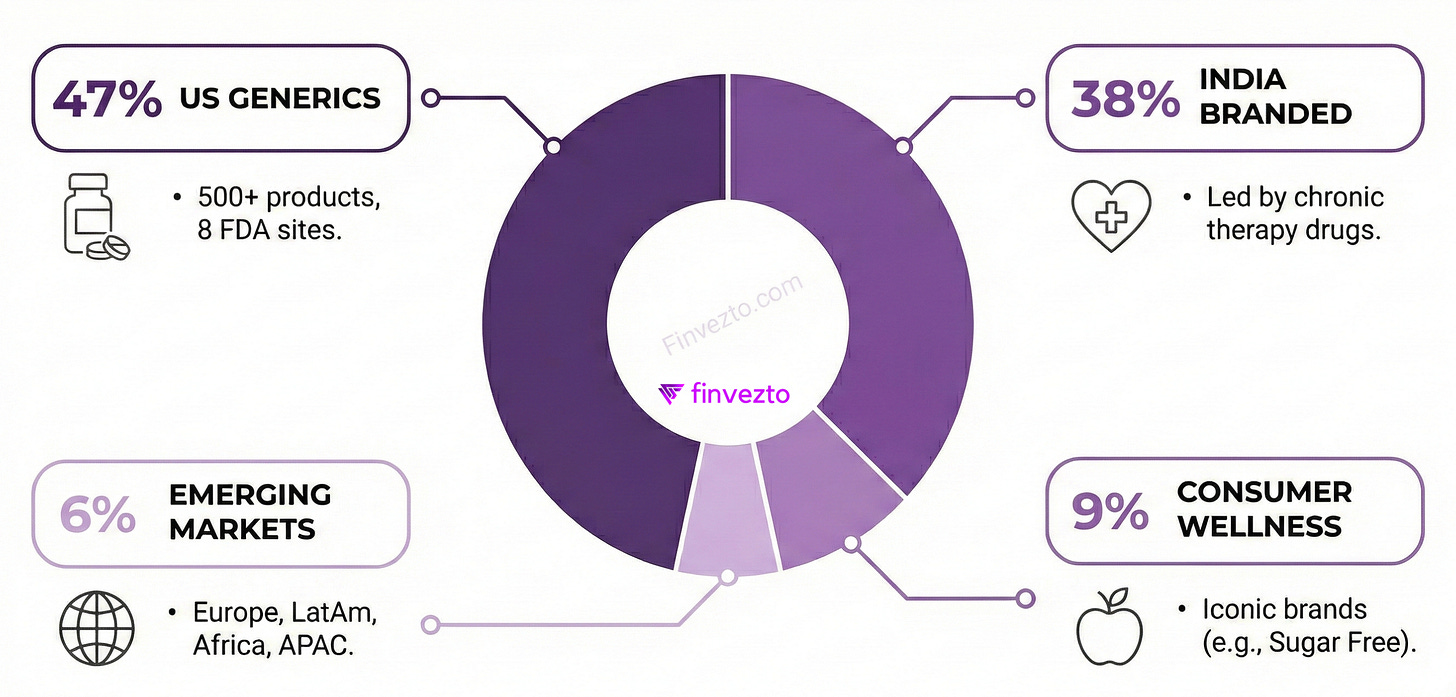

Revenue Mix

US generics contribute ~47% of revenue, selling over 500 products through eight FDA-approved manufacturing sites. Nearly half the business.

India branded formulations account for ~38% of revenue, led by chronic therapy drugs in cardiovascular, diabetology, and women’s health. The home advantage.

The consumer wellness subsidiary Zydus Wellness owns iconic brands like Sugar Free and Glucon-D, contributing ~9% of revenue. Household names.

Emerging markets across Europe, Latin America, Africa, and Asia-Pacific add another 6%. A well-diversified portfolio across geographies and products.

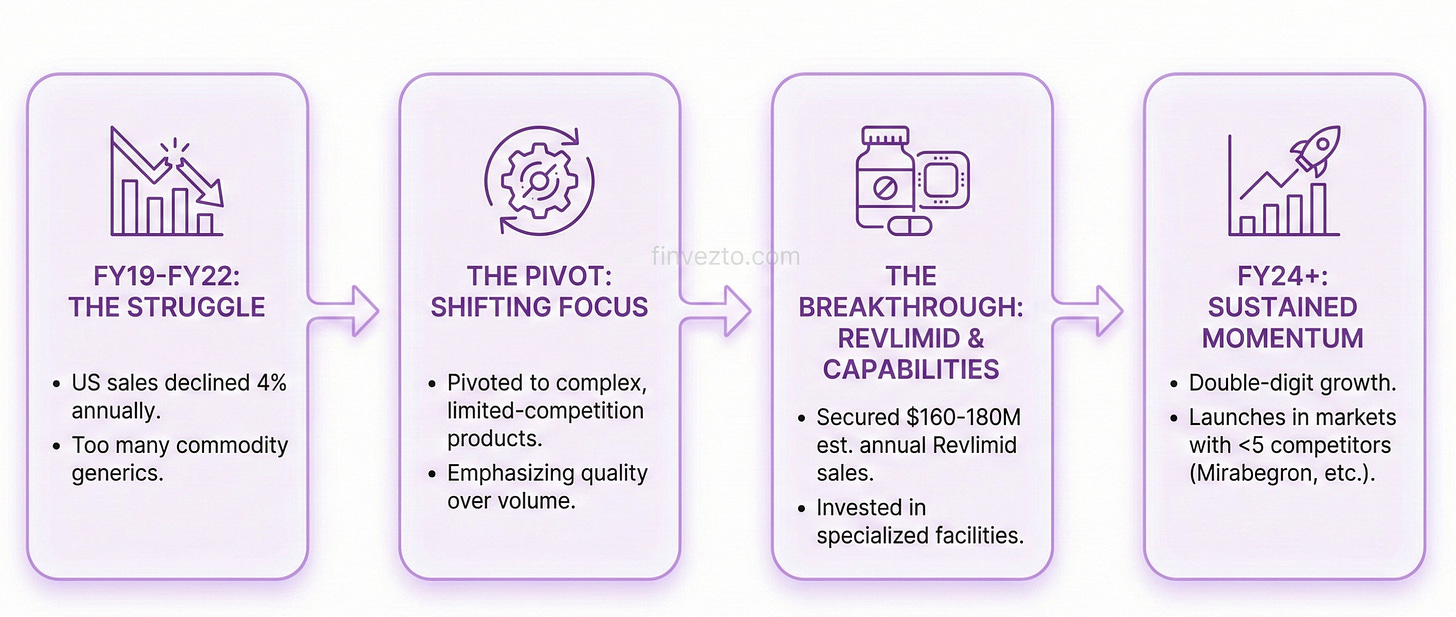

2. The U.S Turnaround

Zydus turned its struggling US operations into a consistent growth driver. How bad was it? Between FY19 and FY22, US sales declined at a 4% annual rate. Management responded by pivoting away from commoditized generics toward complex, limited-competition products. This shift delivered double-digit growth in FY24 and established consistent contribution to overall revenue.

The Revlimid Breakthrough

Zydus won FDA approval to sell generic Revlimid, a vital cancer drug with $12.8 billion in peak US sales. The real win? Helping more patients access life-saving treatment without the crushing financial burden.

Zydus secured a limited volume agreement, generating estimated sales of $160-180 million annually.

The Revlimid win demonstrated the company’s ability to navigate complex patent settlements and capture high-value opportunities.

What did this prove? That Zydus could play in the big leagues.

Handling the Complexities

Transdermal patches, injectable drugs, and modified-release formulations require specialized facilities and development expertise. Not easy.

Zydus invested heavily in these capabilities, filing applications for products where only a few competitors can meet quality standards. This approach sacrifices volume for margin. A deliberate choice.

Recent Momentum

Zydus launched generic Mirabegron in April 2024, entering a billion-dollar market in US. The first domino.

It followed with generic Enzalutamide for prostate cancer and generic Glatiramer for multiple sclerosis.

Each launch targeted markets where fewer than 5 competitors existed at entry. See the pattern? This reveals a disciplined focus on profitable launches.

3. India Formulations growth

India contributes ~40% of Zydus revenue through prescription drugs sold to doctors and hospitals. The domestic business grew 9% in Q2FY26, outpacing the overall pharmaceutical market. What’s driving this? This outperformance stems from a deliberate portfolio shift toward chronic diseases requiring lifelong treatment.

The Chronic Therapy Bet

Chronic therapy drugs now represent 44.5% of Indian sales, up from 39% over three years. A steady climb.

Cardiovascular medicines, diabetes treatments, and respiratory drugs generate recurring prescriptions for years.

Here is the reality: A patient starting blood pressure medication at age 45 may need it for the rest of their life. This creates stable revenue for Zydus, yes. But more importantly, it means being there for patients through their entire health journey.

The Ground Game

Zydus fields approximately 7,500 medical representatives who visit doctors across India. On the ground, every day.

Management added 600-700 representatives recently to expand reach into smaller cities and towns.

Each representative carries a focused portfolio of 20-25 flagship brands, allowing deep physician relationships rather than scattered promotion across hundreds of products. Quality over quantity.

The Power Brands

9 Zydus brands generate over ₹100Cr in annual sales each. Blockbusters at home.

Lipaglyn, India’s first domestically developed novel drug, treats diabetic patients with abnormal cholesterol. It has helped over 1.5 million patients since launch.

The company ranks first in nephrology specialty drugs. Also, the fastest growing company in oncology among Indian pharma companies.

First-mover advantage in chronic categories creates prescription habits that competitors struggle to displace. Once a doctor trusts your product for their patient’s lifelong treatment, that’s loyalty money can’t easily buy.

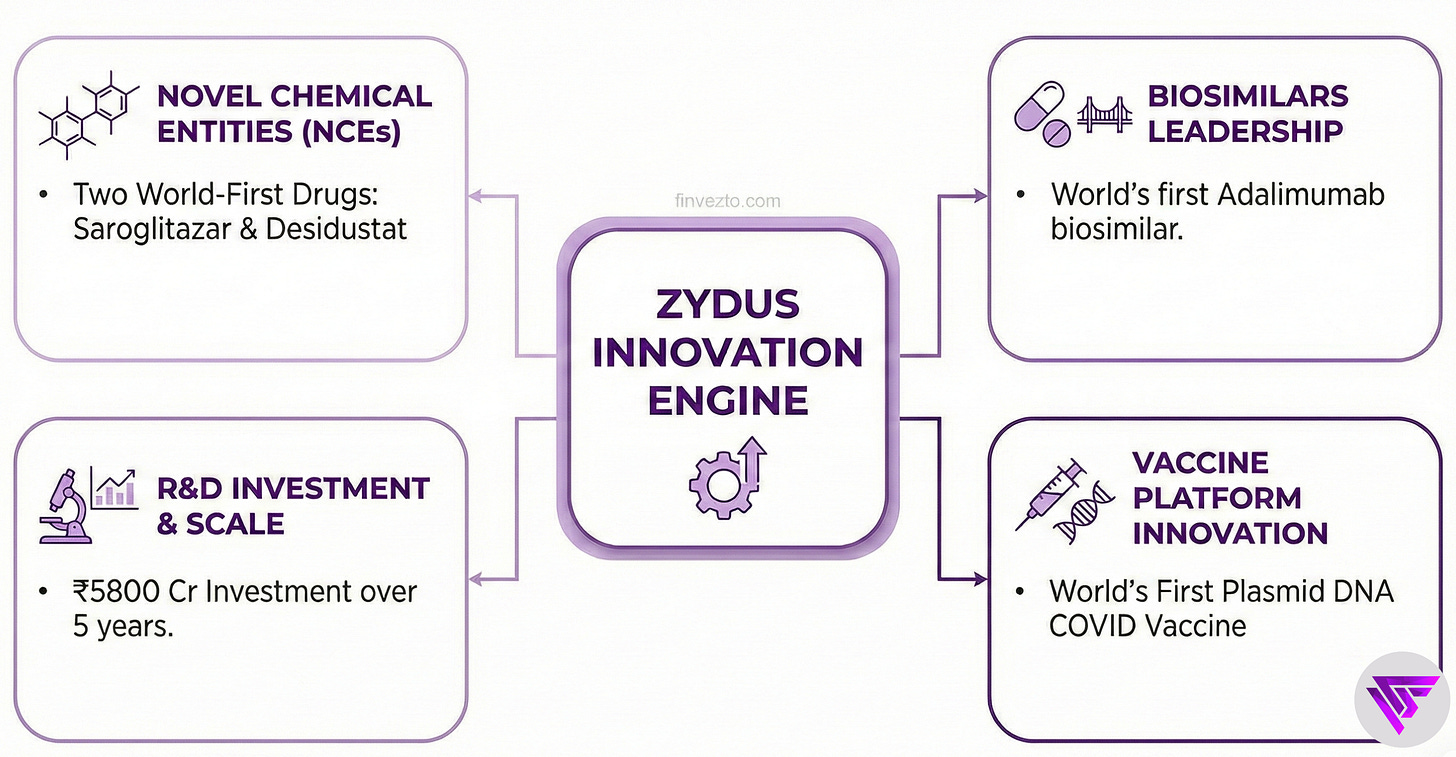

4. Innovation Engine

Zydus is the first Indian pharma company to bring 2 novel chemical entities from laboratory to market. Saroglitazar launched in 2013 as the world’s first drug approved specifically for diabetic dyslipidemia. Desidustat followed in 2022 as India’s first oral treatment for anemia in kidney disease patients. These achievements required over a decade of research investment with no guarantee of success. Pure persistence.

The company employs 1,500 scientists across 19 research sites.

Zydus Research Centre spans 475,000 square feet dedicated to drug discovery.

Investment runs at approximately 7% of revenue annually, totaling ₹5800 Cr over five years. Why this commitment? Zydus builds proprietary medicine.

Biosimilars represent the bridge between generic commodity drugs and expensive innovation. The smart middle ground. Zydus launched the world’s first adalimumab biosimilar in 2014 at one-fifth the originator price.

It subsequently launched biosimilars of trastuzumab, bevacizumab, and the first antibody-drug conjugate biosimilar globally. World firsts, repeatedly.

The vaccine platform produced ZyCoV-D, the world’s first plasmid DNA vaccine for COVID-19. This technology can adapt to future pathogens quickly.

Their rabies vaccine won WHO prequalification for global procurement.

5. Manufacturing Scale

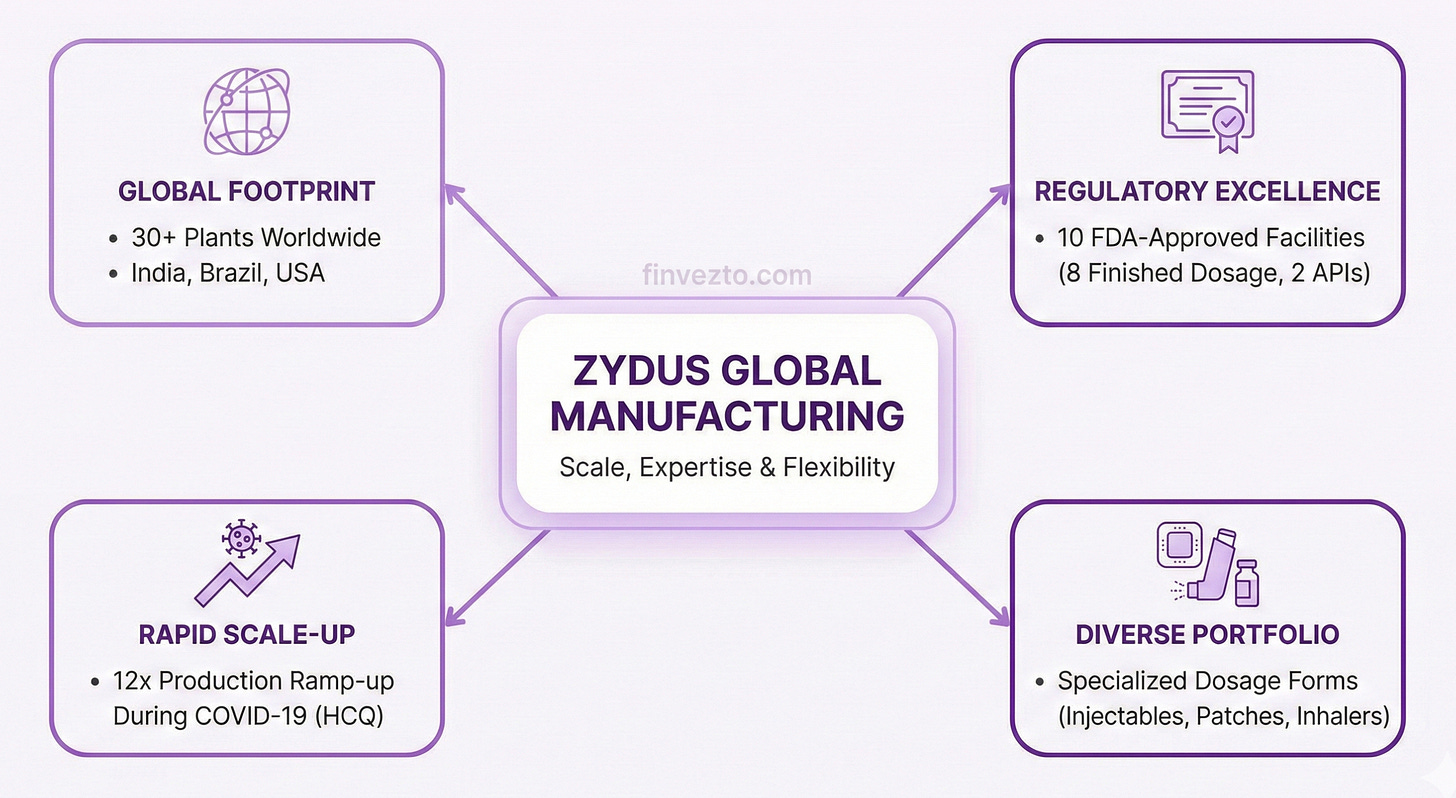

Zydus operates over 30 manufacturing plants worldwide across India, Brazil, and the United States. A global footprint. 8 facilities hold FDA approval for finished dosage forms. 2 additional plants manufacture APIs with FDA certification. This infrastructure required decades of investment.

During COVID-19, Zydus was one of only two Indian companies capable of manufacturing hydroxychloroquine with fully backward-integrated supply chains. When the world needed it most.

The company ramped production from 4 metric tons to 50 metric tons monthly when needed. A 12x scale-up. This flexibility proves valuable during supply disruptions.

Manufacturing diversity spans dosage forms. How diverse? Transdermal patches, sterile injectables, topical creams, respiratory inhalers, and oncology drugs each require specialized facilities and expertise.

Regulatory barriers compound complexity because each facility needs separate approval from authorities in different countries.

The January 2026 acquisition of Agenus biologics facilities in California expanded capabilities significantly. A strategic move.

Zylidac Bio now provides contract manufacturing services for other pharmaceutical companies developing biological drugs.

The timing aligns with the BIOSECURE Act requiring domestic US manufacturing for certain government contracts. Right place, right time.

6. Partnerships

Strategic licensing agreements allow Zydus to sell products it did not develop. Why reinvent the wheel? The Synthon partnership provides exclusive US rights to generic Palbociclib, a major breast cancer drug where Synthon holds first-to-file status. The MSN agreement delivers generic Cabozantinib for oncology. These deals add revenue streams without R&D spending. Smart leverage.

Biosimilar partnerships accelerate market entry in the United States. Speed matters.

The December 2025 Formycon agreement grants exclusive North American rights to a Keytruda biosimilar, the world’s best-selling cancer drug.

The Bioeq partnership brings an interchangeable Lucentis biosimilar to the US ophthalmology market. Both require only licensing payments rather than decade-long development programs. Years of development, avoided.

Beihai Biotech contributed BEIZRAY, the first and only FDA-approved albumin-solubilized docetaxel injection for cancer. Another first.

Management maintains discipline in partner selection. How selective? Each agreement must offer either exclusive market position, limited competition dynamics, or proprietary technology access.

Selectivity preserves margins.

7. Geographic Expansion

Emerging markets and Europe contributed 39% revenue growth in Q2FY26. Strong performance. This segment includes Latin America, Africa, Asia-Pacific, and European operations outside the UK. Diversification protects against regulatory or pricing challenges in any single country.

Sri Lanka demonstrates what focused effort achieves. Zydus holds the number one position with 7.4% market share.

Success in Sri Lanka came from adapting product portfolios to local disease patterns and building distribution relationships over years. The playbook translates to other small markets. Replicable strategy.

Brazil operations date to 2007 when Zydus acquired Nikkho Pharmaceuticals. Nearly two decades of presence.

France and Spain contribute through acquired operations that provide established distribution networks.

Each market required patient investment before generating returns. No shortcuts taken.

The October 2025 acquisition of Amplitude Surgical in France expanded medical technology presence for 257 million euros. This orthopedics company diversifies revenue beyond pharmaceuticals entirely. A bold step outside the core.

Consumer wellness international expansion began in 2024 with the UK acquisition of Comfort Click Limited.

Management targets 8-10% of wellness revenue from international markets within five years.

The same distribution capabilities selling pharmaceuticals can carry consumer products, creating operating leverage. Why does this matter? One network, multiple revenue streams.

8. Consumer Wellness Subsidiary

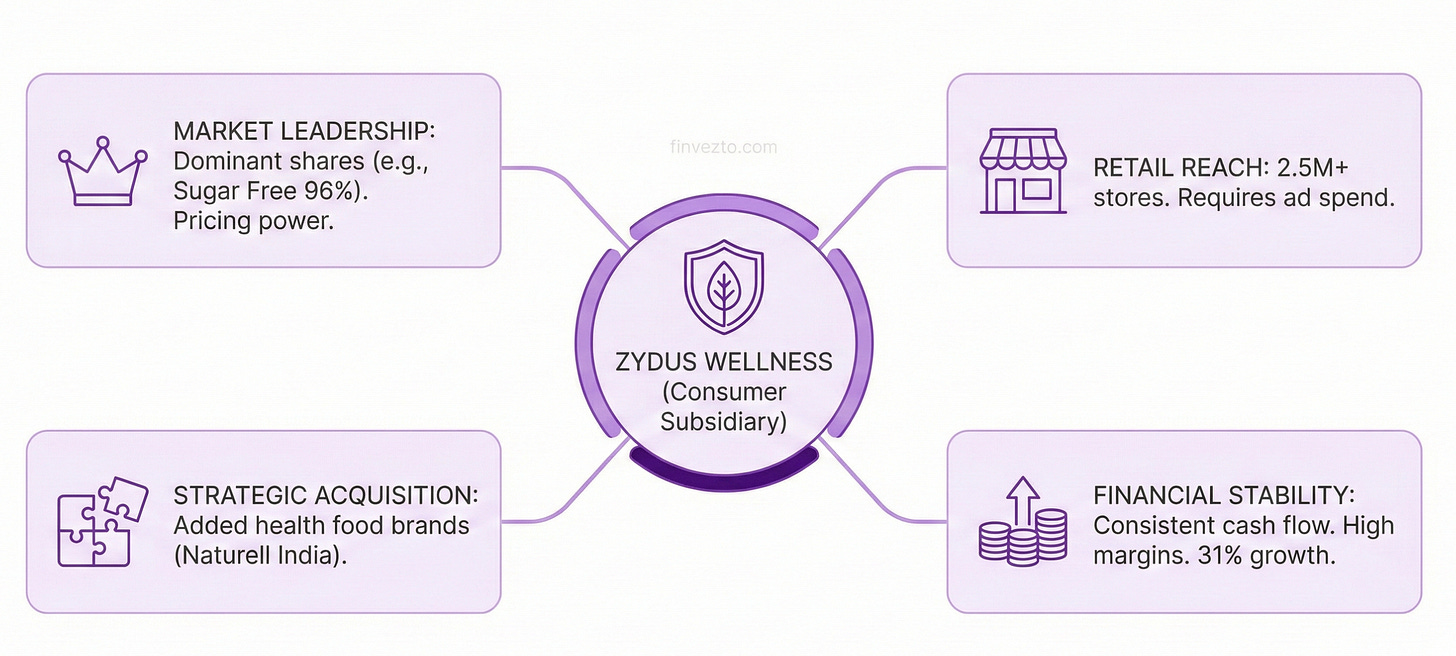

Zydus Wellness operates as a separately listed subsidiary of Zydus Lifesciences generating ~9% of group revenue. The business sells consumer products through retail stores rather than prescriptions through doctors. A completely different playbook.

Market share positions define competitive strength. Sugar Free commands 95.9% of the sugar substitute category. Near monopoly. Glucon-D holds 59.5% of glucose powder sales. Nycil maintains 35% of prickly heat powder volume. Everyuth dominates facial peel-off products with 80.2% share. Category leadership enables pricing power.

Brand building follows different rules than pharmaceutical marketing. Completely different.

Consumer products require advertising spend to maintain awareness. Constant visibility matters.

Distribution must reach over 2.5 million retail stores across India.

The November 2024 acquisition of Naturell India for 390 crore rupees added health food brands to the portfolio.

The business provides consistent cash flows regardless of pharmaceutical industry dynamics. Drug pricing reforms, generic competition intensity, and regulatory inspections do not affect consumer product performance.

This stability supports overall group financial planning.

Wellness also offers higher margins on certain products than commoditized generic drugs. Better economics.

The segment grew 31% in the Q2FY26. Momentum accelerating.

9. Management Vision

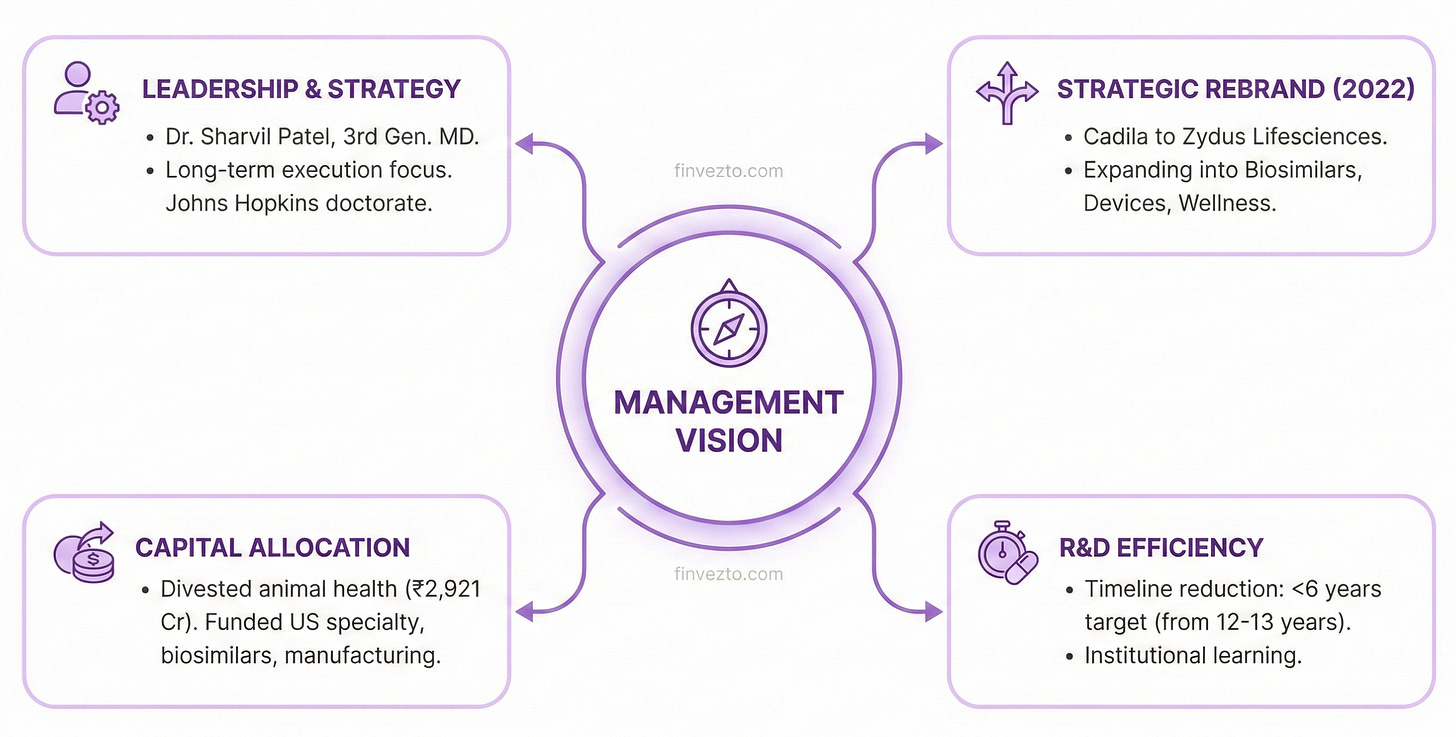

Dr. Sharvil Patel leads Zydus as Managing Director, representing third-generation family ownership. His credentials include a doctorate from Johns Hopkins researching breast cancer. What does this bring? Leadership continuity allows long-term strategy execution. Not chasing quarterly results.

The 2022 rebrand from Cadila Healthcare to Zydus Lifesciences signaled strategic intent.

The company would expand beyond traditional pharmaceuticals into biosimilars, medical devices, diagnostics, and wellness.

Each segment serves patients differently but leverages shared capabilities. The ecosystem approach.

Capital allocation reflects stated priorities. The company divested its animal health business in 2021 for 2,921 crore rupees, exiting a segment peripheral to its core.

Proceeds from above sale funded investments in US specialty pharmaceuticals, biosimilar partnerships, and manufacturing upgrades. Portfolio pruning matches expansion.

R&D timelines demonstrate execution improvement. The first novel drug required 12-13 years from laboratory to market approval. Management expects subsequent drugs to reach patients in under 6 years. Cut in half.

Learning compounds over time as teams develop institutional knowledge.

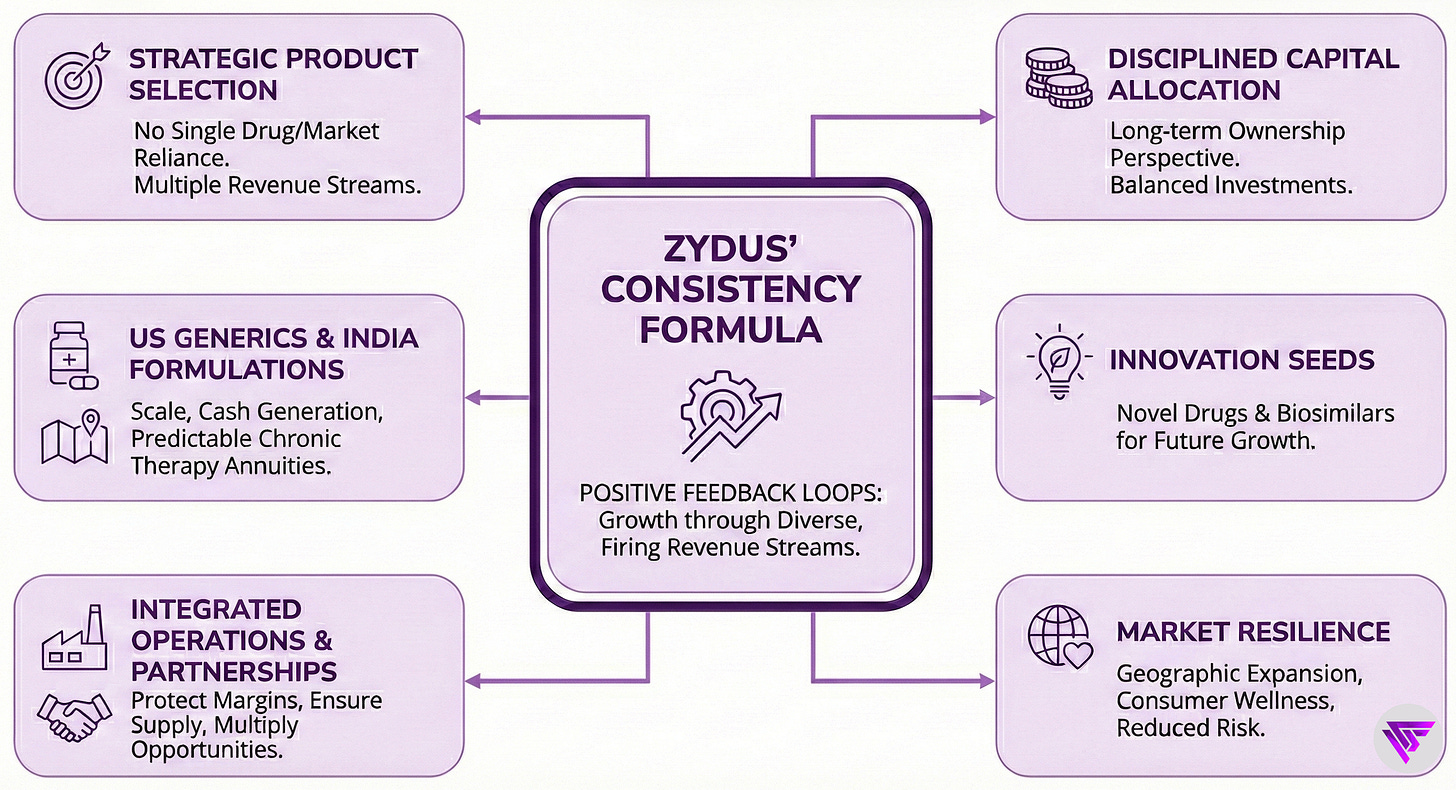

10. Summary: Their Consistency Formula

Zydus Lifesciences delivers consistent growth through strategic product selection and disciplined capital allocation. The company does not rely on any single drug or market. Instead, multiple revenue streams fire in sequence based on their respective growth cycles.

US generics provide scale and cash generation through limited-competition launches. The cash engine.

India formulations deliver predictable chronic therapy annuities through prescription loyalty. Sticky revenue.

Innovation spending seeds future growth through novel drugs and biosimilars. Planting tomorrow’s harvest.

Manufacturing integration protects margins and ensures supply reliability.

Partnerships multiply opportunities without proportional capital commitment. Leverage, not just ownership.

Consumer brands leverage pharmaceutical distribution infrastructure. Also, stabilizes results across industry cycles. The shock absorber.

Management executes the portfolio with long-term ownership perspective.

The system creates positive feedback loops. Each strength reinforces the others.

That’s it for today.

FINVEZTO.COM | Build Wealth. With Clarity.

We give you a proven Flexi-Wealth System to build a Resilient Portfolio that works across market cycles. We believe your Wealth should be flexible enough to give you more options throughout your life. Learn more about the system at finvezto.com

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

Solid breakdown of Zydus's business model. The pivot from commoditized generics to limited-competition products in the US market shows sharp strategic thinking. I find it intresing how vertically integrated manufacturing gives them flexiblity during supply disruptions, which most pharma companies struggle with.