Weekly Stock Market Digest & Nifty Analysis for Dec 04-08, 2023

A comprehensive weekly round-up of what happened last week in the Indian Stock Market and outlook for upcoming week.

What happened last week?

Global Markets had a positive week with Hong Kong being the only exception.

Nifty achieved a new all time high last week, marking the fifth consecutive week of gains (Last 5 Candles are green candles below).

All Broad Market Indices ended in green. Nifty Next 50 led the pack with a gain of 4% last week.

All sectors ended in green as well. So we are seeing a positive momentum across both broad market indices and sectoral indices.

FIIs continued as net buyers in the cash market for five consecutive sessions, supported by successful IPO listings of Tata Tech and 3 others.

FIIs bought for ₹10600 Cr in the cash market. DIIs were also net buyers purchasing ₹4500 Cr.

India's GDP grew by 7.6% YoY in Q2 FY24, exceeding both the consensus estimate of 6.8% and RBI's forecast of 6.5%, demonstrating robust growth.

S&P Global India Manufacturing Purchasing Managers’ Index for November rose to 56 compared to the previous month's eight-month low of 55.5.

Positive global cues, robust GDP data from the US and India, increased FII investments in both Indian Stocks and Bonds, a decrease in bond yields and a decrease in the dollar index might have contributed to the overall positive sentiment.'

RBI's Monetary Policy Committee meeting from 6th to 8th December gains significance, particularly the discussion on future interest rates in the light of a strong GDP performance.

The upcoming outcome of the recently held elections in 5 states, with counting scheduled today (3rd December), might have an impact on the markets in the coming week.

So quite a few important events lined up for the coming week.

India VIX has also shot up last week from 10.96 to almost 12.5 levels and rightly so. Participants are expecting relatively more volatility in the upcoming days.

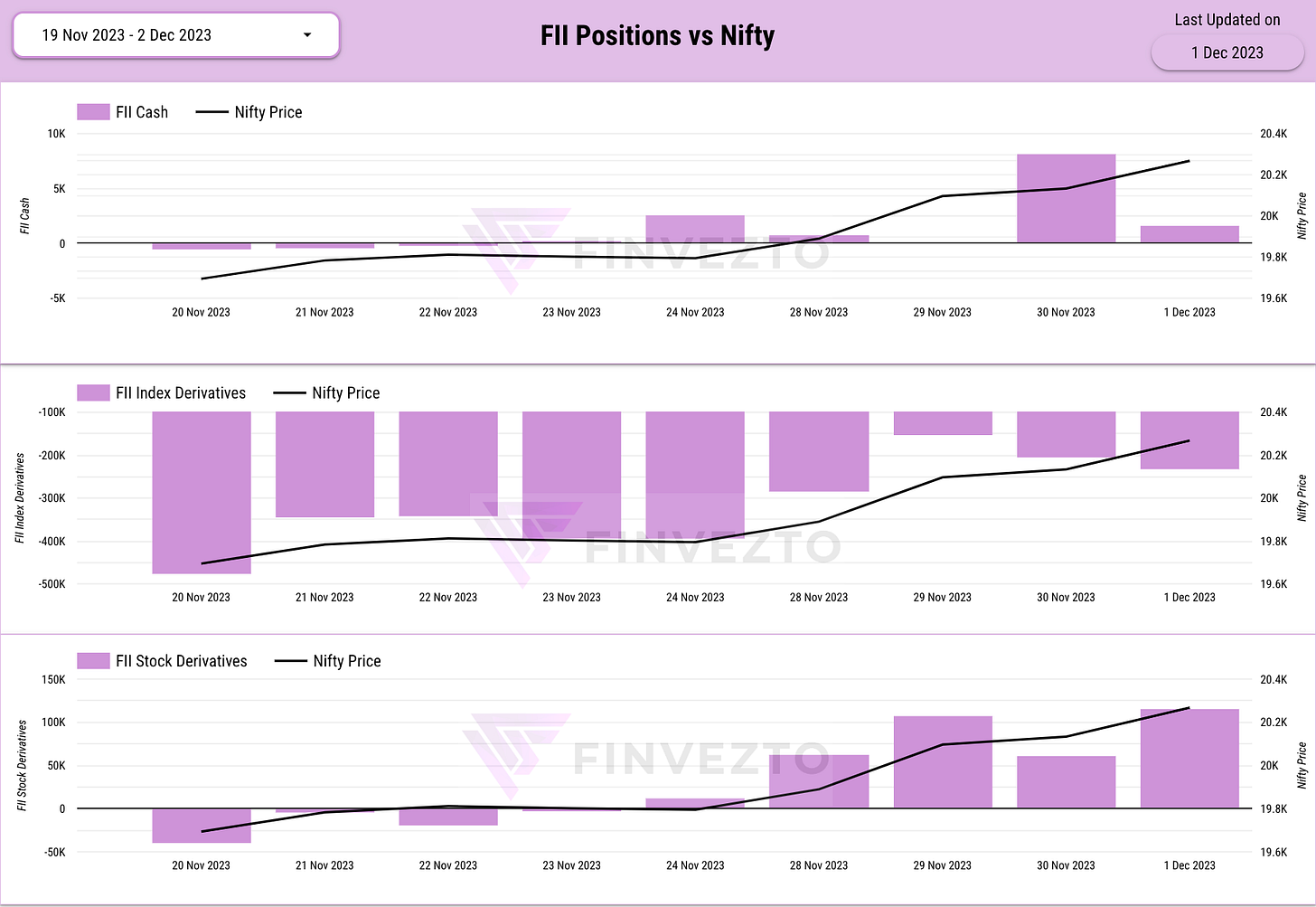

Let us now move on to FII Derivatives Positions Analysis.

FII Positions Analysis

FIIs have turned net buyers in the cash market.

FIIs have significantly reduced their short positions in the Index Derivatives segment.

FIIs have built long positions in the Stock Derivatives segment.

Overall FII sentiment has turned bullish over the last week.

Nifty Analysis

More PUTs have been added compared to CALLs near the ATM Strikes.

Maximum PUT addition has happened at 20200 indicating that participants expectations of Nifty not closing below 20200 in the upcoming week (This view is based on current OI positions. They keep changing over the week).

CALLs have also been closed at 20000 and 20100 levels indicating bullishness.

Nifty Max Pain has also been in an uptrend. Max Pain is a quick indicator to identify the direction of sentiment. Below is the graph of weekly max pain of Nifty. You can see that price and Max Pain - both have gone up in the last week.

Nifty Closed at all time high last week. Both Momentum and Sentiment look Bullish. To know more about key levels and how to interpret them, please check this link.

Let us now move on to business related announcements.

Key Stock Announcements from Last Week

New Orders, Deals & Projects

ITD Cementation India secured a contract of approximately Rs 1,001 crore for Civil & Hydro-Mechanical Works of a 500 MW Hydel Power, Pumped Storage Project.

Power Grid Corp secures bids for two interstate transmission projects in Rajasthan under build-operate-transfer basis.

NCC Limited got ₹553.48 Crores orders for its Building Division from a private agency, to be executed within 14 months without related party transactions.

H G Infra Engineering's arm secures a Rs 1,303.11 crore order from NHAI for Varanasi-Ranchi-Kolkata highway construction.

Salasar Techno Engineering secured a ₹364 Cr from TANGEDCO for loss reduction work in Tamil Nadu within 36 months.

Capacit'e Infraprojects bagged a ₹101 Crore order from Tridhaatu for Aranya Phase-II project with a temporary closure of trading window.

Tata Power Renewable Energy gets LOA for a 200 MW firm renewable energy project with SJVN.

BLS International Services won a three-year contract from UIDAI for data quality checks on Aadhaar, potentially generating INR 50 Crores.

Aarvi Encon Limited received a contract of Rs. 43.77 crores for recruitment services and temporary staff supply starting January 1, 2024, from an undisclosed multinational engineering client.

Goldiam International secured orders worth Rs. 20 crores for diamond-studded gold and lab-grown diamond jewelry, to be fulfilled internationally by December 31, 2023.

Integra Essentia got orders worth over INR 12 Crore for dry fruits and infrastructure materials, targeting 15-20% growth by March 2024.

Vaishali Pharma got a USD 8,00,000 (INR 664 Lakhs) order from Africa, with half the amount received in advance, to be executed in the financial year 2024.

Business Updates

Tata Consultancy Services (TCS) initiated an AWS generative AI practice, empowering clients to optimize AI and AWS services.

Maruti Suzuki plans car price hike in January 2024 due to inflation and increased commodity costs.

JK Cement's Ujjain unit starts a 1.5MTPA cement grinding unit at a new facility in Madhya Pradesh.

Eicher Motors launches the all-new Himalayan adventure tourer, available for bookings in India and Europe.

Avenue Supermarts opens a new store in Nizampet, Telangana, expanding its total store count to 339.

Biocon Biologics completes integration of Viatris' biosimilar business across 31 European countries, acquired last year.

Siemens invests Rs 416 crore in expanding power transformer and vacuum interrupter capacity.

PCBL gets board approval for Aquapharm Chemicals acquisition, venturing into global specialty chemical segments.

UltraTech Cement acquires Burnpur Cement's 0.54 mtpa grinding assets at Patratu, Jharkhand, marking its entry into the region.

Tata Coffee approves Rs 450 crore investment for capacity expansion in its Vietnam-based subsidiary.

PVR Inox aims to open 150 screens with a Rs 500 crore investment in the coming fiscal year.

Partnerships, Collaborations & Acquisitions

UltraTech Cement acquires Kesoram Industries' cement business in a share-swap deal, offering Rs 173.15 per share, valuing the deal at Rs 7,600 crore, including assumed debt.

LTIMindtree partners with Metasphere to scale smart sewer management.

JSW Group forms a joint venture with SAIC Motor Corp. Ltd for electric vehicles, aiming for a 35% stake initially, with plans to become the majority shareholder in two years.

Infosys collaborates with Shell on sustainability-focused immersion cooling services for data centers.

BHEL and Electricité de France sign MoC to maximize local content in Jaitapur nuclear plant project in India.

PCBL plans a joint venture with Kinaltek Pty. Ltd., an Australian firm, to expand into the battery application market.

Havells India introduces 'Lloyd' consumer brand in the Middle East via partnership with TeknoDome.

Foot Locker signs licensing agreements with Metro Brands and Nykaa Fashion for exclusive stores and e-commerce in India.

JSW Infrastructure's Masad Infra Services enters a concession agreement to develop a greenfield port at Keni, Karnataka.

Shivalik Bimetal Controls explores a joint venture with Metalor Technologies International SA to produce electrical contacts in India.

Key Buying & Selling Deals

Texmaco Rail: Societe Generale sold 2,205,323 shares at Rs. 140.03.

Zomato: Alipay Singapore Holding Pte. Ltd. sold 148,036,996 shares at Rs. 112.7; Morgan Stanley Asia (Singapore) Pte. bought 296,073,993 shares at Rs. 112.7.

Polycab India Limited: Blackrock Global Funds-India Fund bought 1,749,372 shares at Rs. 5266.22.

Tata Communications Ltd.: Blackrock Global Funds-India Fund bought 4,462,433 shares at Rs. 1707.69.

One 97 Communications Ltd: BNP Paribas Arbitrage sold 8,615,525 shares at Rs. 875.16; Copthall Mauritius Investment Limited sold 4,650,637 shares at Rs. 875.7.

Indusind Bank: Route One Fund I Lp sold 4,555,000 shares at Rs. 1463.89.

Persistent Systems Ltd: Government Of Singapore bought 388,464 shares at Rs. 6408.05.

Bharti Airtel Limited: Bharti Telecom Limited bought 81,150,803 shares at Rs. 1023; Indian Continent Investment Limited sold 81,150,803 shares at Rs. 1023.

Orchid Pharma: UTI Mutual Fund purchased 445,000 shares at Rs. 571.

Himtek: Emerging India Growth Fund sold 50,000 shares at Rs. 120.48.

Key Upcoming Events

Tuesday, Dec 5:

Services PMI (India): November's Services PMI for India expected

Composite PMI (India): November figures for Composite PMI

Caixin Services PMI (China)

Friday, Dec 8:

RBI Interest Rate Decision (India): The Reserve Bank of India's Monetary Policy Committee (MPC) meeting to announce its decision.

That’s all for this week! Hope we have been able to add some value through these weekly digests that we have been posting. Please do leave some comments below on how we can improve it further. Would love to hear from you.