Weekly Market Summary (Oct 07, 2023)

A comprehensive round up of what happened last week in the Indian Markets and outlook for upcoming week

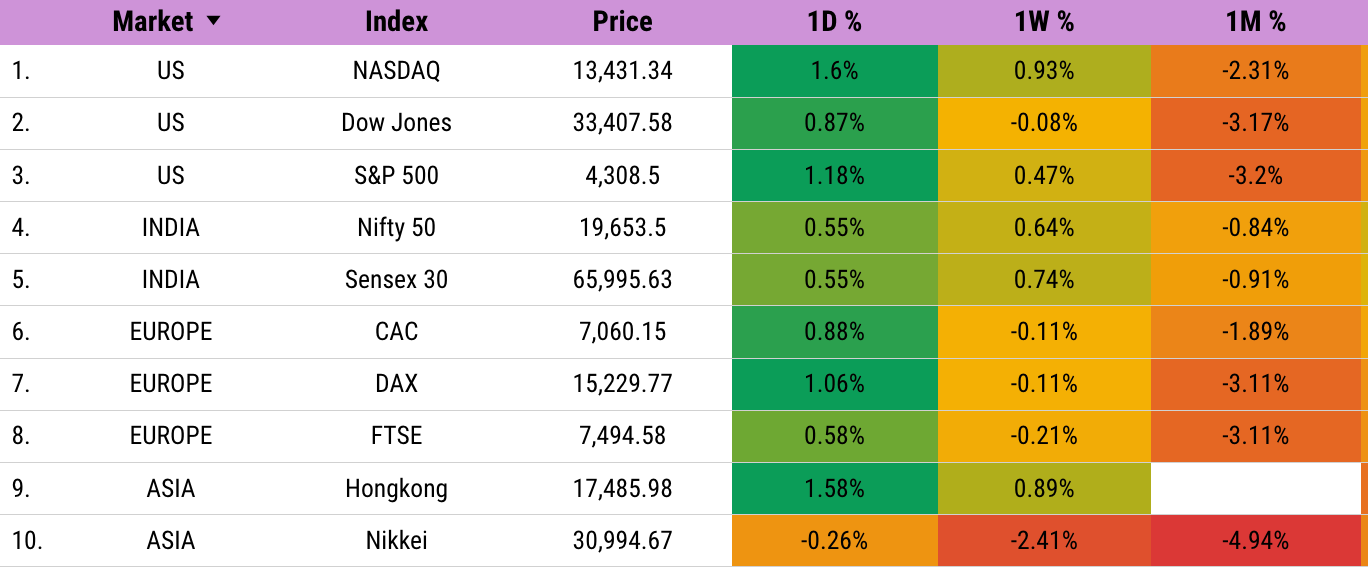

Global Markets Summary

1. Most Global Markets started last week on a Bearish note but rebounded well on Friday. On a weekly basis, there was no significant movement.

2. Indian Markets displayed relatively stronger performance, with the Nifty 50 and BSE Sensex concluding the week with marginal gains.

3. Oil Prices declined and Dollar Index fell last week boosting Sentiment.

4. India manufacturing PMI maintained its strength at 57.5, although it exhibited a slight deceleration from its August level of 58.6. Simultaneously, the services PMI expanded to 61.0 in September, up from 60.1 in August.

5. The Reserve Bank of India (RBI) opted to keep repo rates unchanged in its recent monetary policy meeting. The Monetary Policy Committee (MPC) unanimously focused on withdrawing accommodation.

6. The RBI Governor retained the real GDP growth and inflation forecasts for FY24 at 6.5% and 5.4%, respectively, while acknowledging upward risks to headline inflation. The RBI reaffirmed its commitment to maintaining focus on the 4% inflation target.

7. The RBI's decision dashed hopes of an early rate cut, resulting in a significant increase in bond yields, marking the most significant rise in 14 months.

8. The RBI also stressed that the transmission of the cumulative 250 basis points (bps) rate hike implemented thus far remained incomplete.

9. As the domestic corporate earnings season commences, focus will shift towards individual stock-specific performance and developments.

Indian Indices Performance

Nifty Next 50 and Midcap Indices underperformed last week.

IT and Realty Sector were the best performers last week.

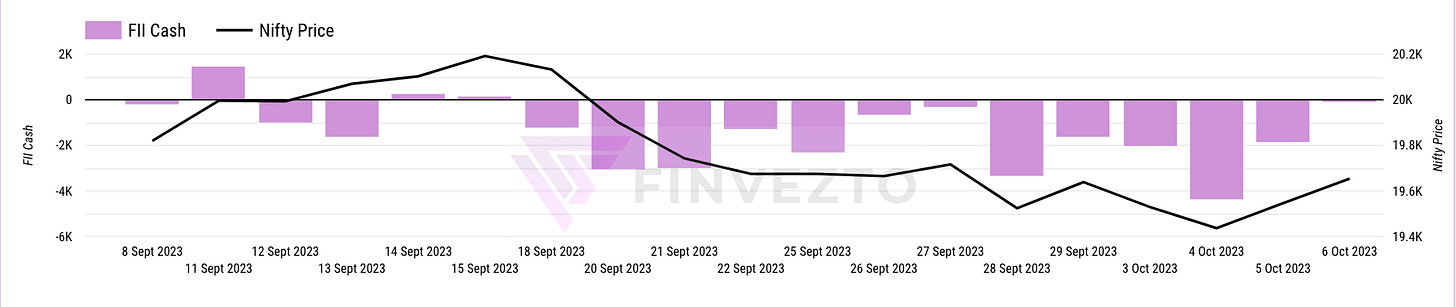

FII Positions Analysis

Cash Market: FIIs continued to be net sellers in the cash market. After selling about 18000 Crores in September, they have already sold 8000 Crores in the first few days of October.

Index Derivatives: FIIs continue to hold shorts on Index Derivatives. Their Sentiment is Bearish. Possible Indication that their selling might continue in Index Stocks.

Stock Derivatives: FIIs have increased their short positions in Stock Derivatives segment. Again Bearish Sentiment when it comes to Stocks. The results season is also round the corner.

FIIs are Bearish. DIIs are well hedged. Current Sentiment is Bearish. But given the rebound in global markets, sentiments could change on Monday. We need to keep track of both Momentum and Sentiment on Monday.

Key Stock Announcements from Last Week

Key Mergers/Acquisitions/Joint Ventures/Collaborations

Sun Pharma is acquiring a 37.76% stake in Ezerx Health Tech Private Limited, a company involved in non-invasive diagnostic and ancillary medical devices, for approximately Rs. 29 crore.

ACC has incorporated two wholly-owned subsidiaries - ACC Concrete South and ACC Concrete West - for manufacturing and dealing in cement, RMC, and allied products and by-products.

Adani Enterprises: Abu Dhabi’s subsidiary increases stake to 5.04% in Adani Enterprises.

Pidilite Industries: Subsidiary forms joint venture for manufacturing construction chemicals in UAE.

UPL: Incorporates subsidiary UPL Lanka Bio in Sri Lanka.

The Singapore subsidiary of NODWIN Gaming, a material subsidiary of Nazara Technologies, has acquired a 100 percent stake in the game marketing agency, PublishME, for $2 million.

HealthCare Global Enterprises has acquired SRJ CBCC Cancer hospital in Indore, with plans to expand it into a 100-bed cancer diagnostic and treatment facility within two years.

Raymond board approves investment of up to Rs 301 crore in Ten X Realty.

Sasken Technologies: Collaborates with Qualcomm Technologies through the Qualcomm IoT Accelerator Program.

VST Tillers Tractors: Establishes joint venture VST ZETOR, launching three tractors in 40-50 HP range.

Cipla divested its 51% stake in UAE-based Saba Investment for $6 million, resulting in the subsidiaries ceasing to be part of Cipla.

Vedanta announced plans to demerge its business units into six separate listed companies, aimed at unlocking value and attracting investment.

Key Buying/Selling Deals

Tube Investments of India: Promoter entity Ambadi Enterprises exited Tube Investments of India by selling its entire personal shareholding of 10.58 lakh shares, with SBI Mutual Fund acquiring 12.04 lakh shares in the company.

New Orders/Projects/Expansion/CAPEX

KPI Green received new orders totaling 12.10 MW for solar power projects. Out of this, 3.10 MW is by KPI Green Energy Limited, and 9 MW is by Sun Drops Energia Private Limited, a subsidiary of the company under the Captive Power Producer(CPP) segment.

Varroc Engineering: Subsidiary enters power purchase agreement for renewable power plants in Karnataka and Tamil Nadu.

Titagarh Rail Systems: Signs Rs 857 crore contract with Gujarat Metro Rail Corporation for 72 standard gauge cars.

Trident: Commissions 9.50 MWp rooftop solar power project in Madhya Pradesh.

Rail Vikas Nigam Limited: Emerges as lowest bidder for Rs 444.26 crore Himachal Pradesh distribution infrastructure project.

Godrej Agrovet plans to invest Rs 300 crore in setting up an integrated palm oil complex in Telangana, including a nursery with a capacity of up to 7 lakh saplings per year.

Kalpataru Projects International and its international subsidiaries secured new orders amounting to Rs 1,016 crore, including orders in the transmission and distribution business.

Lemon Tree Hotels signed a franchise agreement for a new property, Lemon Tree Resort Somnath in Gujarat, expected to open in FY25.

RVNL emerged as the lowest bidder for a project worth Rs 1,098 crore for the development of distribution infrastructure in South Zone of Himachal Pradesh.

Indus Towers signed an agreement with IOC Phinergy (IOP) for the deployment of 300 zero-emission energy systems based on aluminium-air technology to optimize diesel consumption at telecom tower sites.

Key Business & Results Updates

Adani Wilmar reported robust volume growth in double digits, driven by opportunities in packaged staple foods and strong execution. Rural sales surged due to an expanded rural distribution network.

Avenue Supermarts: Reports Q2 FY24 standalone revenue of Rs 12,308 crore, up 18.5% YoY.

Jaguar Land Rover (JLR) reported wholesale volumes of 96,817 cars, up 29% from the previous year, and 4% higher than the April-June period. For the first half of the fiscal year, wholesale volumes reached 190,070, a 29% increase year-on-year.

Marico experienced low single-digit volume growth in domestic sales for products like Parachute Coconut Oil and Saffola Edible Oils. The international business saw double-digit growth. The company expects margin expansion and healthy operating profit growth.

Jammu & Kashmir Bank has reported total business of Rs 2,18,269 crore for the quarter ending in September FY24, with total deposits rising 9.4 percent YoY to Rs 1,26,589 crore and gross advances increasing 15.88 percent YoY to Rs 91,680 crore.

Punjab National Bank has reported an 11.3 percent year-on-year growth in total business, reaching Rs 22.5 lakh crore for the quarter ending in September FY24. Deposits rose 9.7 percent YoY to Rs 13.08 lakh crore, and global gross advances increased 13.8 percent YoY to Rs 9.4 lakh crore.

RBL Bank reported total deposits of Rs 89,774 crore for the quarter ending in September FY24, with gross advances growing by 21 percent YoY to Rs 78,186 crore.

Maruti Suzuki reported a 2.85% increase in car sales, with 181,343 units sold in September 2023 compared to 1.76 lakh units in the same month last year.

Hero MotoCorp, the world’s largest motorcycle and scooter manufacturer, has received 13,688 bookings for its new flagship motorcycle, Karizma XMR. Deliveries to customers will begin during the festive period this month, with the bike priced at Rs 1,79,900 (ex-showroom Delhi). Commences deliveries of Harley-Davidson X440 on October 15. Hero MotoCorp also announced a marginal price increase of approximately 1% for select motorcycles and scooters, effective from October 3, 2023.

Indian Energy Exchange recorded a 13 percent YoY growth in total electricity volume for September, with a 33 percent YoY growth in real-time market volume.

Bandhan Bank reported loans and advances of Rs 1.07 lakh crore for the quarter ending in September FY24, with total deposits growing to Rs 1.12 lakh crore. CASA deposits increased, and retail deposits rose to Rs 82,977 crore.

APL Apollo Tubes: Reports record Q2FY24 sales volume of 6,74,761 tonnes, up 12% YoY.

Vedanta: Q2 FY24 total aluminium production at 594 kt, up 2%.

Bank of Maharashtra: Reports 22.2% YoY deposit growth and 23.55% YoY gross advance growth for Q2 FY24.

Yes Bank: Reports deposits growth of 17.2% YoY and advances growth of 9.5% YoY.

South Indian Bank: Reports gross advances of Rs 74,975 crore for Q2 FY24, up 10.3% YoY.

V-Mart Retail: Reports Q2 FY24 revenue of Rs 549 crore.

Hindustan Zinc reported a marginal 1% year-on-year decrease in mined metal production in Q2FY24, primarily due to lower ore production at certain mines.

Blue Dart Express announced a general price increase, effective from January 1, 2024, with an average shipment price increase of 9.6% compared to 2023.

Eicher Motors: Royal Enfield, a subsidiary of Eicher Motors, experienced a 4% year-on-year decline in sales, with 78,580 units sold in September 2023.

Karur Vysya Bank announced advances of Rs 70,446 crore for the quarter ended September FY24, representing a 15.3% year-on-year growth.

TVS Motor Company achieved total sales of 4.02 lakh units in September 2023, marking a 6% year-on-year growth compared to the same month last year.

Mahindra & Mahindra recorded a 17% growth in vehicle sales in September 2023 compared to the same month last year, selling 75,604 vehicles, including exports.

Atul Auto reported an 18.1% year-on-year growth in vehicle sales, selling 2,662 units in September 2023.

Coal India reported a 12.6% year-on-year increase in coal supply, reaching 55 million tonnes in September 2023.

Mahanagar Gas reduced the retail price of compressed natural gas (CNG) by Rs 3 per kg and domestic PNG (piped natural gas) by Rs 2 per SCM in the Mumbai region.

VST Tillers Tractors reported a 1% year-on-year decrease in total sales for September 2023, with 2,627 units sold.

SML Isuzu increased the prices of its vehicles, including trucks and buses, effective from October 1, to cover rising input costs due to the implementation of the Fire Alarm and Protection System (FAPS) and general inflation.

Key Management Appointments/Resignations

HDFC Bank: Leadership changes, Arvind Kapil leads mortgage business, Arvind Vohra heads retail assets, Parag Rao takes on marketing and liability products, new retail branch banking heads appointed.

Larsen & Toubro has promoted E P Sajit to Senior Vice President and Head of Water & Effluent Treatment IC, effective from October 2.

Oracle Financial Services Software: New appointments for Managing Director, Chief Financial Officer, and Additional Director.

Kapil Raj Luthra, Chief Financial Officer of JCT Limited, resigned with immediate effect as of October 3, 2023, citing personal reasons.

Axita Cotton has reappointed Nitinbhai Govindbhai Patel as the CMD of the company, effective from October 1, 2023.

Asian Energy Services has appointed Gaurav Srivastava as Chief Operating Officer, bringing his two decades of experience in operations, field services, drilling, and business development.

Manish Sheth has resigned as Chief Financial Officer of JM Financial, effective September 30, 2023.

Satyam Jaiswal has resigned as the Managing Director of Sofcom Systems, while Shristi Shaw has resigned as the Chief Financial Officer, effective October 4, 2023.

AXISCADES Technologies has appointed Abidali Neemuchwala as the Chairman of the company, effective from October 4.

Amresh Narayan resigned as Whole-Time Director and CEO of Morarjee Textiles effective from October 4, 2023, with immediate effect.

ADF Foods: Appoints Balark Banerjea as President – Indian Domestic Business.

Subex: COO Shiva Shankar Naga Roddam resigns, effective December 31, 2023.

Zensar Technologies: Senior Vice President Samir Gosavi resigns.

TeamLease Services: CEO – HRTech, Sumit Sabharwal, resigns.

AstraZeneca Pharma: Bhavana Agrawal was appointed as Chief Financial Officer of AstraZeneca Pharma, effective from October 1, 2023.

IPO/Listing/De-Listing

Valiant Laboratories listed on October 6 at an issue price of Rs. 140 per share.

Vinyas Innovative Technologies, an engineering and electronics manufacturing services company, made its debut on October 6 with an offer price of Rs 165 per share. Its equity shares will be available for trading in the trade-for-trade segment.

Organic Recycling Systems, a waste management solutions company, listed on on October 6 at an issue price of Rs 200 per share. The shares will be available for trading in the trade-for-trade segment for the next 10 days.

Updater Services listed on BSE and NSE on October 4 at Rs 300 per share.

Digikore Studios listed on October 4 at an offer price of Rs 171 per share.

Fortis Healthcare subsidiary Agilus Diagnostics has filed a draft red herring prospectus (DRHP) for an initial public offering (IPO).

Saakshi Medtech and Panels listed on October 3, 2023, with an issue price of Rs 97 per share in NSE Emerge.

JSW Infrastructure listed on October 3, with the final issue price fixed at Rs 119 per share.

Key Regulatory/Tax related Announcements

Lupin received tentative approval from the US FDA for Tolvaptan Tablets, a generic equivalent of Jynarque Tablets by Otsuka Pharmaceutical Co., Ltd. The estimated annual sales of Tolvaptan Tablets were USD 287 million in the US.

Bharat Heavy Electricals Ltd. (BHEL) announced receiving two arbitration awards against Jaiprakash Power Ventures Limited in separate cases.

Sheela Foam has received a show cause cum demand notice from the Commissioner of GST Intelligence, Greater Noida, alleging a tax demand of Rs 20.26 crore.

Granules India received approval from the US Food & Drug Administration (US FDA) for its Losartan Potassium and Hydrochlorothiazide tablets, which are indicated for hypertension treatment and risk reduction of stroke in patients with hypertension and left ventricular hypertrophy.

Aurobindo Pharma’s Unit VI - B, a formulation manufacturing facility in Telangana, received an inspection from the US FDA, resulting in one procedural observation.

Life Insurance Corporation of India faces Rs 84.02 crore penalty for assessment years 2012-13, 2018-19 & 2019-20.

Maruti Suzuki India has received a Show Cause Notice amounting to Rs 1.79 crore from the Gujarat GST Authority. Receives draft Assessment Order for FY20, with proposed additions/disallowances of Rs 2,159.7 crore.

Bajaj Finserv: BAGIC receives Rs 1,010 crore tax demand notice for GST non-payment.

Maruti Suzuki, India’s largest car manufacturer, is facing a show-cause notice from the GST Authority, potentially resulting in interest charges and penalties. The notice is related to a tax liability of Rs 139.3 crore under the reverse charge mechanism for certain services.

Key Corporate Actions (Buybacks/Dividends/Fund Raising/QIP/NCD)

Som Distilleries’ board approved the opening of an issue as of October 5, 2023, with a floor price set at Rs 349.24.

Cantabil Retail’s Board of Directors will convene on October 21 via video conferencing to consider and approve the record date for a stock split or sub-division.

Ramkrishna Forgings received board approval to raise funds up to Rs 1,000 crore through the issuance of equity shares via qualified institutional placement (QIP).

Indian Hotels issued a corporate guarantee of 10.05 million euros in favor of lessor Diana Hotel for a lease agreement for a hotel in Frankfurt, valid till June 14, 2045.

Eris Lifesciences entered into a term loan agreement to avail a rupee term loan facility of Rs 212 crore from HDFC Bank.

Important Upcoming Events

Monday, October 9:

Germany Industrial Production data.

Wednesday, October 11:

Tata Consultancy Services (TCS) Results.

US FOMC Minutes Release.

US Producer Price Inflation data for September.

Thursday, October 12:

Infosys, HCL Technologies, HDFC Asset Management Co, Tata Metaliks Results.

India Inflation and Industrial Production data for September.

UK GDP data for August.

OPEC and IEA Oil Market Reports.

US Inflation data for September and Jobless Claims update.

Friday, October 13:

HDFC Life Insurance Co and Aditya Birla Money Results.

India Wholesale Prices and Exports-Imports data for September.

Possible IPO Listing of Plaza Wires.

China Inflation and Exports-Imports data for September.

Saturday, October 14:

Avenue Supermarts Results.

That’s all for this week!

FINVEZTO.COM | Comprehensive Investing & Trading Analytics Platform

💼 Toolkit - https://finvezto.com/toolkit

𝕏 Connect on Twitter (X) - https://twitter.com/finvezto

Know More About Us - https://www.linkedin.com/in/finvezto

📧 E-mail: support@finvezto.com