Weekly Market & Nifty Analysis for Jan 01-05, 2024

New All-Time high to close 2023, FIIs and DIIs remaining net buyers, upcoming FED meeting minutes and much more...

What happened last week and last year?

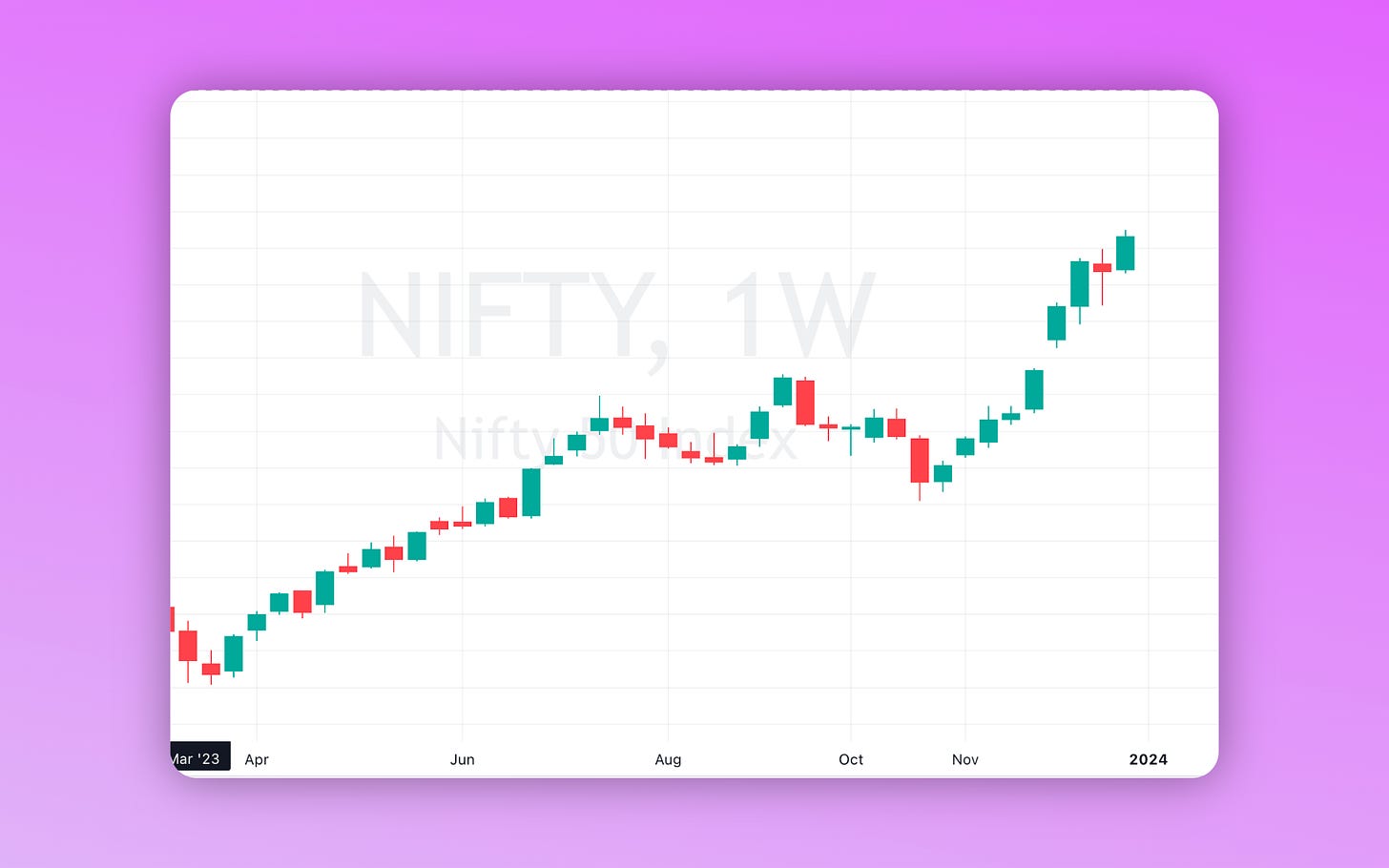

Nifty achieved a new all-time high of 21801 during the last trading week of 2023 closing the year on a high note. Nifty increased by 8% in December alone.

Overall in 2023, Nifty was up by 20%, Nifty Next 50 was up by 26%, Nifty MidCap 150 was up by 43% and Nifty SmallCap 250 was up by 48%. The average Index Investor would have had a great year.

All the sectors went up last year. But the ones that fuelled the rally were Realty, Auto and Public Sector Stocks. Realty has moved around 79% in 2023.

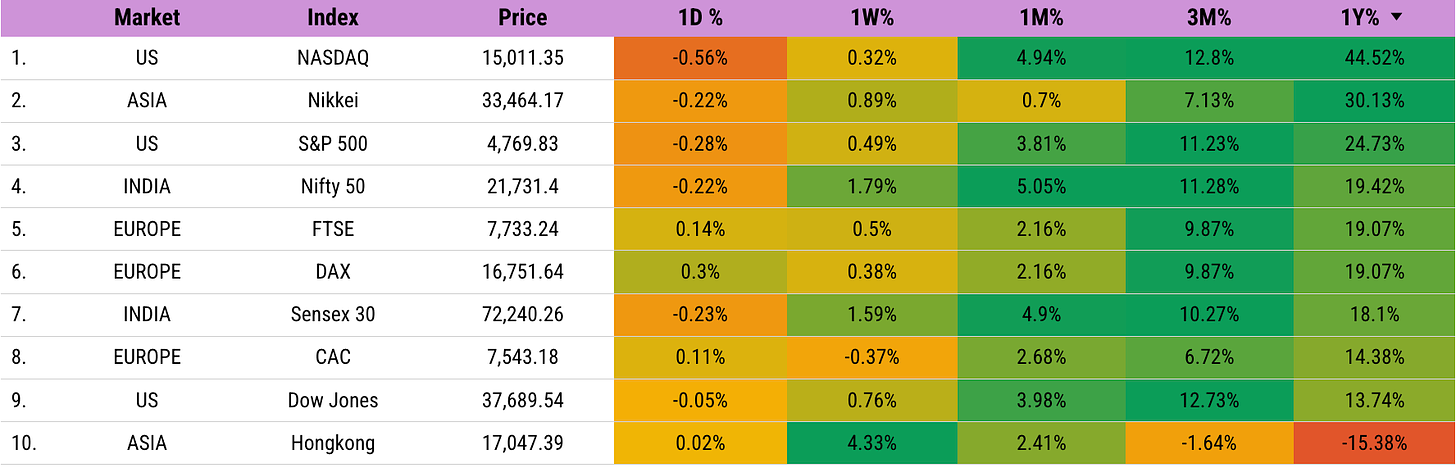

At the Global level, the US, Japan and Indian markets were the top 3 performers. No surprises here as Japan and India witnessed the highest foreign investment inflows in 2023.

2023 saw geopolitical tensions, an increase in policy rates and volatile raw material & commodity prices. Despite all this, most global markets have done well.

Both FIIs and DIIs were net buyers in the cash market last week. FIIs bought for ₹8648 Cr and DIIs bought for ₹666 Cr in the cash market.

FII activity in the cash market has been very volatile this year. However, DIIs have consistently bought in the cash market totalling ₹1,81,855 Cr in 2023.

India VIX continues to move higher closing at 14.5 last week. Usually, it shoots up before the budget season as participants expect higher volatility.

In Q2 FY24, Indian banks saw further improvement in their gross non-performing asset (GNPA) ratio. The ratio reached a new low in a decade, as per RBI report.

In Q2 FY24, India experienced a sequential reduction in its current account deficit (CAD), which decreased to $8.3 billion. This decline was primarily attributed to a decrease in merchandise trade deficit and an upsurge in services exports.

With India's Corporate earnings improving and Government Infrastructure Expenditure increasing, things look good at the macro level going into 2024.

Let us now dive deeper into FII DII positions.

FII Positions Analysis

FIIs were net sellers and DIIs were net buyers in the cash market last week as we saw earlier.

Last week we had the December Monthly Expiry. FIIs have started the Jan Expiry with long positions in Index Derivatives indicating positive sentiment.

FIIs continue to hold long positions in Stock Derivatives too.

FIIs are bullish going into the first week of 2024.

Nifty Analysis

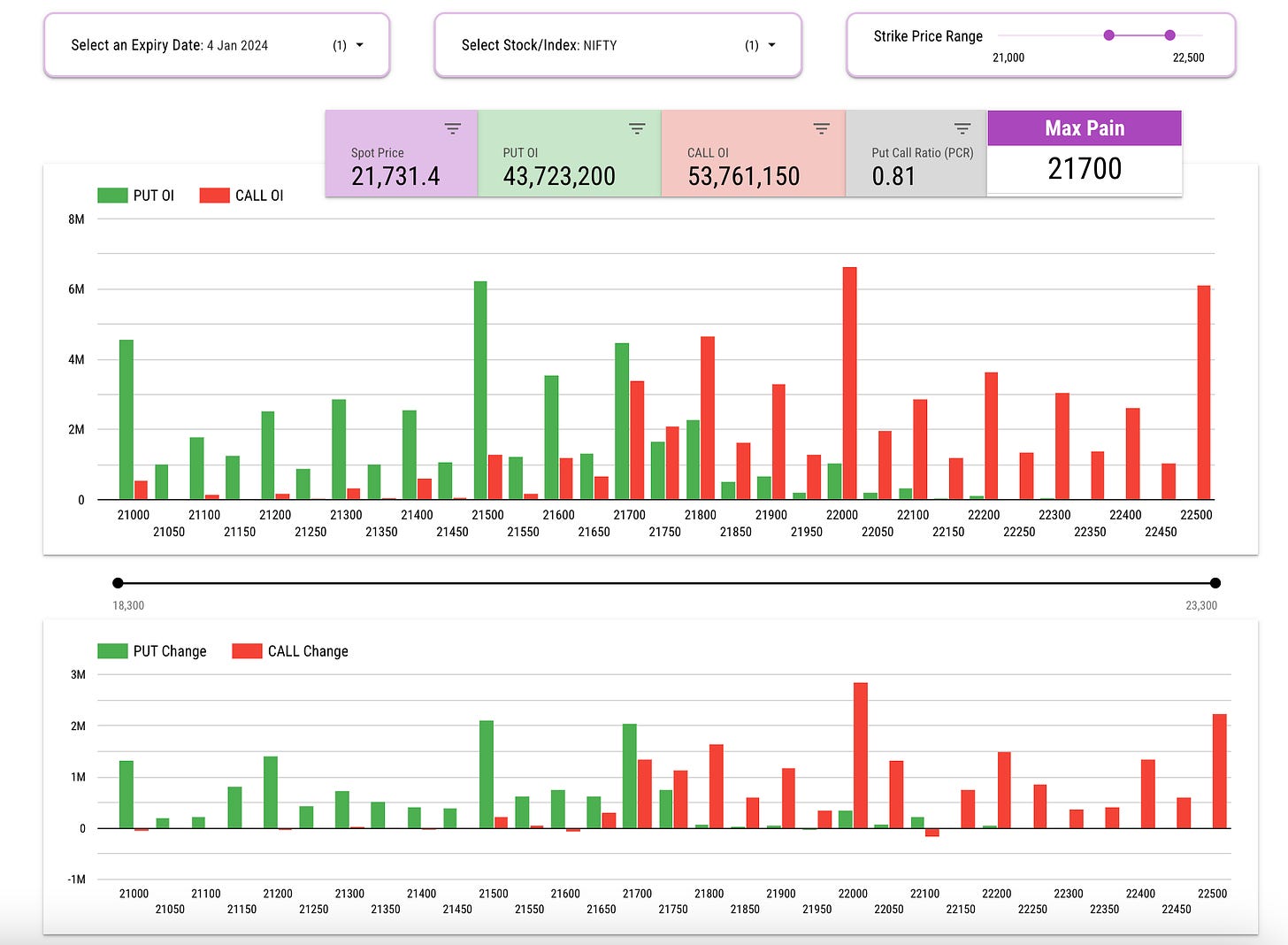

Let us look at the Open Interest of Nifty for the coming week.

Maximum CALLs have been built at 21500 and Max PUTs have been built around 22000. Participants are expecting Nifty to trade between 21500-22000 this week. However, sentiment keeps changing every day and one needs to monitor continuously.

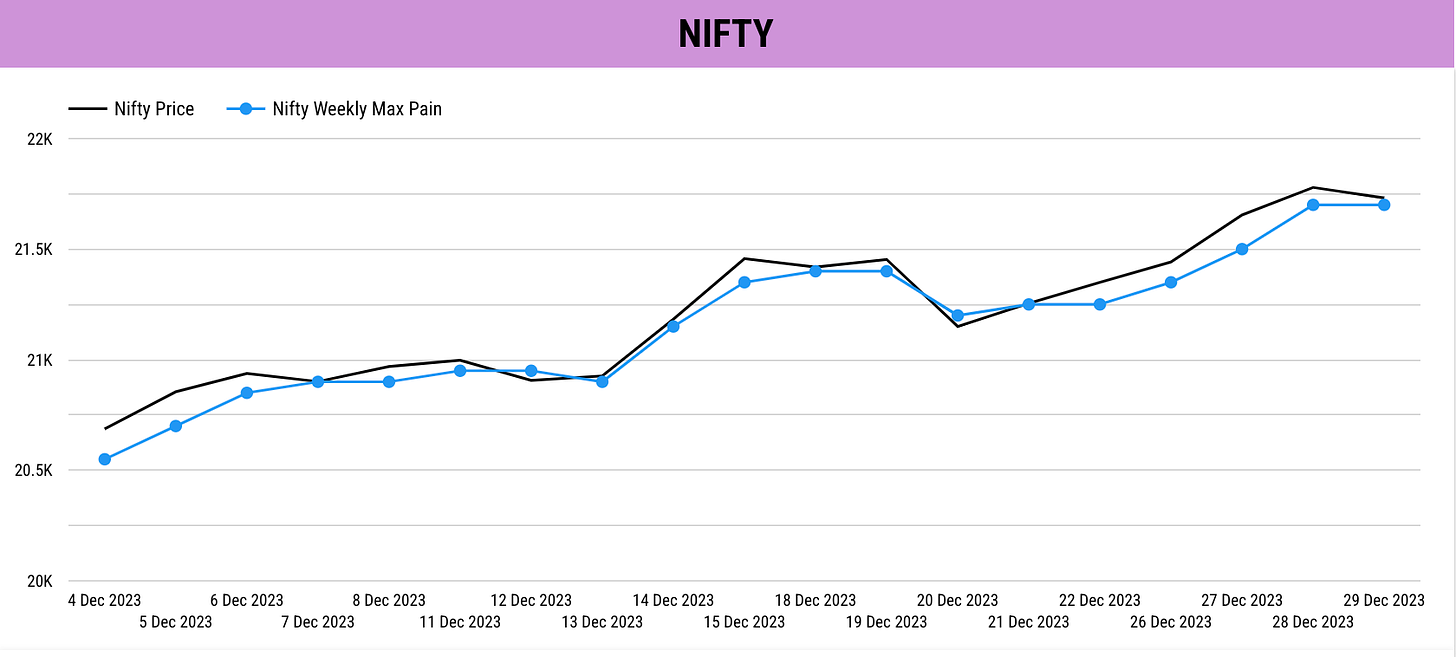

Max Pain of Nifty continuously moved up last week along with an up-move in price. One should not have shorted Nifty last week.

Verdict: Both Momentum (Price) and Sentiment (Positions) are bullish. Until there is new evidence stating otherwise, we will remain Bullish.

Key Upcoming Events

Monday, January 1

India Auto Sales Data

Tuesday, January 2

China Manufacturing PMI Data

Wednesday, January 3

India Manufacturing PMI Data

US Manufacturing PMI Data

Thursday, January 4

US FOMC Meeting Minutes: Federal Reserve to release minutes of the December 2023 meeting.

Friday, January 5

India Services & Composite PMI Data

Key Stock Announcements from Last Week

New Orders, Contracts & Projects

KEC International Ltd. secured Rs. 1,566 crores in diverse orders spanning T&D, Civil, Oil & Gas, and Cables, reflecting growth across segments and global operations.

SJVN: Secured a 100 MW solar power project in Gujarat at Rs 2.63 per unit, developed by its subsidiary, SJVN Green Energy (SGEL), estimated at Rs 550 crore.

Vishnu Prakash R. Punglia: Awarded projects worth Rs 899 crore from Uttarakhand government for water supply systems.

Bharat Electronics Limited (BEL): Issued a press release regarding orders worth Rs.678 Cr, comprising a contract of Rs.445 Cr with the UP Government for the next-gen UP Dial 112 project. An additional Rs.233 Cr in orders for various equipment was received, cumulatively totalling Rs.26,613 Cr for the fiscal year 2023-24.

Larsen & Toubro secures a major Saudi Arabian contract, developing luxury tourism infrastructure with renewable energy systems, water utilities etc.

L&T Construction secures significant orders in the Middle East for Power Transmission & Distribution business. Contracts include a 400/132kV Substation in UAE, plus 400kV Overhead Transmission Lines in Kuwait, aiding power generation and evacuation.

KPI Green Energy: Subsidiary, KPIG Energia Pvt. Ltd., secured a 1.80 MW solar power project order from Radhamohan Dyeing & Printing Mills Pvt. Ltd. This addition surpasses 151+ MW in cumulative orders under the Captive Power Producer segment, scheduled for completion by 2024-25.

EMS Limited: Disclosed securing a project worth Rs. 358.56 crores for sewerage development and septage management in Uttarakhand, complying with SEBI regulations, detailed by Managing Director Ashish Tomar.

Goldiam International: Received export orders totaling Rs. 50 crores for manufacturing lab-grown diamond-studded gold jewelry from international clients.

Inox Wind: Secures a 279 MW order for 3 MW WTGs from a major C&I player, involving equipment supply, turnkey execution, and post-commissioning services across Rajasthan and Gujarat by June 2025.

Aarvi Encon Limited: Indonesian subsidiary won a ₹59.84 Cr work order for supplying manpower services to a multinational engineering company, meeting disclosure regulations.

Atam Valves: Secured its first marine overseas order, marking a vital leap into international markets, emphasizing growth and diversification, as stated in compliance with regulatory obligations.

Suzlon: secures a 100.8 MW order for 32 turbines in Karnataka from a Nordic firm, aiming to power 77k homes and cut 3.02 lakh tons of CO2 yearly.

Suzlon also clinched another 100.8 MW order from Mahindra Susten, installing 48 S120 - 140m turbines in Maharashtra. This partnership aims to provide renewable energy to the state’s Commercial and Industrial customers.

RailTel Corporation of India has received a significant work order worth Rs. 76.19 Crore (Including GST) from the Bihar Education Project Council for supplying Teaching Learning Material for Class I to III under a rate contract. This disclosure adheres to SEBI regulations and aims to inform shareholders and the public.

NBCC (India) Limited secured a significant work order worth approximately Rs. 150 crore from SAIL ISP, Burnpur. The project involves civil and various infrastructure works for a plant and township.

Confidence Petroleum’s subsidiary, Confidence Enterprises Pvt Ltd, secured an LOA from BPCL to supply 450 CNG Type-I cascades for CGD projects, valued at around Rs. 67 Crores.

GE Power India Limited secured domestic orders from NTPC and BPSCL for generator spares and inspections worth around INR 10.47 Crores and INR 9.91 Crores, respectively.

R.P.P Infra Projects Ltd has secured a new project from the Department of Atomic Energy for constructing a DDUO Building at BARCF, Kalpakkam, Tamil Nadu, valued at approximately INR 37.77 Crores (including GST).

Marine Electricals (India) Limited received a significant order totaling Rs. 31.85 crores, including a 5-year AMC worth 6 crores, from the Ministry of Defence for 6 Integrated Bridge Systems.

Partnerships, Acquisitions & Investments

Reliance Industries: Signed non-binding term sheet with Walt Disney for Indian media operations merger, giving Reliance 51% control. Disney to hold remaining 49%.

Biocon: Subsidiary signed distribution deal with Sandoz for exclusive rights to sell Adalimumab BS in Japan, acquired from Viatris’ biosimilars portfolio.

KPIT Technologies: Acquired 13% shareholding in N-Dream, a cloud-based game aggregation platform company in Switzerland.

Jindal Steel & Power: Signed MoU with RINL for operationalization of Blast Furnace-3, to boost monthly hot metal production by 2 lakh metric tonnes.

Piramal Consumer Products: Invested Rs 289.59 crore in Piramal Consumer Products Private Limited (PCPPL) through a subscription-to-rights issue and agreed to acquire Piramal Tower in Mumbai for Rs 875 crore.

Tata Power Company: Acquired 100% equity stake in Bikaner III Neemrana II Transmission SPV for an electrical power transmission system in Rajasthan for Rs 18.6 crore.

Power Grid Corporation of India: Acquired Neemrana II Bareilly Transmission (NIIBTL) and Bikaner III Neemrana Transmission SPVs for establishing transmission systems for power evacuation from Rajasthan.

PTC Industries: Signed an MoU with Nasmyth (UK) for collaboration in offering solutions to defence and aerospace customers in India and globally.

Petronet LNG: Executed binding transaction documents with Goplapur Ports for setting up a floating storage regasification unit (FSRU) based LNG terminal in Odisha.

Aditya Birla Fashion and Retail: Increased its holding in Finesse International Design (FIDPL) by purchasing equity shares for Rs 20 crore.

Info Edge (India): To invest Rs 25 crore in its subsidiary Zwayam Digital.

Satin Creditcare Network: Entered into a master agreement for co-lending of loans to microfinance borrowers with Karnataka Bank.

Business Operations

Infosys: Terminated Memorandum of Understanding; won’t pursue Master Agreement for digital services, impacting estimated $1.5 billion client spend over 15 years.

Asian Paints: Received environmental clearance for its Sriperumbudur plant.

Sula Vineyards: Recorded 12,000 visitors during December 23-25, with December 24 generating a single-day revenue of Rs 85 lakh, totaling Rs 2.28 crore during the period.

Kansai Nerolac Paints: Approved the sale of land in Mumbai for Rs 726 crore to Aethon Developers.

Key Management Changes

Life Insurance Corporation of India: Appointed S. Sunder Krishnan as Chief Risk Officer effective December 27, following the exit of Pratap Chandra Paikray from the same role.

TTK Prestige: Appointed Venkatesh Vijayaraghavan as CEO effective January 2024.

Key Buying and Selling Deals

AllCargo Gati: Equirus Wealth Private Limited sold 1,968,000 shares of Allcargo Gati Limited for ₹25.40 crore.

V-Guard: Aditya Birla Sun Life Mutual Fund purchased 3,500,000 shares, and Chittilappilly Thomas Kochuouseph (Promoter) sold 4,500,000 shares of V-Guard Industries Limited.

Antony Waste Handling Cell: The Miri Strategic Emerging Markets Fund LP acquired 226,000 shares of Antony Waste Hdg Cell Ltd for ₹11.12 crore.

Indiabulls Housing Finance: Former Blackstone India executive acquired 0.52% equity at an average price of Rs 213.57 per share.

Lumax Auto Technologies: Asia Investment Corporation Mauritius sold its entire shareholding of 28,11,262 equity shares.

IIFL Finance: FIH Mauritius Investment reduced its stake by selling 7.2% stake via open market transactions, dropping its shareholding to 15.12% from 22.32%.

Suprajit Engineering: HDFC Mutual Fund increased its stake by buying 1.96% via open market transactions.

Zee Entertainment: Plutus Wealth Management LLP bought equity shares worth Rs 165.03 crore in open market transactions.

IDFC First Bank: ICICI Prudential Asset Management Company and ICICI Prudential Life Insurance Company received RBI approval to acquire up to 9.95% of IDFC FIRST Bank.

Federal Bank: Received RBI approval for ICICI Prudential Asset Management Company to acquire up to 9.95% of Federal Bank shares.

Fund Raising

UPL: Board approved raising up to Rs 4,200 crore via equity shares rights issue, terms to be determined later.

UGRO Capital: Scheduled Investment and Borrowing Committee meeting to consider non-convertible debentures issuance.

Canara Bank: Approved the process of listing its mutual fund subsidiary, Canara Robeco Asset Management Company, via an initial public offering (IPO).

South Indian Bank: Board of Directors approved fund raising of Rs 1,750 crore through issue of equity shares on a right basis to its existing eligible shareholders.

Punjab National Bank: Approved a proposal to raise equity capital up to Rs 7,500 crore in FY25 through QIP/FPO.

Swan Energy: Board approved raising funds up to Rs 4,000 crore through equity shares or eligible securities.

Regulatory & Legal

Zydus Lifesciences: Received an intimation from the Income Tax Department regarding an income tax demand of Rs 284.58 crore for the assessment year 2023-2024, awaiting rectification.

Vedanta: BALCO received Rs 84.7 crore GST demand for FY2017-18 from the Office of the Joint Commissioner.

New Delhi Television (NDTV): Civil suit against NDTV Convergence settled amicably, resulting in withdrawal of the suit and deletion of the concerned article.

Cipla: Received Rs 11.59 crore penalty from Central GST Howrah Commissionerate, Kolkata.

Zydus Lifesciences: USFDA inspection at API site yielded six observations, none related to data integrity or repeat issues.

Religare Enterprises: Commissioned investigation into siphoning off funds from Religare Finvest by previous promoters.

Aurobindo Pharma: US FDA inspection at subsidiary’s facility resulted in 10 procedural observations.

FINVEZTO.COM | Useful & Actionable Stock Market Tools