Weekly Market & Nifty Analysis for Dec 18-22, 2023

Nifty up for 7th consecutive week, FED keeping interest rates unchanged, Short covering rally in IT, CPI Inflation at 5.5% and much more...

What happened last week?

Nifty went up for the 7th consecutive week scaling new all-time highs. Also, we witnessed the biggest gain last week compared to the previous 6 weeks. Well, they say the candle burns the brightest before it goes out. Let’s see.

Foreign Institutional Investors (FIIs) were net buyers with ₹18,858 Cr fuelling the rally. Domestic Institutional Investors (DIIs) were net sellers with ₹2,592 Cr.

The U.S. Federal Reserve maintained its dovish stance in its final 2023 meeting, keeping interest rates unchanged for the third straight month. It has also signalled potential rate cuts in 2024.

Post the FED announcement, the IT sector stocks saw a change in sentiment and witnessed short covering rallies on Friday. Infosys and TCS shot up more than 5% each. The 2 Index Heavyweights alone contributed 110 points to the Nifty rally on Friday.

The overall market sentiment continued to be positive aided by several factors: a sharp drop in the US 10-year Treasury yield, substantial FII buying, and a decline in the Dollar index to around 102 levels.

India Consumer Price Index (CPI) Inflation for Nov 2023 was at 5.55%. It is still below the RBI upper tolerance limit of 6%. Also, RBI has projected 5.4% for the rest of FY24. So things are fine as per RBI.

India IIP (Index of Industrial Production) numbers were better than expected at 11.7% YoY. IIP is a key measure of Industrial and Manufacturing activity.

Overall a good week in terms of numbers.

FII DII Analysis

FIIs have bought about ₹30000 Cr so far in the cash market in December. Last week they added ₹18,858 Cr.

FIIs currently hold net short positions in the Index Derivatives segment. But they are not heavily short.

FIIs are net long in the Stock Derivatives segment.

DIIs have slightly increased short positions on the Index over the week. But they are not heavily short.

Overall, both FIIs and DIIs have a neutral to bullish view as per the current data.

Nifty Analysis

Let us start with the Open Interest Analysis of Nifty. More PUTs have been written near the ATM strikes compared to CALLs. Options Sellers/Market Makers have a bullish view.

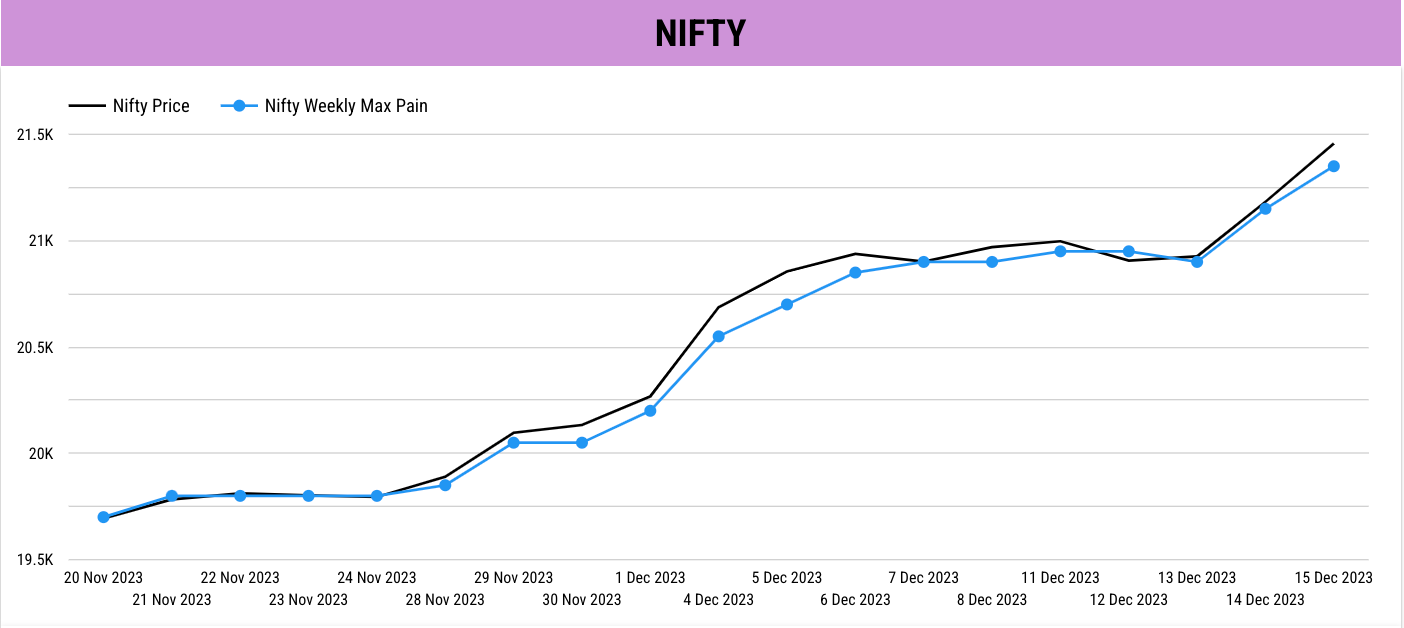

If you look at the Max Pain trend of Nifty, it has been going up throughout the last week indicating increasing bullish sentiment.

For the coming week, 21300 is an important level to watch on the downside as Participants have added a lot of PUTs at 21300 and 21400. In an uptrend like this with Nifty scaling all-time highs, we do not know where it will stop. Irrationality is difficult to measure.

Verdict: Both momentum (price movement) and sentiment (OI positions) continue to be bullish. We need more evidence to turn Bearish.

Key Upcoming Events

A lot of IPOs opening this week.

Monday, December 18

Suraj Estate Developers IPO opens

Motisons Jewellers IPO opens

Tuesday, December 19

Happy Forgings IPO opens

RBZ Jewellers IPO opens

Mufti Menswear IPO opens

Wednesday, December 20

Azad Engineering IPO Opens

Thursday, December 21

US GDP Growth Rate data

Friday, December 22

India Foreign Exchange Reserves data

Key Stock Announcements from Last Week

New Orders, Contracts & Projects

JTEKT India: Secured an international contract worth INR 182.7 Crores from JTEKT Brasil for loose child parts, compliant with SEBI norms as a related-party transaction.

Mishra Dhatu Nigam Limited: Secured a significant order valued at Rs. 357 Cr, with total order bookings for FY 2023-24 at approximately Rs. 1100 Cr and an open order position of around Rs. 1750 Cr.

NBCC: Secured a significant project worth Rs 1,500 Cr from the National Cooperative Development Corporation, constructing 1469 grain warehouses and agri-infrastructure across India.

Texmaco Rail & Engineering: Received an order from the Ministry of Railways for 3,400 BOXNS wagons worth approximately Rs. 1374.41 crores.

Jupiter Wagons: Received a Letter of Acceptance (LOA) from the Ministry of Railways for manufacturing and supplying 4,000 BOXNS Wagons, valued at Rs.1,617 Crores.

Tata Power Solar Systems: Secured a ₹418 crore contract to supply 152 MWp DCR Solar PV Modules for NTPC's Nokh Solar Park in Rajasthan, enhancing India's renewable energy growth.

Mazagon Dock Shipbuilders: Secured contracts to build three 7,500 DWT Multi-Purpose Hybrid Powered Vessels for a European client, valued at approximately $42 million.

Maharashtra Seamless: Secured a Rs. 187 crore order from ONGC Ltd. for premium casing seamless pipes, domestically supplied over 44 weeks.

Partnerships & Acquisitions

TVS Motor Company: Collaboration with Alpinestars to enhance riding experience for customers.

Shoppers Stop: Collaboration with The Good Glamm Group for the launch of MyGlamm POUT, a makeup collection.

REC: Entered a 200-million-euro loan agreement with KfW Development Bank to refinance investments in DISCOMs’ distribution infrastructure.

Wipro: Signed a new agreement with RSA to accelerate RSA’s migration to the cloud and build secure IT infrastructure.

Force Motors: Approved the acquisition of 12.21 percent shares in TP Surya, a Tata Power subsidiary setting up solar power projects in Maharashtra.

Cummins India: Collaborated with Repos Energy to launch DATUM, a smart fuel management system for diesel applications.

Global Health: Formed a joint venture company, GHL Hospital, with DLF to construct super specialty hospitals.

Gokul Agro Resources announced the acquisition of a 25 percent stake in PT Riya Pasifik Nabati in Indonesia, aiming to explore new markets in palm oil production.

GMM Pfaudler’s Patel Family has acquired a 1 percent equity stake from Pfaudler Inc. with 75 percent payment completed, raising their overall shareholding to 25.18 percent in the company.

RBL Bank acquired an 8.51% stake in ONDC for Rs 40 crore.

BHEL and CMTI entered into an MoU for technology development in hydrogen value chain and IIoT solutions.

Hero MotoCorp plans to acquire an additional stake in Ather Energy.

Business Operations

Tata Motors: Announced a price increase of up to 3 percent on commercial vehicles effective January 2024 to offset residual impact of past input costs across the entire range.

Greenlam Industries: Subsidiary acquired 86 acres of land in Uttar Pradesh for future expansion.

Lloyds Metals and Energy: Approved an expansion of iron ore mining capacity and establishment of a beneficiation plant and integrated steel plant.

Blue Dart Express: Approved purchase of two leased aircraft by Blue Dart Aviation from DHL Aviation for Rs 40 crore.

BLS International Services: Retained contract for outsourcing Consular, Passport, and Visa services from the High Commission of India in Canada.

Asahi Songwon: Commenced commercial production of API-intermediate at its new plant in Gujarat.

KIOCL: Temporarily suspended operation of its pellet plant unit in Mangalore due to non-availability of iron ore fines.

Shilpa Medicare: Received approval from TGA, Australia, for manufacturing oral mouth-dissolving films.

Laurus Labs: Received five observations from the US FDA for its manufacturing facility in Visakhapatnam.

IRCTC is expanding its business beyond railways, providing catering services to various ministries, government bodies, and universities.

Uno Minda has launched a new automotive seating systems plant under its subsidiary Uno Minda TACHI-S Seating (UMTS) in Gujarat, expected to begin supplies by Q4 FY24.

Signature Global completed the purchase of a 19% stake in Gurugram Commerce City as part of its first tranche. It had acquired a land parcel measuring 25.14 acres in Gurugram with a development potential of approximately 5.49 million sq ft.

LTIMindtree inaugurated a new delivery center in Mexico City to expand its presence in Latin America.

Mazagon Dock Shipbuilders launched India’s fastest solar-electric boat, SaurShakti, in Kochi through collaboration with NavAlt Solar Electric Boat.

Syrma SGS Technology formed a subsidiary for electronic and communication equipment business.

Panacea Biotec launched a pentavalent vaccine in India and registered a product in Germany.

Management Changes

Adani Energy Solutions: Bimal Dayal, CEO of the transmission business of Adani Energy Solutions, appointed as CEO of Adani Infrastructure India, overseeing projects in thermal, renewable energy, and green hydrogen.

Wipro: Stephanie Trautman resigned as Chief Growth Officer, effective January 31, 2024.

Infosys: Jayesh Sanghrajka appointed as the CFO effective April 1, 2024, replacing Nilanjan Roy.

CIE Automotive India: CEO Hari Krishnan resigned; Sunil Narke appointed as CEO of forgings division.

Key Buying and Selling Deals

Swan Energy: 2I Capital PCC sold 14.43 lakh equity shares via an open market transaction.

Axis Bank: Bain Capital plans to sell a 1.1 percent stake via a block deal at an offer floor price of Rs 1,109 per share.

Mankind Pharma: Beige, a Chrys Capital affiliate, sold 1.79 crore equity shares in open market transactions.

Zee Entertainment: Plutus Wealth Management LLP bought 90 lakh equity shares in the media company.

Karur Vysya Bank: SBI Mutual Fund purchased 1.2 crore equity shares.

Fusion Micro Finance is witnessing a block deal for the sale of a 9.25 percent stake held by Honey Rose Investment, an arm of Warburg Pincus, valued at Rs 500 crore with a floor price set at Rs 535 per share.

Updater Services saw Birla Sunlife Insurance buy 3.58 lakh shares (0.53%) at Rs 304.65 per share.

Zen Technologies Limited: TATA AIA LIFE INSURANCE COMPANY LIMITED bought 2,000,000 shares at ₹725, totaling ₹145 Cr, while TARA DUTT ATLURI sold 1,500,000 shares at ₹725, totaling ₹108.75 Cr.

Fund Raising and IPOs

Bank of India: Closed its QIP, raising Rs 4,500 crore at an issue price of Rs 100.2 per share.

Sterling & Wilson Renewable Energy: Launched a QIP issue with a floor price of Rs 365.02 per share.

Indian Bank: Launched its qualified institution placement (QIP) issue, fixing the floor price at Rs. 414.44 per share.

State Bank of India (SBI) is set to sign a 70-million-euro line of credit with German development bank KfW for supporting solar PV projects in India.

Vedanta will consider issuing non-convertible debentures on a private placement basis.

FINVEZTO.COM | Useful & Actionable Stock Market Tools

You are always top of my list, if you update IIP before and now it would be great