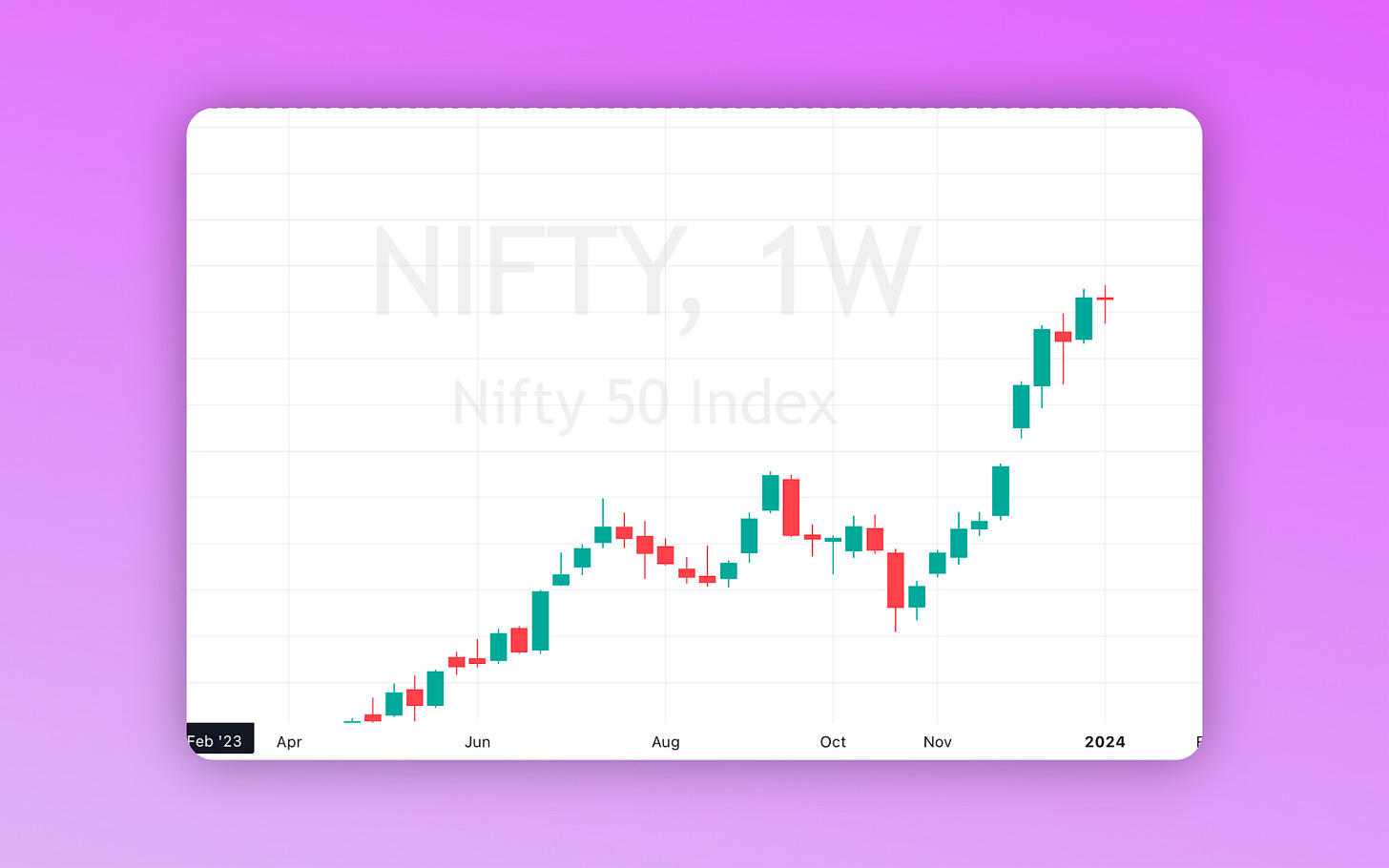

Weekly Market Analysis for Jan 08-12, 2024

Nifty closed flat, Global Momentum paused, Weakness in Global Economies, Strong Indian Economy and much more...

What happened last week?

Nifty witnessed volatile moves last week but ended on a flat note.

Most Global Markets ended in red last week. Nasdaq fell by 3.7%. Apple Shares slumped by 6.6% last week. Indian markets fell less than their peers.

The global price momentum witnessed a setback.

Geopolitical tensions in the Israel-Gaza conflict expanded into a wider regional conflict.

Crude Oil prices spiked 3% last week due to bomb blasts in Iran and the shutdown of the Sharara oilfield in Libya.

Economic Indicators from China and Europe showed weakness.

However, things looked good for India. India GST collections increased 10% YoY in December.

Top Indian Banks reported robust Credit Growth numbers.

Highest ever monthly Domestic Air Traffic was recorded in December.

India Services PMI was at a 3-month High of 59.

Let us now dive deeper into FII DII positions.

FII Positions Analysis

FIIs were net buyers for ₹3290 Crores in the cash market.

DIIs were net sellers for ₹7296 Crores in the cash market.

FIIs held long positions in Index Derivatives throughout last week. However, they trimmed their longs significantly on Friday.

FIIs continue to hold long positions in Stock Derivatives.

DIIs have increased their short positions in Index Derivatives suggesting that they might sell more in the cash market.

Overall, FIIs and DIIs have become less Bullish last week, but not outrightly Bearish.

Nifty Analysis

The week started with Bearish Sentiment, but ended with a Bullish Sentiment. Sentiment is indicated by the blue line and price is indicated by black line below. We will have to wait for more evidence to have a directional view on Nifty.

“No View” is the view for this week.

Key Upcoming Events

Monday (January 8)

Euro Area Economic Sentiment Data (December)

Tuesday (January 9)

Jyoti CNC Automation IPO Listing

Wednesday (January 10)

US Crude Oil Stocks Change Data

Thursday (January 11)

US Inflation Rate December data.

Friday (January 12)

India CPI Inflation Rate

India Manufacturing & Industrial Production data

India Bank Loan Growth and Deposit Growth data

Key Stock Announcements from Last Week

New Orders, Contracts & Projects

NBCC (India) Limited: received a work order valued at ₹88.90 crore from Delhi Metro Rail Corporation Ltd. The project involves serving as Project Management Consultant for constructing staff quarter residential buildings for the Bhubaneswar Metro Rail Project.

Techno Electric & Engineering Company Limited: secured orders totalling ₹1750 Crores, comprising Transmission orders worth ₹709 Crores, including substation packages for Neemrana, Sikar, Dausa, and Beawar, along with an Advance Metering Infrastructure (AMI) project of ₹1041 Crores for installing smart meters in Kashmir.

SJVN: Commissioned a 75 MW Gurhah solar power project in Jalaun, Uttar Pradesh.

RPP Infra Projects: Received three new orders of construction in Chennai for a total contract price of ₹70.50 crore, ₹53.17 crore, and ₹59.92 crore.

Newgen Software Technologies: Received an order for the procurement of a loan-originating system (LOS) platform for ₹14.32 crore.

HFCL Limited secured a significant ₹1,127 Crores order from BSNL to upgrade its Optical Transport Network across India, meeting 4G/5G demands.

R.P.P Infra Projects secured three contracts for stormwater drain works in Chennai’s expanded areas, covering different zones, totalling ₹183.59 Crores.

Kernex Microsystems received a ₹109.465 Cr order from South-Central Railway for signalling works in a joint venture, pending specific work allocation among members, compliant with regulatory disclosures.

G R Infraprojects secures Letter of Intent for power evacuation in Madhya Pradesh, expecting annual transmission charges of Rs 41.9 crore.

Rail Vikas Nigam (RVNL): JV KRDCL-RVNL secured a major project for Varkala Sivagiri railway station upgrade, valued at Rs 123.36 crore.

Surya Roshni Limited received a ₹72 crore LED street lighting project order from Odisha Urban Infrastructure Development Fund for 16 Urban Local Bodies in Odisha, with execution within 6 months. No related-party involvement.

KPI Green Energy received orders for a 2.10 MW Solar Power Plant from domestic entities, M/s Radhey Krishna Terene Pvt. Ltd. and M/s Jay Metal Tech.

RailTel secures a Rs. 35 Cr contract from Rail Vikas Nigam for Data Services, spanning 3+ years.

Jupiter Wagons: Secured a significant contract worth Rs 473 crore from the Ministry of Defense for the manufacturing and supply of 697 Boggie open military (BOM) wagons.

NBCC (India) Limited disclosed work orders worth Rs. 98 crore for educational construction in Assam, Meghalaya, and Tripura.

Partnerships, Acquisitions & Investments

Dr Reddy’s Laboratories: Acquired 10,14,442 preferred A-1 shares of Edity Therapeutics for $2 million.

Central Bank of India: Signed a co-lending partnership with SMFG India Home Finance Company for MSME loans.

Nazara Technologies: Subsidiary Nodwin Gaming International Pte Ltd subscribed to a convertible note of Freaks 4U Gaming GmbH for ₹33.26 crore.

Hindustan Foods Limited expands into sports shoe contract manufacturing, acquiring a unit in Kundli, Haryana, valued at around Rs. 30.72 crores.

Bharti Airtel acquires 97.1% stake in Beetel Teletech, part of group restructuring.

SJVN forms four JVs for hydroelectric and renewable projects in India and Nepal.

NHPC: Signed MoU with Gujarat Power Corporation for proposed investment of Rs 4,000 crore in Kuppa Pumped Storage Project.

Torrent Power: Signed non-binding MoUs with the Government of Gujarat for proposed investments in renewable energy.

Larsen & Toubro: Completed the sale of entire stake in L&T Infrastructure Engineering to STUP Consultants.

Sun TV Network: Approved the scheme of amalgamating Udaya FM with Kal Radio, a subsidiary of Sun TV Network.

Syrma SGS Technology: Established Syrma Mobility, a wholly-owned subsidiary focusing on designing, manufacturing, and assembling memory chips, modules, PCB assemblies, and storage products.

Torrent Pharmaceuticals: Established a subsidiary, Farmacéutica Torrent Colombia SAS, in Colombia for 429 crore Colombian pesos, indicating expansion into the Colombian pharmaceutical market.

Business Operations

SRF: Commissioned a fluorocarbon refrigerant gas capacity expansion project costing ₹317 crore.

Jubilant Ingrevia: Commissioned a multipurpose agro-intermediate plant in Bharuch, Gujarat.

Alkem Laboratories: Closed operations at a St. Louis manufacturing facility in the USA, selling the facility for $7.96 million.

Cantabil Retail India: Opened 11 new showrooms and shops in India during December 2023, totaling 515 showrooms.

Reliance Power: Transferred development rights and assets of the 1,200 MW KalaiII hydro-electric project to THDC for ₹128.39 crore.

Bandhan Bank: Transferred its housing finance NPA portfolio to an ARC for ₹289.60 crore on an outright cash basis.

TVS Motor Company records 25% growth in December 2023 sales, reaching 3,01,898 units. Exports increase by 8% to 85,391 units.

Coal India reports 8.2% YoY increase in December 2023 coal production and an 11% growth in April–December 2023 period.

APL Apollo Tubes’ Q3 FY24 sales volume declines by 0.2% due to channel de-stocking anticipating steel price corrections.

UltraTech Cement sees 6% YoY growth in sales volume, reaching 27.32 million metric tons.

SRF commissions a manufacturing facility for aluminum foil at a cost of Rs 536 crore.

Surya Roshni’s lighting and consumer durable segment become borrowing-free as of December 2023.

JTL Industries achieves highest quarterly sales volume of 1,00,905 MT in Q3 FY24, driven by demand in infrastructure and industrial sectors.

Hero MotoCorp: Sold 3,93,952 units in Dec 2023, a marginal 0.05% drop YoY. Domestic sales fell 0.92%, but exports surged by 25.7%.

Avenue Supermarts: D-Mart chain reported 17.2% YoY revenue growth, reaching Rs 13,247.33 crore in Dec FY24, with 341 operational stores.

Coal India: Supplied a record 98 million metric tons to non-regulated sector consumers, a 31% YoY increase, with 454 MT dispatched to power plants, surpassing committed quantities.

Jio Financial Services: Filed papers with SEBI to launch mutual fund businesses in India, awaiting in-principle approval.

Reliance Industries: Reliance Jio added 31.59 lakh users in October 2023 with a 39.3% market share in wireless subscribers.

Vodafone Idea: Lost 20.4 lakh users in October 2023; holds a 19.59% market share in wireless subscribers.

Key Buying and Selling Deals

PVR INOX: Nippon Life India Trustee acquired 2 lakh equity shares, increasing its shareholding to 7.54 percent.

Kolte-Patil Developers: Promoter and promoter group sold 22,80,132 equity shares, equivalent to 3 percent of paid-up equity, worth ₹110.8 crore.

Innova Captab: Canara Robeco Mutual Fund acquired 9 lakh equity shares at an average price of ₹474.41 each. Invesco Mutual Fund bought 6 lakh shares at an average of ₹452.1, acquiring a 2.6 percent stake in Innova.

LIC increases stake in Asian Paints to 5% from 4.995%.

VST Industries: Radhakishan Shivkishan Damani bought 2,22,935 equity shares, SBI Mutual Fund picked 2.25 lakh shares, while HDFC Mutual Fund and DSP Mutual Fund sold shares.

PDS: Malabar India Fund acquired 10 lakh equity shares, equivalent to 0.76% of paid-up equity.

Strides Pharma Science: Amansa Holding acquired a 2% equity stake via open market transactions.

Sunteck Realty: Pabrai Investment Funds reduced its stake in the realty company by 2.03% via open market transactions on January 2, reducing their ownership from 8.61% to 6.58%.

Tracxn Technologies: Seabright II sold 5.8 lakh shares, equivalent to 0.56% of paid-up equity capital, at an average price of Rs 114.44 per share.

Fund Raising

Gensol Engineering gets approval to raise funds up to Rs 300 crore through various means including QIP.

Shyam Metalics and Energy: Opened QIP issue with a floor price of Rs 597.63 per share.

Adani Ports: Board approved raising funds up to Rs 5,000 crore via NCDs.

Vedanta: Bondholders approved restructuring of $3.2 billion worth of bonds; production details for Lanjigarh refinery and ore production mentioned.

Satin Creditcare Network: To consider fund-raising via non-convertible debentures.

Grasim Industries: Received approval from the Board of Directors for a rights issue worth Rs 3,999.80 crore, signalling an effort to raise funds by offering existing shareholders additional shares at a predetermined price.

Regulatory & Legal

Vedanta: Received orders worth ₹48.82 crore related to GST demands for FY 2017-18 and FY 2018-19.

Macrotech Developers: Received Central Goods and Service Tax demand for ₹91.60 crore related to tax liabilities.

LIC receives a Rs 806.3 crore GST demand notice for Maharashtra state for FY2017–18; minimal impact on operations.

Minda Corporation’s subsidiary faces Rs 67.82 crore GST demand and 100% penalty for goods classification issues from July 2017 to March 2021.

Sudarshan Pharma Industries: Took legal action against Regans International DMCC due to non-receipt of chemicals after making advance payment.

Sundaram Clayton: Received a GST demand of Rs 14.40 crore and penalty of Rs 70.8 lakh for FY18.

Maruti Suzuki India: Gujarat GST Department upheld a tax demand of Rs 173.9 crore; Maruti to appeal.

Life Insurance Corporation of India: Faces GST demands in Tamil Nadu, Uttarakhand, and Gujarat amounting to Rs 667.5 crore; plans to file appeals.

LTIMindtree: Received a tax demand order under the Maharashtra Goods & Services Tax Act for Rs 205.9 crore.

FINVEZTO.COM | Useful & Actionable Stock Market Tools