Weekly Market Analysis for Sep 30-Oct 04, 2024

Nifty scales record high; Metals Surge; Chinese Govt Stimulus and much more...

What happened last week?

After opening, Nifty tested the previous week's high of 25840 and from there it shot up to 26277 recording a new all-time high.

Nifty Closed the September expiry series with a 4.6% gain.

On the global front…

Most markets closed in green except London.

Chinese market surged due to government stimulus measures targeting interest rate reduction and adjustment to mortgage policies to boost consumer spending.

On the sectoral front…

All sectors closed in green. Metals, Auto, Energy and Realty shot up significantly. Media continues to underperform.

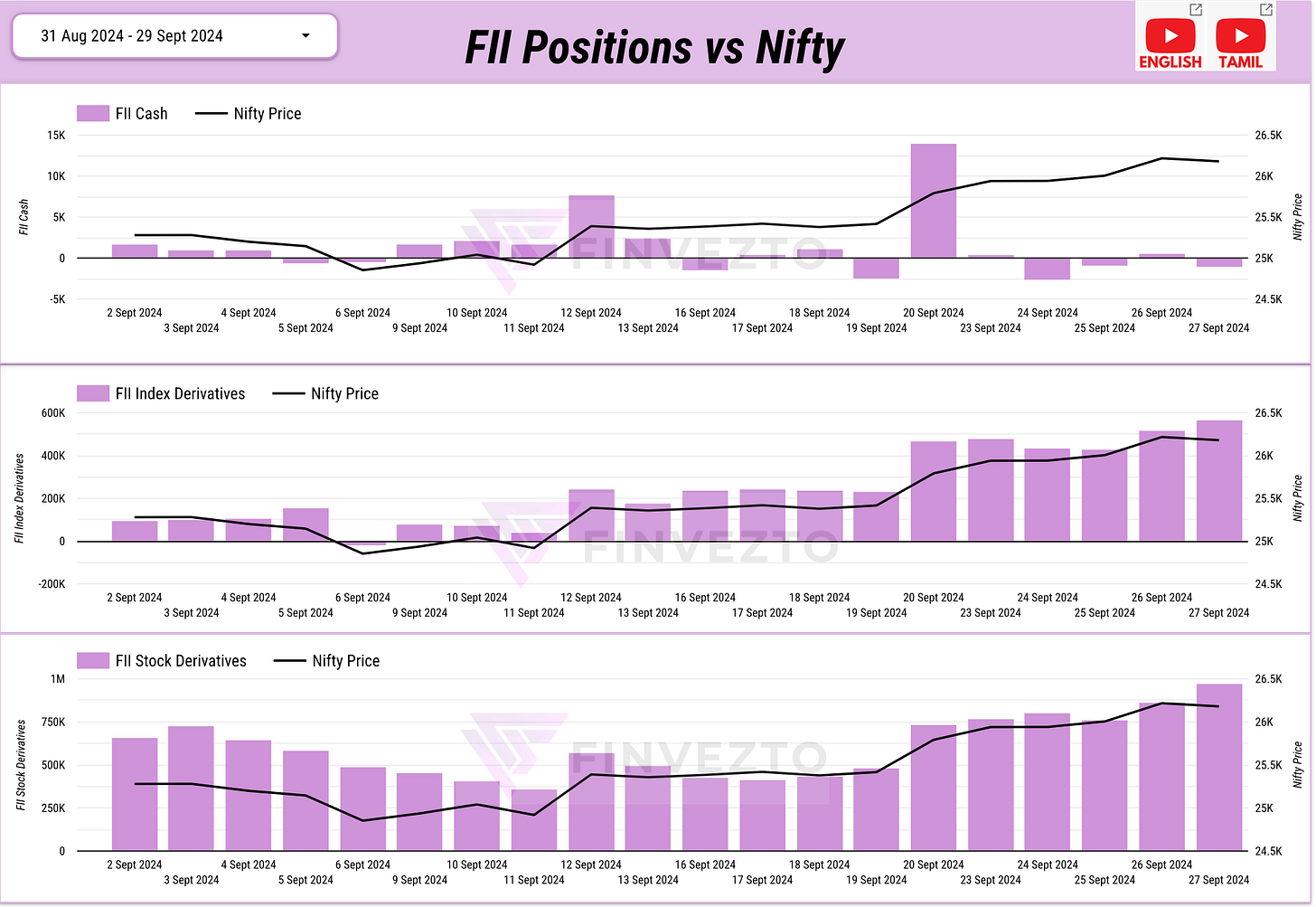

Let us dive deeper into FII DII data…

FIIs sold -3932 Cr and DIIs bought ₹15961 Cr in the cash market last week.

FIIs and DIIs have pumped in ~₹25000 Cr each in September alone.

FIIs have also increased their long positions in both Index and Stock Derivatives. FII sentiment continues to be bullish.

Nifty Sentiment Analysis…

If you look at the Weekly and Monthly Max Pain trend of Nifty below,

Positional Traders have not added aggressive longs after the price reached 26000. They have not closed their existing longs either. If the blue line and pink line below continue to go up, we will remain bullish. If the blue line and pink line move down together, we will turn Bearish.

If you have been long over the last couple of weeks, it might be good to book partial profits. However, it is not time to short now as yet. We need to wait for more evidence.

Key Stock Announcements Last week

New Orders & Projects:

BHEL awarded INR 6,100 crore contract for NTPC's Sipat project.

NBCC subsidiary HSCC awarded INR 1,261 crore AIIMS Darbhanga project.

Interarch Building secures INR 634 crore in new orders across sectors.

PSP Projects received INR 554.92 crore orders from Gold Stone Hotel and Residential Towers.

Patel Engineering wins INR 240.02 crore NHPC hydropower project bid.

Power Mech Projects wins INR 226.66 crore order for power plant O&M.

Hind Rectifiers secures INR 200 crore Indian Railways supply order.

Marine Electricals wins EUR 15.59 mn order for Sri Lanka Navy ships.

NBCC wins INR 75 crore project from IIIT Nagpur for infrastructure development.

Synergy Green gets INR 64.5 crore orders from Flender Drives.

Vinyas received INR 52.34 crore orders from domestic and international customers.

Sahaj Solar received a INR 19.99 crore order for solar water pumps.

Vinfast awards INR 18.77 crore civil work contract to Sathlokhar.

MTAR Technologies received a INR 15.4 crore order from DRDL for combustors.

Service Care secures INR 11.45 crore contracts for workforce and workspace management.

RBM Infracon wins INR 11 crore contract from Nayara Energy Limited.

Surana Solar received a 54 MW solar project under Maharashtra’s solarization scheme.

Gayatri Rubbers awarded annual contract by MSRTC for rubberized packing.

Partnerships, Acquisitions & Investments:

Adani Ports and Rorix Holdings sign MOU to enhance commodities market.

HFCL partners with General Atomics to develop critical UAV sub-systems.

DOMS Industries acquires majority stake in baby hygiene company Uniclan.

Firstsource acquires Ascensos to expand retail, nearshore, and multilingual capabilities.

JSW Infrastructure acquires New Dredger to support expansion plans.

TVS Holdings gets CCI approval to acquire 80.74% of Home Credit India.

Zaggle acquires 98.32% stake in Span Across, a software company.

Cipla acquires remaining stake in Cipla Jiangsu, gaining full control.

Biocon partners with Tabuk to commercialize GLP-1 products in Middle East.

Thomas Cook partners with Cricket Australia for Border-Gavaskar sports tourism.

Krsnaa Diagnostics invests in Apulki Healthcare for cancer and cardiac care.

Linc partners with Mitsubishi for writing instruments joint venture in India.

EaseMyTrip partners with PhonePe to offer hotels, activities, and cabs.

Business Operations:

Vodafone Idea concludes USD 3.6 bn network equipment deal with Nokia, Ericsson, and Samsung.

Adani Total Gas secures largest global financing in city gas distribution.

Tata Steel commissions India's largest blast furnace at Kalinganagar, Odisha.

TCS expands Poland operations, opens new delivery centre in Warsaw.

Samvardhana Motherson International raises INR 6,438 crores through QIP.

Inox Wind obtains ~ INR 2,200 crore credit facility from bank group.

Granules India launches mobile cancer screening unit for underserved communities.

Max Estates receives INR 391 crore from NYL for strategic investments.

Club Mahindra expands in Mysuru with Golden Landmark Resort.

Balu Forge acquires 7 Axis CNC machines for precision engineering.

Zen Technologies launches new weapon and surveillance systems.

Airtel launches AI-powered solution for SPAM detection, improving security.

MICL Group completes 'Atmosphere 02' project early, with near-full sales.

Ola Electric launches 'Network Partner Program' to expand EV adoption.

Allcargo Gati announces general price increase from January.

Intellect launches AI-powered retail platform eMACH.ai Retail 6DX.

Management Changes:

Rushil Decor elevates Rushil K. Thakkar as MD, appoints new director.

Astec LifeSciences Limited announces the resignation of CEO, Anurag Roy.

Snowman Logistics appoints Padamdeep Singh Handa as new CEO.

Key Upcoming Events

September 30 (Monday):

UK GDP Growth Rate

India Infrastructure Output

China Caixin Manufacturing PMI

October 1 (Tuesday):

India Manufacturing PMI

October 4 (Friday):

India Foreign Exchange Reserves

US Unemployment Rate

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools