Weekly Market Analysis for Sep 23-27, 2024

Nifty reaches new all-time highs; Fed cuts rate by 50 basis points; FIIs buying spree and much more...

What happened last week?

Nifty made a new all-time high of 25849 on Friday before closing at 25790.

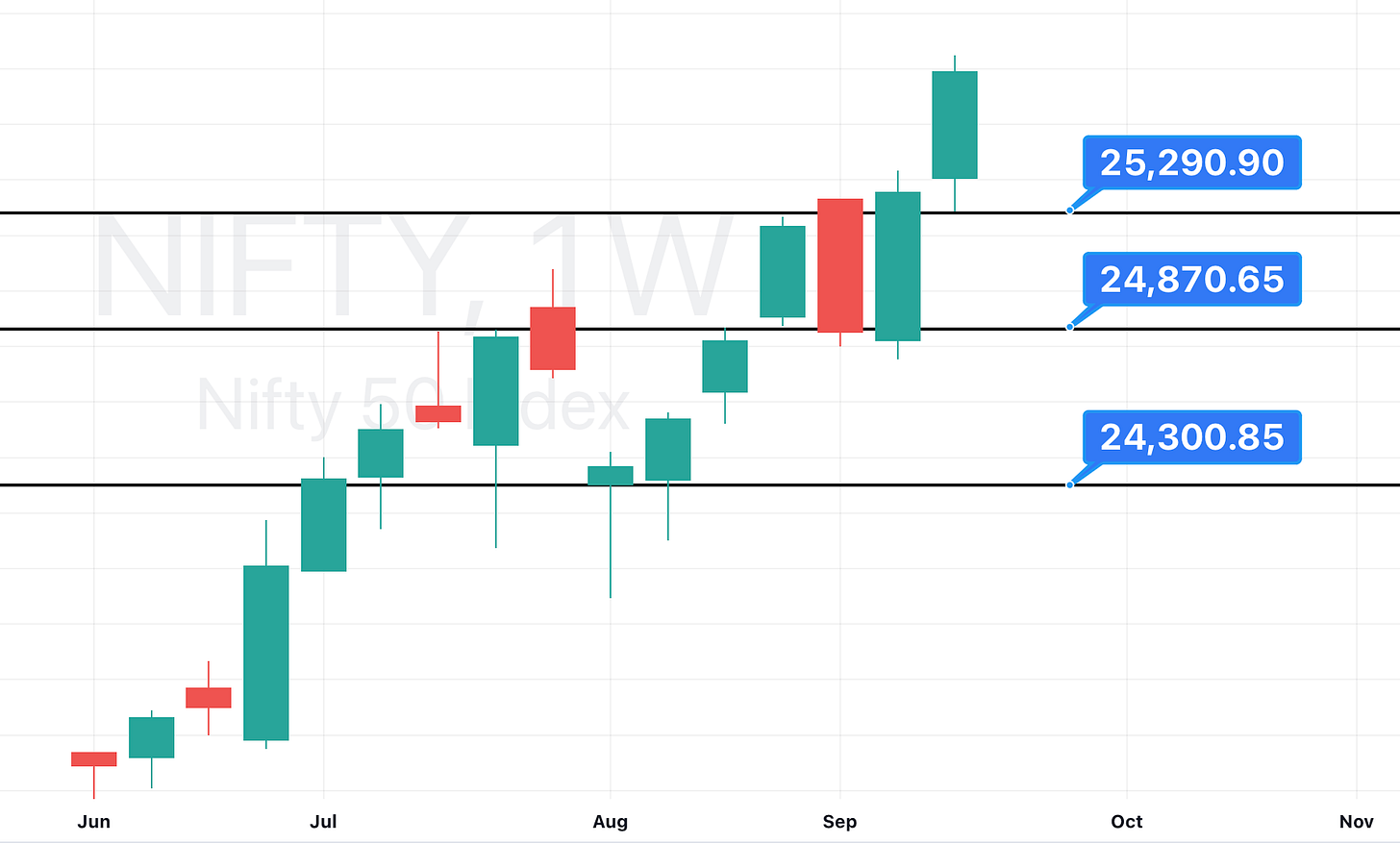

In the previous 3 weeks, Nifty witnessed resistance around the 25300 to 25400 zone. Last week it took that zone as support and shot up. 25300 to 25400 will be a critical zone on the downside.

On the global front…

Most markets closed in green.

US Markets ended higher.

The Federal Reserve (FED) lowered the target range for the federal funds rate by 50 basis points, from 5.25-5.5% to 4.75-5%, the first rate cut since the COVID-19 pandemic.

Fed Chair Jerome Powell also hinted at further rate cuts in the coming months, suggesting a more accommodative monetary policy stance.

On the sectoral front…

Banks, Financial Services and Realty were up significantly. Big money has been going into Large Caps and Financial Services in September.

FIIs have favoured Financials, Healthcare and Realty in the last 15 days.

Let us now dive deeper into FII DII data.

FIIs bought ₹11517 Cr and DIIs sold ₹633 Cr in the cash market. FIIs have almost bought ₹30000 Crores in September so far.

FIIs have added longs in both Index and Stock Derivatives. FII sentiment is Bullish.

DIIs have been holding significant Index hedges over the last 3 weeks. They are still being cautious.

Nifty Sentiment Analysis…

If you look at the Weekly and Monthly Max Pain trend of Nifty below,

Positional Traders have added longs since 13 September. Both Weekly and Monthly Max Pain have shot up from last week. Participants continue to be Bullish.

Let us look at some India-specific developments.

India’s WPI Inflation by 1.31% YoY in August 2024, easing from a 2.04% gain in July. Fuel prices fell for the first time in five months.

Total passenger vehicle sales in India shrank 1.6% from a year earlier to 308,779 in August 2024.

Key Stock Announcements Last week

Note: All the news items below include only the core business activities.

New Orders & Projects:

Power Mech secures INR 865 crore O&M contract from Vedanta subsidiary.

Thermax secures INR 516 crore order for CFBC boilers in Botswana.

GPT Infraprojects wins INR 204 crore contract from South Eastern Railway.

DCX Systems secures INR 154.80 crore export order from Israel.

Supreme Power wins INR 26 crore order from Solar Energy Company.

Inox Wind gets 550 MW LoI from IGREL for wind project execution.

Tata Power Renewable Energy secures a 400 MW hybrid project in Maharashtra.

Pudumjee Paper awarded 15.4 MW solar power project to Prozeal.

TCS partners with McDonald’s Philippines to modernize IT systems.

Partnerships, Acquisitions & Investments:

ONGC Green Limited signs agreement to acquire 100% of PTC Energy Ltd.

BLS International's Visametric acquires Serbian visa services firm wholly.

Max Healthcare acquires controlling stake in Jaypee Healthcare, enhancing network.

EaseMyTrip partners with IIFA for exclusive holiday packages.

Indo Count Global acquires 81% of Fluvitex USA to expand market.

Intellect and HCLTech partner to enhance banking with AI platforms.

Torrent Power commits over INR 64,000 crore, promises 26,000 jobs.

Jindal Steel invests INR 20,000 crore in India's largest green hydrogen facility.

Jupiter Wagons transforms subsidiary, expands capacity with INR 2,500 crore investment.

Whirlpool acquires an additional 9.56% in Elica PB Whirlpool for INR 167 crore.

Exide Industries invested INR 100 crore in its subsidiary, EESL.

Zydus Lifesciences acquires Sterling Biotech's API business for INR 84 crore.

DOMS Industries acquired a 51.77% stake in Uniclan Healthcare for INR 54.88 crore.

Aurobindo Pharma to acquire the remaining 49% of GLS Pharma for INR 22.5 crore.

Lupin partners with Takeda to commercialize Vonoprazan in India for gastrointestinal treatments.

AU Small Finance Bank partners with Niva Bupa to offer health insurance.

Gateway Distriparks acquires 7.1 lakh Snowman Logistics shares, raising stake.

Jyothy Labs acquires Quiclo® brand to expand Hyderabad laundry services.

Unitech Ltd acquires 9.38 lakh shares of Unitech Holdings for INR 15 crore.

Business Operations:

Zydus announces U.S. licensing deal for MRI contrast agents with Viwit.

Responsive Industries to grow with India’s INR 1 lakh crore tunnels.

TVS launches Apache RR 310 with advanced features and technologies.

Strides receives USFDA approval for Fluoxetine 60 mg tablets.

Laurus Labs opens advanced R&D center at IKP Knowledge Park.

Mahindra unveils Veero LCV<3.5t with new modular platform and engine options.

Revolt Motors enters Sri Lanka, debuting its electric motorcycles internationally.

JBM EcoLife Mobility secures funding for deploying 650 e-buses across India.

Man Infraconstruction completes 19th real estate project, Aaradhya Evoq.

Tata Elxsi launches 5G lab for cross-industry digital transformation.

SBI raises INR 7,500 crore through Tier 2 bonds at 7.33% coupon.

Airtel boosts Kolkata network with additional spectrum for improved connectivity.

Mamaearth expands offline reach by distributing through CSD nationwide.

Intellect launches WealthForce.AI in Middle East for AI-driven wealth management.

IGREL Renewables raises INR 300 crore from investors to boost renewable energy capacity.

Awfis launches 30,221 sq. ft. flexible workspace in GIFT City.

Suven's Ropanicant shows positive Phase-2a results for depression treatment.

Reliance Infrastructure cuts debt from INR 3,831 crore to INR 475 crore.

Wockhardt’s Zaynich™ drug successfully treated severe, drug-resistant meningitis case.

IndoStar Capital sells IndoStar Home Finance to EQT for INR 1,750 crore.

Phoenix Mills' subsidiary Casper Realty wins bid for 13.14 acres in Mohali.

Firstsource expands to Australia, creating 400 jobs in Victoria.

Airtel and Cisco launch Airtel SD-Branch for simplified, secure networking.

Key Upcoming Events

September 23 (Monday):

India Manufacturing PMI Flash

September 24 (Tuesday):

Japan Manufacturing PMI Flash

September 26 (Thursday):

BoJ (Japan) Monetary Policy Meeting Minutes

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools