Weekly Market Analysis for Sep 16-20, 2024

Nifty makes new all-time high; Global Cues Positive; Oil Prices at 18-month low; FII Buying and much more...

What happened last week?

Nifty rebounded from the 24870 zone last week and made a new all-time high of 25433 before closing at 25356.

24870 zone proves important again and FIIs have also bought significantly at these levels.

On the global front…

Most markets closed the week in green except certain Asian markets.

US Markets shot up by 2-3%. The US Fed chair is expected to cut rates in the coming week’s announcement.

Oil Prices have declined to an 18-month low which is also a positive for the markets.

On the sectoral front…

Consumption, FMCG and Pharma continue to do well.

The Pharma sector is witnessing tailwinds. The US House of Representatives passed the BioSecure Act restricting business with Chinese biotech firms, potentially benefiting Indian players. The GST council's decision to reduce the GST rate on cancer drugs from 12% to 5% is another positive.

Paint Stocks are benefitting from the continued decline in oil prices. Asian Paints has shot up almost 10% in the recent weeks. Asian paints had witnessed significant institutional activity last month.

Let us now dive deeper into FII DII data.

FIIs bought 15780 Crores and DIIs bought for 1863 Crores in the cash market.

FIIs have maintained long positions in Index Derivatives throughout the week. They have also added long positions in Stock Derivatives. Overall FII Sentiment is Bullish. DIIs continue to hold significant short positions on the Index and are heavily hedged.

What is Nifty up to?

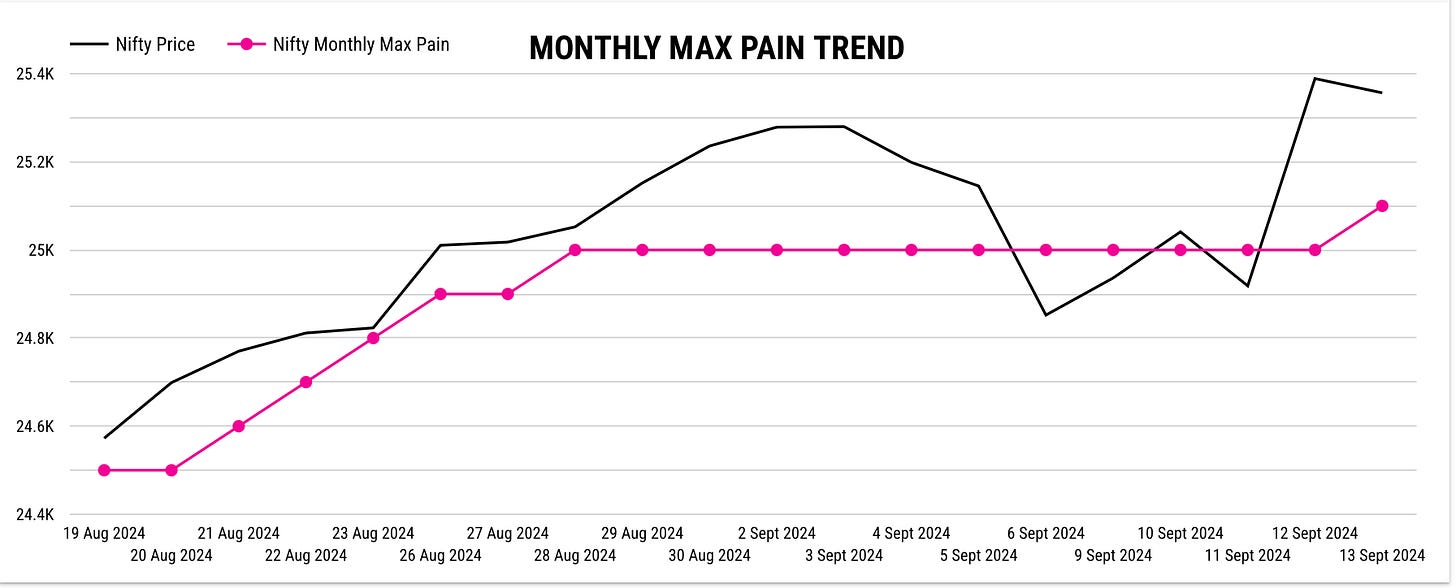

After spending multiple days around 24950, Nifty Max Pain shot up on the last 2 days of the week. Currently, Sentiment is Bullish.

If you look at the Monthly Max Pain trend of Nifty below,

Positional Traders have largely maintained their view that Nifty is likely to trade around 25000. They weren’t excited when Nifty shot up to 25300 for the first time nor did they panic when Nifty went below 24870. They have not changed their view despite Nifty’s wild swings over the last 2 weeks. On Friday, they have added some longs.

Overall, the sentiment is Bullish going into next week. But remember, sentiments change quickly and you need to keep track of them regularly if you are trading in the short term.

Let us look at some India-specific developments.

India's CPI inflation rate stood at 3.65% in August 2024, which was the lowest since August 2019. It is the second consecutive month that inflation has stayed below the RBI’s target of 4% in five years.

India's Industrial output rose by 4.8% YoY in July 2024, following a 4.2% growth in June 2024. Manufacturing output which accounts for nearly 78% of total industrial production, expanded by 4.6% with notable growth for electrical equipment (+28.3%), fabricated metal products, except machinery & equipment (+11%) and other transport equipment (+25.5%).

Key Stock Announcements Last week

Note: All the news items below include only the core business activities.

New Orders & Projects:

Hindustan Aeronautics Ltd signed a INR 26,000 crore contract for 240 aero-engines.

KPIL wins new orders worth INR 2,774 crore across T&D, Airport & Residential sectors.

Mazagon Dock wins INR 1486 crore contract from ONGC for pipeline project.

Deep Industries secures INR 1402 crore ONGC order for 15-year production enhancement.

Ahluwalia Contracts secures INR 1307 crore for two Gurugram projects.

BEL receives orders worth INR 850 crore from Cochin Shipyard.

ITI Limited wins INR 300 crore order for 100,000 solar street lights.

SEPC Limited awarded INR 182.57 crore contract for Bihar water project.

E Factor secured INR 176.10 crore contract for World Expo 2025.

Ion Exchange awarded INR 168 crore contracts for UAE project.

HPL Electric receives INR 143.77 crore order for Smart Meters.

KDAIL secures INR 104 crore order from Larsen & Toubro for steel products.

SAR Televenture signed MOU for IRN 45.64 crore Smart Meter project.

Winsol Engineers received orders from Suzlon Global Services totaling INR 27.65 crore.

Marine Electricals receives INR 12.1 crore order from AM/NS for automation.

Suzlon secures India’s largest wind energy order: 1,166 MW from NTPC.

Oriana Power’s subsidiary wins 128 MW solar project from Dalmia Cement.

Servotech secures contract to install 11 EV charging stations in Karnataka.

Aurionpro wins contract for Panvel Safe City surveillance project.

Tata Steel signed GBP 500 mn agreement with UK Government for green steel project.

Partnerships, Acquisitions & Investments:

JSW Infrastructure approves capex of INR 2,359 crore for capacity expansion.

Century Textiles acquires 10 acres in Worli for INR 1100 crore.

Nazara Technologies acquires 48.42% of Paper Boat Apps for INR 300 crore.

Adani Power has completed the acquisition of Lanco Amarkantak Power Limited.

Jio and BlackRock form joint venture for investment advisory services.

Arvind Limited invests INR 48 crore in its wholly owned subsidiary ATPPL.

GMR to acquire 10% stake in Delhi International Airport Limited.

Alok Ferro Alloys becomes wholly owned subsidiary of Godawari Power.

Thomas Cook India, SOTC partner with Malaysia Airlines for strategic growth.

Persistent Systems is acquiring select assets from SoHo Dragon Inc. for USD 4.7 mn.

Hindustan Foods invests INR 43 crore in wholly owned subsidiary KNS Shoetech.

Dixon's 6.5% stake acquisition in Aditya Infotech approved by CCI.

OIL, OVL, KABIL, and IRH sign MoU for global critical minerals cooperation.

FlixBus partners with AbhiBus to expand premium bus service in India.

Infosys and Proximus Group expand collaboration to enhance CPaaS and DI solutions.

TCS partners with Mansfield Building Society for UK digital transformation.

Mphasis partners with AgentSync to improve insurance compliance solutions.

Gravita India signs MOU to acquire a rubber recycling plant in Romania.

Lupin Limited signs agreement to acquire 42.61% in Sunsure Solarpark.

Reliance Retail and Delta Galil form strategic apparel partnership in India.

Persistent Systems acquires assets from SoHo Dragon for USD 4.7 mn.

Adani Ports & SEZ to develop multipurpose berth at Kandla Port.

ONGC increases stake in OPaL to 91.16% after CCD conversion.

Puravankara acquires Miami Apartments redevelopment rights in South Mumbai.

Linde India invests INR 35 crore for 27% stake in Zenataris.

BLS acquires 100% stake in Citizenship Invest, expanding visa services.

MFSL increases stake in subsidiary MRHMFL to 61.33% via conversion.

Tata Power and Tata Motors to set up 200 EV fast-charging stations.

Thermax and Ceres Power sign global license for green hydrogen SOEC.

Airtel and Sparkle expand global network with Blue-Raman cable.

MapmyIndia partners with Zoomcar for AI-powered travel integration and seamless bookings.

Business Operations:

Strides receive USFDA approval for Theophylline Extended-Release Tablets.

Mahindra Last Mile Mobility unveils ‘e-ZEO’, a new electric four-wheeler.

Lemon Tree Hotels signs agreement for a new Nashik property.

Airtel Finance introduces fixed deposits at interest rates of 9.1%.

Tata Power starts solar cell production at India's largest 4.3 GW plant.

Awfis sells Facility Management division to SMS for INR 27.5 crore.

Ramco Systems Launches aviation software 6.0 for advanced aircraft management.

Brigade Foundation opens 108-bed hospital with St. John’s Medical College.

Hindustan Zinc supplies zinc for India’s heaviest transmission steel pole.

Brigade Group's BuzzWorks expands to Hyderabad with premium flexible workspaces.

Castrol India expands Auto Care range with Microfibre Cloth and Shiner Sponge.

Max Estates' Max House Phase 2 achieves 100% occupancy in under a year.

Airtel boosts network in Bihar and Jharkhand with new spectrum.

Intellect Design Arena launches eMACH.ai, enhancing Sri Lankan financial tech.

Sarveshwar Foods Expands product line with new rice-based offerings.

Sterlite Technologies Limited launches cutting-edge microcables.

HFCL unveils advanced high-density fibre solutions for UK's network expansion.

EaseMyTrip launches ScanMyTrip.com on ONDC, boosting travel service accessibility.

Key Upcoming Events

September 16 (Monday):

India Wholesale Price Inflation Data

September 17 (Tuesday):

US Retail Sales Data

September 18 (Wednesday):

US Interest Rate Decision

September 19 (Thursday):

UK Interest Rate Decision

September 20 (Friday):

Japan Interest Rate Decision

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

All data points above are taken from Finvezto Toolkit. Take a Trial of Finvezto Toolkit for 7 Days here.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools