Weekly Market Analysis for Sep 09-13, 2024

Nifty's 14-day rally ends; FII & DII net buyers despite fall; Negative Global Cues and much more...

What happened last week?

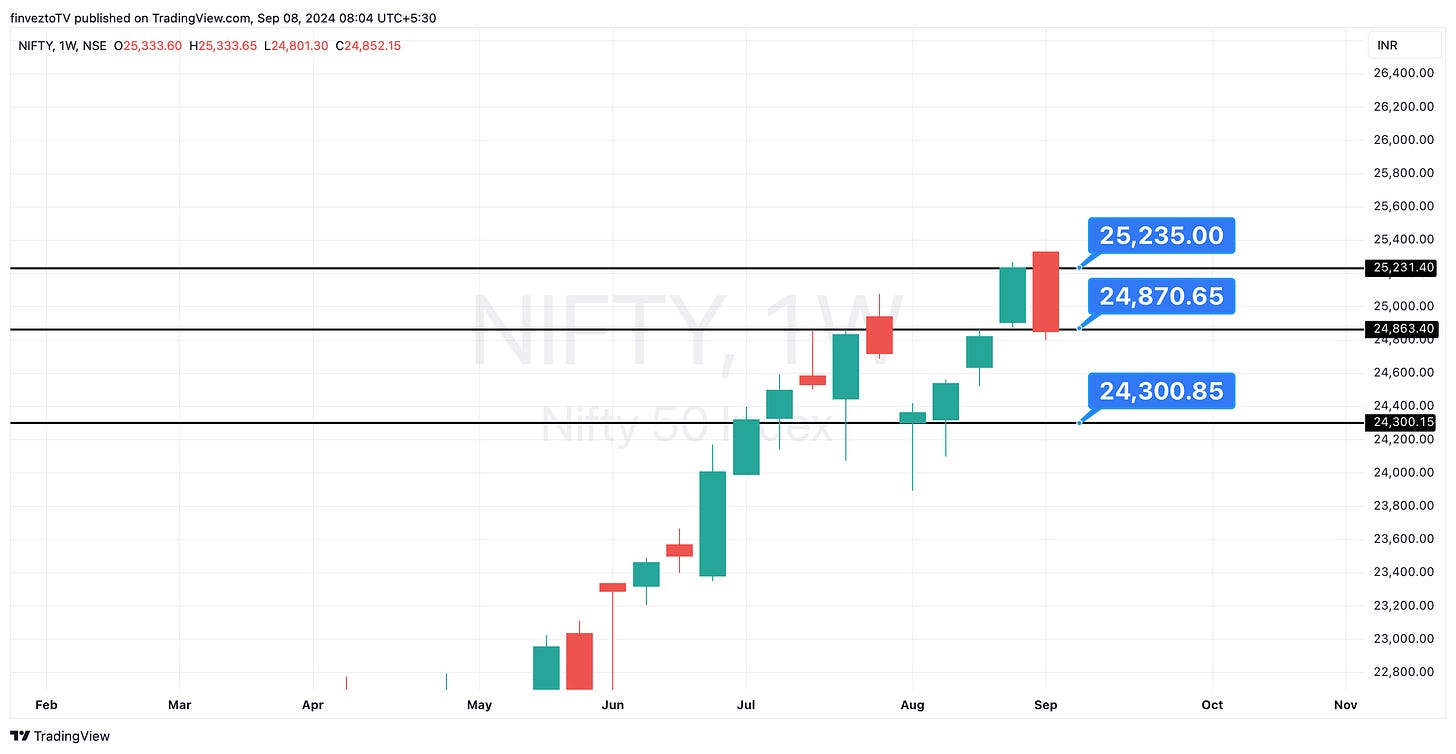

Nifty opened the week higher at 25333, but it dropped by almost 500 points to close at 24852.

Nifty witnessed a sharp selling after a 14-day rally. Surprisingly both FIIs and DIIs were net buyers last week. Even on Friday fall, FIIs did not sell significantly and DIIs bought.

As I mentioned in earlier weeks, the 24870 zone is key. It has acted as support and resistance multiple times. If the price goes below the 24870 zone, we might see a fall towards 24300.

On the sectoral front…

FMCG and Pharma continued steady performance indicating their defensive nature.

Also, crude oil prices are falling, benefitting sectors such as Paints, OMCs, Pharma, Tyres etc.

PSU Banks sink another 4% last week.

On the global front…

all markets closed in red.

Nasdaq was down by 4.7% due to a sharp drop in NVIDIA.

The US showed weak jobs data. Also, with the upcoming Fed Policies and US Elections, there seems to be uncertainty.

Japan plunged 5%.

Let us now dive deeper into FII DII data.

FIIs bought ₹2430 Cr and DIIs bought ₹7442 Cr in the cash market.

FIIs have turned bearish last week. They have short positions in Index Derivatives and have significantly reduced their longs in Stock Derivatives.

DIIs have increased their hedges significantly. They seem to be extremely cautious. They added to their hedges despite Friday’s fall. So, they are expecting a further fall.

Participant’s View on Nifty in the Short Term…

Nifty Price and Max Pain started falling on Sep 4 much before the big fall on Sep 6. That was an indication to exit longs. Nifty is Bearish in the short term.

If you look at the Monthly Max Pain trend of Nifty below,

you can see that Max Pain (pink line) has remained stable. Positional traders still think price will trade around 25000 for a while. They have neither become bullish nor bearish in recent days. They are holding on.

Let us look at key India-specific developments.

India's Manufacturing PMI fell to 57.5 in August 2024. Manufacturing sector saw slower but robust growth in orders and output.

India's Services PMI reached a five-month high of 60.9 in August 2024, marking 38 straight months of growth driven by increased new business, productivity gains, and strong demand.

Key Stock Announcements Last week

New Orders & Projects:

NCC Limited receives IRN 1,236 crore orders for irrigation projects.

Indian Hume Pipe received INR 858.88 crore EPC order for irrigation.

GGBL receives a INR 313.97 crore order from Western Railway.

Oriana Power awarded INR 247.88 crore EPC contract for 52 MW solar project.

NBCC received work orders worth INR 182.50 crore for construction projects in Assam and Delhi.

Centum Electronics received a INR 109.58 crore order from DRDO.

Sathlokhar Synergys secures INR 62.53 crore MEP work contract.

R.P.P Infra Projects Ltd secured INR 55.50 crore order for water supply project.

SBC Exports awarded INR 47.38 crore contract for Maharashtra manpower services.

Akanksha Power received a INR 23.66 crore order from Ashoka Buildcon.

Slone Infosystems Ltd. secures INR 17.43 crore contract for ICT Labs project.

Partnerships, Acquisitions & Investments:

Piramal Pharma will invest EUR 139.37 mn in Piramal Dutch Holdings via loan conversion.

Globalbees Brands, a subsidiary of Firstcry invests INR 105.15 crore in Frootle.

Krishna Institute acquired 100% of Chalasani Hospitals for INR 28 crore.

POWERGRID acquires 100% of BBTL for INR 12.22 crore in cash.

Adani Energy Solutions acquires 100% of Khavda IVA Power Transmission.

HAL partners with SAFHAL to develop 'Aravalli' engines for helicopters.

Mahindra & Sentrycs collaborate to develop anti-drone solutions in India.

Zydus Lifesciences' acquisition of 50% stake in Sterling Biotech completed.

TCS Partners with Google Cloud to Launch AI-powered Cybersecurity solutions.

NHPC signed MoU with Maharashtra for 7,350 MW energy projects.

Hindustan Composites acquires 0.01% of Swiggy for INR 5.175 crore.

UPL's step-down subsidiary acquires Advanta Thailand for seed business expansion.

G R Infraprojects acquires Tumkur-II REZ Power Transmission, making it a wholly owned subsidiary.

Business Operations:

Ashiana converted 168 out of 280 units in Gurugram project, generating INR 403.49 crore.

Ramkrishna Forgings sells hospitality unit for INR 128 crore, refocusing core.

Techno Electric wins contract with RailTel to develop Edge Data Centers in 102 cities across India.

Zydus receives approval from USFDA for Scopolamine Transdermal System.

Crompton installs energy-efficient LED streetlights on Bengaluru's Satellite Town Ring Road.

Marico expands its millets offering with the introduction of Saffola Masala Millets.

Key Upcoming Events

September 11 (Wednesday):

US Inflation Rate Data

September 12 (Thursday):

India Industrial Production

India Manufacturing Production

India CPI Inflation Rate

ECB Interest Rate Decision

The rest of the information will be delivered through Dalal Street Breakfast (Pre- Market Report) on every market day at 8 AM. Check it out here!

All the charts and data points are taken from Finvezto Toolkit. Try it for free for 7 Days here.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools