Weekly Market Analysis for Sep 02-06, 2024

Nifty scales new highs; Global Cues positive; FIIs turn net buyers; Reliance AGM and much more...

What happened last week?

Nifty reached a new all-time high of 25268 and closed the week near the high at 25235.

24870 level which acted as resistance in the prior weeks turned into support last week. It is the most important level to watch out for. We will stay bullish on Nifty as long as 24870 holds.

On the sectoral front…

IT and Pharma Stocks continued their good run following the announcement of a rate cut by US FED.

PSU Banks continue to fall. Almost 13% down in the last 3 months. Private Banks have not done well either. Nifty might reach further highs if Banks participate.

On the global front…

most markets closed higher by 1% or more last week.

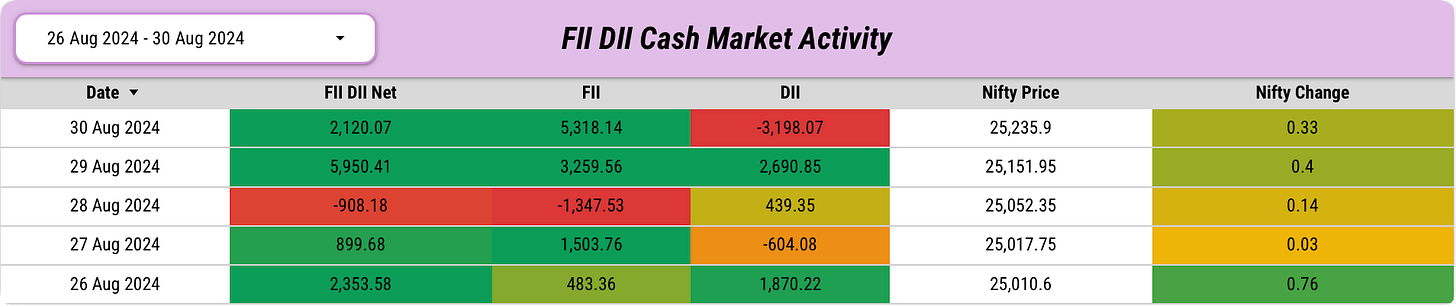

Let us now dive deeper into FII DII data.

FIIs bought ₹9217 Cr and DIIs bought ₹1198 Cr in the cash market. FIIs propelled last week’s rally.

FIIs have added long positions in both Index Derivatives and Stock Derivatives. FIIs are bullish.

DIIs have reduced their hedges post US FED event and Reliance AGM. They are not as cautious as they were last week. Proprietary Traders are also closed the week with long positions.

Overall, FIIs are Bullish, DIIs are not worried and Props are Bullish.

What is Nifty up to?

Nifty has been bullish since Aug 16. It is one of the longest streaks where both price and max pain have either closed higher or at the same level.

And it still looks good. We will stay bullish as long as both Price (black line) and Max Pain (blue line) are inching upwards.

If you look at the Monthly Max Pain trend of Nifty below,

you can see that Max Pain (pink line) has steadily increased. However it has settled at 25000 over the last 3 trading days. Positional Traders havent shown excitement for a new rally yet.

Overall, Nifty is Bullish. No signs of Bearishness yet.

Let us look at some India-specific developments.

India GDP Growth rate for the recent quarter stood at 6.7% compared to 7.8% in the earlier quarter. The slowdown was expected as India witnessed Elections in the previous quarter.

Reliance AGM concluded last week. Here are a few highlights.

Reliance Jio and Reliance Retail are projected to double their revenue and profitability within the next 3-4 years. Overall Reliance Size to double by 2030.

RIL introduces AI platform Jio Brain that includes features like Jio Cloud and Jio Phone Call AI, which offers call recording and transcription services.

A significant announcement was the proposal to issue bonus shares at a ratio of 1:1, which is likely to be approved by the board on Sep 5.

Reliance was up 2% post these announcements.

Note: All the charts and data points above are taken from Finvezto Toolkit. Try it for free for 7 Days here.

Key Stock Announcements Last week

Note: All the news items below include only the core business activities.

New Orders & Projects:

BHEL secures INR 11,000 crore contract from Adani Power and subsidiary.

Filatex Mines and Minerals received a USD 43.875 mn marble supply order.

DCX Systems secured USD 22.32 mn order for electronic kits from abroad.

Ahluwalia Contracts awarded INR 350.35 crore EPC contract by BALCO.

SEPC received INR 232 crore final acceptance for Hutti Gold Mines contract.

Jyoti Structures Limited receives INR 105.57 crore tower supply contract.

RailTel secured INR 70.93 crore contract for communication infrastructure.

Deep Industries received INR 63 crore order for gas separation services.

DEE Development Engineers received a INR 26.58 crore contract.

Infibeam Avenues secured contracts worth USD 1 mn /year for AI tech.

Australian Premium Solar secures INR 14.54 crore order for solar panels and inverters.

Enfuse Solutions secures INR 13.61 crore contract for PACS digitization.

GPT Infraprojects secures INR 13 crore contract for Eastern Railway.

Sonata Software wins major IT outsourcing deal with US healthcare firm.

Business Operations:

PTC Industries acquires mill to boost titanium alloy production.

Sun Pharma introduces treatment for acute bacterial skin and skin structure infections.

GRM Overseas launches 10X Ventures for growth in new brands.

Infibeam Avenues' Phronetic.AI introduces a women's safety feature in AI-powered CCTV manager.

Suven Life Sciences received FDA approval for a potential treatment for dementia.

Airtel partners with Apple to offer Apple TV+ and Apple Music.

JBM Electric Vehicles to supply 200 electric luxury buses to LeafyBus.

Max Factor partners with Shoppers Stop to expand retail presence.

Tanla introduces Registration.ai, enhancing SMS security with TRAI's directives.

AXISCADES delivers advanced mobile command vehicle to Gujarat Police.

G E Shipping sold Supramax vessel "Jag Rani," delivery Q3 FY25.

NBCC sells 100% of office/commercial space worth INR 14,800 crore since inception.

Partnerships, Acquisitions & Investments:

Zydus acquires 50% of Sterling Biotech for INR 5,500 crore for proteins.

ONGC infuses INR 86.28 crore into OPaL, increasing stake to 81.28%.

Bikaji Foods acquires 55% of Ariba Foods for INR 60.49 crore.

JioFin increased its stake in Jio Payments Bank to 82.17% with INR 68 crore.

Datamatics partners with Microsoft to create AI solutions with Copilots.

Wipro partners with Dell, NVIDIA to enhance its AI platform capabilities.

Mastek partners with Onyx Health to enhance healthcare data interoperability.

Tata Power Solar partners with ICICI Bank for financing solutions.

Tanishq and De Beers collaborate to boost India's natural diamond market.

Gateway Distriparks acquires 4.5 lakh shares in Snowman Logistics.

Zomato completes acquisition of Orbgen Technologies and Wasteland Entertainment.

Anant Raj acquires 100% of Sheetij Properties for real estate.

Intellect partners with Wipro to enhance banking technology with eMACH.ai.

Key Upcoming Events

September 2 (Monday):

India Manufacturing PMI Data

September 4 (Wednesday):

India Services PMI Data

September 5 (Thursday):

Reliance Board meeting

The rest of the information will be delivered through Dalal Street Breakfast (Pre- Market Report) on every market day at 8 AM. Check it out here!

All the charts and data points are taken from Finvezto Toolkit. Try it for free for 7 Days here.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools