Weekly Market Analysis for October 07-11, 2024

FII outflows, War Tensions, Crude Oil price rise, Q2 FY24 Results, RBI Policy announcement, Fed Meeting Minutes and much more...

What happened last week?

Nifty erased all its gains in September in just the first 4 days of October, courtesy of FIIs.

FIIs sold a whopping ₹40500 Cr last week. Many reasons could have triggered this sell-off. I have listed the below.

Escalating tensions in the Middle East

Crude Oil prices surging 10%

Funds possibly moving to China post-stimulus announcement

Recent F&O changes by SEBI ?!?! I don’t think so.

Nifty was down ~4.5% and closed at 25014 near the week’s low. 24850 to 24900 is the key zone to watch out on the downside. If that is broken, we might see a further fall towards 24300.

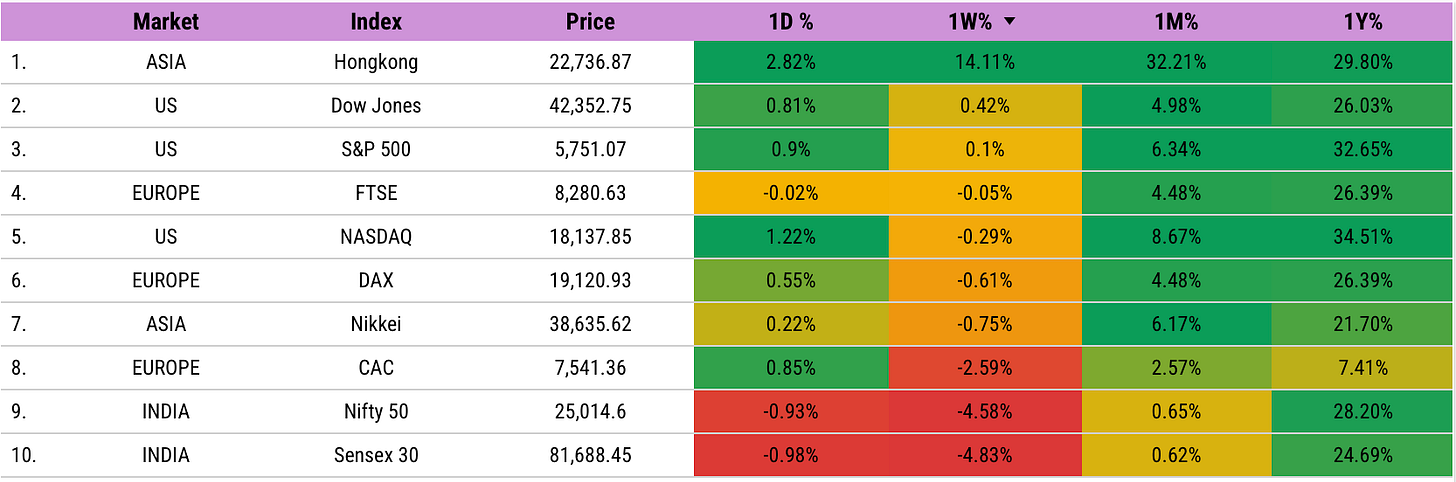

On the global front…

The Chinese market continues to surge after the Stimulus announcements. Shanghai Market was up 21% and HongKong was up 14% last week.

The US and Europe markets ended flat.

On the sectoral front…

All sectors closed in red except Metals.

Let us dive deeper into FII data…

FIIs sold ₹40500 Cr in the cash market last week. They bought ₹26000 Cr in the previous 2 weeks. They have sold all of that and more in the last 4 days.

FIIs are holding short positions in Index Derivatives and have significantly closed down their long positions in Stock Derivatives. FII sentiment is Bearish.

Nifty Sentiment Analysis…

If you look at the Weekly and Monthly Max Pain trend of Nifty below…

Weekly Max Pain has been down since Monday. As mentioned last week, it would have been good to close any previous long positions on Monday.

Both Weekly and Monthly Max Pain went down on Thursday and Friday. Nifty Sentiment is currently Bearish.

Key Upcoming Events

Q2 FY24 results season kickstarts this week with TCS Results. US Fed will be releasing its meeting minutes. The new RBI Committee will also be meeting this week to decide on Interest Rates.

October 9 (Wednesday):

- India RBI Interest Rate Decision

- US Federal Reserve Meeting Minutes

October 10 (Thursday):

- Results: Tata Consultancy Services

- US Inflation Data

October 11 (Friday):

- India Industrial Production

Key Stock Announcements Last week

New Orders & Projects:

NCC Limited received orders worth INR 2,327 crore in September 2024.

ITD Cementation wins INR 1,937 crore contract in Uttar Pradesh.

J. Kumar Infraprojects receives INR 1,847.72 crore contract for elevated road project in Thane.

Effwa Infra & Research Ltd secures USD 1.5 mn export order in Tanzania.

TRIL secures INR 565 crore order from Power Grid Corporation India.

Ashoka Buildcon awarded INR 474.10 crore EPC contract from MMRDA.

Paras Defence secures INR 293 crore order for EO systems manufacturing.

GE Power India secures INR 240 crore order for 100MW hydro project in Nepal.

RailTel secured INR 134.46 crore order from Adani Connex Limited.

NBCC received a work order worth INR 101 crore as Project Management Consultant for NHAI.

RITES wins INR 100 crore railway operation & maintenance contract from Adani Ports.

Lloyds Engineering secures INR 59 crore orders for Eco-pickling, marine arms.

Solex Energy received a INR 51.96 crore work order from Zodiac Energy.

Avantel receives INR 44.49 crore purchase order from Larsen & Toubro.

NBCC awarded INR 42.04 crore for SIDBI Vashi Redevelopment Project.

ANI Integrated received a INR 36.25 crore order from L&T Hydrocarbon.

RITES wins USD 4.28 mn contract for locomotive supply in Africa.

Pelatro wins USD 3.2 mn contract for customer engagement solutions in Southeast Asia.

Genesys wins USD 3.5 mn from NEOM and Saudi Geological Survey.

Pritika Auto finalizes INR 30 crore order for tractor components.

GE Power India receives INR 20.9 crore order from MP Power for boiler parts.

PRITI International secures first CRPF order for 959 metal bunk beds.

PTC Industries secures major order for M777 Howitzer titanium castings.

NTPC Green Energy signs MoU for 25 GW renewable projects in Rajasthan.

Partnerships, Acquisitions & Investments:

SJVN signs MoUs for INR 48,000 crore investment in Maharashtra projects.

Dr. Reddy's invests USD 620 mn in DRL SA to acquire Nicotinell® and related brands.

Adani arm to acquire 74% stake in Cococart for INR 200 crore.

Saksoft acquires Ceptes Software to enhance Salesforce services capabilities.

Zydus partners with CSIR-CDRI to develop drug for Chronic Kidney Disease induced Osteoporosis.

Dr. Reddy's completes acquisition of Nicotinell brand for GBP 458 mn.

Interarch acquires land in Gujarat for new manufacturing facility.

Persistent Systems acquires Arrka Infosec for data privacy expertise.

Adani Power acquires Dahanu Thermal Plant for INR 815 crore.

Krsnaa Diagnostics partners with Medikabazaar and United Imaging to invest INR 300+ crore.

Omaxe acquires four real estate companies for business expansion.

UltraTech increases stake in renewable energy firm for green energy.

IIT Bombay collaborates with ABB India to establish advanced lab.

Greaves partners with Shriram Finance to enhance three-wheeler accessibility.

Zuari Industries acquires 50% stake in Forte Furniture Products.

Allcargo acquires 7.60% of Haryana Orbital Rail Corporation shares.

Craftsman Automation acquires Fronberg Guss GmbH assets and subsidiary.

Thermax invests in Singapore subsidiary for Thailand operations expansion.

Mankind Pharma receives regulatory approvals for 100% acquisition of Bharat Serums.

Business Operations:

Ola Electric's S1 X 2 kWh scooter receives PLI certification for electric vehicle incentives.

Alembic Pharmaceuticals receives USFDA approval for Paliperidone Extended-Release Tablets.

R Systems launches Chaos Engineering model for improved business continuity.

Cummins India launches Retrofit Aftertreatment System for cleaner emissions.

Airtel prepays INR 8,465 crore for spectrum liabilities from 2016.

Great Eastern Shipping delivers "Jag Pranav" tanker; fleet remains 42.

Tilaknagar Industries launches Mansion House Gold Barrel Whisky in Assam.

Jindal Stainless collaborates with CJ Darcl for sustainable steel containers.

SBI Card partners with Singapore Airlines for exclusive co-branded credit card.

Zen Technologies receives patent for advanced infantry training simulation system.

Max Estates' Estate 360 achieves INR 4,100 crore pre-sales in month.

Gulf Oil International sells shares to enhance liquidity and free float.

Sun Pharma enters global agreement with Philogen for Fibromun commercialization.

Rathi Steel invests INR 50 crores for forward integration project.

Birla Trimaya Phase II achieves INR 600 crore bookings in 24 hours.

Aurobindo Pharma receives USFDA approval for Cephalexin Tablets.

Shreyas Shipping rebrands to Transworld Shipping Lines for global identity.

Mahindra Thar ROXX opens with 176218 bookings within 60 minutes.

Emcure partners with Gilead to manufacture and supply generic Lenacapavir globally.

Paytm deploys card machines in Madhya Pradesh Mandis, empowering farmers.

Alembic Pharmaceuticals receives USFDA final approval for Lamotrigine extended release tablets.

RattanIndia launches Kaari, a new ethnic wear line celebrating embroidery.

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools