What happened last week?

Nifty closed at 24854, down by 0.5% last week.

Nifty made a low of 24567 but bounced back to close above the 24850 zone.

Although it closed above the 24850 zone, Nifty has formed lower highs and lower lows over the last four weeks and is still in a downtrend.

We can expect a further fall if there is a close in the weekly chart below the 24850 zone.

If there is a close above 25290 on the upside in the weekly chart, we can expect the next up move.

On the global front…

India and Asian markets were down. India has been the underperformer over the last month primarily due to FII Outflows.

On the sectoral front…

Banks and Financial Services made a comeback last week, helping the Nifty close above the 24850 zone.

The Auto sector experienced a significant downturn (-5%), with major players like Bajaj Auto, Hero MotoCorp, and Maruti Suzuki seeing sharp declines.

Bajaj Auto tanked almost 10% in a session.

Bajaj Auto's management provided a cautious outlook for the upcoming festive season, predicting only a 1-2% increase in motorcycle sales. This forecast was significantly below expectations of 5-6% growth, raising concerns about consumer demand during one of the busiest sales periods of the year.

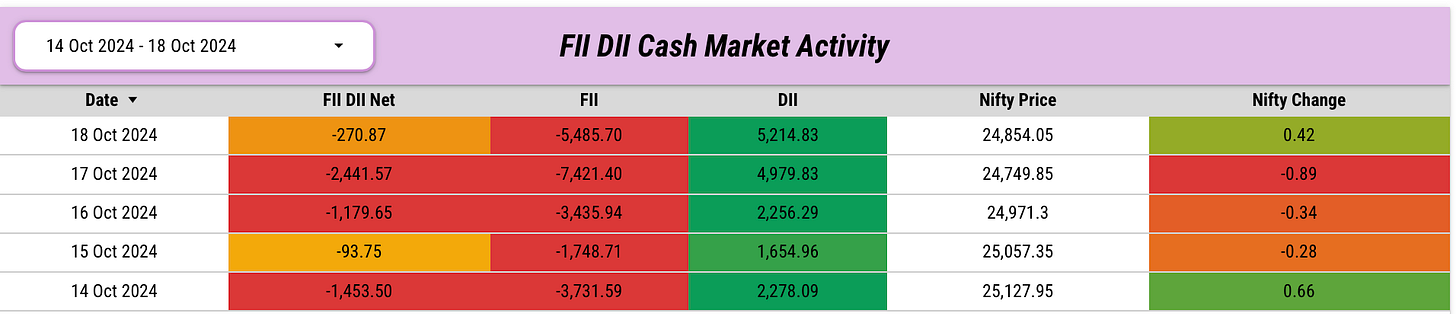

FIIs sold ₹21823 Cr in the cash market last week.

FIIs have sold ₹80000 Crores so far in October. It's the highest ever amount sold by FIIs in a month.

DIIs on the other hand bought ₹16384 Cr last week.

FIIs continue to hold shorts on Index Derivatives. They have also not added significant longs in Stock Derivatives. FIIs are still Bearish.

Nifty Sentiment Analysis…

Both Weekly and Monthly Max Pain of Nifty have been on the decline. Sentiment is Bearish.

Only when the blue line and pink line go up together we will turn bullish.

Key Upcoming Events

October 21 (Monday):

- Q2 Earnings: Bajaj Housing Finance, UltraTech Cement Ltd.

October 22 (Tuesday):

- Q2 Earnings: Adani Energy, Bajaj Finance, Varun Beverages, Zomato

October 23 (Wednesday):

- Q2 Earnings: HUL, Pidilite, SBI, TVS Motors

October 24 (Thursday):

- Q2 Earnings: Adani Total Gas, Colgate, Godrej Consumer, ITC

- India Services PMI

- India Manufacturing PMI

October 25 (Friday):

- Q2 Earnings: Bank of Baroda, Bharat Electronics, Interglobe Aviation

Key Stock Announcements Last week

New Orders & Projects:

PNC Infratech wins INR 2039 crore road construction project from CIDCO.

Ashoka Buildcon secured INR 1,999.99 crore contracts for MSRDCL.

G R Infraprojects secured a Pune Ring Road project worth INR 1885.63 crore.

Valor Estate receives MCGM contract for constructing 13,374 affordable housing units.

Ashoka Buildcon wins INR 1673 crore infrastructure project from CIDCO.

HCC awarded INR 1,031.6 crore contract for bridge construction project.

Ahluwalia Contracts wins INR 1,094.67 crore project for Gurugram's DLF Downtown construction.

WABAG wins INR 1,000 crore desalination plant order from Indosol Solar.

BEML wins INR 866 crore contract from ICF for high-speed rail design and manufacturing.

Premier Energies receives INR 765 crore solar modules and cells order.

Ashoka Buildcon secures INR 310 crore bridge construction project from MSRDCL.

RPP Infra awarded a INR 217.61 crore road improvement contract.

TD Power Systems received INR 142 crore international orders.

Gensol wins AED 81.6 Mn contract for 23 MWp solar project in Dubai.

RPP Infra wins INR 127.46 crore road improvement project in Maharashtra.

NBCC received work orders worth INR 65.15 crore for JNV projects.

Vascon Engineers received a INR 57.23 crore contract from Mumbai Metro.

Kay Cee Energy secured a INR 55.78 crore contract for maintaining 75 substations.

Krystal Integrated wins INR 55 crore contract for facility management.

S J Logistics secured INR 42 crore in domestic logistics orders.

Krystal Integrated received INR 25 crore contract for staffing and payroll services.

L&T wins Agra Metro order for 15 km viaduct, 14 stations construction.

L&T wins significant contract to build NPK fertilizer plant for RCF.

Intellect partners with UAE's NBF for eMACH.ai Cloud banking solution.

WCIL wins 3-year contract as sole logistics partner for Tata Steel Sponge Iron Joda.

Partnerships, Acquisitions & Investments:

Airtel launches ZTA-based cybersecurity solution with Zscaler.

Indo Count acquires Modern Home Textiles to expand utility bedding business.

Amber Group and Korea Circuit form a joint venture for PCB manufacturing in India.

UGRO Capital partners with DFC to boost financial inclusion for India's MSMEs.

Bharat Forge acquires AAM India for INR 544.53 crore to expand commercial vehicle business.

Saksoft Limited has completed the acquisition of Ceptes Software.

Business Operations:

Jio Financial launches enhanced app with loans, savings, UPI, insurance features.

Hidesign partners with Unicommerce for omnichannel management.

Capri Global Capital launches Rooftop Solar Finance, targeting INR 1000 crore loans.

Lupin launches first generic version of Pred Forte® in the US.

SpiceJet settles USD 23.39 mn dispute for US 5 mn, enhancing financial stability.

SpiceJet exits DGCA's enhanced surveillance after corrective actions.

STL enters AI data center market with fiber optic solutions for high-performance computing.

RateGain integrates with TCA PMS to expand hotel bookings in Latin America.

Strides Pharma's CDMO unit OneSource raises $95 mn pre-listing.

Godrej Properties secures Kharghar plots, with INR 3,500 crore revenue potential.

Tata Elxsi launches Coalesce XR platform for digital twins and collaboration.

Airtel Business partners with Vonage to enhance communications solutions for enterprises.

Zydus receives approval from USFDA for Fludrocortisone Acetate tablets USP, 0.1 mg.

Adani Enterprises raises USD 500 mn for growth via equity issue.

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools

Last two days ur not posting any trend chart