Weekly Market Analysis for Oct 31 -Nov 03, 2023

A comprehensive round-up of what happened last week in the Indian Markets and outlook for upcoming week

What happened last week?

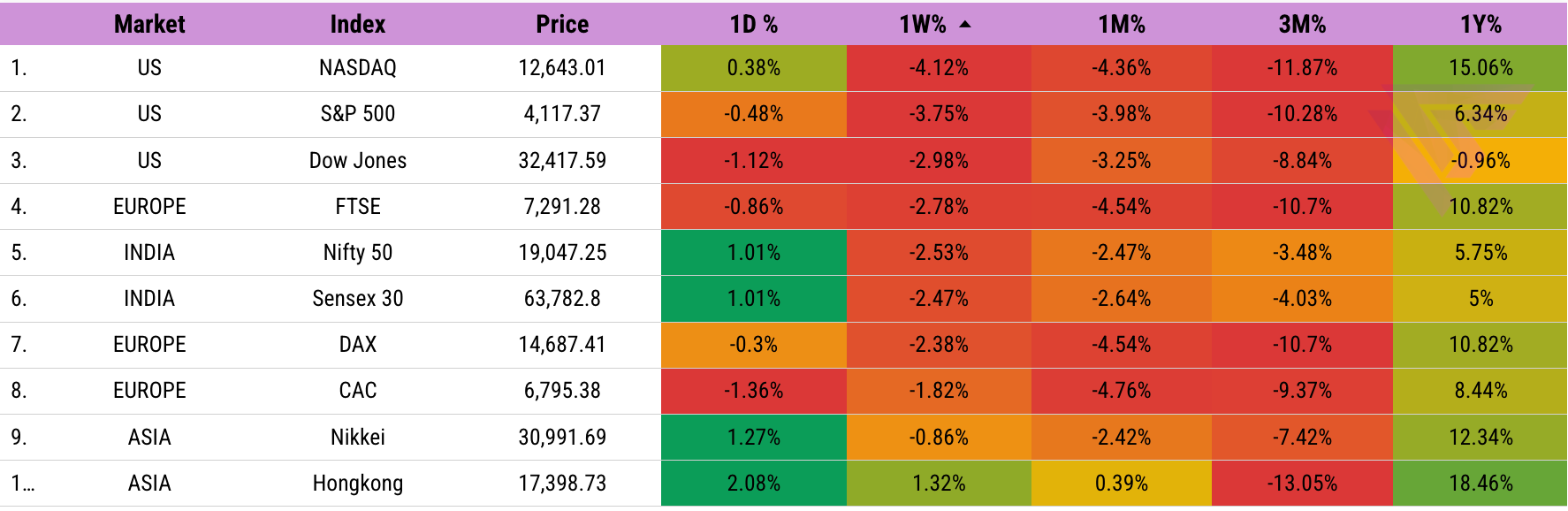

Most Global Equity markets ended in red last week. Indian markets rebounded from lows of 18837 to close at 19047 on Friday.

FPIs/FIIs aggressively sold shares worth ₹13000 crore, resulting in a 2.53% decline in Nifty and a 2.47% drop in BSE Sensex during the week.

Geopolitical tensions and increasing 10-year US bond yields continued to influence market sentiment.

Positive developments emerged as Israel agreed to the US's request to postpone its Gaza invasion.

US reported better-than-expected GDP numbers for the third quarter of 2023, with a growth rate of 4.9%, driven by a 4% increase in consumer spending.

Despite the strong GDP data, the Federal Reserve (Fed) is expected to maintain its plans to keep interest rates stable at its upcoming meeting next week.

European Central Bank (ECB) also reiterated its stance on keeping interest rates unchanged during its most recent monetary policy meeting.

China's national legislature approved a budgetary plan for 2023, allowing for a fiscal deficit ratio of about 3.8% of GDP, a significant increase from the 3% set in March. This move aims to address liquidity challenges in the domestic property market and counteract stock market sell-offs.

The Japanese government is contemplating a stimulus package of approximately $33 billion, including payouts to low-income households and an income tax cut. These measures are intended to mitigate the impact of rising living costs on households.

Indian Indices Performance

Although there was a heavy fall in Small Caps during the start of the week, it was followed by a quick rebound. Nifty 50 and Midcap stocks fell the most.

All sectors ended in red last week. Media and Metal Stocks were the worst hit.

FII Positions Analysis

Cash Market: FIIs remained net sellers in the cash market with a net sell of ₹13000+ Crores last week.

Index Derivatives: FIIs continue to hold short positions in Index Derivatives.

Stock Derivatives: FIIs continue to hold short positions in Stock Derivatives.

FII sentiment continues to be Bearish. Likely to sell more in the cash market based on current sentiment.

Important Upcoming Events

Monday, October 30:

Results: Marico, TVS Motor Co, UPL, Adani Green Energy, IDFC

Cello World IPO subscription opens with a price range of Rs 617 to Rs 648 per equity-share.

Euro Area Economic Sentiment Data

Tuesday, October 31:

Results: Bharti Airtel, Larsen & Toubro, Mankind Pharma

Government to release revenue and expenditure figures for the period ending September 2023.

Honasa Consumer IPO (MAMAEARTH) subscription opens with a price band of Rs 308 to Rs 324.

Bank of Japan policy rate decision.

China PMI Data: Official NBS PMI data for manufacturing and non-manufacturing sectors for October.

Wednesday, November 1:

Results: Sun Pharmaceutical Industries, Tata Steel, Hero MotoCorp, Ambuja Cements

Indian automobile manufacturers will release wholesale dispatch numbers for October 2023.

India Manufacturing PMI: S&P Global's manufacturing PMI data for October.

China PMI: Caixin China General Manufacturing PMI data for October.

US Fed Interest Rate Decision

Thursday, November 2:

Results: Tata Motors, Dabur India, Berger Paints, Container Corporation of India, Adani Enterprises, Adani Power

UK Interest Rate Decision: Bank of England interest rate decision.

Friday, November 3:

Results: Titan, MRF, Zomato, Britannia Industries

India Services PMI data

US, China Service PMI data

US Unemployment Rate

Key Stock Announcements from Last Week

Key Mergers/Acquisitions/Joint Ventures/Collaborations

Reliance Industries is in the final stages of negotiating a cash-and-stock deal to acquire Walt Disney Co’s India operations. The deal, expected to be valued at $10 billion, could bolster Reliance’s presence in the Indian entertainment industry, particularly with the integration of some of its media units into Disney Star.

Samvardhana Motherson International acquired a 100% stake in SSCP Aero Topco SAS for 35 million euros and additional performance-based payments.

Aditya Birla Fashion and Retail’s subsidiary acquired a 51% stake in Styleverse Lifestyle for Rs 155 crore.

Paras Defence and Space Technologies approved a joint venture with MICROLAM Inc., USA, holding a 40% stake, aiming for strategic collaborations in the defense and space sector.

Adani Ports and Special Economic Zone, a subsidiary of the Adani Group, has recently incorporated a wholly owned subsidiary named Udanvat Leasing IFSC, indicating its strategic move into the aircraft leasing business, potentially diversifying its revenue streams.

Tech Mahindra’s subsidiary has approved a proposal to divest its 30 percent shareholding in Avion Networks Inc. for a minimal amount of $50,000, suggesting a strategic shift in its investment portfolio or a focus on core business operations.

Key Buying/Selling Deals

Amber Enterprises (I) Ltd : Franklin Templeton Mutual Fund buys

200000 Shares at Rs. 2820 per share

Tracxn : Kb Global Platform Fund sells 793193 Shares at Rs. 72.18 per share

Karnataka Bank: The bank’s committee of directors of the board approved the allotment of 3.34 crore equity shares to HDFC Life Insurance Company, Bajaj Allianz Life Insurance Company, Quant Mutual Fund, Bharti AXA Life Insurance Company, and Bajaj Allianz General Insurance Company at a price of Rs 239.52 per share, totaling Rs 800 crore, on a preferential basis.

New Orders/Projects/Expansion/CAPEX

Antony Waste Handling Cell Limited subsidiary, AG Enviro Infra Projects, wins ₹386 Crore contract for Door-to-Door Collection and Transportation of Municipal Solid Waste in Panvel Municipal Corporation, funded by PMC.

KPI Green Energy Limited received a 4.20 MW Wind-Solar Hybrid Power Project order from M/s. Sustainable Spinning and Commodities Pvt. Ltd. under the 'Captive Power Producer' segment. The project is set for completion in the 2023-24 financial year.

Nila Infrastructures Limited secured a Letter of Acceptance from Gujarat Housing Board for a project to construct 300 High Income Group housing units and 18 shops, valued at around INR 142.73 Crore on a PPP basis. The project will take 28 months to complete, and it involves no related party transactions or promoter interests.

Lemon Tree Hotels signed a license agreement for a 49-room property in Kasauli, Himachal Pradesh, expected to be operational by FY 2025.

Key Business Updates

One 97 Communications, the operator of Paytm, narrowed its net loss to Rs 290.5 crore for Q2 FY24 while experiencing a 32% YoY revenue increase driven by GMV growth and merchant subscription revenues.

ICICI Bank, India’s second-largest private sector lender, achieved a significant 35.8% YoY profit growth, reaching Rs 10,261 crore for Q2 FY24. This growth was driven by reduced provisions and improved asset quality. Net interest income rose by 23.8% YoY to Rs 18,308 crore.

Jubilant Foodworks saw a 39.5% YoY decline in standalone profit at Rs 72.1 crore, despite a 4.5% increase in revenue from operations.

Axis Bank recorded a 10% YoY growth in standalone profit at Rs 5,864 crore, driven by a 19% increase in net interest income.

Dixon Technologies achieved a 47 percent year-on-year growth in profit, reaching Rs 113 crore for the July-September period of FY24. This growth was accompanied by a 28 percent increase in revenue from operations, which reached Rs 4,943 crore year-on-year, and a 37 percent rise in EBITDA to Rs 200 crore during the same period.

Novartis India: The pharma company is currently facing a shortage of one of its products, Simulect 20 mg, but is making efforts to address the supply issue on a sustainable basis.

Key Regulatory/Legal/Tax related Announcements

Zydus Lifesciences received FDA approval for ZITUVIO, a medication for type 2 diabetes.

Delta Corp has received a directive from the High Court of Bombay at Goa, instructing the Directorate General of GST Intelligence, Hyderabad, to withhold any final orders regarding a substantial tax notice.

That’s all for this week!

FINVEZTO.COM | Comprehensive Investing & Trading Analytics Platform

Toolkit - https://finvezto.com/toolkit

Connect - https://twitter.com/finvezto

Know More About Us - https://www.linkedin.com/in/finvezto

📧 E-mail: support@finvezto.com