Weekly Market Analysis for Oct 23-27, 2023

A comprehensive round-up of what happened last week in the Indian Markets and outlook for upcoming week

What happened last week?

Most Global Markets ended in red last week. US and European markets were hit the worst. Asian Markets were hit less.

Q2 Results season has started with IT companies downgrading guidance and cutting down on hiring.

There is a lot happening in the Middle East. Gold and Brent Crude prices have shot up over the last week. Increasing Crude prices are not good for India.

But Indian markets don’t seem to be bothered much. India VIX still remains below 11.

Although FIIs are selling, the panic button has not been pressed yet.

India’s wholesale price index (WPI) inflation was at -0.26% in September. It continued to remain in negative territory for the sixth consecutive month. CPI Inflation is also moderating.

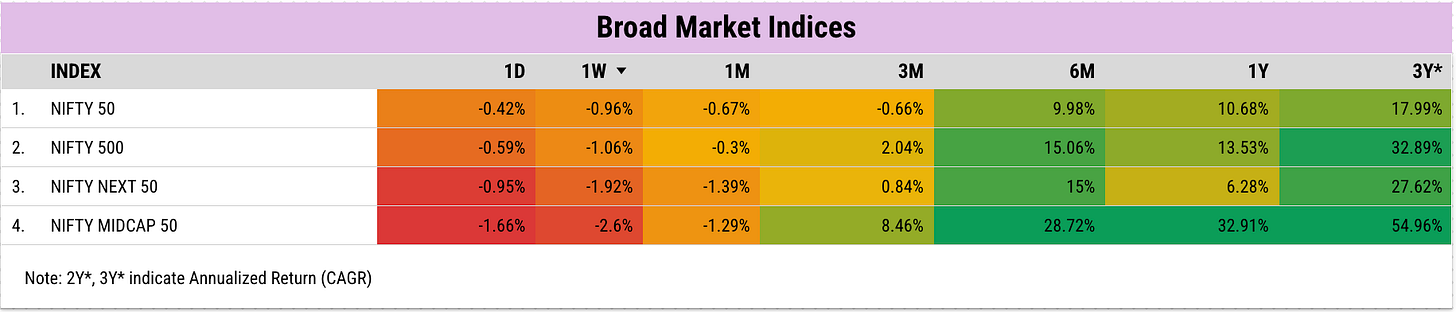

Indian Indices Performance

Nifty Midcaps witnessed aggressive selling last week. Down about 2.5%.

All Sectors were down in the last week. PSU Bank and Metals were the worst hit. After a good run over the last 1 year, PSU Banks are down by about 5% in the last 1 month.

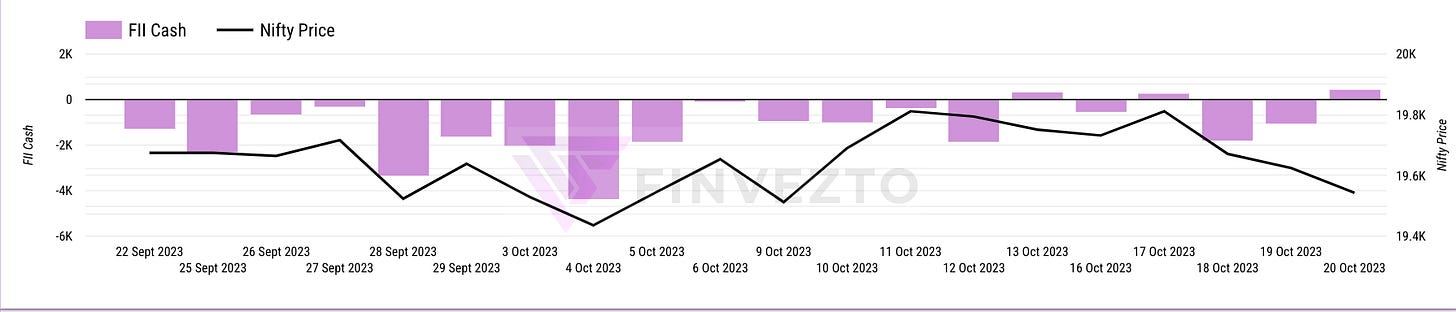

FII Positions Analysis

Cash Market: FIIs continued to be net sellers in the cash market. They have sold about ₹40000 Crores so far in October.

Index Derivatives: FIIs added short positions on the Index last week indicating that they might continue selling in the cash market.

Stock Derivatives: FIIs continue to hold net short positions when it comes to Stock Derivatives as well.

FII sentiment continues to be Bearish.

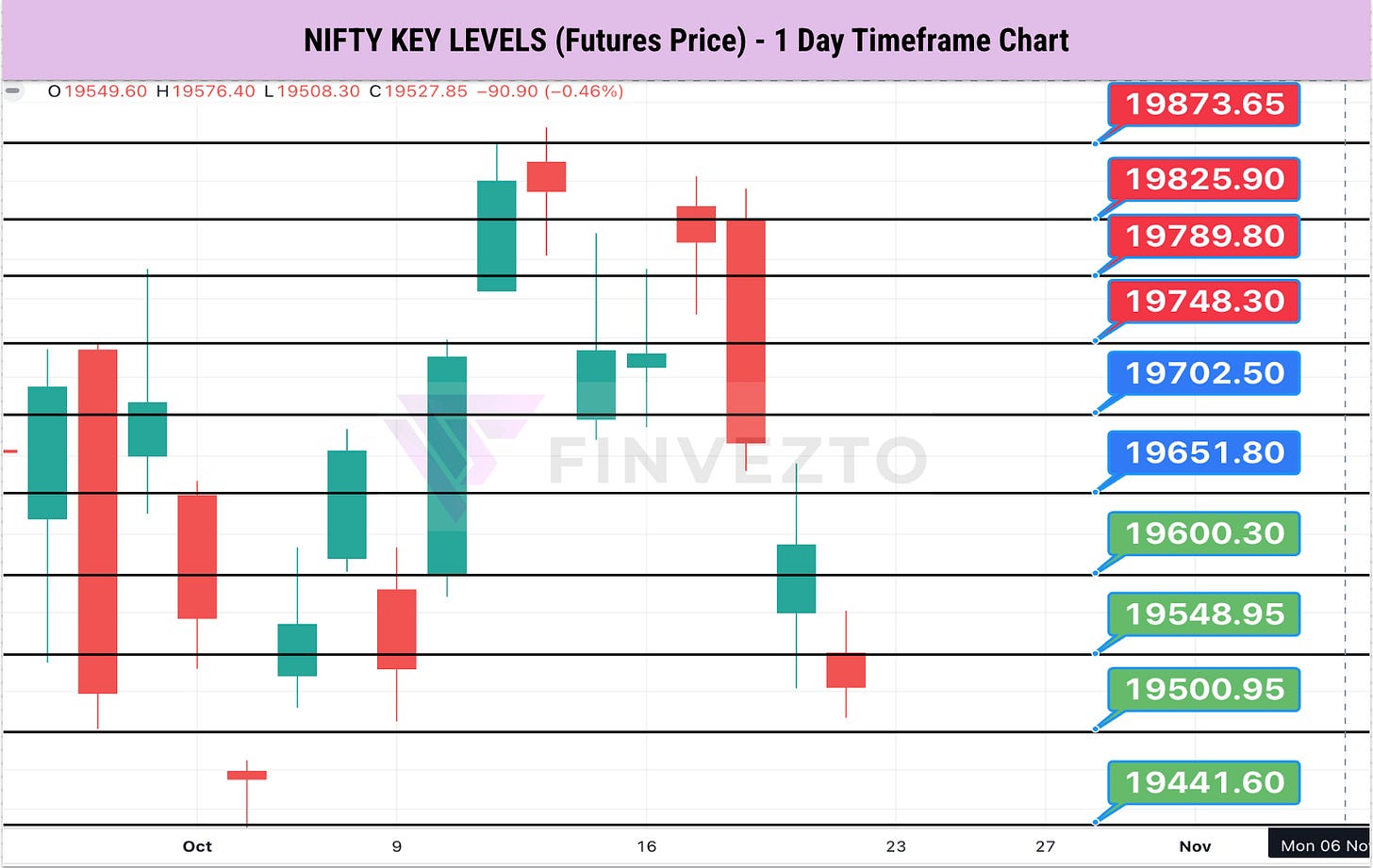

Nifty Analysis

With respect to Nifty, both Momentum and Sentiment are Bearish. Nifty Futures had not witnessed a close below 19450 in the last 2 months. That would be the level to watch out in the coming week.

To know more about key levels and how to interpret them please read this article - https://tribe.finvezto.com/pub/how-to-interpret-and-use-key-levels-bull-bear-control-range

Important Upcoming Events

Monday (October 23):

Results: PNB Housing

EU Consumer Confidence Flash: October flash data for the Euro Area and European Union consumer confidence indicators.

Tuesday (October 24):

Results: Axis Bank

Japan Manufacturing PMI Flash: Release of Japan Manufacturing PMI for October.

Wednesday (October 25):

Results: Jubilant FoodWorks, Network18, Tech Mahindra

Blue Jet Healthcare IPO: Initial public offer for Blue Jet Healthcare opens for subscription.

Thursday (October 26):

Results: ACC, Asian Paints, Canara Bank

US Initial Jobless Claims: Release of the latest data on initial jobless claims.

ECB Press Conference: European Central Bank press conference providing insights into the recent policy decisions.

Friday (October 27):

Results: Bajaj Finserv, Cipla, Dr. Reddy’s, Indian Hotels, Maruti, Union Bank, M&M Finance

Foreign Exchange Reserves: Release of foreign exchange reserves data for India.

Key Stock Announcements from Last Week

Key Mergers/Acquisitions/Joint Ventures/Collaborations

Tata Motors is selling a 9.9% stake in Tata Technologies for Rs 1,613.7 crore. TPG Rise Climate SF Pte Ltd., a climate-focused private equity fund, will acquire a 9% stake in Tata Technologies, and the Ratan Tata Endowment Foundation will purchase a 0.9% stake in Tata Motors. The transaction is set to be completed by October 27. Mitsuhiko Yamashita will step down as a non-executive, non-director of Tata Motors on the same date.

Hindustan Petroleum Corporation announced a strategic partnership with Petromin Corporation, Saudi Arabia, to establish 1,000 Petromin Express Stations at HPCL retail outlets across India over five years. The first set of 16 Petromin Express Stations in Bengaluru and Chennai was launched on October 16.

Mphasis announced a strategic partnership with WorkFusion to leverage WorkFusion’s AI solutions to enhance and evolve its services in transforming financial crime operations for its enterprise clients.

Mahanagar Gas entered into a joint venture agreement (JVC) with Baidyanath LNG to incorporate a private limited company in India for undertaking the business of liquefied natural gas (LNG). MGL and Baidyanath LNG will subscribe to the initial share capital of JVC in the ratio of 51:49.

RITES signed a Memorandum of Understanding with INTECSA-INARSA, S.A.U, to collaborate on projects in the Republic of Guyana and Republic of Colombia.

JK Paper received board approval for the acquisition of Manipal Utility Packaging Solutions for Rs 88.7 crore, with the completion expected within six weeks of executing the Share Purchase Agreement.

Lemon Tree Hotels signed an agreement to open a 55-room hotel property in Dehradun, Uttarakhand, under the brand Keys Prima by Lemon Tree Hotels. It is expected to be operational by FY27 and will be managed by subsidiary Carnation Hotels.

Data Patterns (India) entered into a licensing and transfer of technology (ToT) agreement with IN-SPACe to develop miniature SAR radar capabilities.

Exide Industries invested Rs 100 crore in its wholly-owned subsidiary, Exide Energy Solutions, through a rights issue. This investment did not alter the company’s shareholding percentage in the subsidiary.

Housing & Urban Development Corporation (HUDCO) announced the Government of India’s plan to sell up to 7,00,66,500 equity shares of HUDCO, representing 3.50% of the total paid-up equity, on October 18–19, with an option to sell additional shares if oversubscribed. The floor price was fixed at Rs 79 per share, aiming to raise Rs 1,107 crore for the government.

Sigachi Industries’ subsidiary, Sigachi MENA FZCO, formed a joint venture with Saudi National Projects Investment (SNP) to enter the growing Saudi Arabian market. In the joint venture, Sigachi MENA FZCO will hold a 75 percent stake, while SNP will hold a 25 percent stake.

Key Buying/Selling Deals

BofA Securities Europe SA and Societe Generale sold equity shares in Delta Corp via open market transactions, amounting to Rs 55.9 crore.

Wisdomtree India Investment Portfolio Inc acquired 0.51% of paid-up equity in Gujarat Pipavav Port by purchasing 24.71 lakh shares at an average price of Rs 138.23 per share.

SoftBank-owned Svf Growth planning to sell a 1.1 percent stake in Zomato worth around Rs 1,000 crore in the food delivery giant through block deals. Svf Growth currently holds a 2.22 percent stake in Zomato, valued at Rs 2,090 crore as of October 19.

New Orders/Projects/Expansion/CAPEX

Bajaj Electricals has secured a supply of services contract worth Rs 564.2 crore from Power Grid Corporation of India for Ananthpuram Kurnool Transmission.

Laurus Labs’ associate company, Immunoadoptive Cell Therapy (ImmunoACT), has received approval for India’s first CAR-T cell therapy, NexCAR19, for the treatment of r/r B-cell lymphomas and leukemia.

NBCC (India) has received a work order worth Rs 80 crore from the Visakhapatnam Port Authority for the renovation and refurbishment of an office building.

Aurobindo Pharma inaugurated a green-field manufacturing unit for Eugia Steriles in Vishakhapatnam. This unit, with an approximate cost of Rs 600 crore, will produce general injectables and is expected to commence commercial production in phases during Q4 of FY24.

Tata Power subsidiary, Tata Power Renewable Energy, signed a power delivery agreement with Endurance Technologies for the development of a 12.5 MW AC captive solar plant, which is expected to reduce carbon emissions by approximately 9,125 metric tonnes annually.

Som Distilleries and Breweries signed a strategic contract manufacturing agreement in Jammu and Kashmir for the manufacture of IMFL for the Canteen Stores Department (CSD), aiming to reduce supply time to northern and border regions.

Rail Vikas Nigam’s joint venture company, RVNL-MPCC, received a letter of acceptance (LOA) for civil engineering works, supply of machine-crushed stone ballast, and complete track works related to gauge conversion work between Nadiad-Petalad and Petlad-Bhadran in Vadodara Division of Western Railway. The total contract size for both projects is Rs 420 crore.

Mastek secured a three-year contract from the UK’s Government Digital Service, valued at £8.5 million, for designing, building, and operating the GOV.UK One Login Technical Service Desk.

Oil India received board approval for the charter hire of an anchor moored drillship or semi-submersible drilling unit, along with related equipment and services, at an estimated cost of Rs 1,282.55 crore. They also approved an extension of the completion date for certain construction projects.

Piramal Pharma’s pharma solutions (PPS) business launched a high-throughput screening facility at its drug discovery services site in Ahmedabad, enhancing its screening capabilities for compounds prepared at the site.

Elecon Engineering secured an order worth Rs 51.41 crore from Arcelormittal Nippon Steel India for the supply and supervision of a pipe conveyor system at Arcelormittal Nippon Steel’s Hazira plant in Gujarat.

Paras Defence and Space Technologies announced that its subsidiary, Paras Aerospace, received a second-type certificate from DGCA (Directorate General of Civil Aviation) for its agri-drone, Paras-Agricopter V2.1. This certification will enable the execution of existing contracts with Paras Aerospace and open up new opportunities in the agricultural drone industry.

KEC International, a company under the RPG Group, secured new orders worth Rs 1,315 crore in various businesses, including transmission and distribution projects across different regions.

Bajaj Electricals secured a service contract worth Rs 347.29 crore from the Power Grid Corporation of India.

Mazagon Dock Shipbuilders signed a contract with the Ministry of Defence’s acquisition wing for the construction and delivery of a training ship for the Indian Coast Guard (ICG) at a cost of Rs 310 crore.

Key Business & Results Updates

Avenue Supermarts, the owner of D-Mart stores, has reported a 9.2% YoY decline in consolidated profit at Rs 623 crore for the quarter ending September FY24. Revenue from operations grew by 18.67% YoY to Rs 12,624 crore.

ITC achieved a standalone profit of Rs 4,927 crore in Q2 FY24, marking a 10.3 percent YoY increase, primarily driven by higher other income. Revenue from operations, excluding excise duty, increased by 2.6 percent YoY to reach Rs 16,550 crore, although there was subdued growth in the agribusiness and paperboards and packaging segments. EBITDA increased by 3 percent YoY to Rs 6,041.6 crore, and the margin expanded by 10 basis points to 36.5 percent during the same period.

Hindustan Unilever reported a strong performance in Q2 FY24, with standalone profit of Rs 2,717 crore, marking a 3.9 percent YoY growth. This exceeded analyst expectations, driven by better-than-expected operating margins and lower input costs. Standalone revenue from operations also grew by 3.6 percent YoY to reach Rs 15,276 crore. Notably, the home care segment grew by 3.3 percent, food and refreshment by 2.6 percent, and beauty and personal care by 4.5 percent. The board approved an interim dividend of Rs. 18 per share for the year.

L&T Technology Services reported a 1.4% sequential growth in net profit, totaling Rs 315.4 crore for the quarter ending September FY24. The company’s revenue for the quarter increased by 3.7% QoQ to Rs 2,386.5 crore. The constant currency topline growth during the same period was 3.2%. The company also revised its FY24 USD revenue growth guidance to 17.5–18.5% in constant currency and declared an interim dividend of Rs 17 per share.

Bajaj Auto reported a 20% YoY increase in standalone profit for Q2 FY24, with a 5.6% YoY rise in revenue from operations. The company achieved its first-ever quarterly EBITDA of over Rs 2,000 crore.

Bajaj Finance achieved an impressive 28% YoY increase in its post-tax profit, reaching Rs 3,551 crore for the quarter ending September FY24. During the same period, the company’s net interest income grew by 26% to Rs 8,845 crore. The number of new loans booked also rose by 26%, reaching 8.53 million, while assets under management (AUM) expanded by 33% to Rs 2.9 lakh crore as of September 2023.

Jio Financial Services recorded substantial growth in the September FY24 quarter, with a 101.3 percent QoQ profit increase to Rs 668.18 crore and a 46.8 percent QoQ growth in revenue from operations.

Tata Steel Long Products reported a narrowed net loss of Rs 135.8 crore for the quarter ending September FY24, despite a 9.4% YoY decrease in revenue from operations.

Tata Elxsi achieved a 5.9% sequential growth in net profit, amounting to Rs 200 crore for the July-September period FY24. The company’s revenue increased by 3.7% to Rs 881.7 crore during the same period. Notably, the transportation segment demonstrated 7.1% QoQ growth, supported by substantial deals and strong engagement in software-defined vehicle (SDV) projects, while the healthcare division experienced a 3.6% QoQ growth driven by new product engineering, digital health, and regulatory services. The media and communications segment saw a marginal 0.1% QoQ growth.

Mahindra & Mahindra reported a 21.9% YoY growth in total production, reaching 79,410 units in September. Sales for the month increased by 18.1% YoY to 73,185 units, while exports declined by 4.7% to 2,419 units.

NHPC’s Teesta-V power station in Sikkim suffered a loss of Rs 788 crore due to a flash flood on October 4. The assets and business interruption loss are fully insured.

Mankind Pharma’s Sikkim manufacturing facility resumed operations on October 13 after disruptions caused by a power supply disturbance due to flash floods.

Alkyl Amines Chemicals commenced commercial production in a newly set up plant at its Kurkumbh site to enhance its manufacturing capacity of Ethyl Amines.

Key Management Appointments/Resignations

Sanjay Kulshrestha was appointed as the CMD of HUDCO by the Central Government, effective from October 16. Sanjay Kulshrestha was previously the executive director (ED) at REC.

VA Tech Wabag’s Deputy Managing Director and Group CEO, Pankaj Malhan, resigned due to personal reasons, effective from October 30.

Key Regulatory/Legal/Tax related Announcements

RBL Bank has been fined Rs 64 lakh by the Reserve Bank of India for non-compliance.

ICICI Bank faced a monetary penalty of Rs 12.19 crore imposed by the Reserve Bank of India for contravention of sub-section (1) of Section 20 of the Banking Regulation Act.

Union Bank of India has been imposed a monetary penalty of Rs 1 crore by the Reserve Bank of India for non-compliance with directions related to loans and advances.

Delta Corp.'s subsidiary, Deltatech Gaming, has received a notice for a tax shortfall of Rs 6,236.81 crore for the period between January 2018 and November 2022.

Bajaj Finance has been fined Rs 8.50 lakh by the Reserve Bank of India for non-compliance with the “monitoring of frauds in NBFCs” directions.

Adani Enterprises’ subsidiaries, Mumbai International Airport (MIAL) and Navi Mumbai International Airport (NMIAL), are under investigation by the Ministry of Corporate Affairs, Hyderabad. The investigation covers the period from 2017-18 to 2021-22.

Godrej Redevelopers (Mumbai) Private Limited (GRMPL), a subsidiary of Godrej Properties, has received a GST demand of Rs 48.31 crore along with interest and a penalty from the Additional Commissioner, CGST and Central Excise, Navi Mumbai.

The Reserve Bank of India imposed a monetary penalty of Rs 3.95 crore on Kotak Mahindra Bank for non-compliance with RBI Directions on various aspects of banking operations.

Natco Pharma’s pharma division in Kothur, Hyderabad, underwent a recent inspection by the United States Food and Drug Administration (USFDA) during October 9–18, resulting in the facility receiving eight observations. The company is actively working with the USFDA to address these observations promptly.

Grasim Industries faced a penalty and interest of Rs 117.71 crore imposed by Collector (Stamps), Registration & Stamp (Anti-Evasion), Special Circle Rajasthan, Jaipur, for alleged non-payment of stamp duty of Rs 23.68 crore on a scheme of arrangement between Indian Rayon & Industries and Grasim implemented in the financial year 1999. The company is taking appropriate legal actions, and the financial impact remains undetermined due to the ongoing legal proceedings.

Key Corporate Actions (Buybacks/Dividends/Fund Raising/QIP/NCD)

Reliance Retail Ventures has received a subscription amount of Rs 4,966.80 crore from Platinum Owl C 2018 RSC Limited and allotted 4,11,81,006 equity shares to ADIA. ADIA is the sole beneficiary and settlor of the Platinum Jasmine Trust.

That’s all for this week!

FINVEZTO.COM | Comprehensive Investing & Trading Analytics Platform

Toolkit - https://finvezto.com/toolkit

Connect - https://twitter.com/finvezto

Know More About Us - https://www.linkedin.com/in/finvezto

📧 E-mail: support@finvezto.com

Good Analysis