Weekly Market Analysis for Oct 16-20, 2023

A comprehensive round-up of what happened last week in the Indian Markets and outlook for upcoming week

What happened last week?

Global Equity markets ended flat due to concerns about a global economic slowdown and increased tensions in the Middle East.

Israel's attack on the Gaza Strip resulted in a significant loss of life and negatively impacted market sentiment.

Concerns about war affecting crude oil prices are limited unless Iran becomes directly involved; already high crude prices are influenced by the Russia-Ukraine conflict and production cuts by Russia and Saudi Arabia.

Asian markets performed well last week.

Chinese stocks advanced after a report saying Beijing is planning a potential financial stimulus for the nation’s struggling economy.

US headline inflation came in slightly higher than market expectations.

The Federal Reserve's minutes indicated a likely rate hike before the end of the year, although some officials believed no further increases would be necessary.

India's industrial production growth reached a 14-month high of 10.3% in August, while retail inflation eased to 5.02% in September, returning to the RBI's preferred level of below 6% after two months.

Nifty & Sensex ended have done well over the last week.

The quarterly corporate earnings season began with the IT sector reducing their guidance for FY24 revenue but maintaining strong deal wins.

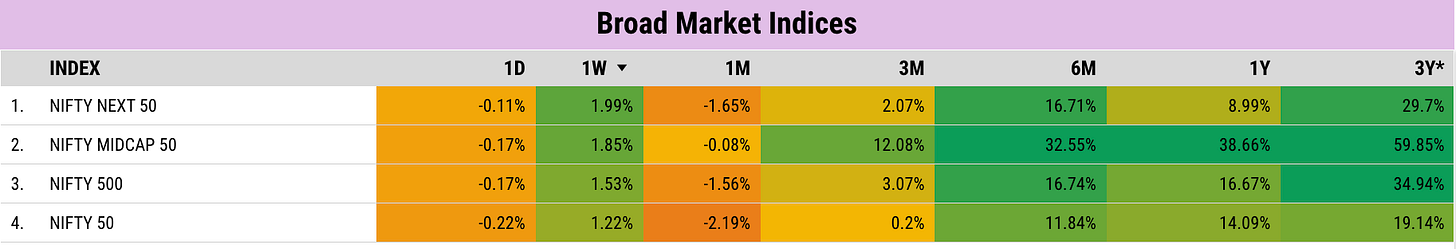

Indian Indices Performance

Nifty Next 50 & Midcap 50 Indices outperformed the broader market.

Realty Sector continued to do well. IT Sector (Information Technology) was at the top last week with positive expectations for the results week. Post the results of TCS and Infosys, it is now at the bottom.

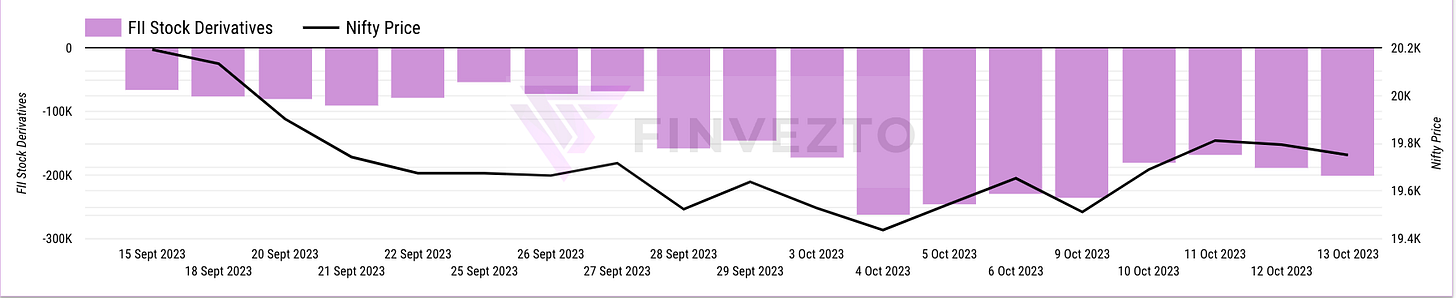

FII Positions Analysis

Cash market: FIIs were net sellers for the week. But on Friday, they were net buyers.

Index Derivatives: FIIs continue to hold short positions on Index Derivatives. They added short positions on the Index post Thursday expiry.

Stock Derivatives: FIIs continue to hold short positions in Stock Derivatives as well.

Overall FII sentiment is Bearish. DIIs are well hedged and are in no mood to reduce their hedges.

Nifty Analysis

Nifty has failed to close above 19850 over the last few weeks. Participants who are short might turn cautious and close positions as and when price moves above 19850. Given the current Bearish Sentiment and with price closing below 19750 the outlook for Monday is Bearish. The Key levels for Nifty are mentioned below. To know more about key levels and how to interpret them please read this article - https://tribe.finvezto.com/pub/how-to-interpret-and-use-key-levels-bull-bear-control-range

Important Upcoming Events

Monday (October 16)

Results: Federal Bank, Jio Financial, Ceat, Cyient

IRM Energy IPO opens

Euro Area Balance of Trade Data

Tuesday (October 17)

Results: Bajaj Finance, L&T Technology Services

US Manufacturing Production

US Industrial Production

UK Unemployment Rate

Wednesday (October 18)

Results: Bajaj Auto, IndusInd Bank, Wipro

India Money Supply

China GDP Annual Growth Rate

UK Inflation Rate

Thursday (October 19)

Results: HUL, ITC, Mphasis, UBL, UltraTech, Coforge, Havells

US Initial Jobless Claims

Friday (October 20)

Results: J&K Bank, JSW Steel, Paytm.

India Deposit Growth

India Bank Loan Growth

India Foreign Exchange Reserves

Japan Inflation Rate

UK Retail Sales

Key Stock Announcements from Last Week

Key Mergers/Acquisitions/Joint Ventures/Collaborations

TVS Motor and BMW Motorrad have commenced production of the BMW CE 02 electric vehicle, marking the 10-year partnership between the two companies.

Vakrangee has partnered with JK Cement to provide lead generation for the sale of grey cement through its Kendra networks, expanding access to cement products in remote areas.

Shree Renuka Sugars has completed the acquisition of Anamika Sugar Mills for Rs 235.5 crore, expanding its presence in Uttar Pradesh.

IIT Bombay and Jindal Stainless have signed an agreement to establish a chair professorship supporting research in the stainless steel sector.

Biocon has partnered with Juno Pharmaceuticals in Canada for the commercialization of Liraglutide, a drug-device combination for type 2 diabetes and obesity treatment.

Adani Energy Solutions has acquired 100 percent equity shares of Sangod Transmission Service from Rajasthan Rajya Vidyut Prasaran Nigam.

Indian Energy Exchange will acquire a 10 percent stake in Enviro Enablers India, aligning with its sustainability and decarbonization goals.

Fine Organic Industries has incorporated a wholly owned subsidiary, Fine Organic Industries (SEZ), for manufacturing specialty chemical products in India.

Wipro has completed its subscription to FPEL’s equity share capital for Rs 6.3 crore. This move involves acquiring a 9.5% stake in FPEL Ujwal, a solar power asset company.

Shakti Pumps received approval from its Board of Directors to invest Rs 114.29 crore in subsidiary Shakti EV Mobility in one or more tranches over the next five years.

Pricol, an automotive components maker, entered into a cooperation agreement with Heilongjiang Tianyouwei Electronics to provide advanced technologies in driver information system solutions for Indian vehicle makers across various vehicle segments.

The Reserve Bank of India has granted approval to SBI Mutual Fund to acquire up to 9.99 percent of the paid-up share capital in IndusInd Bank, with a deadline to complete the acquisition by October 10, 2024.

Route Mobile (Bangladesh) partnered with Robi Axiata in Bangladesh as a technical enabler and sales partner for RCS (rich communication service) business messaging.

Mahindra Lifespace Developers acquired 5.38 acres of land in Wagholi, Pune, with a development potential of over 1.5 million square feet of saleable area.

IRB Infrastructure Developers executed definitive agreements with affiliates of GIC as financial investors and STPL, acting as the project manager for the Samakhiyali Santalpur BOT project in Gujarat worth Rs 2,092 crore.

Key Buying/Selling Deals

Societe Generale has acquired a 0.58% stake in PB Fintech, while Softbank entities offloaded a 2.5% stake in the company.

Ashish Rameshchandra Kacholia has acquired 6,22,800 lakh equity shares in Saakshi Medtech and Panels at Rs 167.01. Hem Finlease has sold 6,20,400 shares in the company at an average price of Rs 167 per share.

Ag Dynamic Funds Limited Sell 91200 Shares of Sotac Pharmaceuticals Ltd at Rs 121 per share.

Quant Mutual Fund Gilt Fund Buy 1100000 Shares of Moil Limited at Rs 226.8 per share.

Bnp Paribas Arbitrage Sell 275946 Shares of Venus Pipes & Tubes Ltd at Rs 1234.21 per share.

Norges Bank On Account Of The Government Pension Fund Global Buy 3275807 Shares of 360 One Wam Limited at Rs 511.2 per share. Morgan Stanley Investment Funds Emerging Leaders Equity Fund Sell 2442218 Shares at Rs 511.2 per share.

New Orders/Projects/Expansion/CAPEX

IDL Explosives, a subsidiary of GOCL Corporation, has secured an order worth Rs 766 crore from Coal India for the supply of bulk explosives over two years.

Aster DM Healthcare’s subsidiary in Trivandrum has signed a lease agreement to expand Aster Whitefield Hospital in Bengaluru, adding 159 beds and increasing the total capacity to 506 beds.

KPI Green Energy has received new orders for 4.20 MW of solar power projects under the captive power producer segment, surpassing 100+ MW in cumulative orders.

Adani Solar Energy Jaisalmer Two Private Limited has completed the commissioning of a 150 MW solar power project in Rajasthan, increasing Adani Green Energy’s operational renewable generation capacity to 8,404 MW.

Genus Power Infrastructures’ subsidiary has received two letters of award (LOA) worth Rs 3,115.01 crore for the appointment of Advanced Metering Infrastructure Service Providers (AMISPs).

Bhageria Industries has received a turnkey international solar engineering, procurement, and construction (Solar EPC) project in Bahrain with a capacity of 11.40 MWp and a total order value of Rs 104.49 crore.

Dibang Power (Lot 4) Consortium, a joint venture between GR Infraprojects and Patel Engineering, has executed a contract agreement worth Rs 3,637.12 crore with NHPC for the Dibang multipurpose project in Arunachal Pradesh.

Mazagon Dock Shipbuilders has signed a Letter of Intent (LOI) with a European client for the construction of six 7,500 DWT multi-purpose hybrid power vessels, with an option for four additional units. The unit prices will be finalized upon contract signing.

Dilip Buildcon has signed an agreement for the construction of Dewas III and IV Dams in Gogunda, Rajasthan, worth Rs 396.93 crore, including 10 years of operation and maintenance.

Rail Vikas Nigam, a state-owned railway company, emerged as the lowest bidder for a project worth Rs 28.73 crore from Northeast Frontier Railway. This project involves the supply, installation, testing, and commissioning of an integrated tunnel communication system.

EMS secured a contract worth Rs 270.82 crore from the Office of Municipal Corporation, Jaipur Heritage, for laying, testing, commissioning of sewerage systems, and ancillary works, along with defect liability and operation and maintenance for towns.

SJVN’s subsidiary, SJVN Green Energy, received a Letter of Award for the development of a 100 MW solar power project in Rajasthan at a tariff of Rs 2.62 per unit.

Key Business & Results Updates

Tata Consultancy Services (TCS), India’s largest IT services exporter, reported an 8.7 percent year-on-year growth in profit for the quarter ending September FY24, reaching Rs 11,342 crore. This performance exceeded analyst expectations and was attributed to improved operating numbers. TCS also announced an interim dividend of Rs 9 per share and plans to buy back shares worth Rs 17,000 crore.

Infosys, India’s second-largest IT services exporter, reported a 4.5 percent sequential growth in net profit at Rs 6,212 crore for the quarter ending September FY24. Revenue increased by 2.8 percent QoQ to Rs 38,994 crore, with revenue in dollar terms rising by 2.2 percent QoQ to $4,718 million.

HCL Technologies recorded a net profit of Rs 3,832 crore for the quarter ending September FY24, surpassing analyst estimates. Full-year revenue growth is expected to be in the range of 4-5 percent YoY, with an interim dividend of Rs 12 per share declared.

Prestige Estates Projects achieved a 102 percent YoY sales growth, reaching Rs 7,092.6 crore in the quarter ending September FY24, attributed to increased volume and average realizations for apartments, villas, and plot sales.

Titan Company has reported a 20 percent YoY revenue growth for the quarter ending September FY24, with growth in its jewelry division at 19 percent, watches and wearables at 32 percent, and eyecare segment at 12 percent YoY.

Maruti Suzuki India, the country’s largest car manufacturer, has begun exporting its Jimny 5-Door model to Latin America, the Middle East, and Africa.

Angel One, a retail stock broking house, achieved its highest-ever business performance for the quarter ending September FY24. Profit grew by 42.6 percent to Rs 304.5 crore, and revenue increased by 40.6 percent to Rs 1,048 crore compared to the previous year.

Capri Global Capital’s gold loan AUM has crossed Rs 2,000 crore in just 13 months and aims to achieve Rs 3,000 crore by March 2024.

Metropolis Healthcare has recorded a 13 percent YoY growth in core business revenue for the quarter ending September FY24, driven by volume growth and increased B2C revenue.

Bank of Baroda’s total business exceeded Rs 22 lakh crore in the quarter ending September FY24, with total advances growing 17.43 percent YoY and deposits increasing by 14.63 percent YoY.

Container Corporation of India reported a 26.13% YoY growth in domestic volumes and a 3.50% YoY growth in EXIM volumes for the quarter ended September FY24, with total volumes increasing by 7.59% YoY.

IDFC First Bank has entered into an agreement with the National Securities Depository (NSDL) to sell its premises at Naman Chambers, BKC, Mumbai, as part of its operational consolidation. The sale amounted to Rs 198 crore.

IRCON International has been granted Navratna Status by the Department of Public Enterprise, making it the 15th Navratna among the CPSEs.

Phoenix Mills reported a 20% YoY growth in total consumption to Rs 2,637 crore, with a 23% YoY increase in retail collections to Rs 638 crore.

NCL Industries reported increased cement production and dispatches for the quarter ending in September, with growth rates of 9% and 11%, respectively. Cement boards production and dispatches also saw growth.

Patanjali Foods reported pricing pressure in the edible oil segment during Q2 FY24 due to excessive imports, resulting in elevated inventory levels that affected both revenue and margins. However, the firm saw an increase in edible oil sales volume in Q2.

Delta Corp, a casino gaming company, achieved a consolidated profit of Rs 69.44 crore in the quarter ending September FY24, a 1.74 percent increase compared to the previous year. Anil Malani was appointed as President and CFO, and Manoj Jain as Chief Operating Officer of the company, effective October 11.

Bhagiradha Chemicals was granted a patent titled “Novel Process for Preparation of Ethiprole” by the Patent Office, Government of India, effective from January 12, 2021.

Shilpa Medicare received approval from the Office of the Directorate of Ayurveda and Unani Services for manufacturing and selling an oral mucositis spray in India under the brand name ORAAL. The composition of ORAAL is protected by a patent in India until November 2033.

GMR Airports Infrastructure reported a 23 percent year-on-year growth in passenger traffic and a 4 percent decline month-on-month for September.

Key Management Appointments/Resignations

Tamilnad Mercantile Bank has been advised by the Reserve Bank of India to identify a regular MD and CEO immediately and submit an application for approval, with S. Krishnan continuing until a successor assumes office.

Punjab National Bank has appointed Sanjeevan Nikhar as Group Chief Compliance Officer with immediate effect.

Lal Singh has been appointed as Executive Director of Bank of Baroda for a three-year term, effective October 9. Lal Singh was previously the chief general manager at Union Bank of India.

Bani Varma has been appointed as director (industrial systems and products) of BHEL, effective October 9. She previously led BHEL’s transportation business segment and electronics division manufacturing unit in Bangalore.

Divgi TorqTransfer has appointed Dipak Vani as Chief Operating Officer and Girish Ghatwade as Senior Manager, Strategic Sourcing and Global Supply Management, effective from November 1.

EIH Associated Hotels: Shib Sanker Mukherji resigned as Chairman and Director due to personal reasons.

Vikram Surendran resigned as the Chief Executive Officer of MIRC Electronics, effective October 11, citing personal reasons.

IPO/Listing/De-Listing

Arabian Petroleum listed its equity shares on the NSE Emerge at an issue price of Rs 70 per share.

E Factor Experiences debuted on the NSE Emerge with an issue price of Rs. 75 per share.

Kontor Space debuted on the NSE Emerge on October 10 at an issue price of Rs. 93 per share.

Vishnusurya Projects and Infra, a rough stone mining company, listed its equity shares on the NSE Emerge on October 10 at an offer price of Rs. 68 per share.

Goyal Salt listed its shares on the NSE Emerge at an issue price of Rs. 38 per share.

Oneclick Logistics India debuted on the NSE Emerge at an offer price of Rs 99 per share.

Sharp Chucks and Machines debuted on the NSE Emerge on October 12 with an offer price of Rs. 58 per share.

Key Regulatory/Legal/Tax related Announcements

The Income Tax Department has conducted searches at Puravankara’s registered office and premises.

Dr. Reddy’s Laboratories and other pharmaceutical companies have been named as defendants in a complaint filed in the United States District Court, alleging antitrust violations related to the sale of brand and generic Revlimid. Dr. Reddy’s maintains that the allegations lack merit and will vigorously defend the litigation.

Maruti Suzuki receives show cause notice from the customs department for allegedly evading customs duty of Rs 16.27 lakh by wrongly availing a customs duty concession based on the end use of imported goods.

Birla Corporation faces a penalty of Rs 8.43 crore for excessive limestone production without environmental clearance from 2000-01 to 2006-07.

Akzo Nobel India received a demand order from the Karnataka GST Department for the collection of GST, along with interest and penalties amounting to Rs 9.95 lakh, related to ineligible credits for FY2017–18.

The Reserve Bank of India has directed Bank of Baroda to halt customer onboarding onto the ‘bob World’ mobile app due to supervisory concerns. Any future onboarding is subject to resolving these issues.

Larsen & Toubro, an infrastructure major, received a penalty of Rs 64.98 lakh under the Central Goods and Services Tax Act from the Assistant Commissioner of CGST & CX, Gangtok Division, Gangtok, Sikkim.

Cipla received an Establishment Inspection Report (EIR) from the United States Food and Drug Administration (USFDA) following an inspection of its subsidiary, InvaGen Pharmaceuticals Inc.'s manufacturing facility in Central Islip, Long Island, New York. The inspection was classified as Voluntary Action Indicated (VAI).

Paytm Payments Bank, a part of mobile payment company Paytm, has been penalized by the Reserve Bank of India with a monetary penalty of Rs 5.39 crore for non-compliance with Know Your Customer (KYC) norms.

The United States Food and Drug Administration (US FDA) issued a Form 483 with nine observations for Dr. Reddy’s Laboratories’ manufacturing facility in Bachupally, Hyderabad, following a product-specific pre-approval inspection.

Lupin received tentative approval from the US FDA for its generic equivalent of Xywav oral solution from Jazz Pharmaceuticals Ireland in the US.

The US FDA conducted an inspection of Panacea Biotec’s Baddi unit in Himachal Pradesh, issuing a Form 483 with nine observations related to improvements in existing procedures.

Key Corporate Actions (Buybacks/Dividends/Fund Raising/QIP/NCD)

Tata Consultancy Services discusses proposal for share buyback on October 11.

Reliance Industries will receive an investment of Rs 4,966.80 crore from the Abu Dhabi Investment Authority’s subsidiary, valuing Reliance Retail Ventures at Rs 8.381 lakh crore on a fully diluted basis.

Glenmark Life Sciences has declared an interim dividend of Rs 22.50 per share for the financial year 2023–24, with a record date of October 17 and payment by October 23.

Titan’s board of directors will meet on October 17 to consider issuing non-convertible debentures on a private placement basis within borrowing limits.

Laxmi Organic Industries raised Rs 259 crore through a qualified institution placement (QIP) of its equity shares, allotting 96.25 lakh equity shares at an issue price of Rs 269.20 per share.

MedPlus Health Services, a retail pharmacy chain, received approval from its board of directors to raise up to Rs 1,200 crore through the issuance of non-convertible debentures and warrants in one or more tranches.

Adani Enterprises has successfully raised Rs 700 crore by allotting 70,000 non-convertible debentures (NCDs) with a face value of Rs 1 lakh each through a private placement.

Grasim Industries, an Aditya Birla Group company, will meet on October 16 to consider raising funds through equity shares or other securities via rights issue, qualified institution placement, preferential issue, or other methods.

That’s all for this week! All the above information can be tracked using Finvezto Toolkit and Tribe on a daily basis.

If you wish to explore, the links are below. Finvezto Tools and Products are available on a subscription basis only.

FINVEZTO.COM | Comprehensive Investing & Trading Analytics Platform

Toolkit - https://finvezto.com/toolkit

Tribe - https://tribe.finvezto.com

Lessons & Mistakes - https://courses.finvezto.com

Connect - https://twitter.com/finvezto

Know More About Us - https://www.linkedin.com/in/finvezto

📧 E-mail: support@finvezto.com