Weekly Market Analysis for Nov 06-10, 2023

A comprehensive round-up of what happened last week in the Indian Markets and outlook for upcoming week

What happened last week?

Most Global Markets rebounded last week and ended in green. US markets performed the best followed by European markets.

Indian Markets were up by about 0.96% despite FII selling. FPIs/FIIs sold ₹5548 Cr in the cash market. The selling pressure was absorbed by DIIs who bought for ₹5072 Cr.

In its recent meeting, the Fed kept interest rates unchanged. It sparked a rally in the US Markets.

Crude oil prices dropped even amid tensions in the Middle East.

The Indian Government has increased the windfall gains tax on domestic crude oil by Rs 750 per tonne, bringing it to Rs 9,800 per tonne.

In October 2023, India's GST collections surged by 13% YoY to reach Rs 1.72 trillion, the second-highest ever recorded, with the highest monthly collection being Rs 1.87 trillion in April 2023.

The India Manufacturing Purchasing Managers' Index (PMI) dropped to 55.5 in October, down from 57.5 in September. This marks the lowest level since March, when the PMI stood at 56.4.

Indian Indices Performance

Nifty Next 50 and Midcap Stocks outperformed the Index. Small Cap stocks continue their momentum.

Realty and Media were the best performers last week. Realty Index was up 10%. It continues to be the pest performing sector over the last year.

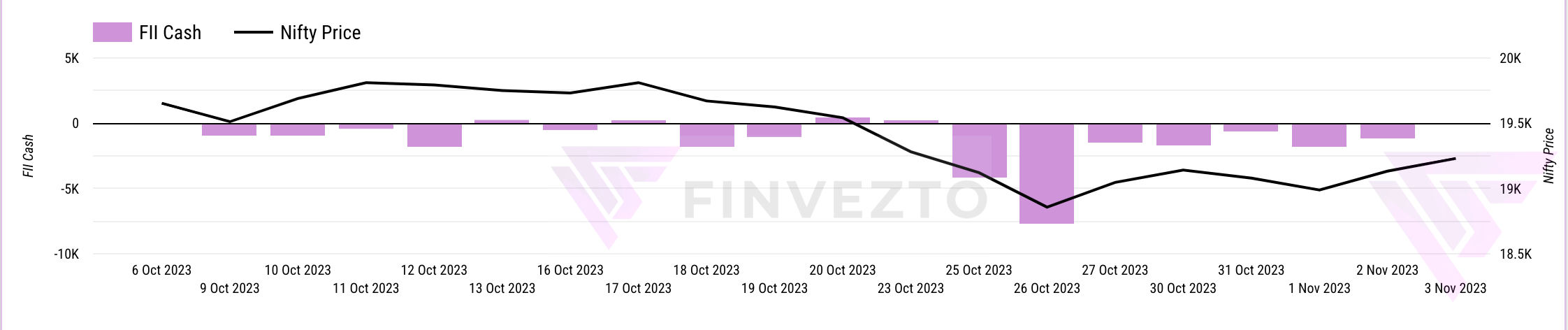

FII Positions Analysis

Cash Market: FIIs remained net sellers in the cash market with a net sell of ₹5548 Crores last week.

Index Derivatives: FIIs continue to hold short positions in Index Derivatives. They do not seem to be reducing their shorts on the Index. It could mean that the selling spree in cash market might continue in the coming week.

Stock Derivatives: FIIs continue to hold short positions in Stock Derivatives. However, they have marginally reduced their short positions over the week.

FII sentiment continues to be Bearish overall. Check out our detailed analysis below.

Important Upcoming Events

Monday, November 6:

Results: Bharat Forge, Divi's Lab, Bajaj Electricals, Emami, Max Healthcare, Nykaa.

Protean eGov Technologies IPO Opens

Euro Area Services PMI Data

Tuesday, November 7:

Results: Apollo Tyres, Cochin Shipyard, Crisil, Cummins, Eveready, IRCTC, Jyothy Lab, Naukri.

ASK Automotive IPO Opens

China Balance of Trade Data

US Balance of Trade Data

Wednesday, November 8:

Results: Bata India, BHEL, Birla Corp, Lupin, Patanjali Foods

Thursday, November 9:

Results: ABB India, Adani Ports, Apollo Hospital

China Inflation Rate

Friday, November 10:

Results: Biocon, Glenmark Pharma, Hindalco, Mahindra & Mahindra , ONGC, SAIL

India Industrial Production Data

India Manufacturing Production

Key Stock Announcements from Last Week

Key Mergers/Acquisitions/Joint Ventures/Collaborations

GAIL (India) signed a 15-year supply agreement with Bharat Petroleum Corporation to secure propane feedstock for its upcoming petrochemical plant in Usar, Maharashtra. The contract is valued at over Rs 63,000 crore, with GAIL procuring 600 KTPA of propane from BPCL’s LPG import facility at Uran.

Bharti Airtel partnered with Microsoft to offer calling services over Microsoft Teams.

Crompton Greaves Consumer Electricals announced that the public shareholders of Butterfly Gandhimathi voted overwhelmingly against the merger between the two companies, and the merger will not proceed.

SBI Card and Reliance Retail collaborated to launch the co-branded Reliance SBI Card, a lifestyle-focused credit card offering a rewarding shopping experience to customers.

Jindal Drilling and Industries’ Rig Virtue I commenced operations under a charter hire contract with Oil and Natural Gas Corporation.

Shilpa Medicare has acquired Pilnova Pharma Inc. in the United States, making it a wholly-owned subsidiary with a par value of $1 per share. The acquisition is expected to be completed by November 15 and aims to establish a presence in the US market to leverage niche portfolios.

Larsen & Toubro sold its entire 100 percent stake in L&T Infrastructure Engineering (LTIEL) to STUP Consultants, a subsidiary of Assystem SA of France, for Rs 60 crore. This divestment aligns with L&T’s strategic focus on its core businesses and assets. LTIEL reported revenues of Rs 92 crore in FY23, and the transaction is expected to be completed by January 15, 2024.

Tata Motors subsidiaries, Tata Passenger Electric Mobility (TPEM) and Jaguar Land Rover Plc (JLR), have signed a Memorandum of Understanding (MoU) to license JLR's Electrified Modular Architecture (EMA) platform. This licensing agreement involves a royalty fee and aims to facilitate the development of TPEM's premium pure electric vehicle series, known as 'Avinya,' utilizing the EMA platform.

Adani Cement Ltd. has indicated that it anticipates the acquisition of Sanghi Industries Ltd. by Ambuja Cements Ltd. to be finalized during the third quarter of the fiscal year 2023-24.

Fincare Small Finance Bank is set to merge with AU Small Finance Bank (AU SFB) in an all-share deal. Fincare shareholders will receive 579 shares of AU for every 2,000 shares held.

Key Buying/Selling Deals

Kotak Mahindra Life Insurance Company Limited's Classic Opportunities Fund has acquired 1,378,340 shares of Minda Corporation Ltd at a price of Rs. 330.94 per share.

Norges Bank, on behalf of the Government Pension Fund Global, has purchased 2,100,000 shares of Blue Jet Healthcare Ltd at a price of Rs. 380 per share.

Morgan Stanley Asia (Singapore) Pte. has acquired 193,219 shares of Praveg at a price of Rs. 549.98 per share.

New Orders/Projects/Expansion/CAPEX

UltraTech Cement approved a Rs 13,000 crore investment to increase its capacity by 21.9 mtpa, with production starting in FY26.

NBCC India bagged two orders worth Rs 212 crore from the Haryana government for the supply of equipment to medical colleges.

Panacea Biotec launched a generic version of Paclitaxel protein-bound particles for injectable suspension in the Canadian market.

PSP Projects received work orders worth Rs 200.25 crore in Ahmedabad, bringing the total order inflow for FY23-24 to Rs 958.63 crore. It also emerged as the lowest bidder for a project worth Rs 101.67 crore for the Gujarat Biotechnology Research Centre.

Bondada Engineering received a work order worth Rs 381 crore from Bharat Sanchar Nigam for infrastructure as a service (IaaSP), which includes the supply and erection of GBT, the supply and installation of infrastructure items, and subsequent operation and maintenance for five years.

JK Tyre & Industries has approved an expansion plan to increase its tire manufacturing capacity. The company plans to invest Rs 1,025 crore to boost capacity by 19.45% with the goal of achieving this enhanced capacity by October 2025.

Key Business Updates

Maruti Suzuki India, the country’s largest car manufacturer, produced a total of 1.76 lakh units in October, representing a 13.05 percent year-on-year growth compared to 1.56 lakh units produced in the same month the previous year, including production from Suzuki Motor Gujarat.

Gujarat Gas increased industrial gas prices to Rs 45.6 per standard cubic metre, effective from November 1, 2023.

Britannia Industries has started production at its Bihta plant in Bihar.

Tata Motors has received an arbitral award of Rs 766 crore, along with interest, as compensation for its investment in the now-defunct Singur plant. The arbitration proceedings with the West Bengal Industrial Development Corporation have concluded in Tata Motors’ favour.

Prashant Jain, the Joint Managing Director and CEO of JSW Energy, has decided to retire early from his professional life to pursue personal interests. He will continue in his current position until January 31, 2024, to facilitate a smooth transition.

KFin Technologies has introduced Guardian, a trade reporting and compliance management platform designed for organizations operating in the capital markets.

Fund Raising

Inox Wind Energy, a promoter of Inox Wind, raised approximately Rs 800 crore through the sale of equity shares in Inox Wind. The funds will be used to reduce Inox Wind’s external debt. Several funds and entities purchased equity shares in the transaction.

State Bank of India (SBI) successfully raised Rs 10,000 crore through its first Basel III-compliant Tier 2 bond for the current financial year, with a coupon rate of 7.81 percent. These bonds have a 15-year term and include a first call option after 10 years.

Bajaj Finance received board approval to issue 15.5 lakh warrants to the promoter Bajaj Finserv at an issue price of Rs 7,670 per warrant, totaling Rs 1,188.85 crore.

Adani Green is currently in discussions with a consortium of international lenders with the intention of securing a loan of up to $1.8 billion.

IPOs

Rajgor Castor Derivatives debuted on the NSE Emerge on October 31, with an issue price of Rs. 50 per share. Its equity shares were available for trading in the trade-for-trade segment.

Blue Jet Healthcare, a pharmaceutical company, made its debut on the BSE and NSE on November 1, with a final issue price of Rs. 346 per share. The allotment of IPO shares took place on October 30.

Paragon Fine and Specialty Chemical, a specialty chemical intermediate manufacturing company, debuted on the NSE Emerge on November 3, with a final issue price of Rs. 100 per share. Its equity shares were also available for trading in the trade-to-trade segment.

Shanthala FMCG Products, an FMCG product distribution company, listed its equity shares on the NSE Emerge on November 3, with an issue price of Rs. 91 per share. The equity shares were available for trading in the trade-to-trade segment.

Key Regulatory/Legal/Tax related Announcements

Dr. Reddy’s Laboratories received 10 observations from the USFDA following a cGMP inspection at its formulations manufacturing facility in Hyderabad.

Maruti Suzuki India received a Show Cause Notice from the Senior Inspector, Legal Metrology, Agra, Uttar Pradesh, for failing to mention the Maximum Retail Price (MRP) on products listed for sale on its official website. This omission is a violation of the Legal Metrology Act, 2009, and Rule 6(2) of the Legal Metrology (Packaged Commodities) Rules, 2011.

Speciality Restaurants received a demand notice for payment of shortfall tax from the Office of the Commissioner, Kolkata South CGST & CX Commissionerate.

Lupin received an Establishment Inspection Report (EIR) from the United States Food and Drug Administration (US FDA) for its Mandideep unit-2 manufacturing facility. The inspection, conducted in August 2023, resulted in a classification of ‘no action indicated’ (NAI) for the facility.

Kalpataru Projects International underwent a search by the Directorate General of GST Intelligence in Gujarat, with no official order issued.

Colgate-Palmolive received an income tax liability of Rs 170 crore from the Income Tax Authority due to a transfer pricing order for the Assessment Year 2021–22, disallowing certain international transactions.

That’s all for this week!