What happened last week?

Nifty was up by 0.2% last week. Nifty opened the week at 22475, reached an all-time high of 22794 and then closed the week back at the open price of 22475.

On Friday, Nifty erased all the gains it made over the first 4 days of the week. This is also the 4th time Nifty has witnessed a sharp fall after reaching 22700 levels.

There was relatively higher volatility in the US and Global Markets throughout the week owing to the FED Decision.

FED Chair Jerome Powell emphasized that while rate increases are unlikely, the timeline for rate cuts remains uncertain due to fluctuating inflationary pressures.

Powell expressed lower confidence in inflation declining towards the target of 2% and highlighted the importance of data in determining future policy decisions.

Both Equity and Bond Markets witnessed a positive response post the FED announcement.

At a Sectoral level, Nifty Fin Services, Nifty PSU Bank, Nifty Auto were the biggest gainers last week. Nifty IT was down 2.25%.

At an Industry level, Bearings (+8%), NBFCs (+6%) and Pipe Manufacturers (+4%) were the top gainers continuing their good run.

India GST collections grew 12.4% to a record high of Rs 2.1 lakh crore in April 2024, aided by strong economic momentum and increased domestic transactions, as per the Finance Ministry.

Infrastructure output in India increased 5.2% year-on-year in March 2024, following an upwardly revised 7.1% rise in February.

The HSBC India Manufacturing PMI stood at 58.8 in April 2024 compared to March’s 59.1. Still, the latest reading was the second-fastest in over three years, supported by rising demand.

Q4 FY24 Results season is underway. Although Index Heavyweights were disappointing, other Stocks outside the index have so far posted good results. We are covering the top stocks of the results season here.

Let us now dive deeper into FII DII Data.

FII DII Positions Analysis

FIIs sold ₹2115 Cr in the cash market. DIIs bought ₹4164 Cr.

FIIs continue to be significantly short on the Index. They might continue to be sellers in the cash market.

DIIs have increased their hedges over the last 2 weeks. DIIs remain cautious.

Overall FIIs are Bearish and DIIs remain cautious.

Nifty Analysis

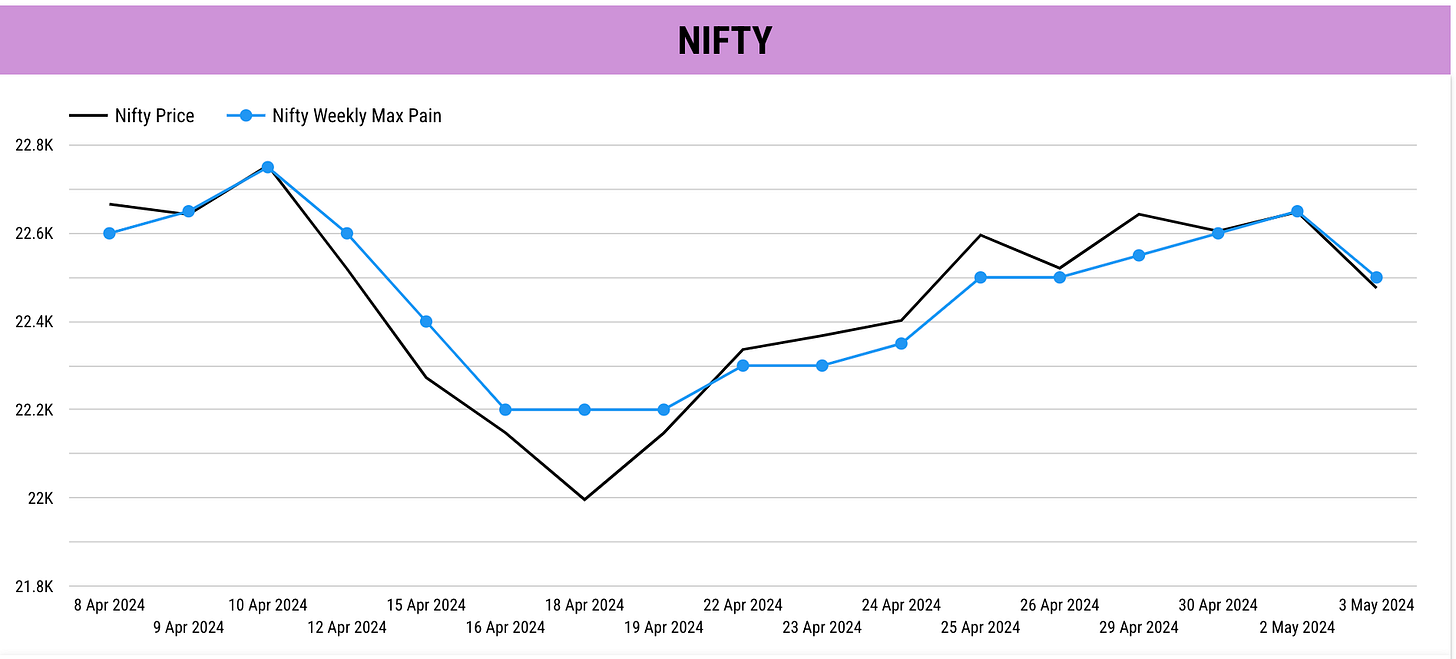

Nifty Max Pain remained at 22500 (same as last week) despite the volatile moves. Participants did not any significant directional bets last week. However, momentum and sentiment took a Bearish turn on Friday eating up all the intra-week gains from Monday to Thursday. Hence the bias is Bearish.

Stocks Coverage

Key Upcoming Events

Monday, May 6

India Final PMI Data

China Services PMI

Thursday, May 9

China Exports, Imports Data

UK Interest Rate Decision

US Jobless Claims release

Friday, May 10

India Industrial Production Data

UK GDP Data

Key Stock Announcements Last week

Please check Dalal Street Breakfast (Daily Pre-Market Report) for all stock-related updates from the past week. You can also use the Search on the top right to see stock-specific updates.

FINVEZTO.COM | Useful & Actionable Stock Market Tools