Weekly Market Analysis for July 22-26, 2024

Nifty's Rollercoaster Week, New All-Time Highs, IT outage and Global Market jitters amid Strong FII Inflows, Sectoral Shifts, and Promising Economic Indicators for India.

What happened last week?

Nifty was in green till Thursday making new highs.

It reached a high of 24854. But, it lost all weekly gains and closed lower at 24530 on Friday. The global IT outage on Friday may have triggered a sell-off.

FIIs continue to be net buyers

in the cash market. Money is moving into large caps and small/mid caps witnessed aggressive selling.

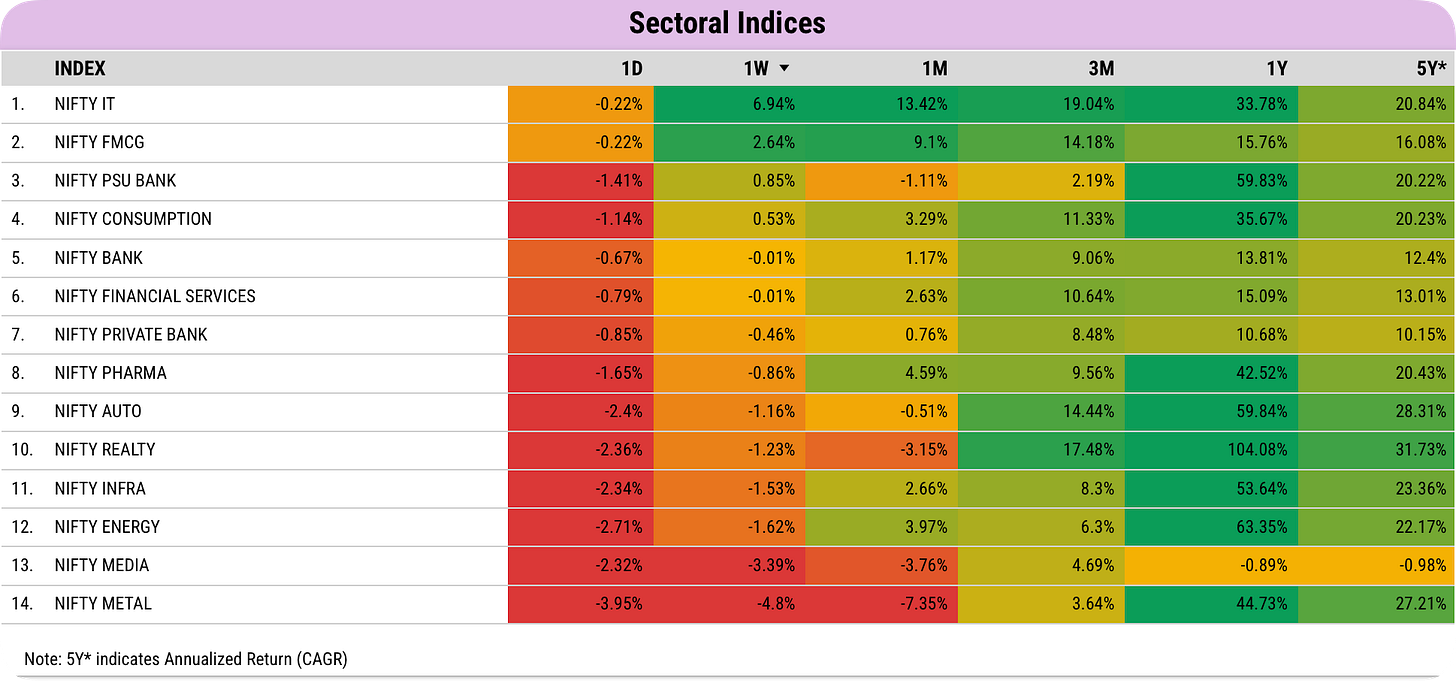

On the sectoral front,

IT and FMCG were the top performers last week. Media and Metals tanked.

On the global front,

most markets were down. US Tech/Semiconductor stocks took a hit on reports of trade restrictions with China. Global IT outages might have also contributed to the negative sentiment.

Let us look at some India-specific developments.

All eyes will be on the budget session this week on Jul 23. FIIs have turned cautious before the budget.

Q1 FY25 results season is underway. So far the results have been good led by IT majors. So far, around 230 companies have announced their results and around 130 companies have shown positive earnings growth.

India’s WPI Inflation increased by 3.36% YoY in June 2024, accelerating from a 2.61% rise in the previous month. It marked the eighth consecutive period of wholesale inflation and the fastest pace since last February 2023, due to a faster rise in manufacturing, primary articles, and food prices.

The International Monetary Fund (IMF) upgraded India's economic outlook by raising its growth forecast for the 2024-25 financial year to 7%.

Total passenger vehicle sales in India grew 5.0% from a year earlier to 294,133 in June 2024, accelerating from a 4.3% increase in the previous month. (Source: SIAM)

Let us now dive deeper into FII DII Data.

FII DII Positions Analysis

FIIs bought ₹10945 Cr and DIIs sold ₹4226 Cr in the cash market.

FIIs continued their buying in the cash market. They have bought 21600+ Cr in July so far.

However, they have reduced their longs in Index Derivatives at 24800 levels suggesting a key resistance area for the upcoming week.

FIIs continue to hold longs in Stock Derivatives. We can expect stock-specific action.

Overall, FIIs are not bearish, but they have become cautious ahead of the budget week.

DIIs have slightly reduced their hedges following Friday's decline. Important to note that they were sellers in the cash market last week when their hedges were high. I had pointed it out last week. Their behaviour now indicates a readiness to support the market at lower levels.

Nifty Analysis

Things were going well for Nifty till Thursday. But both Price (Momentum) and Positions (Sentiment) turned Bearish on Friday. There was a huge dip in the weekly max pain from 24800 to 24500.

However, if you look at the Monthly Max Pain trend of Nifty below,

you can see that Max Pain (pink line) has not dipped on Friday. So Positional Traders have still not panicked.

Overall, Nifty is neither in an uptrend or a downtrend now. We need to wait and re-evaluate.

Stocks Coverage

Pl find below the list of stocks with significant Institutional Buying last week. This helps uncover where the big money is moving to.

Key Stock Announcements Last week

Note: All the news items below include only the core business activities.

New Orders & Projects:

Power Mech Projects receives INR 209.50 crore order from Hindustan Zinc.

GPT Infraprojects wins INR 103 crore contract enhancements from NHAI, Eastern Railway.

KEC International secures new T&D orders worth INR 1100 crore.

RITES secured INR 50.18 crore order from Assam PWRD for road monitoring.

Latteys Industries received a INR 30 crore order from Rajasthan Horticulture Department.

Partnerships, Acquisitions & Investments:

Zydus announces licensing agreement with Takeda for Vault® in India.

Magic Moments partners with Saregama for 'Magic Moments Music Studio'.

Tata Technologies partners with Arm to innovate software-defined vehicles (SDVs).

Hahnair partners with RateGain to enhance airline pricing for 350+ global airlines.

Zensar acquires BridgeView to enhance Healthcare and Life Sciences capabilities.

Hinduja Tech acquires TECOSIM Group to enhance global engineering services.

UltraTech acquires 26% in Amplus Omega Solar for green energy.

Dixon Technologies receives CCI approval for acquiring Ismartu India majority stake.

Business Operations:

Glenmark Pharmaceuticals receives ANDA approval for Topiramate Capsules.

Balu Forge raises INR 496.80 crore to boost manufacturing capabilities.

Happiest Minds launches WATCH360, AI-powered Managed Infrastructure Services offering.

Navin Fluorine's subsidiary allots INR 2498 crore preference shares to parent company.

Som Distilleries' Power Cool Beer ranks second in Karnataka market.

Radico Khaitan launches award-winning Sangam World Malt Whisky in India.

Birla Estates acquires prime Gurugram land for luxury residential development.

Lupin sells U.S. Women's Health Business to Evofem for USD 84 mn.

NLC India secures Machhakata coal mine in Odisha, boosting capacity.

Key Upcoming Events

July 22 (Monday):

The Economic Survey (Before the Budget)

July 23 (Tuesday):

Union Budget 2024

July 24 (Wednesday):

HSBC Manufacturing PMI Flash

July 26 (Friday):

Bank Loan Growth

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools