Weekly Market Analysis for July 15-19, 2024

The surge in mutual fund and FII inflows, robust corporate earnings expectations and favourable economic indicators have contributed to the positive sentiment.

What happened last week?

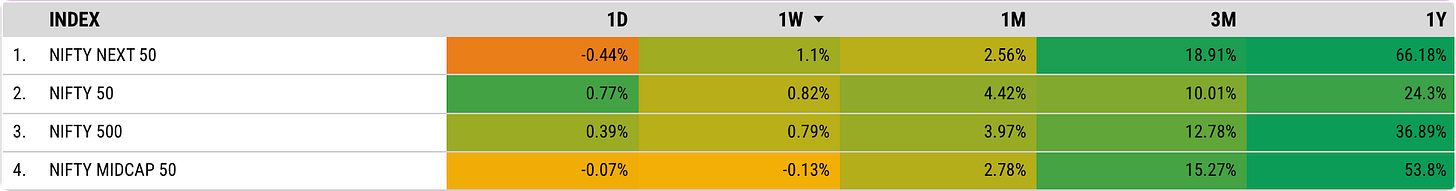

Nifty continued to make record highs crossing the 24500 mark.

FIIs continue to be net buyers

in the cash market. Big Money is moving into the large caps.

On the sectoral front,

IT and FMCG were the top performers propelled by strong earnings expectations.

On the global front,

the US S&P 500 and NASDAQ reached record highs. Most Global Markets closed the week in green.

The US Inflation rate

came in lower than anticipated at 3%, marking the first monthly dip in inflation in over four years. This strengthens the case for the Fed to ease interest rates.

Let us look at some India-specific developments.

Indian mutual funds also saw record-breaking net inflows into equity funds

in June 2024, totalling Rs 40,608 crore (Data by AMFI).

The strong inflows propelled the mutual fund industry's total assets under management (AUM) past the Rs 60 trillion mark for the first time.

Within the equity fund category, sector/thematic funds saw the highest net inflows of Rs 22,351 crore, aided by the launch of 9 new fund offerings (NFO) that garnered Rs 12,974 crore.

Q1 FY25 results season has started.

TCS delivered a strong performance in Q1 FY 2025, surpassing revenue estimates and securing significant deals. TCS was up by 6.5% on Friday.

India's CPI Inflation rose to 5.08% in June 2024, up from 4.75% in May.

It is still within the RBI's 2-6% target range set for inflation. This increase in CPI is likely to reinforce the RBI's cautious stance, potentially delaying rate cuts.

In May 2024, India's Industrial Production (IIP) reached a seven-month high of 5.9% YoY, up from around 5.0% in the prior month. This increase was fueled by expansions in manufacturing and electricity output (hot weather).

The surge in mutual fund and FII inflows, robust corporate earnings expectations and favourable economic indicators have contributed to the positive sentiment.

Let us now dive deeper into FII DII Data.

FII DII Positions Analysis

FIIs are still bullish

Both FIIs and DIIs were net buyers last week.

FIIs bought for ₹3843 Crores and DIIs bought for ₹5390 Crores in the cash market.

FIIs still hold long positions in both Stock and Index Derivatives. But they are not as bullish as they were a week back. They have trimmed down their longs in Derivatives.

DIIs are cautious

DIIs continue to hold significant hedges in Index Derivatives. DIIs continue to be cautious with the budget approaching.

Nifty Analysis

Nifty continues to be Bullish.

Both Price and Max Pain shot up last week.

If you look at the Monthly Max Pain trend of Nifty below,

you can see that Nifty has been bullish since June 20, 2024. Not once has it gone down in the Monthly Chart confirming bullish sentiment.

Stocks Coverage

I curated a list of stocks with significant Institutional Buying last week. This helps uncover where the big money is moving to.

Key Stock Announcements Last week

Note: All the news items below include only the core business activities.

New Orders & Projects:

Kalpataru Projects secures new orders worth INR 2,995 crore in T&D, Water, and B&F sectors.

HPL Electric & Power received INR 2101 crore order for smart meters supply.

Goldiam received INR 60 crore export orders for lab-grown diamond jewelry.

NBCC awarded INR 36.15 crore contract for setting up solar/electric water heating systems.

Solex Energy wins INR 16 crore work order for 5,220 solar street lights in Bihar.

GE Power wins INR 76.67M turbine spares contract from Mangalore Refinery.

L&T wins significant order for constructing two Fleet Support Ships.

Diamond Power received INR 899.75 crore order from Adani Energy Solutions. Diamond Power Infrastructure receives INR 409 crore order from Adani Green Energy.

RPP Infra wins orders for new district jails worth INR 310.93 crore.

RVNL receives acceptance from Nagpur Metro for constructing six elevated metro stations.

L&T secures mega orders for 3.5 GW solar plants in Middle East.

MAN Industries secures INR 1,850 crore offshore line pipe order.

Marine Electricals secures INR 50 crore order from DC Development.

Partnerships, Acquisitions & Investments:

Indegene and Microsoft collaborate to boost generative AI in life sciences.

IRCTC and DMRC collaborate for QR code ticketing under 'One India - One Ticket' initiative.

Greaves Finance partners with ACKO to facilitate seamless EV ownership.

Krishna Institute acquires Chalasani Hospitals for INR 75 crore in Vizag.

BLS International acquires iDATA, strengthening global visa services presence.

Dixon Technologies acquires 6.5% stake in Aditya Infotech Limited.

Apollo acquires shares in AHLL to support operations and expansion.

Business Operations:

Brigade Group launches Cobalt, 948 apartments, INR 400 crore potential revenue.

Zydus receives USFDA approval for Sacubitril and Valsartan Tablets.

Satin Creditcare raises EUR 15M to empower rural women entrepreneurs, expand operations.

Alembic Pharmaceuticals receives USFDA approval for Bromfenac Ophthalmic Solution.

Rama Steel Tubes expands capacity in Andhra Pradesh for growing demand.

HFCL establishes a UK subsidiary to expand global telecom product operations.

EaseMyTrip opens first franchise store in Ahmedabad, Gujarat.

Key Upcoming Events

Monday, July 15

India WPI Inflation Data

China GDP, Industrial Production Data

US FED Chief Jerome Powell Comments

Wednesday, July 17

Market Holiday (India)

Thursday, July 18

ECB Interest Rate Decision

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools