What happened last week?

Indian Markets continue to make record highs. Nifty closed at 24323 last week.

In July 2023 Nifty started a bull rally breaking the barrier of 18500. It has reached 24400 in July 2024—nearly 6000 points increase, equivalent to a 32% rise.

In the past year, Nifty has not experienced a drawdown of even 10%. The most significant drop occurred during the budget week, with a brief 8% decline.

This ranks among the top bull rallies in the yearly timeframe, if not the strongest.

Pharma and IT stocks were the top performers last week. At an industry level, Railways, Transformers and Defense Stocks did exceedingly well.

Most Global Markets were up last week.

Keir Starmer led the Labour Party to a staggering victory in the UK election, ending 14 years of Conservative Party rule. It clinched over 400 seats in the Parliament (326 for majority). Prime Minister Rishi Sunak promptly resigned.

Let us look at some India-specific developments.

Q1 FY25 Earnings season kickstarts this week with TCS results.

The market is already optimistic about it. TCS and Infosys have surged in the past week.

The HSBC India Manufacturing PMI came in at 58.3 in June 2024, up from May's 57.5. It indicates a sharper improvement in business conditions.

The HSBC India Services PMI came in at 60.5 in June 2024 up from from May's 60.2. This marked the 35th consecutive month of growth in services activity, supported by a faster rise in new orders and International Sales.

Let us now dive deeper into FII DII Data.

FII DII Positions Analysis

FIIs bought ₹6874 Cr and DIIs sold ₹385 Cr in the cash market.

Over the last 3 weeks, we have pointed out that FIIs are bullish.

They continue to be net buyers in the cash market.

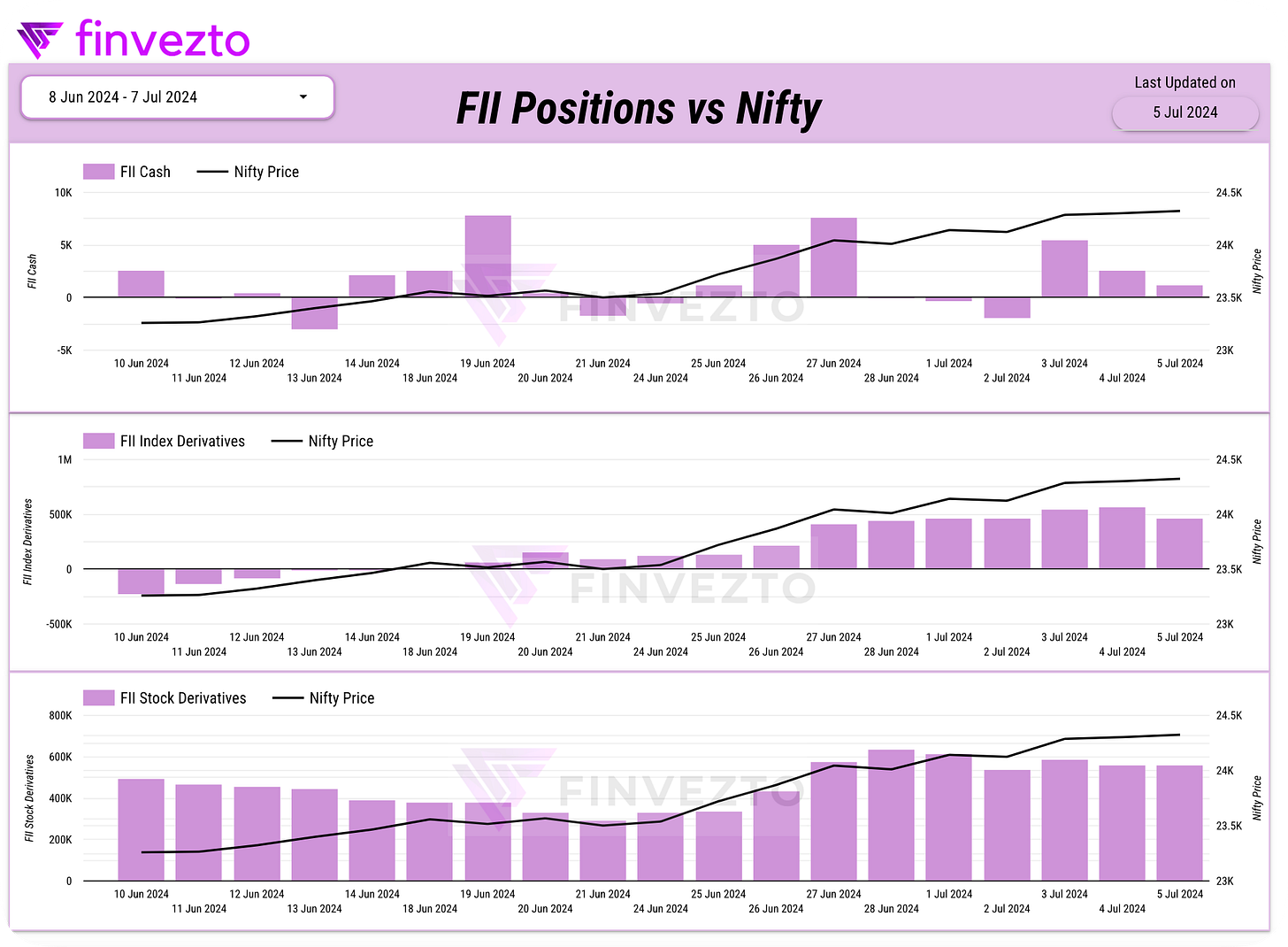

Below is the activity of FIIs across the cash market, Index Derivatives, and Stock Derivatives segments. FIIs continue to hold long positions in Index and Stock Derivatives.

Evidence suggests FIIs are still bullish. They have significant longs in Index Futures.

On the other hand, DIIs are heavily hedged. Their hedging levels are the highest in the last 1 year. Maybe they have already anticipated increased volatility before the budget. DIIs continue to be cautious.

Nifty Analysis

Both Price and Max Pain shot up last week. Nifty continues to be Bullish.

However, the Sentiment took a small dip on Friday. The first time Sentiment dropped after June 20.

So if you have been bullish over the last 2 weeks, it is good to book partial profits at this juncture.

Note: We will follow the direction of the black and blue line below. If both black and blue lines are moving upwards, then the market is bullish. If both the black and blue lines are moving downwards then the market is bearish.

Stocks Coverage

I have curated a list of stocks with significant Institutional Buying last week. This helps uncover where the big money is moving to.

Key Stock Announcements Last week

Note: All the news items below include only the core business activities.

New Orders & Projects:

DCX Systems received INR 1,250 crore contract from Larsen & Toubro.

Garden Reach Shipbuilders received USD 21 mn contract from Bangladesh.

Transformers and Rectifiers received INR 148.55 crore orders from NCC, Power Grid, Adani.

RITES received INR 26.79 crore order from Karnataka Mining Environment Restoration Corporation.

MIC Electronics received approval for Emergency Lighting System from Ministry of Railways.

KEC International secures new orders worth INR 1,017 crore in T&D and Renewables.

GE T&D India received EUR 64 mn order from Grid Solutions SAS, France.

Atmastco received INR 55 crore order from Megha Engineering.

ABB's PixelPaint chosen by Mahindra for premium EV paint options.

Mahindra Lifespaces chosen for Rs. 1800 crore redevelopment in Borivali West.

Ahluwalia Contracts secured INR 572 crore order from Airports Authority for Darbhanga Airport.

DCIL secures Rs 156.50 crore Cochin Port maintenance dredging contract.

Oriana Power received INR 151 crore order for a 25 MWp solar plant in Delhi.

Krsnaa Diagnostics received tender from BARC for Tele Reporting Services in Radiology.

NBCC received INR 36 crore order from NIT Patna for construction supervision.

RailTel received INR 23.96 crore order from Webel Technology.

Partnerships, Acquisitions & Investments:

EaseMyTrip signs MoU with UP EcoTourism Board to boost tourism.

Puravankara acquires 7-acre land in Hebbagodi, Bengaluru, with a GDV of INR 900 crore.

TCS signs five-year partnership with Sydney Marathon for USD 44.79 bn.

HealthCare Global acquires 51% stake in Vizag Hospital for INR 207 Crores.

Confidence Petroleum acquires 99.99% of Punjab Petroleum Corporation.

SEPC's subsidiary acquires 75% of ALMOAYYED Electrical for AED 1 million, turnover USD 10 mn.

Marico collaborates with Kaya to expand advanced personal care products.

Business Operations:

Manorama Industries’ new plant increases fractionation capacity to 40,000 TPA.

Alembic Pharma receives USFDA tentative approval for Bosutinib Tablets.

Godrej Properties to develop 11-acre land in Pune, revenue potential INR 1,800 crore.

Godrej Properties sells over 2,000 homes worth INR 3,150 crore in Bengaluru.

Brigade Group plans an 8-acre residential project worth INR 1100 crores.

Alembic Pharmaceuticals receives 11 USFDA product approvals during Q1 2024.

Paytm introduces Health Saathi plan for merchants starting at INR 35 monthly.

Optiemus launches drones for agriculture and mapping investing INR 140 crore.

Raymond demerges real estate business into new entity Raymond Realty Ltd.

Intellect launches AI-driven iGPX platform to revolutionize public procurement efficiency.

Key Upcoming Events

Monday, July 8:

US Consumer Inflation Expectations

Wednesday, July 10:

China Inflation Rate

Thursday, July 11:

Q1 FY25 Earnings Season Begins with TCS Results

US Inflation Rate MoM

US Initial Jobless Claims

Friday, July 12:

Q1 FY25 Earnings: HCL

India Inflation Rate

India Manufacturing Production

India Industrial Production

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: I am Anand Ganapathy K, a SEBI registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools