Weekly Market Analysis for Jul 29 - Aug 02, 2024

Nifty's Post-Budget Resilience: Overcoming Tax Hikes and Global Tech Slump, India's Market Rallies on Infrastructure Push and Strong DII Buying

What happened last week?

Nifty witnessed a fall during the first half of the week post Budget 2024.

Negative sentiment on Budget Day could be attributed to the hike in Long-Term Capital Gains Tax from 10% to 12.5% and increase in STT to 0.02%.

It made a low of 24074 on Budget Day but quickly recovered and shot up almost 800 points to close the week at 24834.

The bull run that started in May at around 22000 has sustained despite several challenges and volatility.

As pointed out in earlier weeks, the large and mega-cap stocks are witnessing Institutional buying.

DIIs who were cautious before the budget but bought significantly after the event was over. DIIs bought ₹8100 Cr last week in the cash market.

On the sectoral front,

Pharma, FMCG and IT continued their good run.

On the global front,

NASDAQ tanked 3% following disappointing results from Tesla and Google.

Let us look at some India-specific developments.

FM targets fiscal consolidation with a fiscal deficit of 4.9% this year and a 3.6% towards capex allocation. It signifies a continued focus on infrastructure investment.

Capital goods, defence, housing, FMCG, jewellery, and two-wheelers are expected to benefit from the government's focus on infrastructure and consumption.

Let us now dive deeper into FII DII Data.

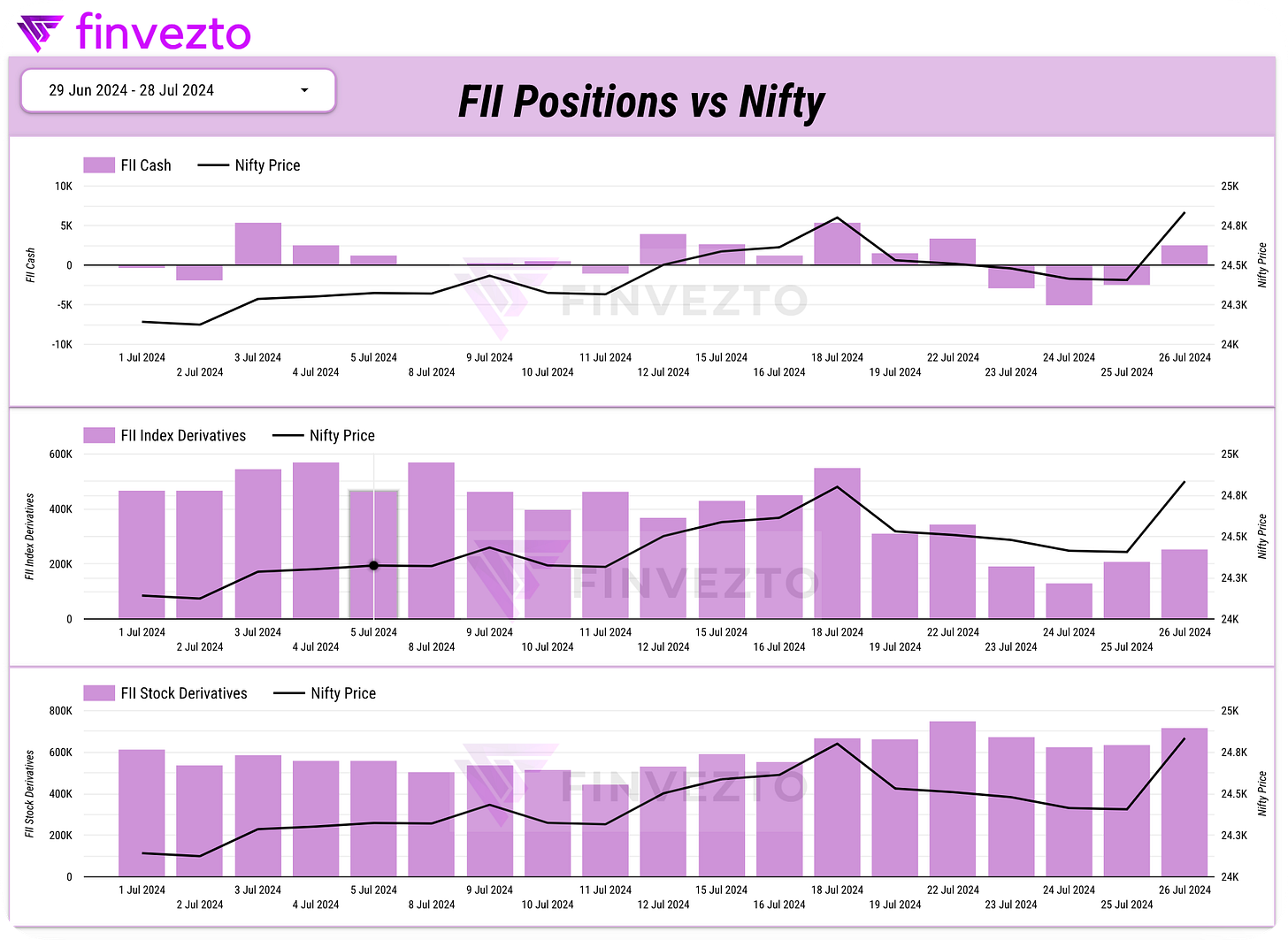

FII DII Positions Analysis

FIIs sold ₹4721 Cr and DIIs bought ₹8100 Cr in the cash market.

FIIs turned sellers last week post-budget. FIIs have also reduced their longs in Index Derivatives significantly.

However, FIIs continue to hold their longs in Stock Derivatives suggesting stock-specific activity.

DIIs have played it well. After being cautious for several weeks, they have bought on the budget day dip. They have also reduced their index hedges.

Overall, FIIs are less bullish and DIIs are bullish.

Nifty Analysis

Things were not going well for Nifty till thursday. But both momentum (price) and sentiment (max pain) turned bullish on Friday.

However, if you look at the Monthly Max Pain trend of Nifty below,

you can see that Max Pain (pink line) has not shot up significantly. So, positional traders are still not so aggressively bullish.

Overall, Nifty is in Bulls control.

Stocks Coverage

Pl find below the list of stocks with significant Institutional Buying last week. This helps uncover where the big money is moving to.

Key Stock Announcements Last week

Note: All the news items below include only the core business activities.

New Orders & Projects:

RITES secures INR 321.30 crore PMC contract for Amravati Medical College.

B.L. Kashyap secures INR 160 crore order from Suruchi Properties Pvt. Ltd.

DEE Development wins INR 41.4 crore order from John Cockerill, Belgium.

RVNL wins INR 191 crore order for South Eastern Railway project.

Bajel Projects wins INR 586.28 cr transmission line contract from PowerGrid.

Titagarh Rail Systems exports traction converters to Italy worth EUR 7.18 mn.

RailTel secures INR 186.81 crore order from Indian Railways.

SRM Contractors awarded NHAI project worth INR 118.53 crore.

Power Mech's Uttarakhand Pey Jal contract value at INR 593.99 crore.

Coal India wins its first graphite mining bid, diversifying into non-coal minerals.

Partnerships, Acquisitions & Investments:

Texmaco completes acquisition of Jindal Rail Infrastructure for INR 615 crore.

Emcure acquires 26% of Sunsure Solarpark for INR 8.65 crore.

CG Power acquires 55% Stake in G.G. Tronics for INR 319.38 crore.

Global Health Limited acquires land for new hospital in Mumbai.

Medanta acquires land in Mumbai for INR 125.11 crore hospital project.

Infosys commits EUR 5.0 mn investment in UVC Partners for AI and Deep Tech innovation.

Piramal Pharma to acquire 15.76% equity in renewable energy firm, Clean Max Aero Private Limited.

United Spirits to invest INR 7.29 crore in V9 Beverages (Sober) and Indie Brews.

Nidec signs MOU with Tata Elxsi for software development collaboration.

L&T Technology Services partners with SymphonyAI for AI business transformation.

Paytm partners with Axis Bank to provide POS solutions, EDC devices.

TCS and Rolls-Royce partner to research hydrogen fuel technology for aviation.

Business Operations:

Cupid Limited boosts online sales on major Indian platforms.

Alembic Pharmaceuticals received USFDA approval for Fluphenazine hydrochloride tablets.

Hindustan Zinc launches EcoZen, Asia’s first low carbon ‘Green’ zinc.

Zydus receives final approval from USFDA for Valsartan tablets.

Key Upcoming Events

July 30 (Tuesday):

IPO: Akums Drugs and Pharmaceuticals Opens

Euro Area GDP Growth Rate (Q2 Flash Data)

July 31 (Wednesday)

US Fed Meeting

August 1 (Thursday):

India Manufacturing PMI

August 2 (Friday):

India Foreign Exchange Reserves Data Release

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools