What happened last week?

Nifty closed last week at 23813.4, up 1% over the previous week.

Last week the volumes traded were 60% of the yearly average as it was a holiday week.

India VIX dropped 10% last week indicating reduced expectations of volatility.

We have come to the end of 2024 and this is how different asset classes performed. Mid Caps and Small Caps end up on top for the second consecutive year.

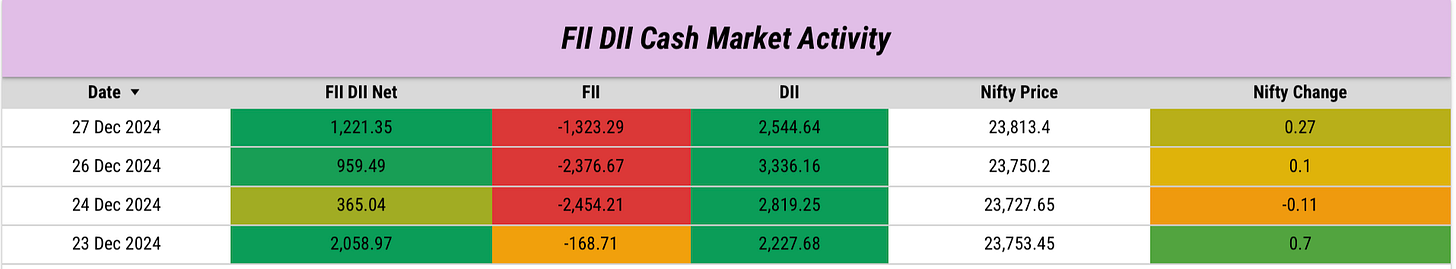

FIIs sold -6322 Cr and DIIs bought 10927 Crs last week.

In 2024, FIIs sold 2,85,181 Cr and DIIs bought a whopping 5 lac Crores.

FIIs have reduced their shorts throughout last week. But they are still net short.

FIIs are slowly starting to add longs in stock derivatives. Overall, FIIs are not as Bearish as they were the previous week.

Nifty Sentiment Analysis…

Weekly and Monthly Max Pain both remained mostly flat last week. The sentiment continues to remain neutral to Bearish.

Note: When the blue line and pink line below start moving up together, we will turn bullish. If they tread down together, we will stay Bearish.

Key Upcoming Events

December 30:

IPO Listing: Ventive Hospitality, Senores Pharmaceuticals, Carraro India

December 31:

IPO Listing: Unimech Aerospace and Manufacturing

January 3:

US Manufacturing PMI

Quick Recap of Last week

Please check out our daily market bytes for a quick recap of last week’s action and Key Stock Announcements.

At Finvezto Stock Research, we offer the following services.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.