Weekly Market Analysis for Aug 26-30, 2024

Nifty inches towards record highs propelled by DIIs; US FED chair signals rate cut; Positive Global Cues and much more...

What happened last week?

Nifty closed at 24823 up by 1.15% from last week.

It has closed higher than the open for the 3rd consecutive week propelled by DIIs. FIIs were also net buyers during the last 2 days of the week.

Markets have not closed above 24870 in the weekly chart. We can expect another leg of up move if that happens. 24870 is the key level to watch on the upside. 24300 is the level to watch on the downside.

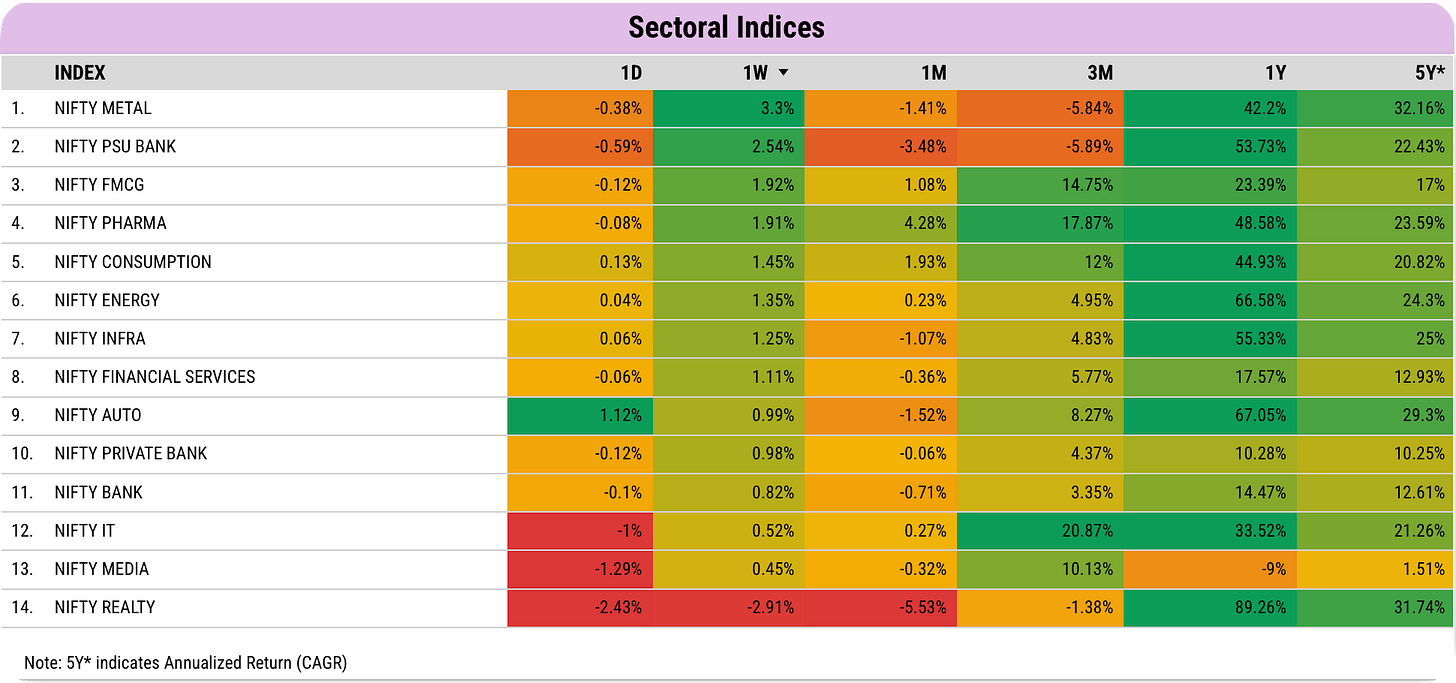

On the sectoral front…

Metals and PSU Banks continued their rebound from last week.

Consumption is a sector that FIIs are betting on.

Realty sank further.

On the global front…

most markets closed in green.

In his speech at the Jackson Hole Symposium, Jerome Powell signalled that the Federal Reserve is poised to cut interest rates soon. It was on expected lines. US markets closed in the green after the event.

Japanese markets make a remarkable comeback from the early August slump.

Global cues are positive. Gift Nifty closed above 24900.

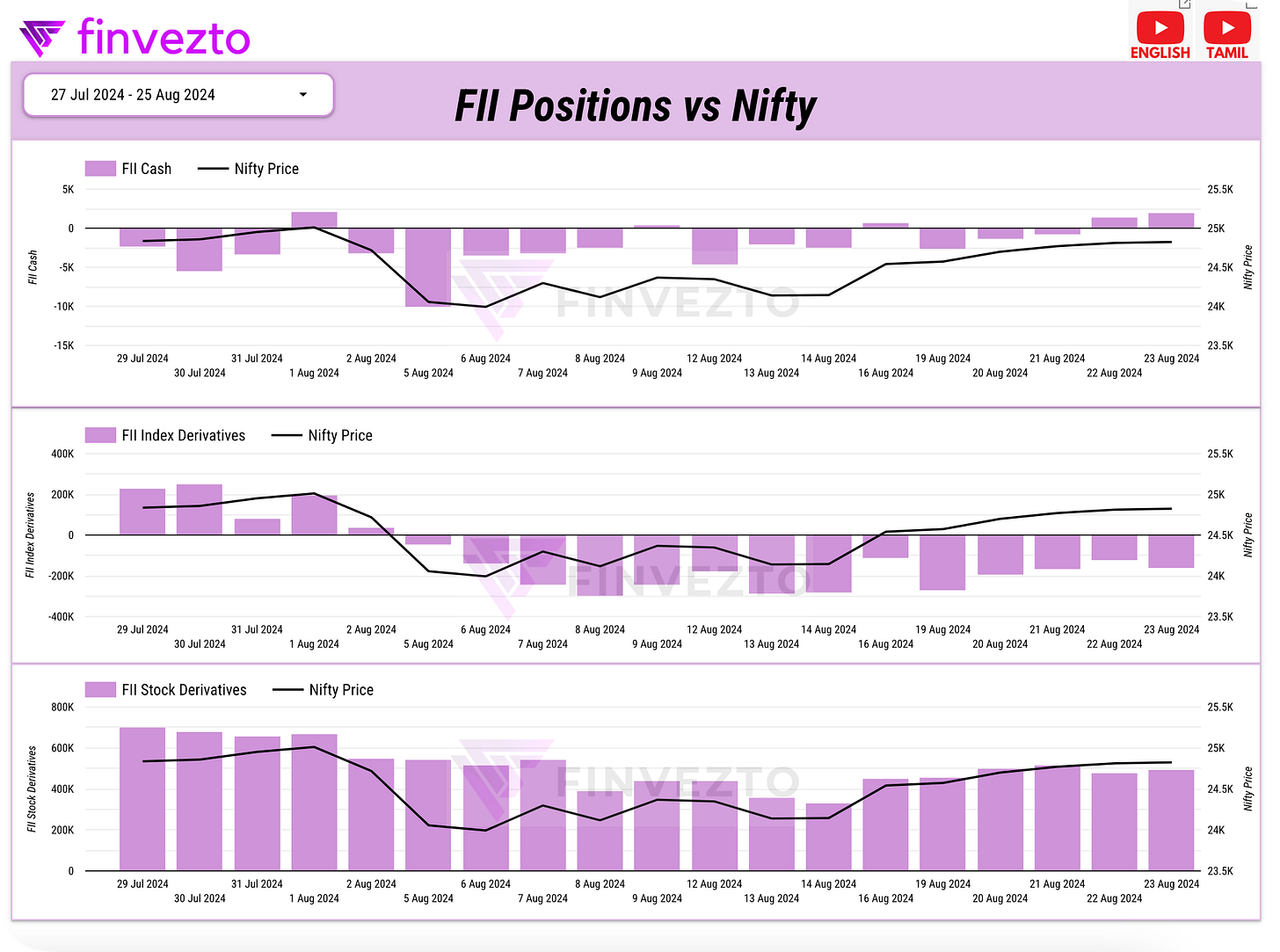

Let us now dive deeper into FII DII data.

FIIs sold ₹1620 Cr and DIIs bought ₹13020 Cr in the cash market.

FIIs continue to hold short positions on the Index. However, FIIs continue to hold their longs in Stock Derivatives suggesting stock-specific activity.

DIIs have increased their shorts on the Index significantly. This could be due to the uncertainty around the FED event. But we need to wait till Monday close to check if DIIs have hedged for the FED event or if they are anticipating something else.

Overall, FIIs are bullish on specific stocks and short on the Index. DIIs hold their highest shorts on the Index in recent times and seem to be cautious.

What is Nifty up to?

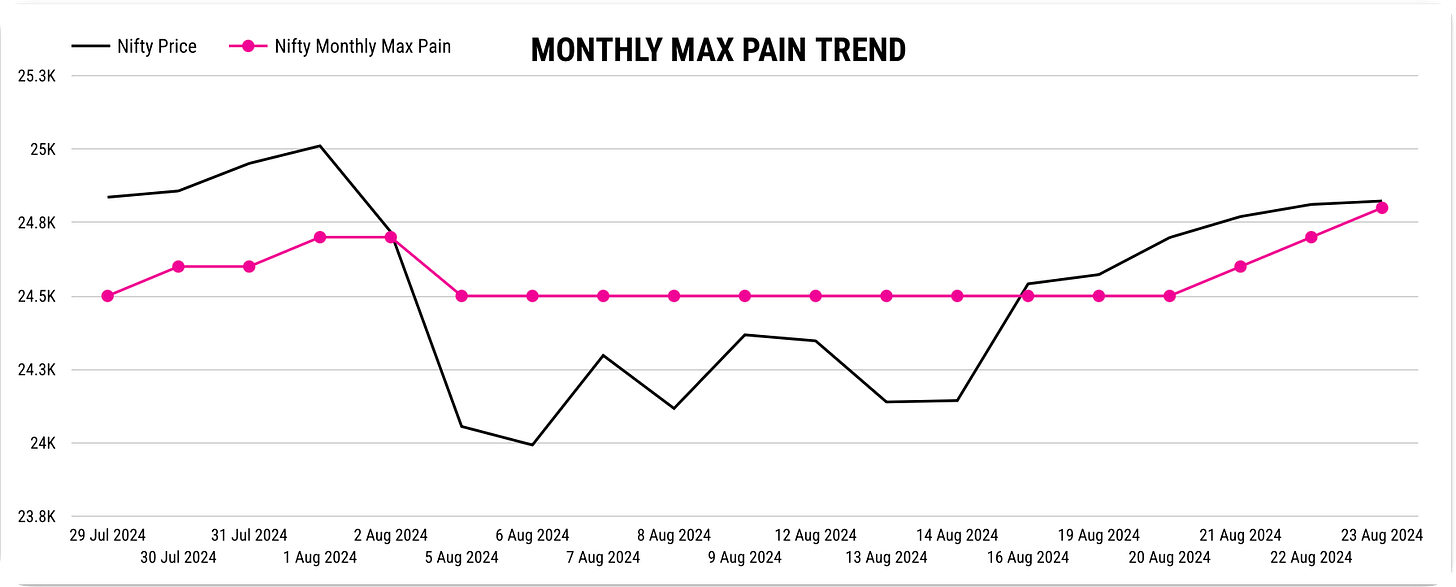

Both momentum (price) and sentiment (max pain) were bullish throughout last week. You should have been only on the long side of the trade last week. Nifty is bullish.

If you look at the Monthly Max Pain trend of Nifty below,

you can see that Max Pain (pink line) has shot up. Over the last 2 weeks, I have been pointing out that positional traders have not panicked despite Nifty falling below 24000. They were expecting a price rebound and it has happened. Not just that they have turned more bullish in the last 3 days.

Overall, Nifty is Bullish.

Let us look at some India-specific developments…

The Indian government has introduced a comprehensive roadmap aimed at reducing industrial waste, particularly focusing on non-ferrous metals. Some stocks that could benefit from this are Gravita, Eco Recycling, Baheti Recycling.

The HSBC India Composite PMI stood at 60.5 in Aug 2024. It was the 37th month of rise in private sector activity.

Key Stock Announcements

New Orders & Projects:

Transformers and Rectifiers received USD 16.80 mn export orders from two international clients.

RailTel secured INR 52.66 crore order for biometric surveillance services.

Bharat Electronics receives orders worth INR 695 crore; total orders at INR 5920 crore.

Vishnusurya Projects awarded INR 123 crore EPC contract for Palamu Pipeline.

Gensol bags INR 40 crore repeat order for rooftop solar project.

Hi-Tech Pipes secures INR 105 crore order from renewable energy sector.

Vinyas secures INR 49.22 crore orders from domestic and international customers.

AXISCADES’ Epcogen secures long-term contract with Highview Power for energy.

Digikore Studios secures USD 1.2 mn contract for U.S. OTT series.

Ishan International receives INR 60 crore order from Reliance Industries.

Genus Power wins INR 2,925.52 crore orders for smart metering infrastructure.

DCX Systems receives INR 107.08 crore order for electronic kits and harnesses.

Partnerships, Acquisitions & Investments:

Bharat Forge invests INR 105.45 crore in Kalyani Powertrain Limited (KPTL).

Prism Johnson Ltd invested INR 18.72 crore for 50% in Sunbath Sanitary.

PowerGrid acquires Sirohi Transmission Limited for INR 18.74 crore.

GAIL and Petron sign MoU to explore setting up a bio-ethylene plant in India.

Optiemus partners with Tejas Networks to boost telecom equipment manufacturing.

Thales and LTTS collaborate to enhance software monetization for customers.

BEML and SMH Rail partner to meet Global Rail & Metro demand.

Hindustan Zinc and JNCASR team up for advanced zinc batteries.

Greaves Finance partners with River Mobility for electric scooter financing.

PI Industries completes acquisition of Plant Health Care Plc.

Techno Electric collaborates with IndiGrid to develop greenfield transmission projects.

Adani Wilmar acquires 67% stake in Omkar Chemical Industries.

Business Operations:

Jain Irrigation pioneers tissue culture for coffee, signs MoU with Coffee Board.

Zen Technologies receives Indian patent for "TacSim®" Trigger Sensing System.

Paytm sells entertainment ticketing business to Zomato for INR 2,048 crore.

Awfis expands in Bengaluru, unveils 66,846 sq. ft. of premium workspace.

Sigachi Industries launches products for pharmaceutical coatings.

Optiemus Electronics enters telecom equipment manufacturing.

Granules India receives FDA approval for Glycopyrrolate Oral Solution ANDA.

RIR Power Electronics expands into new sectors, including railways and defence.

Zen Technologies announces Indian patent grant for innovative Mine Detection System.

Sona BLW Precision Forgings received PLI certification for Hub Wheel Motor.

Urja Global pre-launches high-speed electric scooter "CHETNA" with RTO compliance.

Key Upcoming Events

August 29 (Thursday):

Euro Area Consumer Confidence

US GDP Growth Rate

US Initial Jobless Claims Data

August 30 (Friday):

Euro Area Inflation Rate

India GDP Growth Rate

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools