Weekly Market Analysis for Aug 19-23, 2024

Nifty brushes aside the Adani-Hindenburg row; FIIs continue to sell; Global Markets rebound; Easing Inflation and much more...

What happened last week?

The week began with anxiety surrounding the Adani-SEBI Chief-Hindenburg case.

However, post the weekly expiry, Nifty shot up from 24100 to 24500 on Friday closing at 24541.

Although Nifty has dropped to 24100 levels multiple times, it has always closed above it in the weekly chart.

Nifty has closed above 24300 in the last 7 weeks. 24300/24100 will be a key level to watch.

A close below 24300/24100 on the downside might lead to further selling.

On the sectoral front…

IT and Realty rebounded. Consumption continued its uptrend.

On the global front…

most markets rebounded last week after the fall in the first week of August.

Japanese markets experienced a notable rebound last week after Bank of Japan’s reassuring statements. Nikkei was up by ~10%.

Let us now dive deeper into FII DII data.

FIIs sold ₹8616 Cr and DIIs bought ₹10560 Cr in the cash market.

FIIs continue to be net sellers post budget. They have sold almost ₹50000 Cr in less than a month.

FIIs continue to hold short positions on the Index. However, they have exited some of their shorts on Friday.

FIIs continue to hold their longs in Stock Derivatives suggesting stock-specific activity. They have increased their longs on Friday.

After being cautious for several weeks, DIIs gradually reduced their hedges last week. This indicates that they might continue to be buyers in the cash market.

Overall, FIIs are less bearish than they were last week and DIIs have turned less cautious. Props have also turned long last week.

What is Nifty up to?

Till Thursday Nifty was moving sideways. But both momentum (price) and sentiment (max pain) turned bullish on Friday.

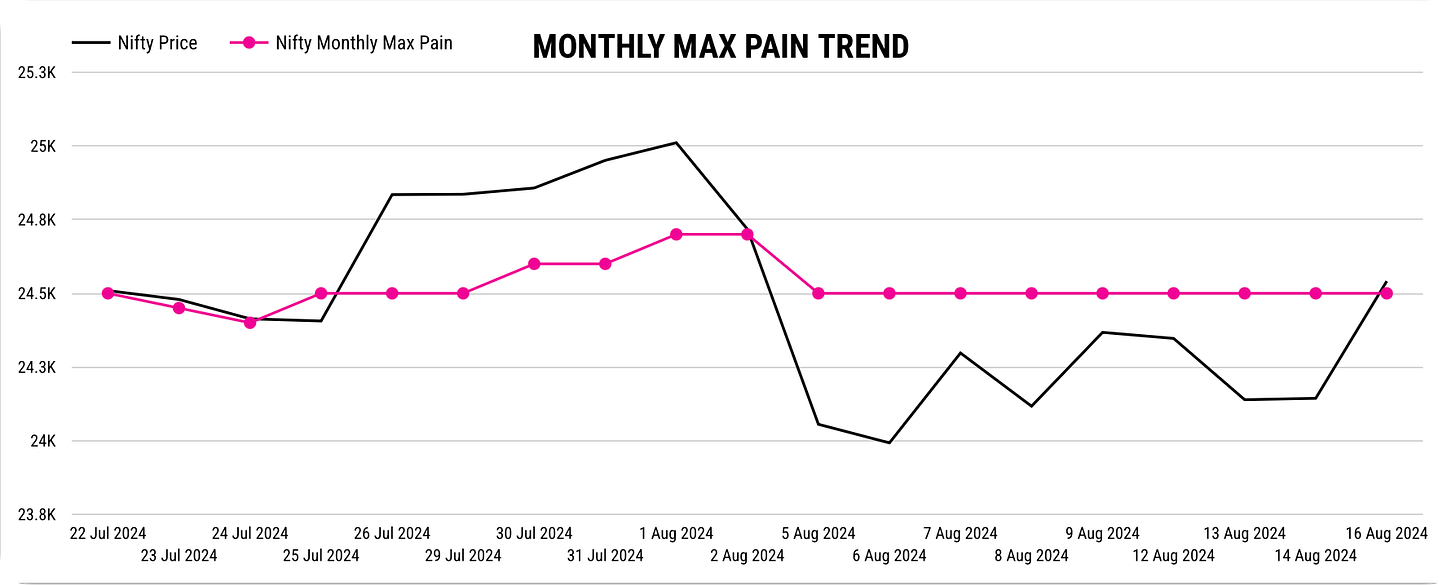

If you look at the Monthly Max Pain trend of Nifty below,

you can see that Max Pain (pink line) has remained stable over the past 2 weeks. So, positional traders have not panicked as price moved to 24100 levels. Price has also rightly come back to Max Pain level of 24500.

Overall, Nifty is not as bearish as it was in the previous weeks. GIFT Nifty has closed around 24640. It indicates a higher opening.

Let us look at some India-specific developments.

India's weight in MSCI Global Standard index hits record 19.8%, up from 19.2%. This might bring $3 billion in inflows to Indian equities. The change takes effect after August 30.

India's CPI Inflation dropped to 3.54% in July 2024 from 5.08% in June. This marks the lowest inflation since August 2019. The sharp decline is mainly due to base effects in food prices. RBI is anticipating higher inflation for the rest of the year.

India’s WPI Inflation increased by 2.04% year-on-year in July 2024, down from a 3.36% rise in the previous month.

India's industrial output grew 4.2% year-on-year marking a five-month low. Manufacturing, comprising 78% of industrial production, increased by 2.6%. Computer/Electronic products rose 10.7%, Electrical equipment surged 28.4%. However, tobacco products fell 10.9%, and pharmaceuticals declined 2.9%.

The Union Cabinet on August 16 approved three metro rail projects in the states of Karnataka and Maharashtra, with a total estimated cost of about Rs 30,765 crore.

India's passenger vehicle sales fell 1.9% year-on-year to 296,785 units in July 2024, according to SIAM data.

Stocks Coverage

Pl find below the list of stocks with significant Institutional Buying last week. This helps uncover where the big money is moving to.

Key Stock Announcements Last week

Note: All the news items below include only the core business activities.

New Orders & Projects:

NBCC awarded INR 15,000 crore Srinagar satellite township project.

Mazagon Dock awarded INR 4676 crore ONGC contract for platforms.

NBCC receives Rs. 719.97 crore work order for projects in Hyderabad, Jhansi.

PSP Projects secured INR 653.67 crore construction work order.

Paras Defence's associate received INR 305 crore order from L&T.

Kalahridhaan Trendz received INR 115.5 crore order from Beximcorp Textiles.

GE Power secures INR 47.27 crore order for 600MW boiler R&M.

SBC Exports receives USD 5.36 mn order from Dubai-based Gawgee Brothers.

Power and Instrumentation secured INR 28.41 crore JBVNL contract.

Australian Premium Solar received a INR 15.48 crore solar products order.

Partnerships, Acquisitions & Investments:

JSW Steel to acquire 66.67% interest in M Res NSW for USD 120 mn.

Oberoi Realty acquires Nirmal Lifestyle Realty for INR 273 crore.

Nykaa increases stake in Dot & Key to 90% for INR 265 crore.

Emami Limited increases stake in Cannis Lupus from 30% to 47.43%.

Kotak Mahindra Bank acquires 30 lakh ONDC shares, raising stake.

Amara Raja partners with Piaggio India for Li-ion cell development.

Zaggle partners with ONDC to issue prepaid payment instruments.

eMudhra completed acquisition of Sendrcrypt Technologies Inc.

Share India invests INR 18 crore for 15.59% stake in DSM Foods.

Mukka Proteins acquires 74% of Ento Proteins for INR 7 crore.

Business Operations:

Mahindra Logistics launches platform to reduce supply chain emissions.

Mahindra launches Thar ROXX, an advanced, powerful, luxurious SUV.

Amara Raja inaugurates battery plant, lays foundation for new facility.

Wipro integrates Google Cloud's Gemini AI to enhance cloud innovation.

Great Eastern Shipping delivers "Jag Pranam," updating fleet to 42 vessels.

TCS's OmniStore™ enables 100% in-store mobile checkout for Croma.

Shalby partners with Monogram for clinical trials of robotic surgery.

Coal India simplifies coal supply rules, boosting supply to power plants.

Karnataka Bank launches UPI credit line with Navi, enhancing digital credit.

Management Changes:

JTL Industries Limited appoints Amit Gaur as Chief Strategy Officer.

Vakrangee Limited announces Vedant Nandwana as MD and Ammeet Sabarwal as CEO.

Hindalco Industries Limited has appointed Mr. Bharat Goenka as CFO.

Key Upcoming Events

August 19 (Monday):

US Fed Official Mr. Waller Speech

August 20 (Tuesday):

China Interest Rate Decision

August 21 (Wednesday):

US FOMC Meeting Minutes

August 22 (Thursday):

India Flash PMI

US Jobless Claims Data

August 23 (Friday):

India Bank Deposit, Loan Growth

Japan Inflation Data

US Fed Chair Powell Speech

The rest of the information will be delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This weekly update highlights market trends and upcoming events for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Actionable Stock Market Ideas and Tools