Weekly Market Analysis for April 01 to 05, 2024

Nifty gives 28.3% return in FY24; FII Inflow in India and outflow in Japan; Auto sales Data and RBI Monetary policy decision to be released this week.

What happened last week?

Nifty ended the short week 1.3% higher. It made a weekly high of 22516 but closed at 22326.

FY24 (Apr 2023 - March 2024) has come to an end and Nifty delivered stellar returns of 28.3% in FY24.

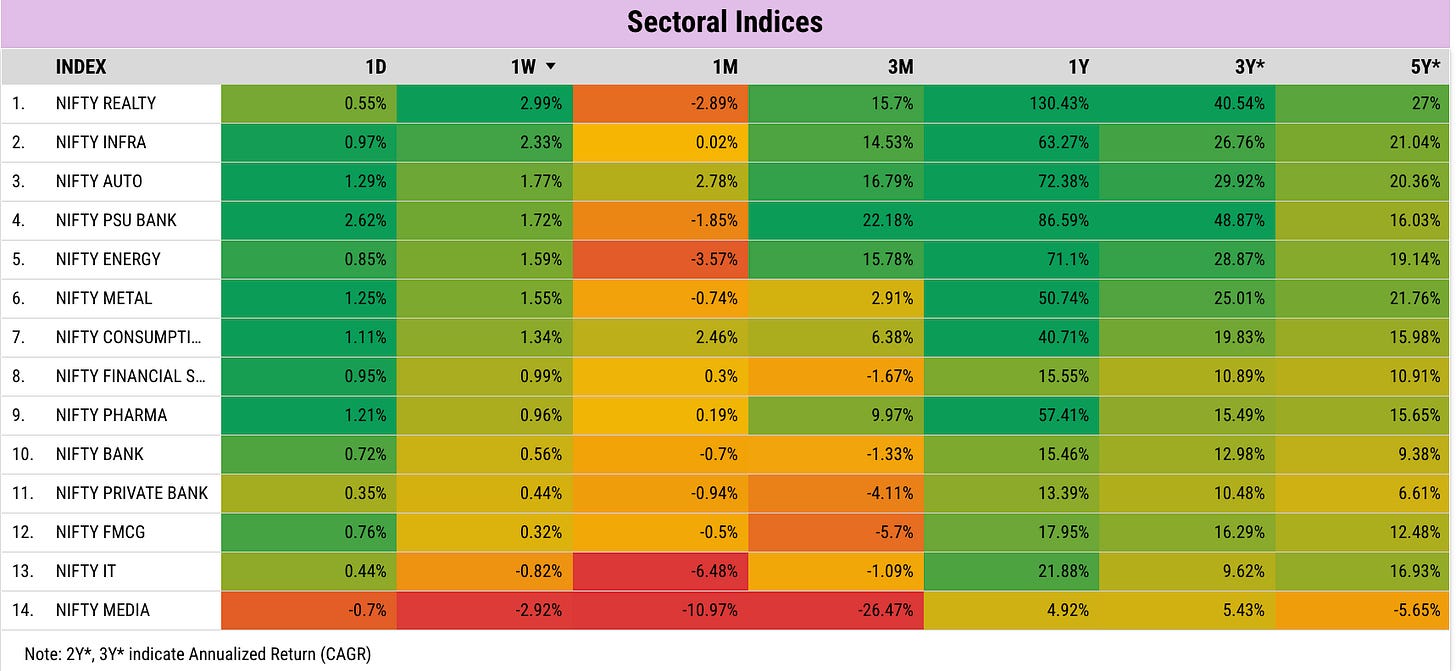

Realty and Auto were the top-performing sectors last week.

On the global front India and Europe were the top performers. While India saw Foreign Investor inflows in March, Japan witnessed foreign investor outflows.

The year ahead (FY25) has a lot of events lined up - Indian Elections 2024, the Union Budget by the newly elected Party, U.S Elections in November, FED Rate cuts etc.

NSE introduced T+0 settlement for 25 stocks including SBI, MRF, Hindalco, and Vedanta from March 28. T+0 settlement facilitates same-day transfer of securities and funds, enhancing market liquidity and reducing risk.

Auto Sales numbers for March to be released this week. Auto stocks have already shot up leading up to the data release.

RBI Monetary policy decision will also be released in the coming week.

Let us now dive deeper into FII DII Data.

FII Positions Analysis

Both FIIs and DIIs were net buyers last week. FIIs bought for ₹2368 Cr and the DIIs bought for ₹8913 Cr.

For several weeks, I have been pointing out that the DIIs have fewer hedges in place and they are likely to buy in the cash market at these levels.

FIIs have also been turning bullish steadily. They have actually cut down their short positions going into April Expiry.

FIIs significantly reduced their short positions in the Index Derivatives segment and increased their longs in the Stock Derivatives segment.

Overall both FIIs and DIIs are bullish.

Nifty & BankNifty Analysis

Nifty: Both Price (Momentum) and Max Pain (Sentiment) moved up last week suggesting bullishness.

Banknifty: Both Price and Max Pain inched up together suggesting bullishness.

Institutional Activity Last Week

Key Upcoming Events

Monday, April 1:

Auto Sales Data: Wholesale dispatch figures for March 2024 to be released.

China Manufacturing PMI Data

US Manufacturing PMI Data

Tuesday, April 2:

India Manufacturing PMI Data

Wednesday, April 3:

Bharti Hexacom's IPO Subscription opens.

SRM Contractors IPO listing.

Thursday, April 4:

India Services PMI Data

Friday, April 5:

RBI Interest Rate Decision

India Bank Loan, Deposit Growth Data

US Non-Farm Payrolls, Unemployment Rate Data

Key Stock Announcements Last week

All my notes on major stock announcements last week are arranged date-wise below. Please have a look at the respective note below to view all updates.

FINVEZTO.COM | Useful & Actionable Stock Market Tools