Weekly Market & Nifty Analysis for Dec 26-29, 2023

A steep fall on 20 Dec, continuous DII buying, a correction in Midcaps, India VIX shooting above 14, a flurry of IPOs and much more...

What happened last week?

After 7 weeks of positive closes in Nifty, we had a negative close last week. Nifty experienced a significant fall on 20th Dec falling by almost 300+ points in a single day (biggest fall in a single day this year). But it bounced back in the last 2 trading days to close at 21349.4.

Although there was a steep fall on 20 Dec, DIIs were net buyers on that day and they did not add hedges on that day suggesting that they will continue to be buyers in the cash market and support the markets.

FIIs sold ₹6422 Cr and DIIs bought ₹9093 Cr in the cash market last week. However, both FIIs and DIIs have remained net buyers in December with FIIs buying ₹23310 Cr and DIIs buying ₹12276 Cr. Together it adds up to a whopping ₹35587 Cr of Institutional buying in December so far. Both FIIs and DIIs were net buyers even in November.

Global Market performance was mixed last week. US markets were up on a weekly closing basis. Other markets were neutral to negative.

In India, Midcaps saw a significant correction last week with Nifty Midcap 50 Index falling by 1.47%.

India VIX went above 14 levels last week for the first time in 9 months. Participants are expecting higher volatility in the upcoming sessions.

We have reached the last trading week of this year. Looking back, it wasn’t a good start to 2023 as Nifty fell about 1300 points in Jan and Feb. But what happened in the last 9 months is beyond anyone’s expectation. It has shot up from the lows of 16800 in March to 21300 now. A 4500 point move (~27%).

At the start of the year, there were almost no IPOs. And look at the number of IPOs being filed now. A great turnaround!

In October 2023, India saw a significant surge in net foreign direct investment (FDI) to $5.9 billion, marking a 21-month peak.

India has been next only to Japan when it comes to Foreign Investments in 2023.

Let us now dive deeper into FII DII positions.

FII DII Analysis

FIIs were net sellers and DIIs were net buyers in the cash market last week as we saw earlier.

FIIs hold moderate short positions in Index Derivatives and significant long positions in Stock Derivatives. Their long positions in Stock Derivatives is the highest in the last couple of months.

DIIs have not increased their hedges significantly. In fact, on 20 Dec when the market fell, they reduced their hedges suggesting they will continue to buy in the cash market and provide support.

FII and DII positions suggest that both parties maintain a neutral to bullish standpoint.

Nifty Analysis

Let us look at the Open Interest for the coming week.

On Friday, more PUTs were added than CALLs at near-the-money strikes (21200, 21300 & 21400) indicating bullishness.

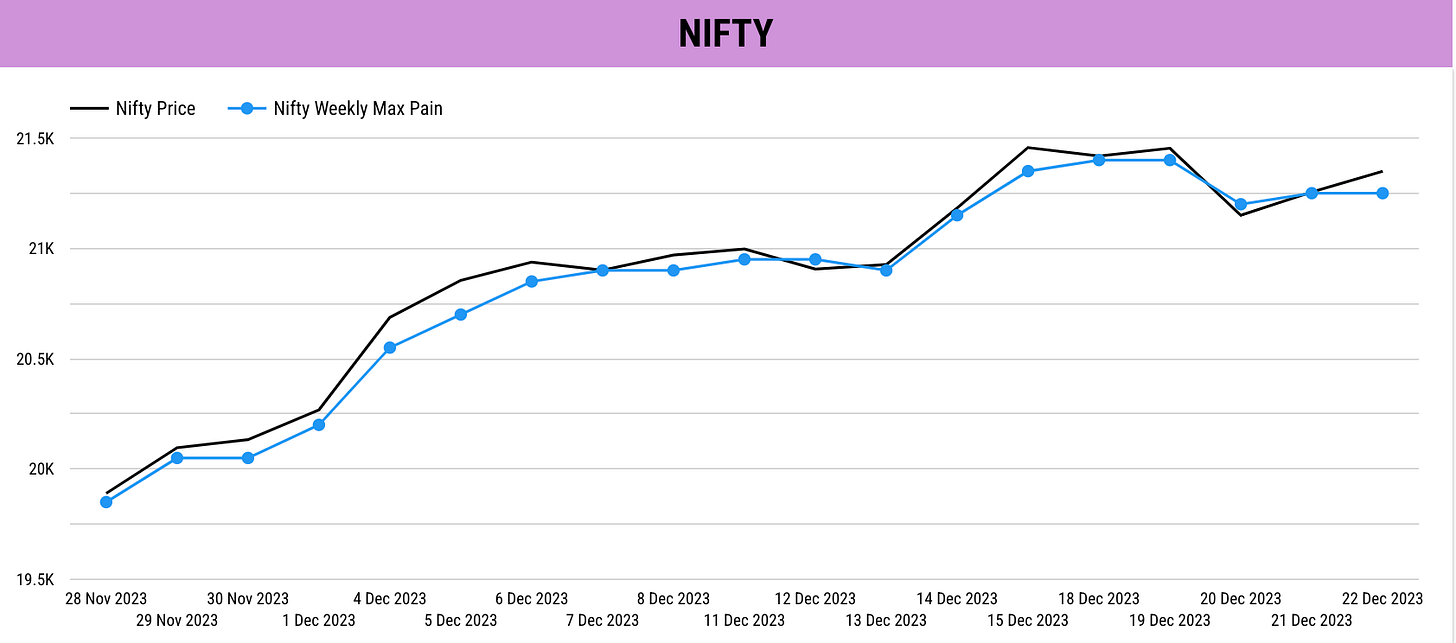

If you look at the Max Pain trend of Nifty, it took a dip on 20 Dec, but has remained stable at 21250 post that. This indicates that participants do not have a significantly bearish view on Nifty.

Verdict: Nifty price movement has been volatile last week. Bullish sentiment has slightly reduced on a weekly basis. However, participants have still not loaded up on short positions. We need to wait for more evidence next week to take sides.

Key Upcoming Events

December 25 (Monday)

Market Holiday on account of Christmas

December 29 (Friday)

India Fiscal Deficit November Data Release

India Current Account Deficit Q3 Data Release

India Bank Loan Growth Data Release

India Infrastructure Output Data Release

Key Stock Announcements from Last Week

New Orders, Contracts & Projects

Tata Power: Signed a contract to supply 152 MWp DCR solar PV modules for NTPC’s Nokh solar PV project in Rajasthan valued at approximately ₹418 crore.

Mazagon Dock Shipbuilders: Signed individual shipbuilding contracts for constructing three units of 7,500 DWT multi-purpose hybrid-powered vessels with an approximate value of $42 million.

PNC Infratech: Declared the first lowest bidder for a highway project in Madhya Pradesh; to construct Western Bhopal Bypass as a 4-lane road.

IRB Infrastructure Trust: Secured NHAI’s Letter of Award for TOT-13, encompassing Gwalior-Jhansi and Kota Bypass projects, valuing ₹1,683 Cr.

We Win Limited: Secured a 4-year contract (extendable by 2 years) worth ₹110.61 Cr from UPDESCO for operating the Chief Minister Helpline in Uttar Pradesh.

Marine Electricals (India) Limited: Received orders worth ₹21.90 crores: supply contracts from Larsen & Toubro for shipbuilding, Material Organisation for spares, and Data Center Holdings for installation and commissioning.

NBCC (India) Limited: Secured a construction and renovation contract worth ₹150 crores from SAIL DSP, Durgapur, for a project management consultancy over 3 years.

NBCC: Also secured a ₹29.70 crore contract for building a Composite Regional Centre in Samba, Jammu, from Pt. Deendayal Upadhyaya National Institute.

Oriana Power Limited: Clinched a ₹13.64 Crores contract for a 2.75 MWp Floating Solar Power Plant in Udaipur, Rajasthan, from a domestic cement industry, slated for completion in 2023-24.

RVNL: Emerged as the lowest bidder for the Varkala Sivagiri Railway station upgrade project in Kerala, valued at ₹123.26 crore with a 30-month project duration.

Deepak Nitrite: Subsidiary, Deepak Phenolics, approved a 15-year binding term sheet with Petronet LNG for purchasing 250 KTPA of Propylene and 11 KTPA of Hydrogen from Gujarat’s Petronet Petrochemical Project.

Transformers and Rectifiers (India) Limited: Clinched a ₹118 Crores contract from Uttar Pradesh Power Transmission Corp. to supply 5 transformers within 20 months. It also secured a ₹237 Crores contract from Power Grid Corporation to supply reactors for substations within 15 months.

Sanghvi Movers: Received a substantial ₹166 Crores contract from a renewable energy Independent Power Producer for 300 MW capacity addition, spanning 24 months in various wind-related services.

Transformers and Rectifiers (India) Limited: Obtained a contract worth ₹219 Crores from Power Grid for various reactors. This is the third set of orders reported in 2 days by TRIL.

Texmaco Rail & Engineering Ltd.: Secured a Ministry of Railways order for 3,400 BOXNS wagons worth ₹1374.41 crores. Tranches of 1133 wagons to be delivered by 2025.

Mazagon Dock Shipbuilders: Secured a significant contract worth ₹1,600 crore with the Ministry of Defence for the construction and delivery of six next-generation offshore patrol vessels (NGOPVs) for the Indian Coast Guard.

Cochin Shipyard: Secured a contract worth ₹488.25 crore with the Ministry of Defence (MoD) for repair and maintenance work on naval vessels, expected to be completed by Q1 FY25.

Praveg: Received a work order for the development, operation, maintenance, and management of at least 50 tents at Agatti Island, Union Territory of Lakshwadeep, expanding its resort properties.

Ashok Leyland: Secures a milestone order of 552 Ultra-Low Entry Diesel Non-AC buses from Tamil Nadu State Transport Corporation (TNSTC), valued at ₹500.97 Cr. The buses, featuring advanced technology, will support TNSTC’s “Mobility for All” initiative. Delivery is set between April to July 2024.

KPI Green Energy Ltd.: Received a substantial order of 193.2 MW, comprising 92 wind turbines for Suzlon. The project, in Bharuch district, involves three subsidiaries, marking a leap towards their green energy goals.

RailTel Corp: Received a ₹66.83 Crore order from N F Railway Construction for Tunnel Communication Systems & Station Arrangements in Lumding Division’s Bhairabi-Sairang section.

Marine Electricals (India) Ltd.: Discloses orders totalling ₹27.97 crores from Hooghly Cochin Shipyard Ltd., Garden Reach Shipbuilders & Engineers Ltd., and Deepak Chem Tech Ltd. for electrical packages and spares, spanning deliveries over 5 to 10 months.

Partnerships & Acquisitions

Landmark Cars: Received a Letter of Intent from MG Motor India for opening a dealership in Ahmedabad, Gujarat, and approval from Mercedes-Benz India for opening a workshop in Hyderabad.

GMR Airports Infrastructure: Investing ₹675 crore in the Bhogapuram airport project in Andhra Pradesh with NIIF.

Zomato: Denies media reports on acquiring Shiprocket for $2 billion, cautioning investors against inaccurate information. Zomato plans to focus on existing ventures without acquisitions.

Bharti Airtel: Strategic partnership with IntelliSmart aims to empower 20 million smart meters, facilitating advanced metering infrastructure and cloud-based analytics. This aligns with India’s aim to digitize 250 million conventional meters.

Coforge: Partners with Microsoft’s Generative AI to empower enterprises, offering comprehensive solutions for innovation, decision-making, and ethical AI applications, fostering transformative outcomes in business operations.

UltraTech Cement: Entered into a Share Subscription and Shareholders Agreement to acquire 26% equity shares of Clean Max Terra for ₹20.25 crore to fulfill its green energy requirements.

Mankind Pharma: Made an investment of 999,900 pounds in Actimed Therapeutics for an additional stake in the treatment of muscle-wasting disorders.

Devyani International: Announced entry into Thai QSR and LSR markets by acquiring controlling interest in Restaurants Development Co., Ltd., which operates 274 KFC restaurants.

Sun Pharmaceutical Industries: To Acquire 16.7% shares in Lyndra Therapeutics Inc. for $30 million, a company focusing on novel long-acting oral therapies.

Grasim Industries: In advanced negotiations with Nebras Power for a proposed 51:49 JV, expecting a $400 million investment in its renewable energy business.

Varun Beverages: Approved the acquisition of Beverage Company, South Africa (Bevco) for Rs 1320 crore and signed an MoU with the Jharkhand government for a plant in Pataru with an outlay of Rs 450 crore.

CONCOR: Signed an MoU with DB Schenker India to collaborate on EXIM and domestic business, focusing on sustainable supply chain practices in the logistics industry.

Business Operations

Zydus Lifesciences: Received permission from the USFDA to initiate a Phase II clinical study of the NLRP3 inhibitor ZYIL1 in patients with Parkinson’s disease and received final approval to manufacture and market Lacosamide tablets.

Lupin: Received approval from the US FDA for its Allopurinol tablets and plans to manufacture them in India.

Insecticides India: Granted a patent for an invention entitled A Novel Isoxazole Compound or a Salt Thereof for 20 years with effect from November 29, 2018, by The Patent Office, Government of India.

Welspun Corp: Subsidiary Sintex BAPL finalized an investment of up to Rs 807 crore to set up a manufacturing unit in Telangana for plastic pipes, water storage tanks, and sandwich-moulded tanks.

Biocon: Biocon Biologics completed the transition of acquired biosimilars business in 120+ countries ahead of schedule, including emerging markets and Japan, Australia, and New Zealand.

DCW: Suspended operations at Sahupuram plant due to flooding; expects gradual scale-up after water levels normalize in approximately 7 days.

Bharat Petroleum Corporation: Received board approval for setting up a polypropylene (PP) unit at Kochi Refinery with a gross project cost of Rs 5,044 crore.

Lupin: Launching Softovac Liquifibre, a new Ayurvedic liquid laxative in India.

MOIL: Reported a significant increase in production, crossing 16 lakh metric tonnes.

ADF Foods: Invested ₹5 crore in subsidiary Telluric Foods India for e-commerce business working capital.

KIOCL: Resumed operations at its pellet plant unit in Mangalore on December 19 after temporary suspension due to the unavailability of iron-ore fines.

Allcargo Logistics: Reported marginal decline in LCL volume for November 2023 compared to November 2022, reflecting subdued demand across key global geographies.

AstraZeneca Pharma India: Obtained import and market permission for Enhertu, a treatment for unresectable or metastatic HER2-positive breast cancer, set to launch in January 2024 in India.

Management Changes

Tech Mahindra: Witnessed Mohit Joshi taking over as Managing Director and CEO while CP Gurnani’s term ended on December 19.

BSE: Received SEBI’s approval for the appointment of Pramod Agrawal as the Chairman of the Governing Board starting from January 17, 2024, succeeding S. S. Mundra.

ICICI Bank: Received approval from the Reserve Bank of India for the re-appointment of Sandeep Batra as Executive Director from December 23, 2023, to December 22, 2025.

Bata India: Pankaj Gupta, Head of Retail and Franchisee Operations, to resign, with Badri Beriwal set to take charge.

Suven Pharmaceuticals: Appointed Himanshu Agarwal as CFO, replacing Subba Rao Parupalli.

Key Buying and Selling Deals

J Kumar Infraprojects: Abakkus, owned by ace investor Sunil Singhania, bought an additional 1.32% stake in the construction engineering company via open market transactions.

PVR INOX: Plenty Private Equity sold 762,499 shares at ₹1,753 per share, totalling ₹133.67 Cr; Plenty Private Equity sold 1,076,258 shares at ₹1,753 per share, totalling ₹188.67 Cr; Norges Bank bought 666,183 shares at ₹1,753 per share, amounting to ₹116.78 Cr.

Sterling and Wilson Renewable Energy: Plutus Wealth Management bought 2,500,000 shares at ₹426 per share, totalling ₹102.5 Cr; Shapoorji Pallonji & Company sold 3,914,279 shares at ₹426 per share, totalling ₹162.62 Cr.

Pricol Limited: Franklin Templeton Mutual Fund bought ₹50 Cr; Phi Capital Solutions LLP sold ₹50 Cr.

Archean Chemical Ind Ltd: India Resurgence Fund - Scheme 2 sold ₹115 Cr; Piramal Natural Resources Private Limited sold ₹68 Cr; Tata AIA Life Insurance Company Limited bought ₹84 Cr; Goldman Sachs FDS Goldman Sachs India EQ Portfolio bought ₹37 Cr; DSP Mutual Fund bought ₹60 Cr.

Apollo Tyres: White Iris Investment sold a 4.5% stake (2,85,79,542 equity shares) and Nippon India Mutual Fund acquired a 1.9% stake (1,20,44,000 equity shares) at Rs 448.35 per share.

Jindal Saw: Cresta Fund offloaded 20 lakh equity shares (0.6% stake) at Rs 429.1 per share.

KFin Technologies: Foreign promoter General Atlantic Singapore Fund Pte Ltd sold equity shares in KFin, while several entities including ICICI Prudential and Societe Generale bought shares.

Ajmera Realty & Infra India: Quest Investment Advisors bought 5,01,443 equity shares (1.4% stake), and Fahrenheit Fun and Games sold 7 lakh shares at Rs 425 per share.

Landmark Cars: Bajaj Finance sold 3.2 lakh shares in the luxury car retailer at ₹805.58 per share, amounting to ₹25.77 crore.

Shriram Pistons & Rings: Witnessed significant share transactions where Abakkus Growth Fund-1, Abakkus Emerging Opportunities Fund-1, and others purchased shares worth ₹326 Crores, while K S Kolbenschmidt GMBH sold 39 lakh equity shares in the company at ₹1,103.6 per share.

Ami Organics: Multiple buyers purchased varying quantities at ₹1030, totaling ₹300+ Crores; sellers include Dhwani Girishkumar and ICICI Prudential Mutual Fund.

GMR Power & Urban: ASN Investments sold 5,000,000 shares at ₹52.75, totaling ₹26.38 Cr.

Fund Raising and IPOs

IREDA: Its board approved raising unsecured bonds worth Rs 500 crore with a green shoe option of up to Rs 1500 crore as part of a Rs 26,000 crore borrowing program for 23–24.

Satin Creditcare Network: Completed its qualified institutional placement (QIP), raising ₹250 crore through the allotment of equity shares to institutional buyers.

Allcargo Gati: The board approved raising funds up to ₹500 crore for expansion, capex, and working capital.

Corporate Actions

Nestle India: Set January 5, 2024, as the record date for the split of existing equity shares. Each share of ₹10 face value will be split into 10 shares of ₹1 each.

Vedanta: Approved a second interim dividend of ₹11 per equity share for FY 2023–24, totalling ₹4,089 crore, with the record date set for December 27.

Regulatory & Legal

Persistent Systems: The subsidiary of Persistent Systems faced a penalty from the Vermont State Department of Taxes for a tax payment shortfall for FY21–22.

Granules India: The US FDA completed a GMP inspection of its subsidiary’s facility in Virginia, USA, with five observations.

Medplus Health Services: Subsidiary faced a five-day suspension of drug licenses from the Drugs and Control Authority due to violations.

FINVEZTO.COM | Useful & Actionable Stock Market Tools