Weekly Market Analysis for Feb 26 - March 01, 2024

Nifty at all-time highs; US tech stocks skyrocket; 100% FDI in space sector and much more...

What happened last week?

Nifty increased by ~1% last week with volatile price movement. It made a new all-time high of 22297 driven by DII buying. It also closed the week higher at 22212.

Realty and FMCG were the top-performing sectors last week.

Most Global Markets closed in green last week. Japanese equities continue to scale new all-time highs.

Good Earnings reports from US tech stocks (particularly NVIDIA) bolstered market sentiment.

FED meeting minutes was released last week. It highlighted that the policymakers were concerned about the risks of cutting interest rates too soon.

Let us look at some local developments.

The Indian government has allowed 100% Foreign Direct Investment (FDI) for the space sector. The decision led to a surge in space-related stocks, with companies such as MTAR Technologies, Apollo Micro Systems, Paras Defence and Space Technologies, Data Patterns (India), Bharat Electronics, Centum Electronics, and Zen Technologies shooting up.

Q3 FY24 Results season is coming to an end. Overall a good season with around 9% growth in Revenue YoY and 19% growth in Net Profit YoY.

India's gross domestic product (GDP) data for the third quarter will be released on February 29, 2024.

Auto stocks will be in focus as auto companies will announce their monthly auto sales numbers for February on March 1, 2024.

We have a busy IPO market ahead with 6 new IPO issues and 5 listings for the upcoming week. Typical when the market is at all-time highs.

Let us now dive deeper into FII DII positions.

FII Positions Analysis

FIIs sold ₹1939 Cr in the cash market and DIIs bought ₹3532 Cr in the cash market.

We have been pointing out over the last 3 weeks that DIIs have minimal hedges and they are likely to buy in the cash market. However, this week they have slightly increased their hedges and have become relatively cautious.

FIIs have also added shorts on the Index on Friday. They continue to be Bearish.

Overall, FIIs continue to be Bearish. DIIs have turned slightly cautious.

Nifty & BankNifty Analysis

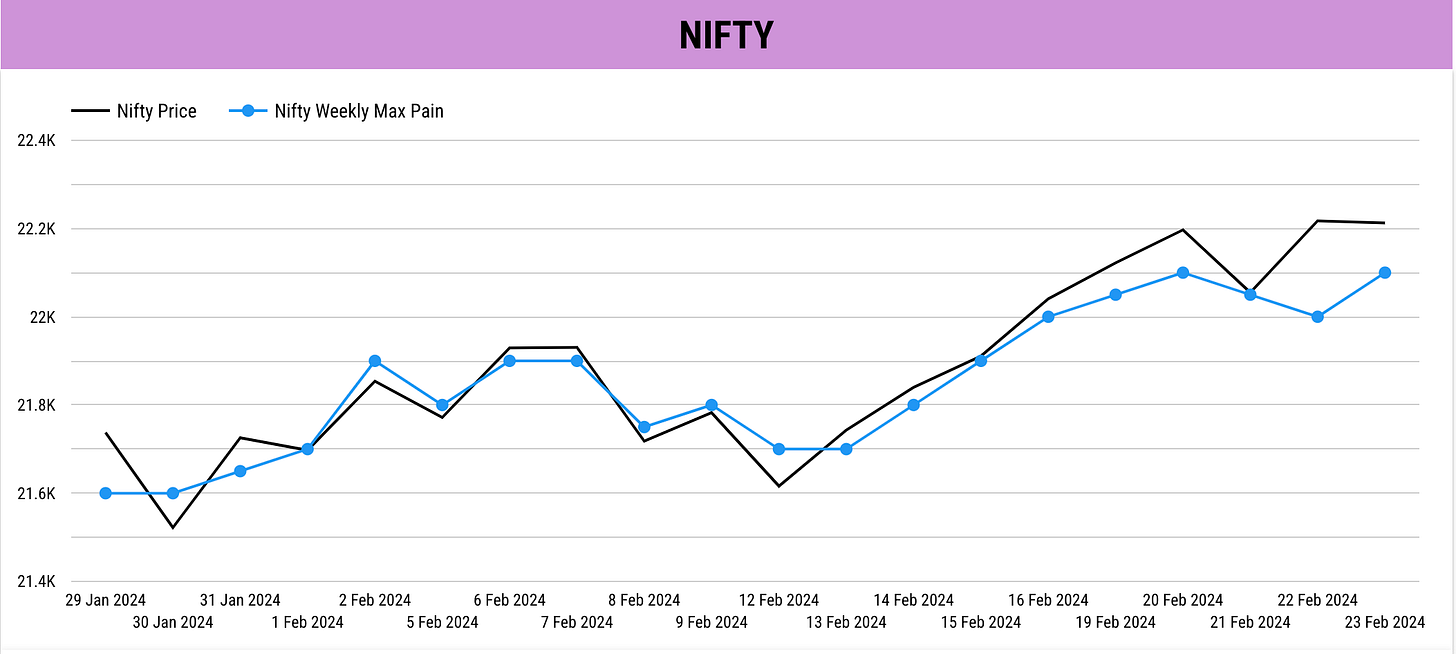

Nifty: Both Price (Momentum) and Max Pain (Sentiment) moved up last week. However, max pain has not moved up as much as the price has shot up. This indicates that participants are cautious. Till we get further evidence we will stay bullish. But a wise thing to do would be to wind down partial long positions if any and book some profits.

BankNifty: Both Price (Momentum) and Max Pain (Sentiment) moved up last week suggesting bullishness.

Key Upcoming Events

February 27 (Tuesday)

Platinum Industries IPO issue opens.

Exicom Tele-Systems IPO issue opens.

February 28 (Wednesday)

US GDP Growth Rate Data

Eurozone Economic Sentiment Data

February 29 (Thursday)

India GDP Growth Rate Data

India Fiscal Deficit Data

Key Stock Announcements last week

All my notes on major stock announcements last week are arranged date-wise below. Please click on the respective note below to view all updates.

FINVEZTO.COM | Useful & Actionable Stock Market Tools