Weekly Market Analysis for March 26-29, 2024

Nifty ended 0.33% up on a volatile week; FED announces possible 3 rate cuts in 2024; Japan soars; Election Dates announced and much more...

What happened last week?

Nifty increased by 0.33% last week. Although it reached a low of 21710 Intra-Week, it managed to close above 22000 supported by DIIs. Nifty has been closing above 22000 for 6 straight weeks now.

On the sectoral front, Realty, Auto and Metal were the top performers. IT sector tanked 6%.

U.S. market rallied to record highs following indications from the Federal Reserve (FED) that it expected to cut interest rates three times this year. The FED also increased their projections for US GDP growth from 1.4% to 2.1%.

The Japanese Nikkei 225 Index rose 5.6% continuing to make record highs. The Bank of Japan raised (BOJ) its key interest rate from -0.1% to a range of 0%-0.1%, marking the first increase in borrowing costs in 17 years. The BOJ's move signifies a departure from negative interest rate policies.

The Election Commission of India has announced the schedule for the 2024 Lok Sabha elections, with voting set to commence on April 19 and results declared on June 4. If you are planning to use options strategies to reduce volatility or hedge your portfolio, you might want to build strategies in June Expiry and not May. Also, June expiry options are more liquid right now.

India Flash Purchasing Managers' Index (PMI) surged to 59.2 in March from 56.9 in February suggesting improving business conditions in India.

Let us now dive deeper into FII DII Data.

FII Positions Analysis

FIIs sold 8365 Crores and DIIs bought 19351 Crores in the cash market.

DII’s hedging positions suggest that they will continue to be buyers in the cash market.

FIIs continue to hold short positions on the Index. But they have piled up long positions in Stock Derivatives. We might see some stock-specific moves in F&O.

Nifty & BankNifty Analysis

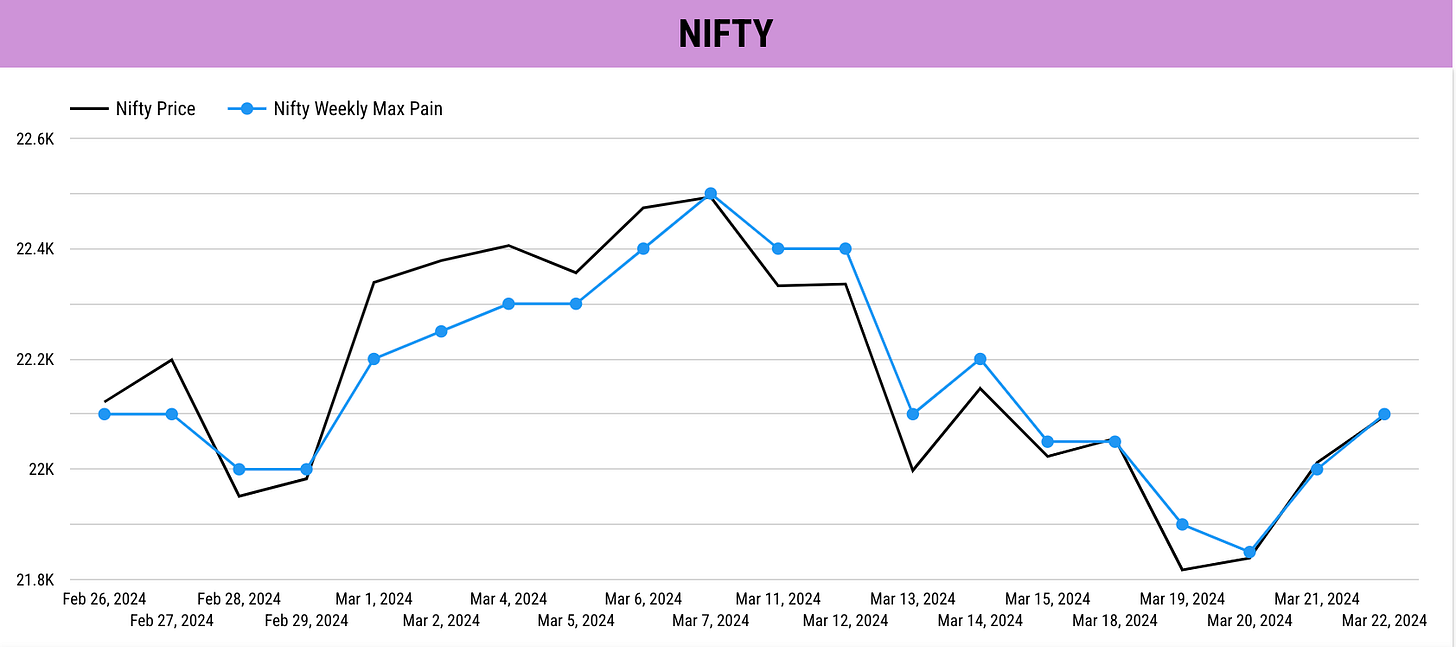

Nifty: Price and Max Pain went down below 22000 in the first half of the week. But, on a closing basis, both price and max pain closed above 22000. Nifty ended the week on a bullish note.

BankNifty: After a continuous fall in price and max pain for several days, both price and max pain have shot up in the last 2 days. If price and max pain go up together we will be bullish. If price and max pain go down together, we will turn bearish. Based on the evidence, we keep changing our view.

Institutional Activity Last Week

Key Upcoming Events

Monday (March 25)

Bank of Japan Policy Meeting Minutes

Tuesday (March 26)

SRM Contractors IPO Subscription opens.

Wednesday (March 27)

Euro Area Consumer Confidence Data

Thursday (March 28)

UK GDP Growth Rate

US Initial Jobless Claims Data

Friday (March 29)

India Foreign Exchange Reserves Data

Key Stock Announcements Last week

All my notes on major stock announcements last week are arranged date-wise below. Please have a look at the respective note below to view all updates.

FINVEZTO.COM | Useful & Actionable Stock Market Tools

Thank you very much bro.