What happened last week?

Nifty was up by 0.2% and closed at 23501 and traded within a narrow range.

Midcaps continued their good run.

Banks & Financial Services were up 3-4%.

At the Global level, US & India were the top performers.

Let us look at some India Specific Developments.

India Services June Flash PMI rose slightly to 60.4 from 60.2 the previous month. This increase marks the 35th consecutive month of growth in services activity supported by an in new orders.

India Manufacturing June Flash PMI rose to 58.5 from 57.5 in May, indicating expansion in the manufacturing sector supported by stronger output and new orders growth.

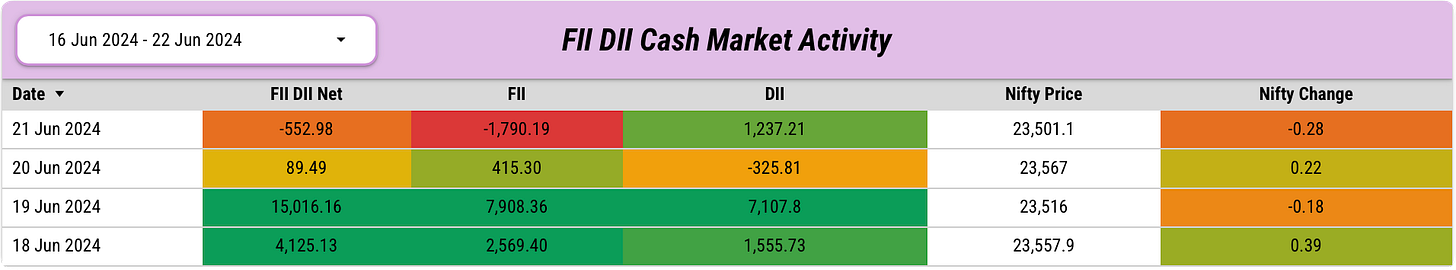

Let us now dive deeper into FII DII Data.

FII DII Positions Analysis

FIIs bought ₹9102 Cr and DIIs bought ₹9574 Cr in the cash market. Last week we had pointed out that both FIIs and DIIs were bullish based on their Derivatives positions.

FIIs have net long positions in Index Derivatives right now. It has been a rarity over the last year or so.

On the other hand, DIIs have added more shorts in Index Derivatives indicating cautiousness.

Overall, FIIs have turned more bullish and DIIs have turned more cautious last week.

Nifty Analysis

Both Price and Max Pain remained flat last week. Participants have not taken any significant directional positions last week.

Note: We will follow the direction of the black and blue line below. If both black and blue lines are moving upwards, then the market is bullish. If both the black and blue lines are moving downwards then the market is bearish.

Stocks Coverage

Key Stock Announcements Last week

Note: All the news items below include only the core business activities.

New Orders & Projects:

GE Power India secures ₹243 Cr contract for turbine renovation.

RailTel received ₹20.2 crore order from South Central Railway.

Jindal Stainless supplies steel for 100 freight wagons to Mozambique.

Gensol Engineering expands BESS project revenue to ₹3100 crore.

Eimco Elecon secures ₹33.11 crore order for coal mining equipment.

Kavveri Telecom secures ₹10.9 crore order for RF products, antennas in India.

Blue Pebble Limited receives ₹9.57 crore order from 3M India.

Solex Energy receives ₹9.44 crore work order for Bihar solar project.

AESL secures a ₹148 crore contract from SCCL for Coal Evacuation System.

L&T Construction secures significant orders for Hyderabad hospital and Mumbai office space projects.

NBCC awarded a ₹70 crore interior works contract by Grid-India.

KBC Global awarded USD $20 mn sub-contract by CRJE East Africa.

RIL awarded JNK India a mega order for Gas Cracker Unit, valued over ₹350 crore.

VPRPL awarded North Western Railway contract worth ₹90 crore.

RailTel received ₹24 crore order from Tamil Nadu Fibrenet Corporation.

Partnerships, Acquisitions & Investments:

Amara Raja invests EUR 20mn, raises stake in InoBat AS to 9.32%.

Triveni Engineering acquires 36.34% of Sir Shadi Lal Enterprises for ₹ 44.83 crore.

Yatra Online Ltd. acquires 49% stake in Adventure and Nature Network.

Axis Bank increases Max Life stake to 19.99% for ₹336 crore.

Restaurant Brands Asia invests ₹19.5 crore in PT Sari Burger Indonesia.

ABB India and Witt India collaborate on advanced tunnel ventilation solutions.

Hubject and Exicom form strategic partnership for India’s EV market growth.

JLR and Chery Automobile announce new EV collaboration in China.

Esconet Tech acquires ₹49 crore worth of Kriti Industries warrants.

Puravankara’s subsidiary acquires land valued ₹122 crore in Goa.

Maithan Alloys acquired ₹60 crore worth of Hindustan Aeronautics Ltd. shares.

Maithan Alloys acquired INR 30.07 crore worth of LIC shares.

RITES, DVC collaborate for rail infrastructure innovation in West Bengal and Jharkhand.

Business Operations:

Tata Communications launches Hosted SASE, enhancing global enterprise security and connectivity.

Havells will invest ₹50-60 crore in air conditioner manufacturing capacities.

Brigade Group to develop third WTC Tower at Infopark Kochi, ₹150 crore project.

Coal India awards 23 mines to private operators for coal extraction.

Datamatics secures patent for AI-powered Intelligent Document Processing Software.

Bharat Forge invests USD 40 mn in Bharat Forge Aluminum USA.

Tata Technologies, Microsoft, and Tata Motors innovate with Generative AI hackathon.

Radico Khaitan introduces Rampur Asava Indian Single Malt whisky.

Alembic Pharmaceuticals gains USFDA approval for Dabigatran Etexilate Capsules.

UGRO Capital completes ₹1,265 crore equity capital raise successfully.

Alembic Pharmaceuticals gains USFDA approval for Icatibant Injection.

Airtel clears ₹7904 crores spectrum acquisition liabilities.

Management Changes:

Mr. Pawankumar Lohiya resigns as CFO of Arfin India Limited.

Ms. Swetha Sagar as Manager & CBO of Butterfly Gandhimathi Appliances.

Lupin appoints Abdelaziz Toumi as CEO of Lupin Manufacturing Solutions.

Rahul Talele, the Group CEO of Kolte-Patil Developers Ltd resigned.

Key Upcoming Events

June 25

Lisa D. Cook (Fed Official) Speech

June 26

India Money Supply Data

June 27

Euro Area Economic Sentiment

US Jobless Claims Data

June 28

India Current Account Deficit Data

The rest of the information is delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

FINVEZTO.COM | Useful & Actionable Stock Market Tools