Weekly Market Analysis for Jan 23-25, 2024

HDFC Bank drags Nifty and Banknifty; Railway Stocks continue dream run; Results season in full flow and much more.

What happened last week?

Nifty opened at an all-time high last week above 22000 but ended the week much lower at 21571. The primary trigger for the big fall was the disappointing results of HDFC Bank.

HDFC Bank was down 11% last week and brought both Nifty and BankNifty down heavily. The selling happened with the highest weekly volumes ever. Also, it was the biggest weekly fall after Covid fall.

Global Markets were mixed last week. US and Japan did well. Other markets fell. Chinese markets are at a 5-year low. Hong Kong is down 32% in the last 1 year.

IndiaVIX went up to 15 levels last week. Participants are expecting more volatility in the coming weeks. IndiaVIX usually increases before the budget session.

Railway Stocks witnessed huge up moves last week. The announcement by the Rail minister regarding the government's plans to increase the production of Amrit Bharat trains has bolstered sentiment.

Just look at the performance of Railway Stocks in the below chart. RVNL shot up 45% last week and is up 320% for the year. Most rail stocks have tripled in the last year.

RVNL has been witnessing Institutional Activity from the time it was at Rs 33. Now it is at Rs 320. Almost a 10x move in about 1.5 years. But the latest move has not come with a spike in Institutional Activity as the previous up moves.

Results season started last week. Around 250 companies have announced their results so far. Overall it has been good except for HDFC Bank.

India's WPI Inflation climbed by 0.73% YoY in Dec 2023. It was the second straight month of increase in wholesale prices primarily due to food prices.

Govt. cuts windfall tax on petroleum crude to ₹1700 per tonne from ₹2300 per tonne. A boost for Oil Sector Stocks.

Govt. also imposed a 50% export duty on Molasses starting Jan 18 to ensure adequate quantities for Ethanol Blending.

Total Passenger Vehicle sales in India increased by 3.2% from a year earlier to 242,920 in December 2023.

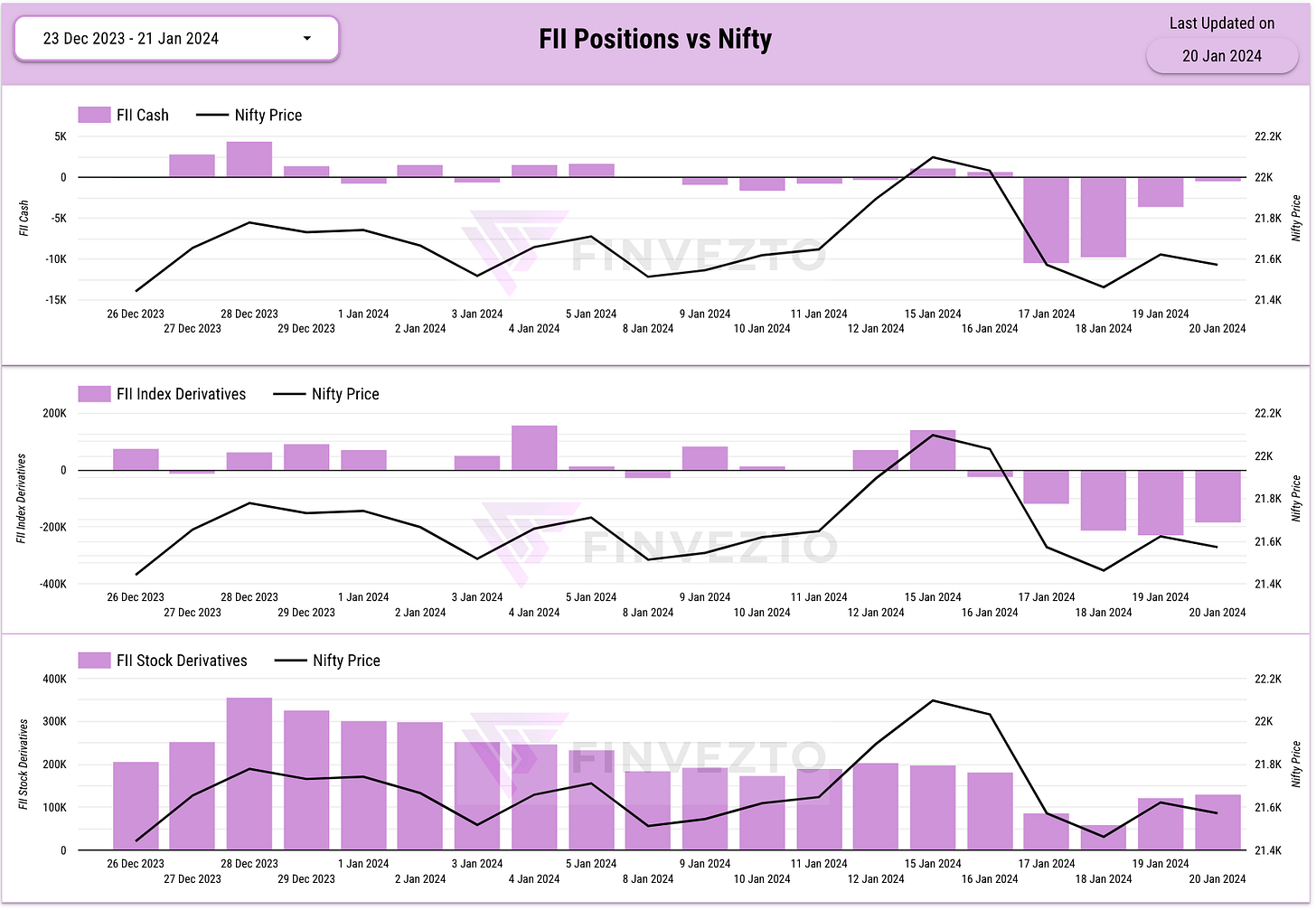

Let us now dive deeper into FII DII positions.

FII Positions Analysis

FII sold about 23000 Crores last week while the DIIs bought 10700 Crores in the cash market.

FIIs are net short in the Index Derivatives segment.

FIIs are long in the Stock Derivatives segment. However, they have trimmed their longs compared to last week.

FIIs had net long positions in Futures a week back. Now they are net short in Futures.

Overall FII sentiment looks Bearish.

Nifty Analysis

21500 is an important level to watch out for this week. Nifty has bounced back thrice from that level in January. Participants are also covering shorts every time the price reaches 21500. This has happened in the recent fall as well.

Overall momentum (price) and sentiment(positions/max pain) are Bearish. FIIs are more on the Bearish side. If the price and max pain in the upcoming week fall below 21500, then there might be a further fall. If price and max pain inch up together, then there might be an up move. We update our views based on the evidence.

Key Upcoming Events

Tuesday, January 23:

Market Holiday

Tuesday, January 23:

Results: Axis Bank, Havells, Granules, Pidilite Industries

Wednesday, January 24:

Results: Tata Steel, Tech Mahindra, TVS Motors, Bajaj Auto, Blue Dart Express, IOCL, Laurus Labs, RailTel

Thursday, January 25:

Results: ACC, Cipla, Cyient, IEX, SBI Life

US GDP Growth Rate Data

Friday, January 26:

Market Holiday

Key Stock Announcements from Last Week

New Orders, Contracts & Projects

Adani Enterprises: Subsidiary received Letter of Award for 198.5 MW electrolyser manufacturing capacity under Green Hydrogen Transition Scheme.

Bharat Heavy Electricals (BHEL): Received Letter of Award for EPC package of Rs 15,000 crore for NLC Talabira Thermal Power Project.

HEC Infra Projects received a Rs. 62.1 crore work order from Rail Vikas Nigam Limited for Surat Metro Rail project.

Rail Vikas Nigam (RVNL): Emerges as the lowest bidder for 11 KV line-associated works in multiple regions, securing a significant contract for 24 months.

Manav Infra Projects Limited received a work order for excavation works at ‘K B Tower’ in Mumbai, with a total project value of approximately Rs. 2 Crores

Sarda Energy & Minerals Ltd. awarded Gensol Engineering Limited a ₹150 crore contract for a 50 MW DC Solar Power Plant in Chhattisgarh, meeting captive energy needs.

HSCC (India) Limited, a wholly-owned subsidiary of NBCC (India) Limited, has been awarded a Rs. 76.62 crore project for Project Management Consultancy to set up Central Research Institute of Yoga & Naturopathy in Dibrugarh.

Man Industries (India) Limited discloses new orders of approximately Rs. 400 Crores, contributing to a total unexecuted order book of Rs. 1300 Crores to be completed in 6 months.

PNC Infratech: Receives a letter of award for a project worth Rs 1,174 crore from MP Road Development Corporation to construct the Western Bhopal Bypass.

NBCC (India) Limited received work orders totaling approximately Rs. 138.95 crore. The orders include construction works for Jawahar Navodaya Vidyalayas in various locations and renovation work for the Insolvency and Bankruptcy Board of India in New Delhi.

Vishnu Prakash R Punglia Limited has received a Letter of Award for a project from the Office of Sr. Divisional Engineer/Co., DRM Office, NW Railway, Jodhpur, Rajasthan. The project involves constructing Foot Over Bridges (FOB) at various stations over IR tracks, with a total project cost of INR 116.56 Crores.

Larsen & Toubro’s Railways Strategic Business Group secured a Mega Contract for the Mumbai-Ahmedabad High-Speed Rail Project, involving 508 km of Electrification System Works with Japanese technology.

RailTel Corporation of India: Receives a work order worth Rs 82.4 crore from South Central Railway for comprehensive ground infrastructure works to provide 4G LTE-R in 523 RKM of Secunderabad division.

Uniparts India: Receives an order of $1.2 million from Doosan Bobcat North America Inc. to supply construction equipment parts.

PNC Infratech: Receives a letter of award for a project worth Rs 1,174 crore from MP Road Development Corporation to construct the Western Bhopal Bypass.

GPT Infraprojects Limited secured a Rs. 267 Crore contract from MORTH for constructing a 4-lane Raniganj Bypass in West Bengal. Specializing in railways and concrete sleepers, the company’s total outstanding order book is around Rs. 3,144 Crore.

Bharat Electronics Limited (BEL) announced orders worth Rs. 1034.31 Crore, including a Rs. 695 Crore contract with Mazagon Dock Shipbuilders Ltd for missile system spares.

Larsen & Toubro’s Buildings & Factories Business secured significant orders in India and Oman. In India, it includes a repeat order for EWS Housing in Navi Mumbai, and in Oman, a contract for a Mixed-Use Development project in Muscat.

Ashok Leyland reveals a Rs. 522 Crores order for 1225 Viking buses from Karnataka State Transport. Scheduled for execution by April 2024.

KPI Green Energy: Subsidiary KPIG Energia received a new order of 5.60 MW for executing a solar power project from Shree Varudi Paper Mill LLP.

HFCL: Received a purchase order worth Rs 623 crore for the supply of indigenously manufactured telecom networking equipment for the 5G network of one of the domestic telecom service providers.

CE Info Systems (MapmyIndia) has secured a project valued at ~Rs. 400 Crores (~USD 50 Million) from Hyundai AutoEver Corp., Seoul, Korea, for Hyundai and Kia Cars OEM Business in India. The contract involves licensing Map & Connected Services Contents.

Partnerships, Acquisitions & Investments

Tata Consumer Products: Acquiring 100% stake in Capital Foods for Rs 5,100 crore and up to 100% stake in Organic India for Rs 1,900 crore.

Vikas Lifecare: Subsidiary accomplished the incorporation of joint venture company IGL Genesis Technologies with Indraprastha Gas.

Usha Martin: USSIPCL, a subsidiary in Thailand, acquires 50 percent of share capital in TUWCL, a step-down joint venture, for Baht 74.45 million.

Aster DM Healthcare: Affinity Holdings and Alpha GCC Holdings aim to complete the stake sale in the GCC business, with a proposed distribution of upfront consideration as dividends to shareholders.

PNC Infratech: Executes definitive agreements with Highways Infrastructure Trust (HIT) to divest 12 road assets in multiple states for an enterprise value of Rs 9,005.7 crore.

BLS International Services: Through its subsidiary BLS International FZE, the company acquires 100 percent stake in iData Danismanlik Ve Hizmet Dis Ticaret Anonim Sirketi for euro 50 million (Rs 450 crore).

UltraTech Cement: Incorporates Letein Valley Cement as a wholly-owned subsidiary, focusing on mining limestone, raw material manufacturing, and cement sales.

Karnataka Bank: Enters a strategic digital co-lending partnership with Clix Capital to provide loans to the Indian MSME sector through the Yubi Co.lend platform.

Bharat Petroleum Corporation: Announces a tender offer for around $120 million in 4.375% senior notes issued by BPRL International Singapore Pte Ltd, an indirect step-down subsidiary.

Mahindra and Mahindra (M&M): Subsidiary Mahindra Aerostructures (MASPL) and Airbus Aerostructures GmbH sign a contract for the manufacture and delivery of metallic components for all Airbus commercial aircraft models.

Nazara Technologies to acquire a 10.77 percent stake in Kofluence Tech.

Grindwell Norton: Executes a shareholder agreement and share issue agreement with Advanced Synthetic Minerals (ASM) to hold 49 percent of the equity share capital of ASM.

Wipro: Signed a definitive agreement to subscribe for a 14 percent equity share in Huoban Energy 11 for Rs 3.17 crore, aiming to enhance the usage of renewable energy for its offices in Maharashtra.

Hindustan Unilever: To Acquire 27.73 percent stake in the SPV (special purpose vehicle) Transition Sustainable Energy Services One, for renewable power.

Shalby: Acquires an 87.26 percent stake in Sanar International Hospitals, Gurugram (PK Healthcare) for Rs 102 crore.

Prataap Snacks: Issued a clarification note denying negotiations with Haldiram’s for acquisition.

Business Operations

Adani Energy Solutions: Maintains system availability of 99.67% in Q3 FY24, adds 302 ckms to operational network, secures contracts for 2 million smart meters, and improves distribution loss in the utility segment.

Godrej Properties: Acquires approximately one acre of land parcel in Yeshwanthpur, Bengaluru, with a developable potential of approximately 1.40 lakh square feet for premium residential apartments.

Avenue Supermarts: D-Mart operator opens two new stores at Velan Mall, Tirupur, and Sehore, increasing the total number of stores to 344.

Cochin Shipyard: Opens a new dry dock and the international ship repair facility (ISRF) in Kochi, costing Rs 1,799 crore and Rs 970 crore, respectively.

Balaji Amines: Receives BIS certification for the product Morpholine from the Bureau of Indian Standards.

Intellect Design Arena: Receives approval to set up a branch office at the International Financial Services Centre, GIFT City SEZ, Gujarat.

Zaggle Prepaid Ocean Services: Enters into an agreement with Torrent Gas to implement a close-loop fleet program.

Indian Bank: Receives approval from the Reserve Bank of India (RBI) for setting up a new wholly-owned operations support subsidiary.

Lupin: Receives approval from the United States Food and Drug Administration (US FDA) for its abbreviated new drug application for Febuxostat tablets.

REC: Designated by the Ministry of New and Renewable Energy, Government of India, as the overall program implementation agency for the rooftop solar (RTS) program.

Fortis Healthcare: Agilus Diagnostics, a material subsidiary of the company, received a notice from the Anti-Corruption Branch, Government of the National Capital Territory of Delhi, in respect of alleged anomalies in diagnostic tests conducted in the Aam Aadmi Mohalla Clinic.

Key Buying and Selling Deals

Zomato: Motilal Oswal MF sells 45,000,000 Shares at Rs. 138.15

Hi-Tech Pipes: Bandhan Core Fund buys 1,400,000 Shares at Rs. 148.5

Indigo Paints Limited: Smallcap World Fund sells 705389 Shares at Rs. 1475.32; Morgan Stanley Asia Singapore Pte buys 275,000 Shares at Rs. 1475.

Suyog: Destinations Int Eq Fund A Series Of Brinker Capital Destinations Trust buys 125,828 Shares at Rs. 1086.4; Nhit Global Emerging Markets Equity Trust buys 112,261 Shares at Rs. 1086.4; Natixis International Funds Lux I buys 57,886 Shares at Rs. 1086.4

Pricol Limited: Minda Corporation Limited sells 19,122,458 Shares to several Mutual Funds at Rs. 343.5; Nomura India Stock Mother Fund buys 3,097,900 Shares at Rs. 343.5; Fidelity Funds India Focus Fund buys 3,070,947 Shares at Rs. 343.5; Aditya Birla Sun Life Insurance Company Limited buys 3,030,000 Shares at Rs. 343.5; ICICI Prudential Mutual Fund buys 3,745,000 Shares at Rs. 343.5; Tata Mutual Fund buys 1,749,300 Shares at Rs. 343.5; Goldman Sachs India Limited buys 1,490,024 Shares at Rs. 343.5

Jindal Saw: Cresta Fund Ltd sells 1,800,000 Shares at Rs. 519

IEX: Indus India Fund (Mauritius) Limited sells 5,017,900 Shares at Rs. 138.08

Grasim Ind Ltd: Citibank sells 287,500 Shares at Rs. 310.89

Liberty Shoes: Societe Generale buys 105,711 Shares at Rs. 370.78

Corporate Actions & Fund Raising

Nazara Technologies: Board approves a preferential allotment of equity shares to raise up to Rs 250 crore

Indiabulls Housing Finance: Receives board approval for raising funds up to Rs 5,000 crore through the issue of equity shares or any other convertible or exchangeable securities.

FINVEZTO.COM | Useful & Actionable Stock Market Tools