Weekly Market Analysis for April 22-26, 2024

Tension in Middle East; Gold and Crude Oil soar; Q4FY24 Results underway; General Elections Phase 1 started and much more...

What happened last week?

Nifty was down 1.6% last week over tensions in the Middle East. It reached a low of 21777 last week and then bounced back on Friday to close at 22147.

All the major sectors took a hit last week with IT being the worst hit. IT fell by 4.7% and PSU Banks fell by 3.7%.

However, the Solar Panel Manufacturers (Solex, Swelect, Websol etc) were up around 6% to 30% even while several major sectors were in the red.

Most Global markets also ended in red last week. US Nasdaq (-7%) & Japan Nikkei (-6.2%) were the worst hit.

Pressure mounted in the Middle East following Iran's attack on Israel. Gold prices soared above $2,400 per ounce last week.

Crude oil prices also hit the $90 mark but eased to $87.1 per barrel after Iran denied reports of Israel's missile attack.

Let us look at some India-specific developments.

India's wholesale inflation rate (WPI) was at a three-month high of 0.53% in February, driven by food and primary articles.

The Q4FY24 results season is underway. TCS and Infosys announced results last week and it was quite subdued. We have covered the companies that posted good results last week here.

The first phase of voting for the 2024 Lok Sabha election commenced on 19 April 2024. The elections will occur in 7 phases, ending on 1 June 2024. The results will declared on 4 June 2024.

Let us now dive deeper into FII DII Data.

FII DII Positions Analysis

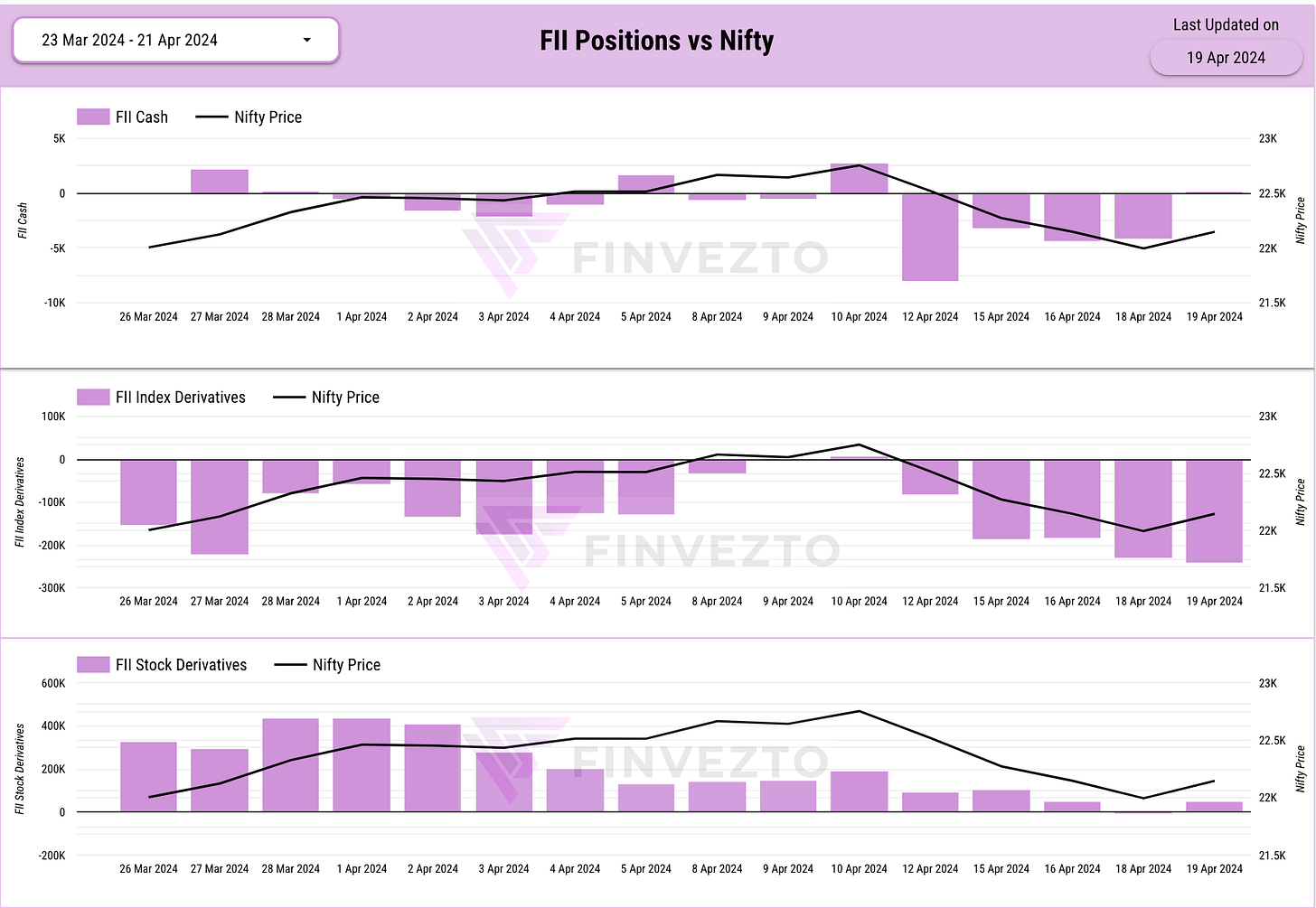

FIIs sold ₹11867 Cr and DIIs bought ₹9036 Cr in the cash market.

DIIs have been net buyers since the start of this year. But they seem to be slightly increasing their hedges now. Could be completely short-term owing to global uncertainties.

Both FIIs and DIIs have increased their shorts in Index Derivatives.

FIIs have reduced longs in Stock Derivatives.

Overall FIIs are Bearish and they might continue selling in the cash market as per their latest derivatives positions.

Nifty Analysis

Both Price and Max Pain were down last week indicating Bearishness. Even as the price fell to 21800 levels during the week, Max Pain did not fall below 22200. We saw a significant rebound on Friday towards 22200. We need to wait for the next directional change in max pain to ascertain a view.

Stocks Coverage

Key Upcoming Events

Tuesday, April 23:

India Flash PMIs

JNK India IPO Subscription opens

Thursday, April 25:

US GDP Data

Friday, April 26:

Japan Interest Rate Decision

Key Stock Announcements Last week

For all stock-related updates from the past week, please check Dalal Street Breakfast (Daily Pre-Market Report).

FINVEZTO.COM | Useful & Actionable Stock Market Tools