Weekly Market Analysis for March 18-22, 2024

Nifty witnessed a sharp fall; Mid Caps and Small Caps bloodbath; Correction in US and Japan; India Inflation Updates & much more...

What happened last week?

Nifty witnessed a sharp sell-off falling 2.1% last week. Went down to test the 22000 level and closed at 22023.

On Wednesday last week, there was a significant correction across mid, small, and micro-cap stocks plunging by up to 5% in a single day.

AMCs came out with rules around curbing lumpsum and SIP investments into the mid and small-cap space after the SEBI and AMFI signal bubble.

Nifty witnessed a drop of 550 points from its peak on Wednesday.

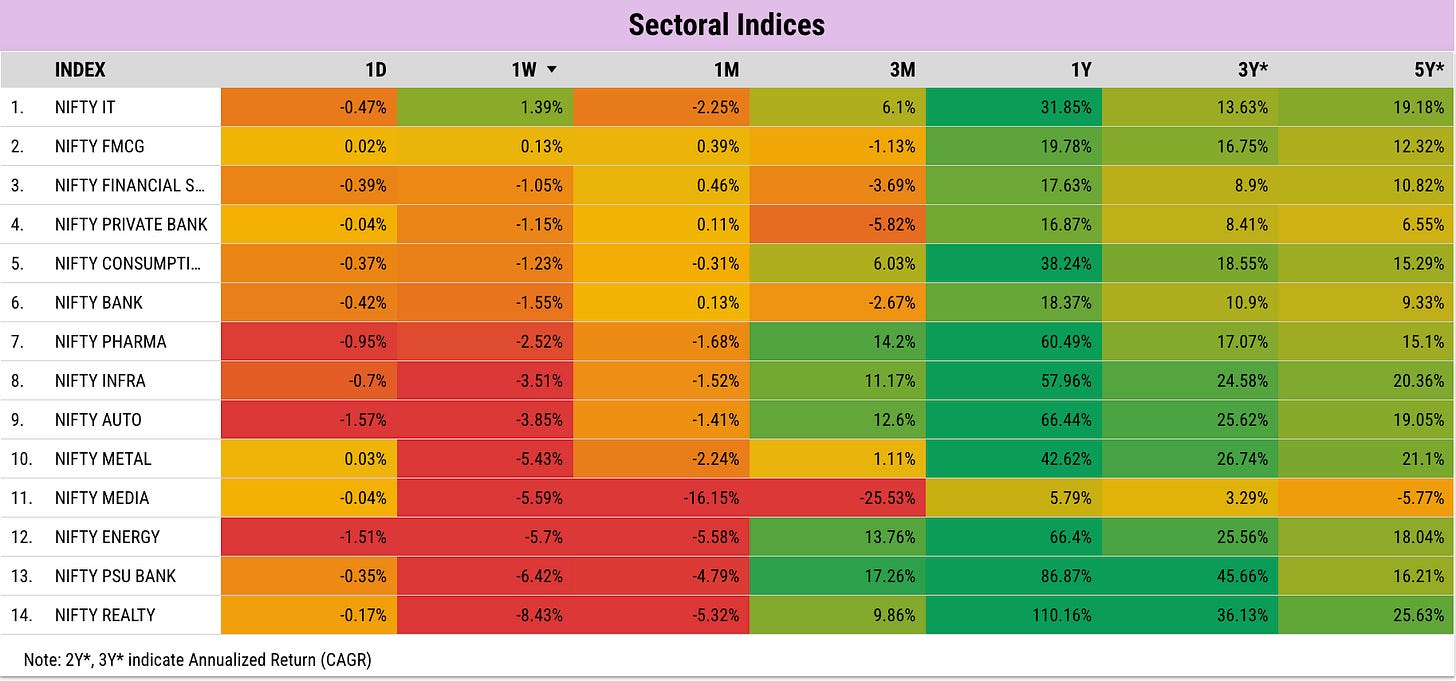

Except IT sector, all other sectors ended in red. PSU Stocks and Realty were heavily hit.

The US (S&P 500) and Japan (Nikkei) markets also witnessed a correction last week.

Let us look at some India specific developments.

The Consumer Price Index (CPI) inflation eased to 5.09% in February. Inflation continues to stay within the RBI’s tolerance level of 2-6% for six

consecutive months.

The Wholesale Price Index (WPI) inflation eased to 0.2 per cent in February from 0.27 per cent in the preceding month.

Oil marketing companies (OMCs) in India have reduced prices of

petrol and diesel after a record 22 months. It will be cheaper by ₹2 now.

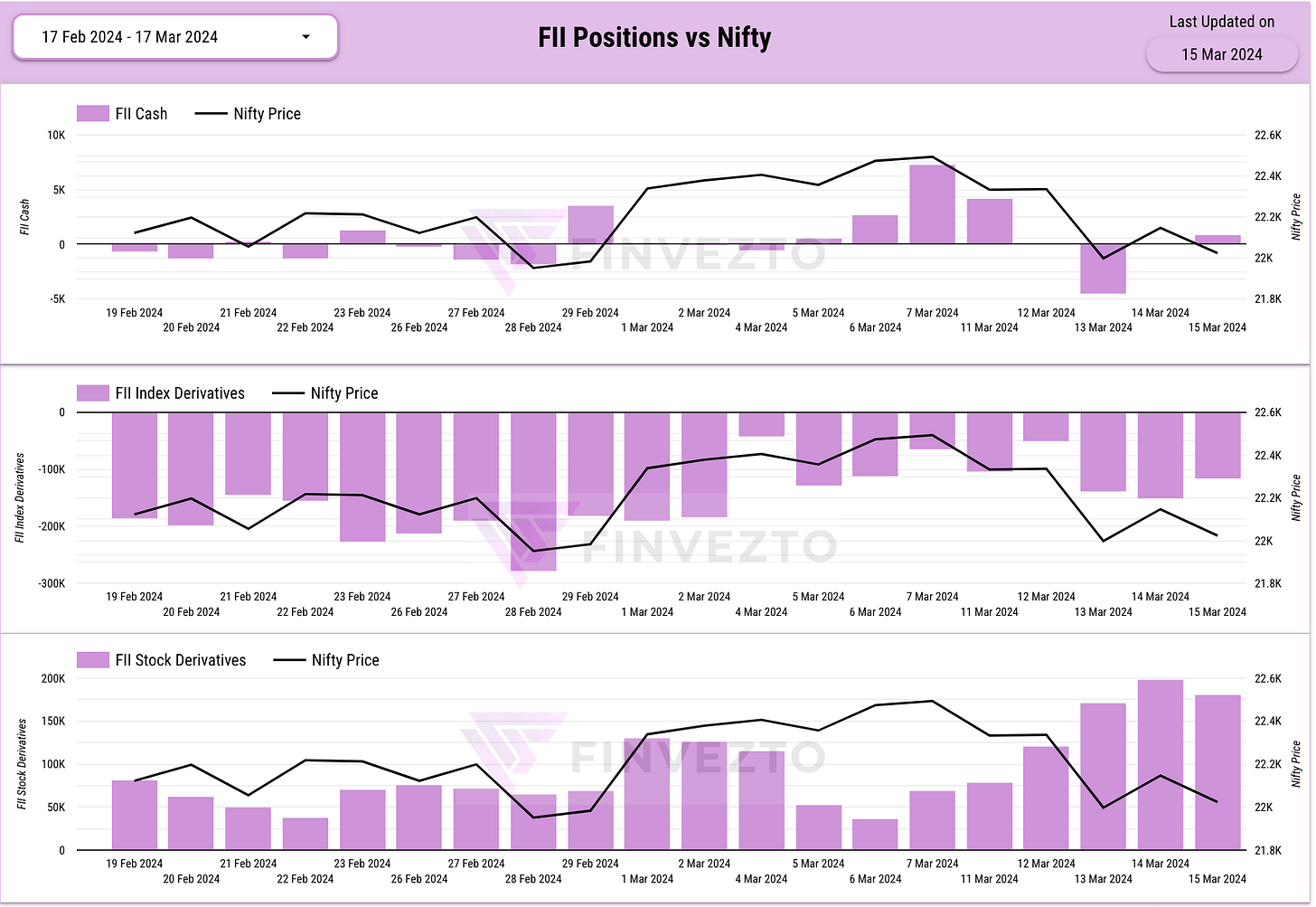

Let us now dive deeper into FII DII Data.

FII Positions Analysis

Both FIIs and DIIs were net buyers in the cash market last week. FIIs bought for ₹678 Cr and DIIs bought for ₹12651 Cr.

DIIs continue to be buyers and they have not increased their hedges despite the fall. They have actually reduced it. This means they are likely to be buyers in the upcoming week.

FIIs have slightly increased their short positions on the Index. But they have significantly added long positions in Stock Derivatives.

Although there was a bloodbath on Wednesday, both FIIs and DIIs are not significantly bearish.

DIIs continue to be Bullish. FIIs are bullish on certain stocks and are slightly Bearish on the Index.

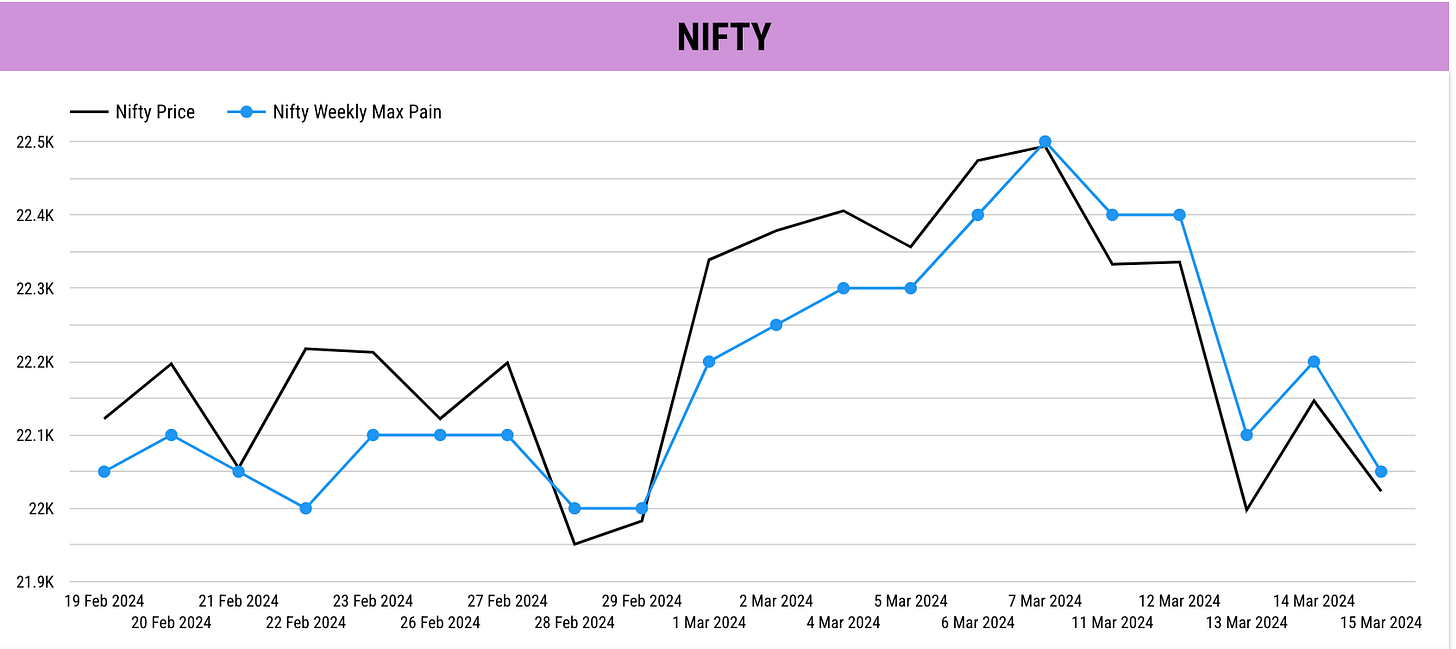

Nifty & BankNifty Analysis

Nifty: Both Price (Momentum) and Max Pain (Sentiment) went down last week. However, Max Pain has not gone below 22000. We will wait for price and max pain to shoot up together to go Bullish. Currently Nifty still looks Bearish.

BankNifty: Both Price (Momentum) and Max Pain (Sentiment) went down last week. Currently, BankNifty looks Bearish.

Key Upcoming Events

March 20 (Wednesday)

Fed Interest Rate Decision

March 21 (Thursday)

India Manufacturing PMI Flash

US Initial Jobless Claims

March 22 (Friday)

India Bank Loan & Deposit Growth

Key Stock Announcements last week

All my notes on major stock announcements last week are arranged date-wise below. Please have a look at the respective note below to view all updates.

Stocks with Institutional Activity last week

FINVEZTO.COM | Useful & Actionable Stock Market Tools