What happened last week?

Nifty fell by 1.87% last week closing at 22052. In the last 5 weeks, Nifty has witnessed aggressive selling every time it reached the 22600-22700 zone. It now becomes an important zone to watch on the upside.

The Broader Markets fell more than Nifty. Next 50, Midcaps and Small Caps were all down 2-3% last week.

FMCG and Auto Sector stocks did well amidst the fall. PSU Banks were the worst hit falling by 6%.

At an Industry level, Plastic Pipes (+3.9%) and Bearings stocks (+2.5%) continued their good run from the previous weeks. Institutional Buying continues in these sectors.

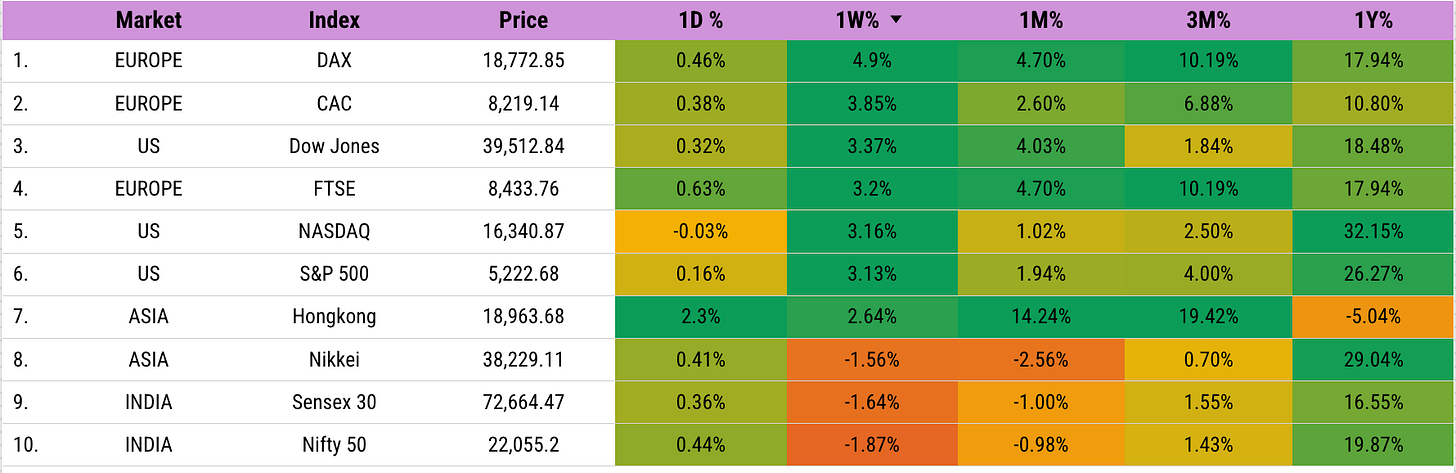

While the Indian & Japanese Stock Markets took a beating, their global counterparts did exceedingly well. Europe was up 3-4%. The US was up 3%.

India VIX has shot up 60% in the last 1 month from 11.53% to 18.47%. Several factors might be attributed to this increase in volatility - General Elections, Geopolitical uncertainties, Aggressive Selling by FIIs, Cautious Approach by DIIs, So-So Corporate Earnings, US Fed Rate Cut delay, Increasing Crude Oil prices etc.

Let us look at some India-specific developments.

The HSBC India Composite PMI Index stood at 61.5 in April, from 61.8 in March signalling a substantial rate of expansion across the private sector.

Industrial output in India rose by 4.9% YoY in March 2024. Manufacturing output which accounts for nearly 78% of total industrial production, expanded by 5.2% YoY.

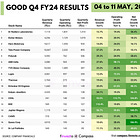

Q4 FY24 Results season is underway. It has been a lacklustre one. However, there are still some hidden gems. Here are the list of stocks that posted good results last week.

Let us now dive deeper into FII DII Data.

FII DII Positions Analysis

FIIs sold 🔴₹21619 Cr and DIIs bought 🟢₹17367 Cr in the cash market.

FIIs increased their short positions on the Index throughout the week. They continue to hold significant shorts on the Index.

FIIs hold longs in the Stock Derivatives segment.

DIIs have increased their hedges over the last 2 weeks as Nifty started falling from 22700 levels.

Overall FIIs are Bearish; DIIs are cautious but willing to buy on dips.

Nifty Analysis

Both Momentum (Price Movement) and Sentiment (OI Positions & Max Pain) indicate Bearishness. Participants added aggressive shorts as the price fell from 22600 levels. Amidst the Bearishness, the only positive was that Nifty Max Pain did not fall below 22100.

Stocks Coverage

Key Upcoming Economic Events

Monday (May 13):

India CPI Inflation Rate

Tuesday (May 14):

India WPI Inflation Rate

Wednesday (May 15):

US Inflation Rate

Euro Area Industrial Production Data

Thursday (May 16):

US Initial Jobless Claims

US Industrial Production

US Manufacturing Production

Friday (May 17):

China Industrial Production Data

Euro Area Inflation Rate

Key Stock Announcements Last week

Please check Dalal Street Breakfast (Daily Pre-Market Report) for all stock-related updates from the past week. You can also use the Search on the top right to see stock-specific updates.

FINVEZTO.COM | Useful & Actionable Stock Market Tools