What happened last week?

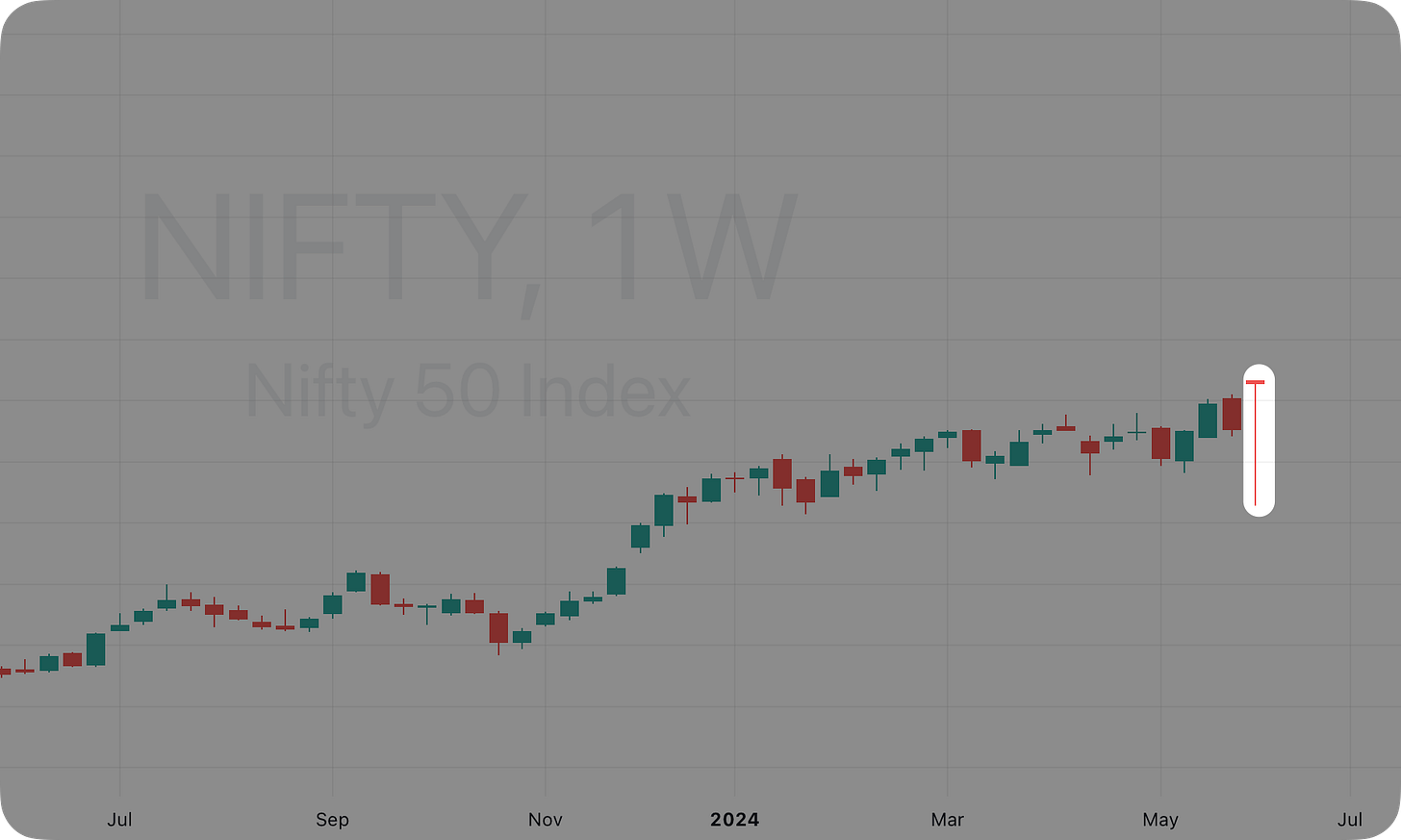

Nifty witnessed extremely volatile moves last week. It began with a gap-up opening at the start of the week following the exit poll results and GDP numbers. However, once the Lok Sabha election results started coming out on Tuesday, Nifty briefly fell by 8%. It was mainly because the ruling party BJP could not get a majority on its own.

Bulls returned strongly in the second half of the week once clarity emerged about NDA forming a coalition government.

Despite the volatility, Nifty closed last week at 23290 up by 3.3% from last week. The best week of 2024 on a closing basis.

India VIX shot up to 31% mid-week but cooled down to 16% towards the end of the week.

Prime Minister Narendra Modi is set to form the government for a third consecutive term. The BJP emerged as the largest party, winning 240 out of 543 seats, while the Congress secured 99 seats.

The BJP-led National Democratic Alliance (NDA) won 293 seats (later rising to 303 as small parties/independent candidates joined NDA), and the Opposition INDIA alliance won 232 seats.

The Reserve Bank of India kept its benchmark policy repo at 6.5% for the eighth consecutive meeting in June 2024. The latest move came after annual inflation stood at 4.85% in April 2024 staying within the RBI's 2-6% target range in the medium term.

Additionally, the RBI revised the economic growth forecast for the fiscal year 2025 to 7.2% from 7%.

The HSBC India Manufacturing PMI was 57.5 in May 2024. This indicates a slower but still significant improvement in manufacturing. Reduced working hours due to an intensive heatwave may have impacted production volumes. However, new export orders reached their highest level in over 13 years.

The HSBC India Services PMI was at 60.4 in May 2024. This was the 34th consecutive month of expansion in services activity. New orders continued to rise substantially.

Let us now dive deeper into FII DII Data.

FII DII Positions Analysis

FIIs sold ₹13718 Cr and DIIs bought ₹5578 Cr in the cash market.

FIIs were net buyers in the cash market on Monday. However, as the results started coming out on Tuesday, they sold heavily. On June 4, 5 & 6 alone they sold about ₹23000 Cr.

As the week progressed FIIs significantly reduced their shorts on Index Derivatives and held on to their long positions in Stock Derivatives.

FIIs are not as Bearish as they were on Tuesday or Wednesday last week.

DIIs did not increase their hedges on any day in the last week. DIIs continue to support the market by buying in the cash market.

Nifty Analysis

Both Price and Max Pain were extremely volatile last week. However, as per the latest data, both Momentum & Sentiment are Bullish.

Note: We will follow the direction of the black and blue line below. If both black and blue lines are moving upwards, then the market is bullish. If both the black and blue lines are moving downwards then the market is bearish.

Stocks Coverage

Key Stock Announcements Last week

New Orders & Projects:

Ahluwalia Contracts secured two projects worth INR 2245.15 crore.

Solex Energy bags INR 119 crore contract for solar street lights in Bihar.

RVNL secures Ankai-Karanjgaon track doubling project with South Central Railway.

Urban Enviro Waste Management Limited secures J&K sanitation project.

Konstelec Engineers reports INR 614 crore order book from marquee clients.

BHEL scores INR 3500 crore order to build a 1600 MW thermal power plant for Adani Power.

KEC International secures new orders worth INR 1,002 crore in civil business.

KPI Green’s subsidiary receives orders for 26.15 MW solar power plant.

Rail Vikas Nigam gets order for Sitarampur bypass line construction, valued at INR 391 crore.

Garden Reach Shipbuilders signs contract for dredger with Bangladesh.

RITES secures Tata Steel contract for Loco Hiring worth INR 39.63 crore.

Partnerships, Acquisitions & Investments:

Puravankara acquires 12.75-acre Thane land for INR 4,000 crore.

Endurance Tech’s subsidiary acquires Ingenia, enhancing automation capabilities.

Techno Electric & Engineering acquires NERES XVI Power Transmission.

Zydus Lifesciences acquires Zydus Medtech for medical device exploration.

Kalyan Jewellers India acquires 15% residual stake in Enovate Lifestyles.

Omaxe Limited acquires 14.27% stake in Inditrade Capital Limited.

Vakrangee acquires 18.5% stake in Vortex for ATM integration.

Texmaco Rail and Engineering acquires 51% stake in Saira Asia Interiors.

Gateway Distriparks increased their holding in Snowman Logistics to 45.55%.

CONCOR and SCI signed an MoU for seamless logistics solutions.

Mphasis and Classiq partner to develop quantum solutions for enterprises.

UNO Minda partners with lnovance Automotive to strengthen e-4W product portfolio.

Lupin completes acquisition of European and Canadian brands.

Hero MotoCorp to buy more shares in Ather Energy, worth INR 124 crore.

Sun Pharma to acquire 9.6% of HaystackAnalytics Private Limited.

Mastek partners with NVIDIA to enhance customer experience across sectors.

Business Operations:

Wipro, Cisco, and AT&T launch Wipro VisionEDGE+ for retail transformation.

Hero MotoCorp sells 498,123 units, strong demand for Xtreme 125R.

Maruti Suzuki India achieves sales of 174,551 units in May 2024.

Mahindra Auto sees 31% SUV sales growth and 17% total volume growth in May 2024.

Sansera Engineering's associate, MMRFIC Technology, expands into semiconductor packaging.

Aurigene Pharmaceutical Services opens a biologics facility in Hyderabad.

Cupid Limited broadens distribution network for rapid IVD kits.

Cupid Limited gains vendor approval from GCPL for Kamasutra condoms.

Shriram Finance raises USD 468 mn social loan, largest syndicated transaction.

JTL Industries completes Phase-I expansion at Nabha Steels, Punjab subsidiary.

Wipro launches an AI-assisted security and risk platform, powered by Zscaler.

Sun Pharma and Philogen submit marketing authorization application for Nidlegy™ in Europe.

ISRO Chairman inaugurates HAL facilities to support LVM3 program.

Intellect launches codeless banking platform for personalized customer engagement.

Titagarh Rail opens a new engineering center in Bangalore for innovation.

Tata Motors to incorporate a wholly-owned subsidiary named TML Commercial Vehicles Limited.

TVS Srichakra launches steel belted agro industrial radial tyres in Germany.

Persistent Systems launches GenAI Hub for enterprise AI adoption.

Orchid Pharma gains DCGI approval for Enmetazobactam-Cefepime combination injection.

Management Change:

G. V. Kiran appointed Chairman + Managing Director at KIOCL.

Wipro Appoints Bruno Schenk as Country Head and MD for Switzerland.

Abhijit Kabra resigned from the position of CEO of Sasken Technologies.

Key Upcoming Events

Wednesday, June 12

US FED Interest Rate Decision

India CPI Inflation Rate

India Industrial Production Data

Thursday, June 13

India Passenger Vehicles Sales Data

US Initial Jobless Claims Data

Friday, June 14

BoJ Interest Rate Decision

India WPI Inflation Data

The rest of the information is delivered through Dalal Street Breakfast on every market day at 8 AM. Check it out here!

FINVEZTO.COM | Useful & Actionable Stock Market Tools