Weekly Market Analysis for April 08 to 12, 2024

Nifty scales all time high; Midcaps rebound; RBI keeps repo rate unchanged; A lot of positives for India and much more...

What happened last week?

Nifty has started FY25 on a positive note and closed at 22513 last week. It closed above 22500 for the first time in the Weekly chart. It also made a new all-time high of 22619.

Banks, Financial Services & Media were the top-performing sectors last week.

Mid Caps, Small Caps and Micro Caps had a stellar week with 4%, 6% and 7% returns respectively. They have rebounded sharply after the recent fall.

The IT Midcap Stocks have shot up significantly. Mphasis and Coforge were up more than 5% last week. Bearings Industry stocks were also up significantly.

On the global front, India was the only market that was in green last week.

There was a big fall in the US market on Thursday following the FED commentary, but it rebounded on Friday.

Japan witnessed FII outflows over the last couple of weeks and the Nikkei Index was down 3.4% last week.

The RBI kept the repo rate unchanged at 6.5% for the seventh time. The RBI also decided to remain focused on the withdrawal of its accommodative stance to ensure that inflation progressively aligns with the target of 4% ± 2%, while supporting growth.

India's Goods and Services Tax (GST) collections hit the second highest level ever in March 2024, reaching Rs 1.78 lakh crore.

India Forex reserves hit an all-time high of $642.63 billion.

India witnessed strong services sector activity in March with India Services PMI at 61.2 compared to 60.6 the previous month. It is the highest recorded Services PMI in 14 years.

Even the India Manufacturing PMI climbed to a 16-year high of 59.1 in March from 56.9 in February.

A lot of positives for India in the last week.

Q4 FY24 Earnings season will start in the upcoming week.

Let us now dive deeper into FII DII Data.

FII DII Positions Analysis

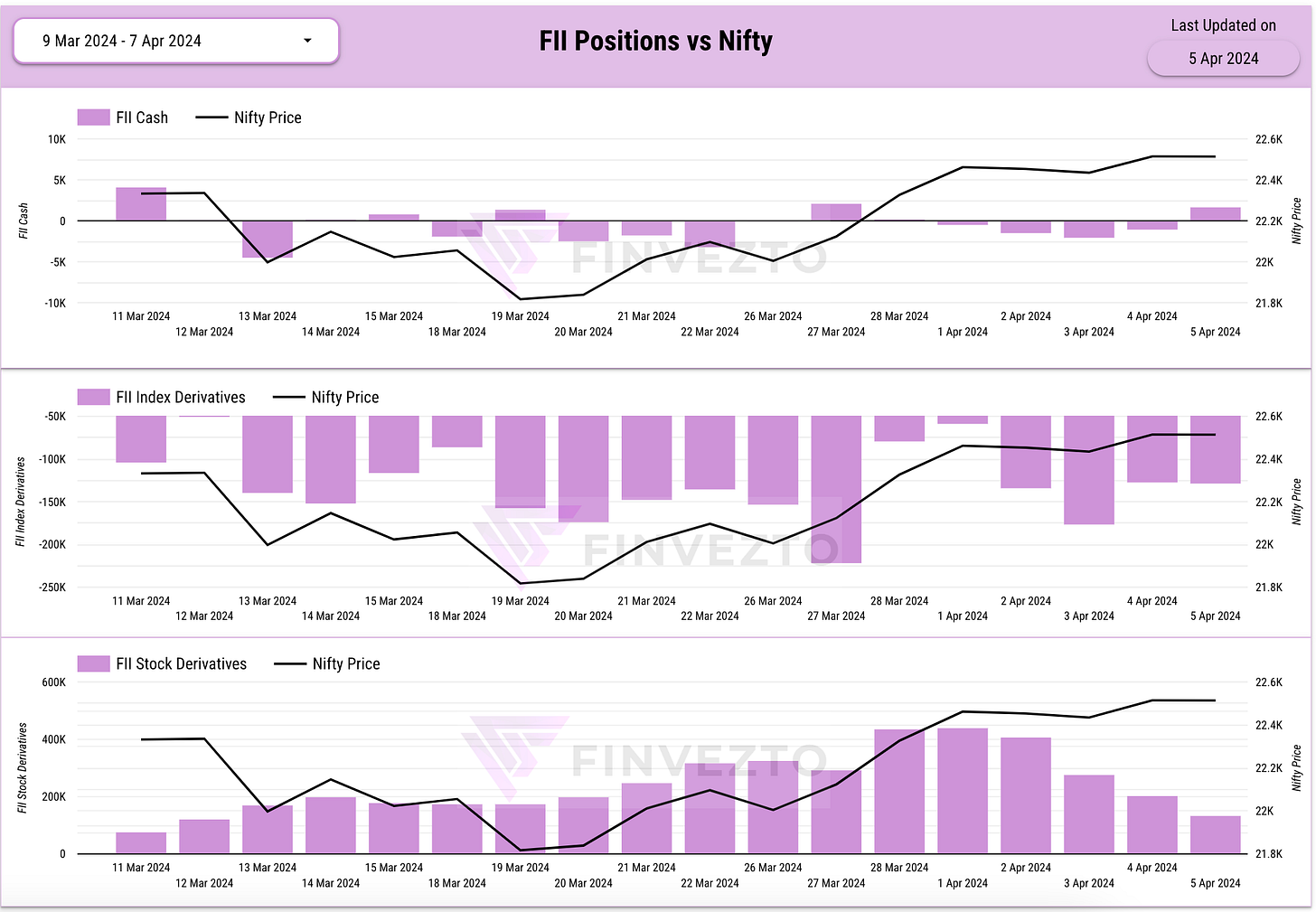

FIIs sold for 3835 Crores and DIIs were neither net buyers not net sellers.

FIIs hold short positions on the Index and have reduced their longs in Stock Derivatives significantly.

DIIs continue to maintain their hedges, but have not increased them significantly over last week.

FIIs have turned slightly Bearish from last week and DIIs continue to maintain their bullish stance but are not extremely bullish compared to earlier weeks.

Nifty & BankNifty Analysis

Nifty: Both Price and Max Pain shot up together last week suggesting bullishness.

Banknifty: Both Price and Max Pain shot up together last week suggesting bullishness.

Institutional Activity Last Week

Key Upcoming Events

April 10 (Wednesday)

US Inflation Rate

April 11 (Thursday)

ECB Interest Rate Decision

US Initial Jobless Claims Data

April 12 (Friday)

India Retail Inflation (CPI) Data

India Industrial Production (IIP) Data

Key Stock Announcements Last week

All my notes on major stock announcements last week are arranged date-wise below. Please have a look at the respective note below to view all updates.

FINVEZTO.COM | Useful & Actionable Stock Market Tools