The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

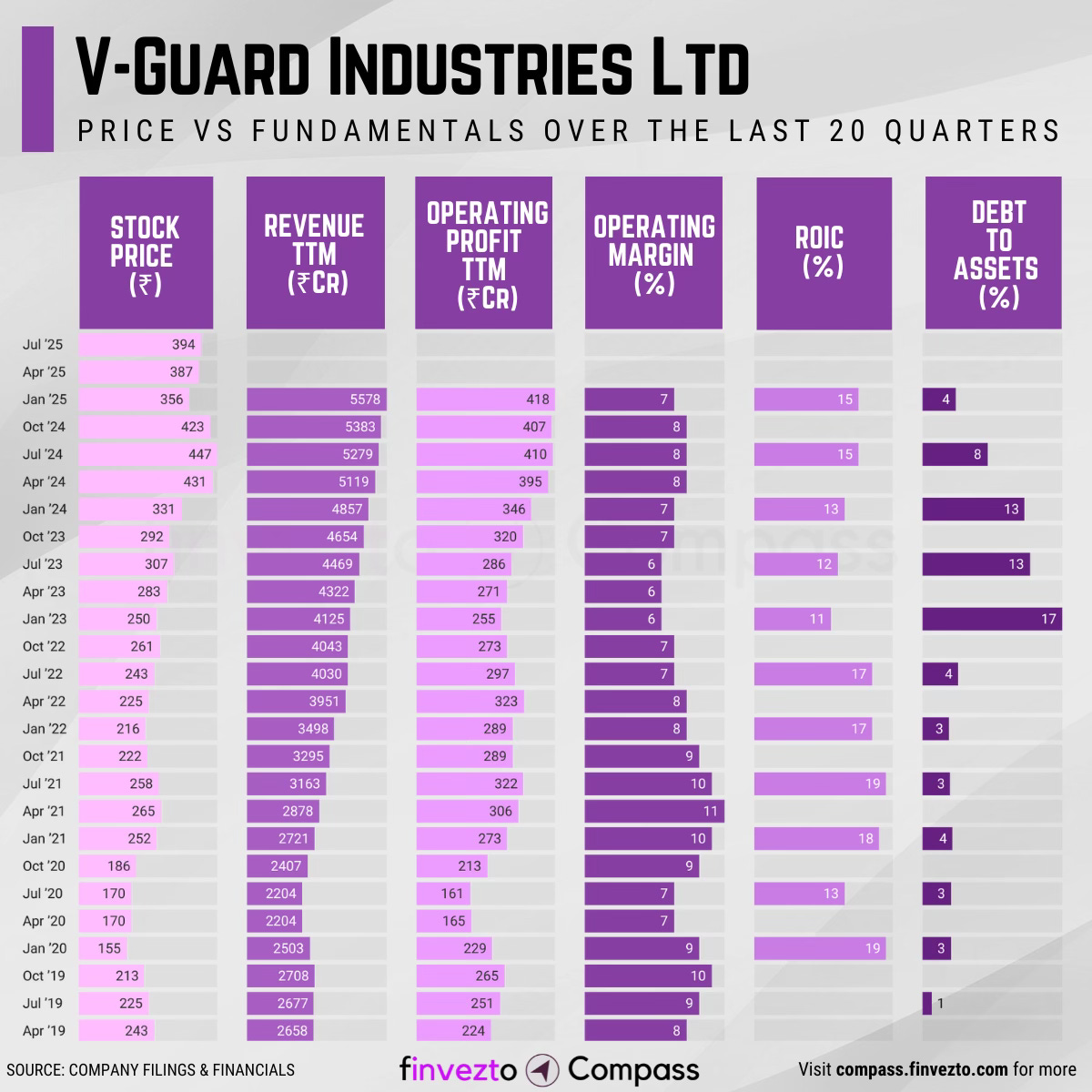

Today, we will look at the key fundamentals & business of V-Guard Industries Ltd.

Click here to learn more about each of the parameters in the chart above.

What Has Led to This Consistency

Company Overview

Established in 1977 as a voltage stabilizer manufacturing unit, V-Guard Industries has transformed into India's leading multi-product electrical company.

The company specializes in electronics, electricals, and consumer durables across voltage stabilizers, cables, pumps, and kitchen appliances.

Product Segments:

Market Leadership

V-Guard ranks as the third-largest organized electrical company.

Market share across key segments: 40-45% in voltage stabilizers (Rs. 1,600-2,000 crores market), 8-9% in house wiring cables, 14-16% in water heaters, 5-7% in electric fans, and 15-17% in solar water heaters → Leadership across diversified portfolio

Gaining 2-3% market share annually in organized segments as regulations eliminate unorganized competition → Systematic market expansion

Prices 15-25% above unorganized players but stays 20-30% below premium brands like Havells and Anchor → Strategic market positioning

Manufacturing Scale

V-Guard operates 11+ manufacturing facilities across 8 states including Tamil Nadu, Uttarakhand, Himachal Pradesh, Sikkim, and Gujarat.

Combined annual output exceeding 16+ billion units → Scale enabling production economies and supply reliability

PVC compounding units reduce input costs by 8-12% through vertical manufacturing control → Cost advantages

65% in-house production, targeting 75% → Manufacturing control and margin enhancement

Launched energy-efficient BLDC fans, smart inverters, and IoT-enabled appliances with 15% reduction in product defects → Technology differentiation and quality leadership

99.2% regulatory approval rates and 3-year warranty coverage → Quality assurance

Employs 4,500+ people with 15% annual workforce growth

Distribution Network

400+ distributors and 100,000+ retailers provide nationwide coverage → Comprehensive market reach

250+ service centers ensure product availability within 5km radius in major markets → Customer retention advantage

Long-term dealer relationships with 15+ year average tenure and exclusive territorial agreements

Online channels contribute 8-12% of total sales alongside traditional retail

Strategic Acquisitions

V-Guard has invested Rs 1,000+ crores in systematic acquisitions with 25%+ revenue growth contribution from acquired brands.

Sunflame acquisition (Rs 660 crores, 2023) added kitchen appliances brand with Rs 350 crores annual revenue → Kitchen appliances market entry with immediate scale

Simon Electric merger (Rs 27 crores, 2021) brought Spanish modular switches technology and European design capabilities → Technology transfer and premium portfolio enhancement

Geographic Evolution

V-Guard expanded beyond South India over 15 years, with non-South markets contributing 43.8% of revenue versus historical 9%.

Hindi packaging and lower-priced variants for Northern markets → Market penetration in price-sensitive regions

New Uttarakhand and Himachal Pradesh factories reduce logistics costs to Delhi-NCR and UP markets by 25-30% → Cost advantage enabling competitive pricing

Added 150+ new dealers in Bihar, Jharkhand, and Northeast territories → Revenue stream expansion in high-growth tier-2 and tier-3 cities

Non-South regions growing at 16.9% YoY versus 13.6% in traditional South markets → Geographic revenue balance reducing dependency risk

Targets India's 300+ million middle-class consumers with 15-25% price premium over unorganized players

Consistency Formula

Manufacturing Scale + Distribution Network → Market dominance and cost advantages

Financial Discipline + Strategic Acquisitions → Sustainable growth and capital efficiency

Market Leadership + Geographic Evolution → Pricing power and Revenue diversification

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research