TRIVENI TURBINES || Consistently Performing Stocks #1

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business a little bit more, figure out the key growth drivers and identify broader industry trends & patterns. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity. Hope I am clear.

Let’s start ⬇️

Today, we will look at the key fundamentals & business of TRIVENI TURBINES.

In the last 25 quarters,

Revenue TTM has become 2.3x (from ₹844 cr to ₹1926 cr)

Operating Profit TTM has multiplied 2.5x (from ₹151 cr to ₹382 cr)

Stock Price shot up 6.7x (from ₹111 to ₹741)

What impresses me is the consistency in the numbers. Let us explore how they are doing this.

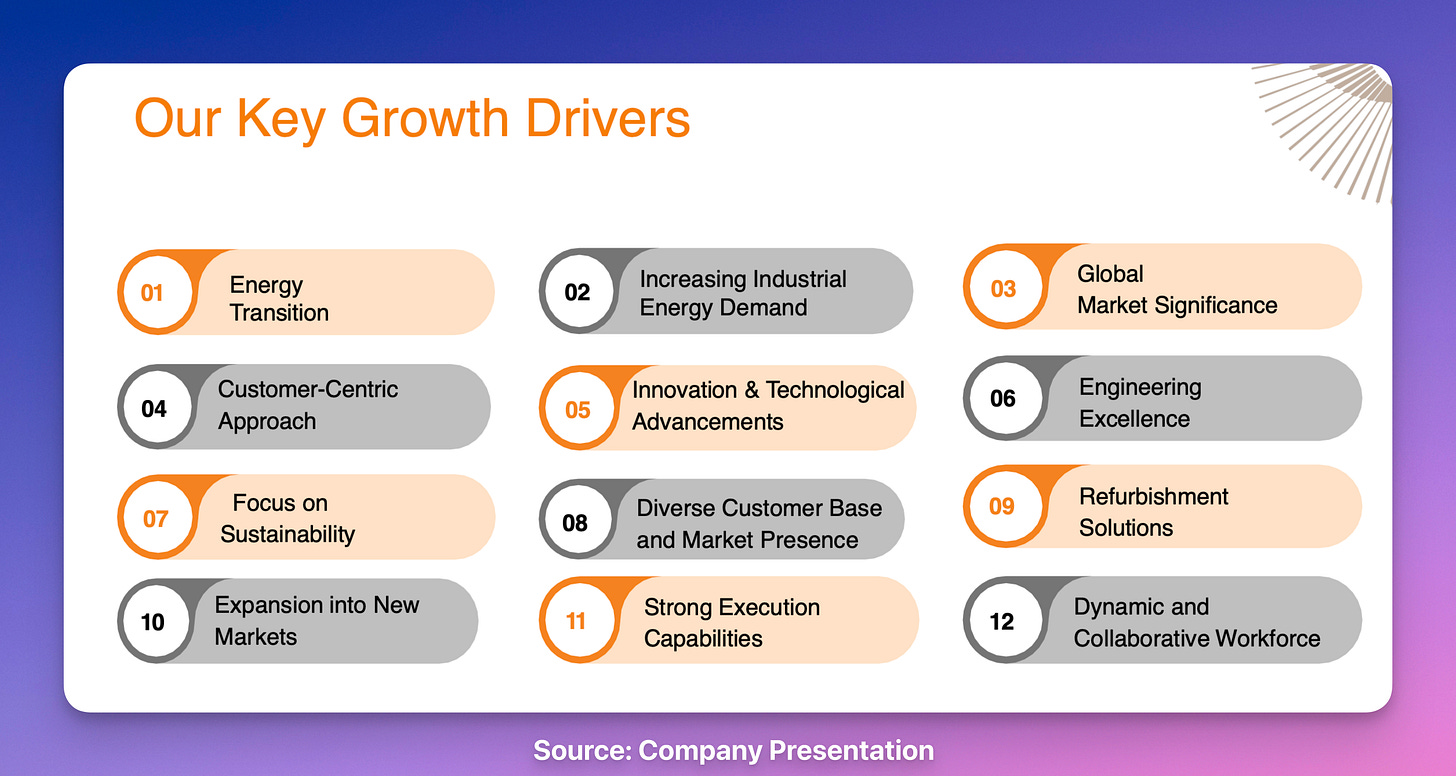

What Has Led to This Consistency

Company Overview:

Triveni Turbines manufactures industrial steam turbines up to 100MW, with over 6,000 installations.

The company dominates India's market with a 60% share in sub-30MW segment and generates significant revenue from exports to USA, Brazil, and South Africa.

Global Footprint:

With installations across 80+ countries and strong presence in Southeast Asia, Africa, and Latin America, Triveni reduces dependence on any single market.

The company achieved its highest-ever quarterly export orders in Q2FY25, with significant growth in renewable energy, biomass, and waste-to-energy projects.

Technological Edge:

The company's turbines feature advanced designs including high-speed axial exhaust configurations that reduce plant footprint and civil costs by up to 30%.

Their solutions provide optimal efficiency through enhanced HP blading and LP flow control techniques, delivering competitive power generation with lower lifecycle costs.

Industry Diversification:

Triveni excels in diverse process industries, offering specialized turbines for sugar co-generation, pulp and paper mills, petrochemicals, and waste-to-energy applications.

Their API-compliant turbines serve refineries and fertilizer plants with high-efficiency solutions across 20+ industries.

Customer-Centric Approach:

The company provides comprehensive services including installation, commissioning, and customized training through their world-class learning center. This results in high customer satisfaction scores and significant repeat orders across 80+ countries.

Aftermarket Excellence:

Triveni's aftermarket business contributes approximately 33% to total turnover, with highest-ever quarterly order booking of Rs 1.74 billion in Q2FY25.

Through their multi-brand REFURB division, they offer comprehensive services including overhauling, upgrades, health surveys, and retrofitting across 80+ countries with rapid turnaround times and 24x7 support.

Digital Solutions:

Their predictive maintenance systems use real-time monitoring, IoT sensors, and machine learning algorithms to detect potential failures, optimize performance, and reduce downtime. This enhances customer value through 24x7 support and proactive maintenance scheduling.

Innovation Leadership:

Triveni maintains a DSIR-approved R&D facility, investing 1.2% of sales in innovation.

The company collaborates with global institutions like IISc, Cambridge, and Polimi, developing advanced technologies including API turbines and CO2-based power blocks for future growth.

Market Drivers:

The "Make in India" initiative, coupled with renewable energy incentives, has strengthened domestic turbine manufacturing.

Rising industrial CAPEX in emerging markets, particularly in power generation and co-generation sectors, drives sustained demand despite global supply chain challenges.

Growth Trajectory:

Triveni is developing turbines up to 120 MW to capture larger industrial markets, while strengthening its presence in API-compliant turbines and expanding manufacturing capacity from 150-180 to 200-250 machines annually.

Market Leadership Formula:

Design Innovation → Cost Advantage

Service Integration → Revenue Stability

Industry Expertise → Customer Trust

Global Scale → Market Resilience

R&D Excellence → Future Growth

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services.

Conceptual Lessons & Deep Dives

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.