TIPS MUSIC || Consistently Performing Stocks #45

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they were able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Let’s Start.

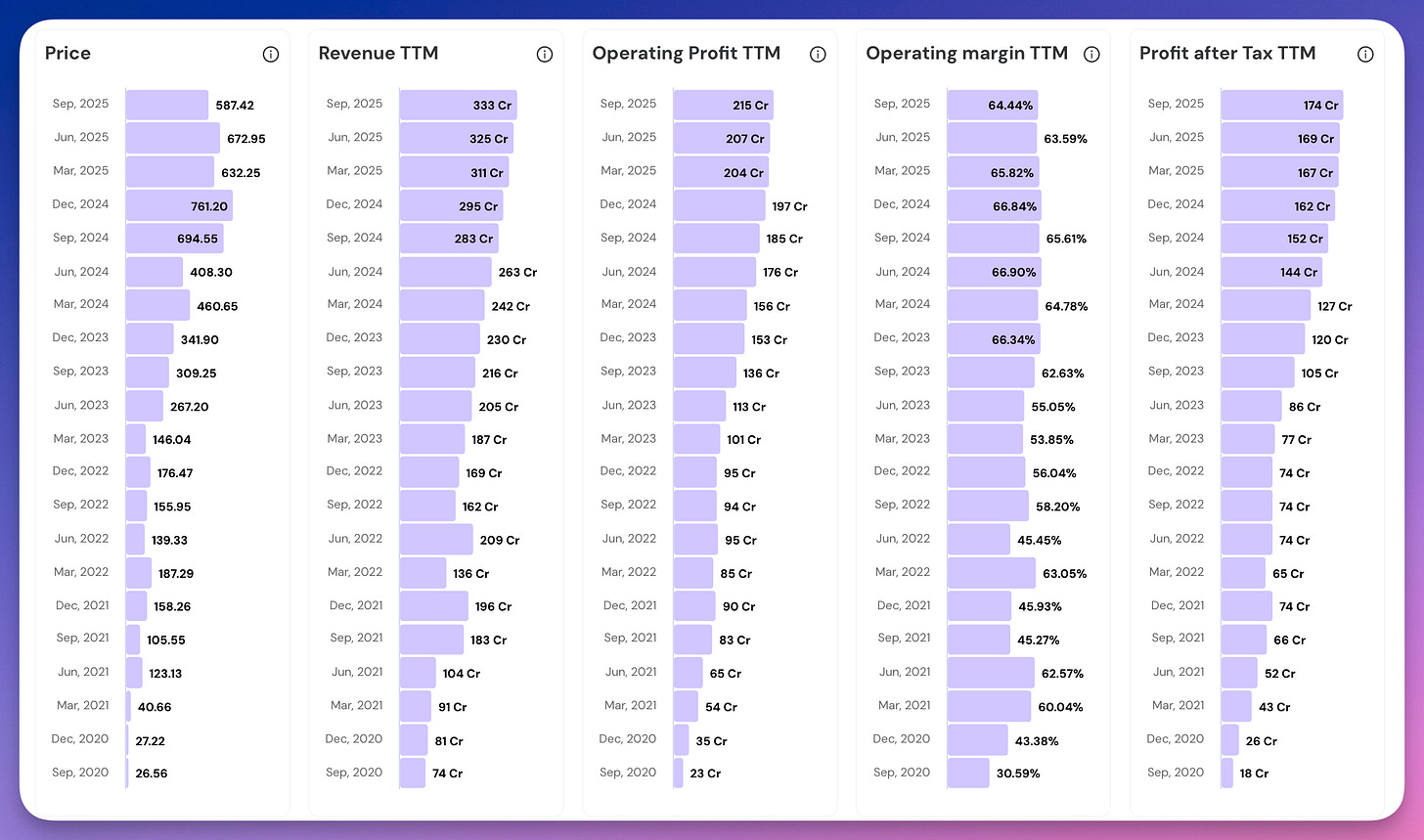

Since Sep 2020…

This Stock’s price has surged 22.1 times

Revenue has grown 4.5 times

Operating profit has grown 9.3 times

PAT has grown 9.7 times

Operating Margins have increased from 30.59% to 64.44%

Take a look at the numbers below. Incredible Consistency.Did you guess the stock?

Yes. It is Tips Music Ltd. It has quietly transformed into one of India’s most profitable music companies. Their formula is simple. Own Songs and collect royalties eternally.

Lets explore.

Their Road to Consistency

Overview, Business Model & Revenue Mix

In 1975, Kumar and Ramesh Taurani opened a small shop on Mumbai’s Lamington Road, distributing LP (Long Play Albums) vinyl phonograph records.

Their genius: Instead of remaining distributors, they started acquiring music rights outright in the 1980s.

The pivotal insight was understanding music’s eternal nature. A great song remains valuable for generations.

“Tip Tip Barsa Pani” trends on Instagram Reels even today, three decades after release.

Tips accumulated soundtracks through the 1990s golden era. When India’s streaming revolution began in 2016, this old catalog became extremely valuable.

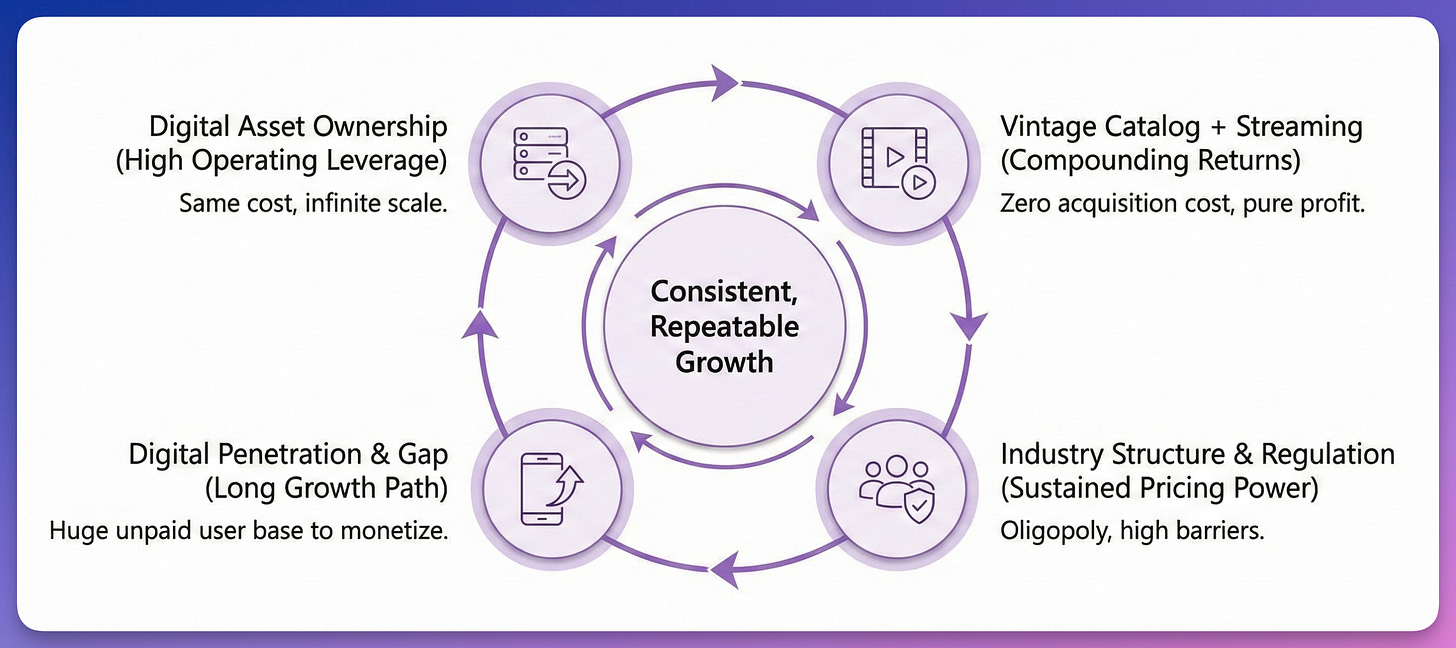

The business model revolves around permanent intellectual property ownership.

Tips pays one-time fees to film producers and composers for complete soundtrack rights covering 60+ years.

TIPS owns 34,000+ songs across 25 languages.

Each acquired song appreciates over time as streaming adoption grows. This creates annuity-like revenue.

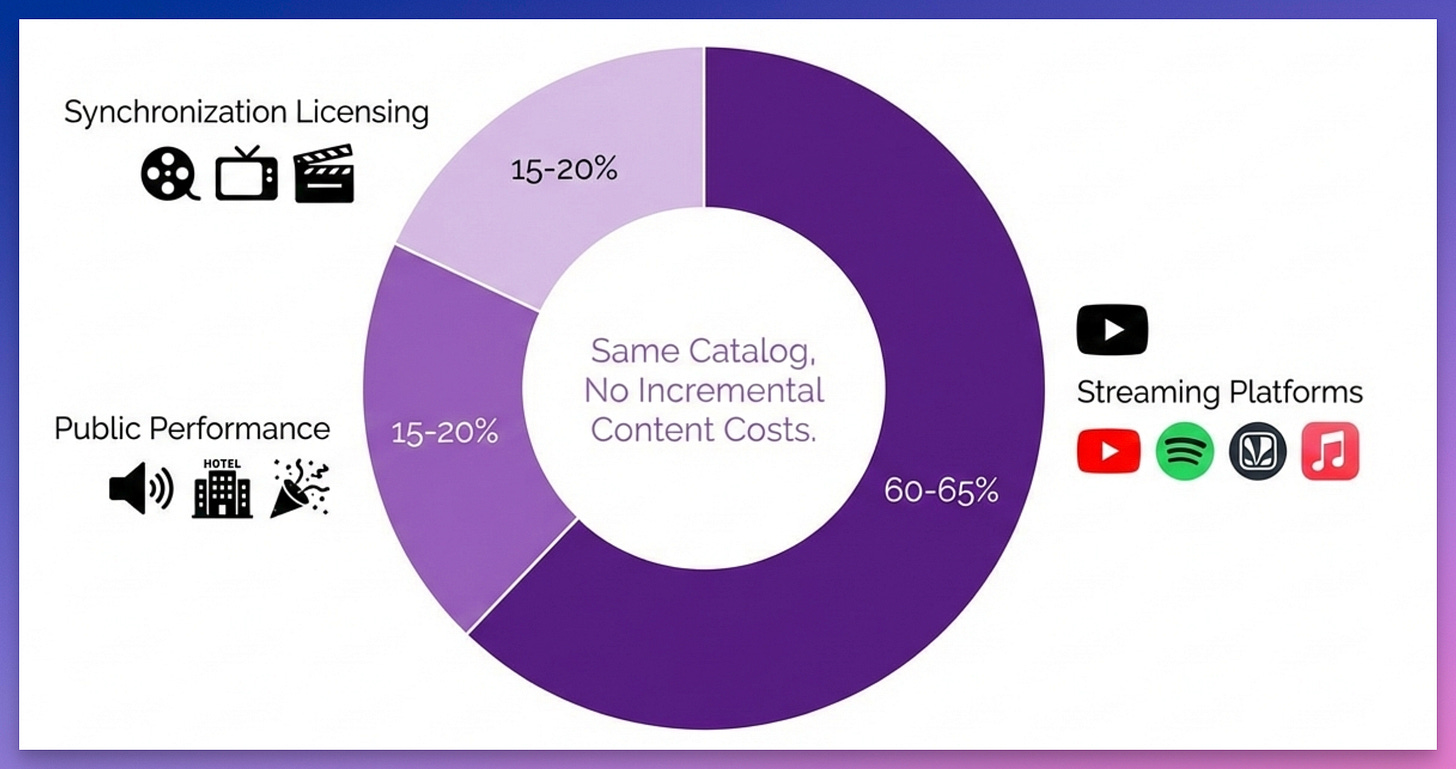

Revenue streams split across three primary channels.

Streaming platforms contribute approximately 60-65% through YouTube, Spotify, JioSaavn, and Apple Music.

Public performance royalties from hotels, restaurants, and events generate 15-20%.

Synchronization licensing for advertisements, films, and television shows adds another 15-20%. Each channel monetizes the same catalog without incremental content costs.

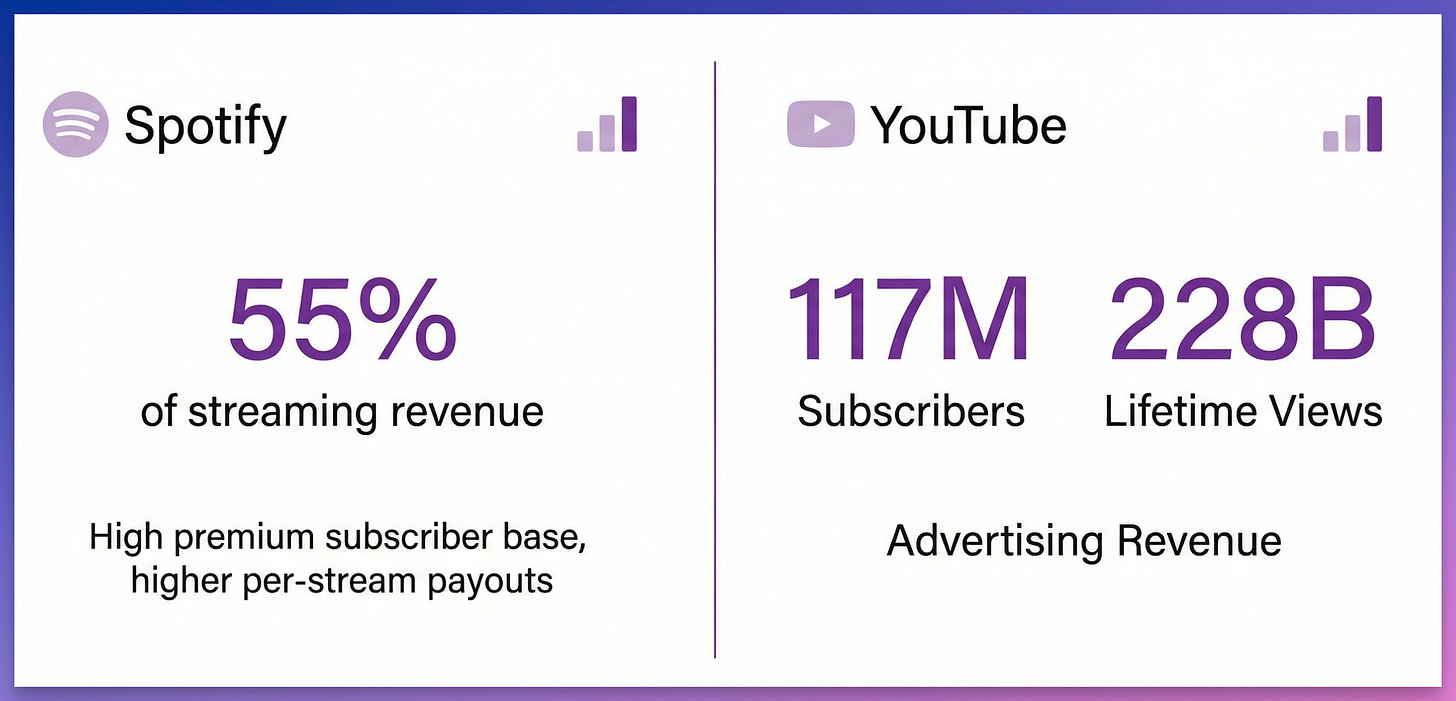

Spotify and YouTube dominate the platform mix.

Spotify alone contributes roughly 55% of streaming revenue, reflecting its premium subscriber base and higher per-stream payouts.

YouTube generates advertising revenue through Tips’ 117 million subscribers and 228 billion lifetime views.

Data & Streaming Explosion

Jio’s 4G launch in September 2016 change the dynamics of several industries. Music Streaming was one of them.

Data prices crashed 95%. Monthly data usage exploded from 200 million GB to 1.3 billion GB within nine months.

Suddenly, ~700 million Indians could stream music freely.

India now ranks as the world’s second-largest streaming market by volume (over 1 trillion streams annually).

TIPS was a clear beneficiary. In the right place at the right time.

Focused Acquisition Strategy

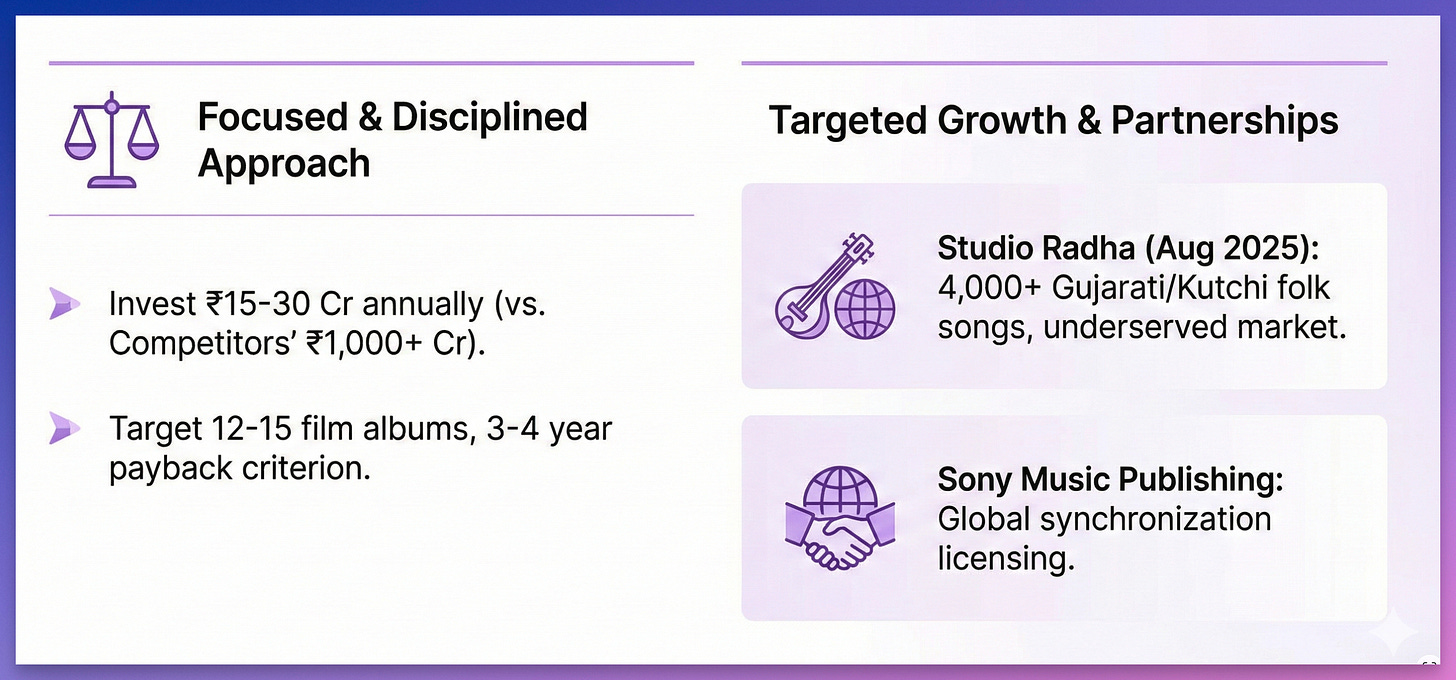

The acquisition philosophy prioritizes quality over quantity.

Tips invests ₹15-30 crore annually acquiring 300-350 songs, targeting 12-15 film albums. This disciplined approach contrasts sharply with competitors (T-Series, Saregama) spending ₹1,000+ crore on aggressive expansion.

For Tips, each acquisition must demonstrate potential to payback within 3-4 years. Otherwise, they give it a pass. No wonder their return on capital is so high.

The August 2025 acquisition of Studio Radha brought 4,000+ Gujarati and Kutchi folk song. Targeting underserved markets.

The Sony Music Publishing partnership handles global synchronization licensing.

Industry Tailwinds

Music Streaming is booming.

India’s music industry projects growth from ₹5,300 crore (2024) to ₹7,800 crore by 2026, a 47% YoY expansion.

TIPS targets 7-8% market share, translating to potential revenue of ₹700-800 crore within five years.

Paid subscription conversion represents the largest lever.

Currently, India ARPU sits at just $0.69 annually. Compared to $40+ in the United States.

Only 1% of Indian listeners pay for subscriptions, compared to 25-30% in US. This gap represents Tips’ growth runway.

India streams music volumes comparable to the United States but generates 1/10th the revenue. As this gap narrows, catalog owners automatically benefit.

Paid music subscriptions is growing about 50% YoY in India. When paid subscribers increase, royalty pools expand.

Short-form video monetization offers emerging potential.

If TikTok returns to India and platforms begin revenue-sharing, Tips projects ₹100 crore additional business over 3-5 years.

Competitive Positioning

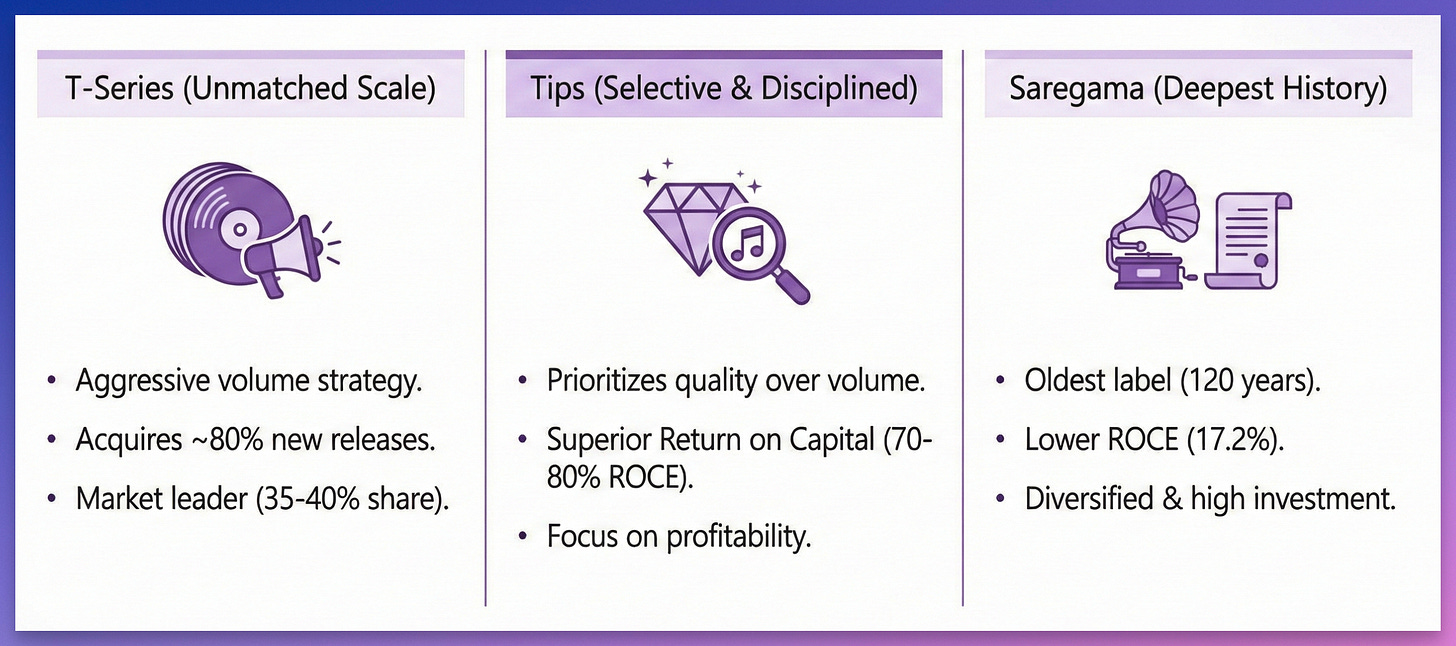

Tips operates in a 3 player market alongside T-Series (largest catalog), Saregama (oldest catalog) that dominate Indian Music.

T-Series dominates with unmatched scale.

T-Series has 308 million YouTube subscribers. The last reported revenue a year back was about ₹3170 crores. The market leader with 35-40% market share.

T-Series strategy is completely opposite to TIPS. T-Series has a very aggressive strategy. It acquires 80% of almost all Bollywood’s new releases.

Tips has a more selective approach where it prioritizes quality over volume leading to higher Return on Capital.

Sony Music India leverages global backing.

Ranking second with 19-25% market share and ~₹1000 crore revenue, Sony focuses on digital-first releases and partnerships.

Its international distribution network and acquisition of catalogs like Think Music gives it pan-India reach

Sony’s approach differs from Tips’ pure-play music licensing model.

Zee Music commands YouTube’s third position.

With 112-121 million subscribers and 82 billion views. Zee leverages parent company Zee Entertainment’s media ecosystem.

However, they have had licensing disputes in the past including Spotify removing all Zee content in 2023 etc.

Saregama offers the deepest historical catalog.

With 130,000-160,000 songs spanning 120 years, it is India’s oldest label. It posted ₹1,171 crore revenue in FY25.

However, its ROCE of 17.2% trails Tips’ 70-80% due to diversification into Carvaan devices, Yoodlee Films and aggressive content investment of ₹1,000 crore through FY27.

Regional players capture niche dominance.

Speed Records leads Punjabi music with 46.3 million subscribers. Aditya Music controls Telugu soundtracks with 35 million subscribers.

These specialists demonstrate how focused strategies succeed. Similar to Tips’ concentrated Bollywood catalog.

But these regional players lack Tips’ profit margins and capital efficiency metrics.

Tips occupies the sweet spot. Pure-play music exposure with the highest capital efficiency.

Entry barriers protect all the above incumbents. Building a 30,000-song catalog would require 20-30 years of consistent acquisition. Copyright duration of 60+ years means today’s investments generate returns for generations. A new entrant would face at least 5 years of losses before achieving competitive scale.

Their Consistency Formula

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.