Things I read yesterday as part of my stock research activities.

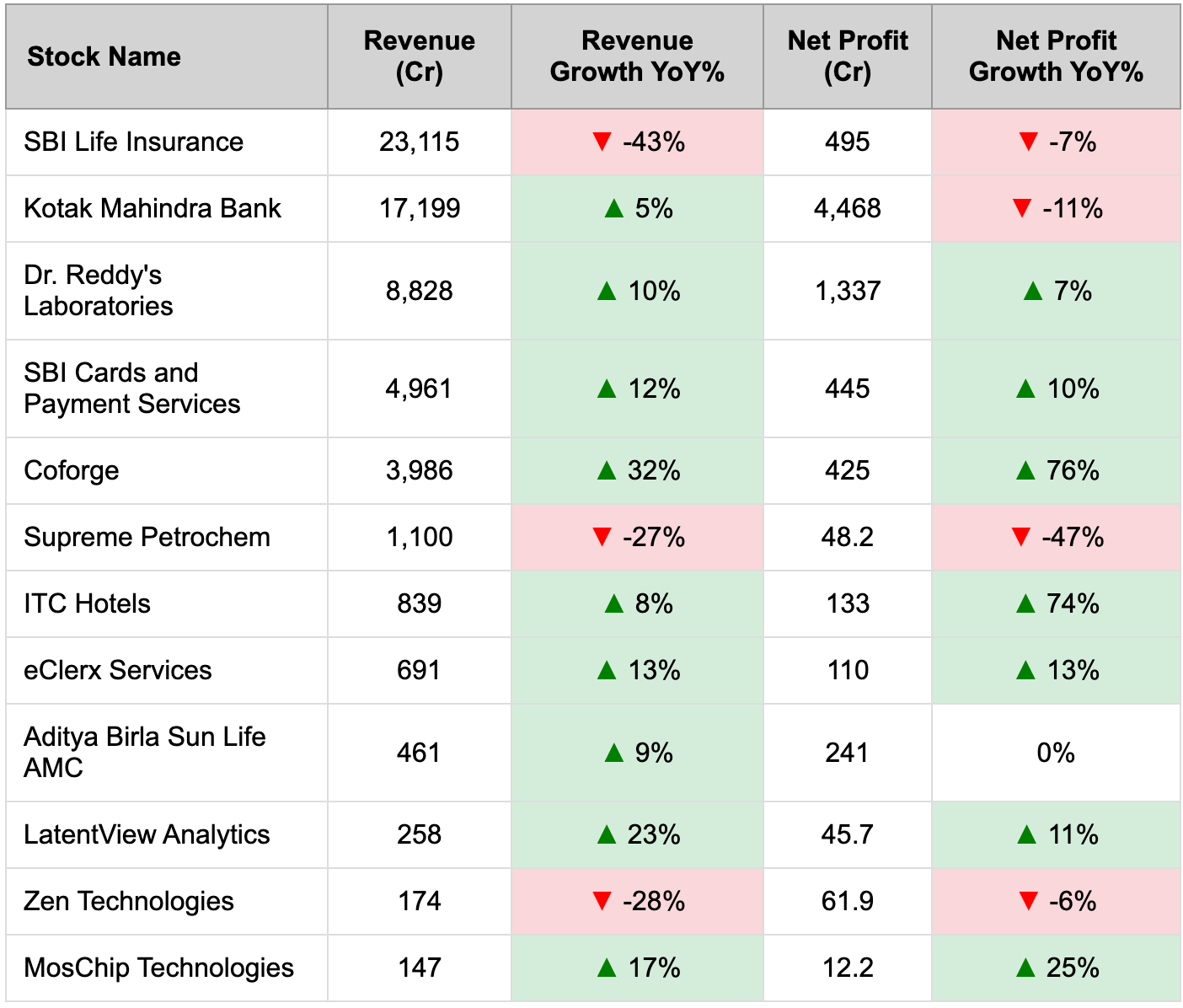

Q2 Company Results

New Orders Received

🟢 NCC won a ₹6,829 crore LoA from Central Coalfields for coal and overburden removal at Amrapali OCP, Jharkhand. The multi-year MDO contract strengthens NCC’s mining vertical.

🟢 Refex Industries Limited clinched major domestic contract worth ₹300 Cr for coal excavation and transportation in Jharkhand with 8-month execution period.

🟢 IRCON International’s JV with Finolex J-Power Systems bagged turnkey contract worth ₹168 Cr from MSETCL.

🟢 GPT Infraprojects bagged international contract worth ₹195 Cr for conveyor belt system in Ivory Coast boosting order book to ₹4,047.65 Cr.

🟢 Longi Green Energy signed agreement to source ₹7,000 Cr worth of solar modules from Inox Solar.

Core Business & Regulatory

🟢 Reliance is fast-tracking shipments of battery manufacturing equipment from China. New Chinese export controls effective November 8 will require licenses for certain lithium-battery technologies and graphite materials. Shipping early reduces the risk of delays to its gigafactory timeline.

🟢 Hyundai Motor India opened bookings for the all-new Venue ahead of November 4 launch.

🟢 ITC Hotels launched the premium Epiq Collection, targeting about 1,000 keys under the brand in the medium term.

🟢 Vakrangee subsidiary Vortex Engineering shipped 562 ATMs and won software orders from Africa, with reported revenue growth of 56.6%, indicating traction in cash-recycling ATMs and services.

🟢 Godrej Properties secured RERA approval for Phase 1 of Godrej Trilogy in Worli Mumbai featuring two towers with estimated gross revenue potential exceeding ₹10,000 Cr launching this quarter.

🟢 Arkade Developers acquired two new land parcels in Bhandup and Thane planning 7 major project launches next year with potential GDV over ₹8,000 Cr.

Partnerships & Acquisitions

🟢 Reliance Intelligence and Meta’s Facebook Overseas formed Reliance Enterprise Intelligence Ltd, a 70:30 JV with an initial ₹855 crore commitment, to build AI-based enterprise services for Indian clients.

🟢 Zydus Lifesciences completed acquisition of 100% of France-based Amplitude Surgical. The deal adds a European orthopedics platform and cross-selling potential.

🟢 LatentView deepened collaboration with Databricks as an Elite partner. Focus areas include GenAI integration, talent upskilling, APAC expansion, and marketing analytics built on Databricks’ Data Intelligence for Marketing.

Economy, Industries, IPO & Other

🟢 Karnataka cleared 11 investments including a Schneider Electric project worth ₹27,607 crore, spanning electronics, renewables, and manufacturing, with multi-district job creation potential.

🟢 CESL will open a mega tender on November 6 to procure 10,900 electric buses under the National Electric Bus Programme for Bengaluru, Delhi, Hyderabad, Ahmedabad, and Surat.

🟢 RBI data show Overseas Education remittances fell to an eight-year low in August, about 24% lower year on year, reflecting tighter visas and higher costs.

🟢 SBI plans to recruit roughly 3,500 officers in the next five months, aligning with a goal to lift women’s share of the workforce toward 30% over the medium term.

🟢 Apple in talks with Elon Musk’s SpaceX to integrate Starlink satellite service into future iPhones.

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.