Things I read yesterday as part of my stock research activities.

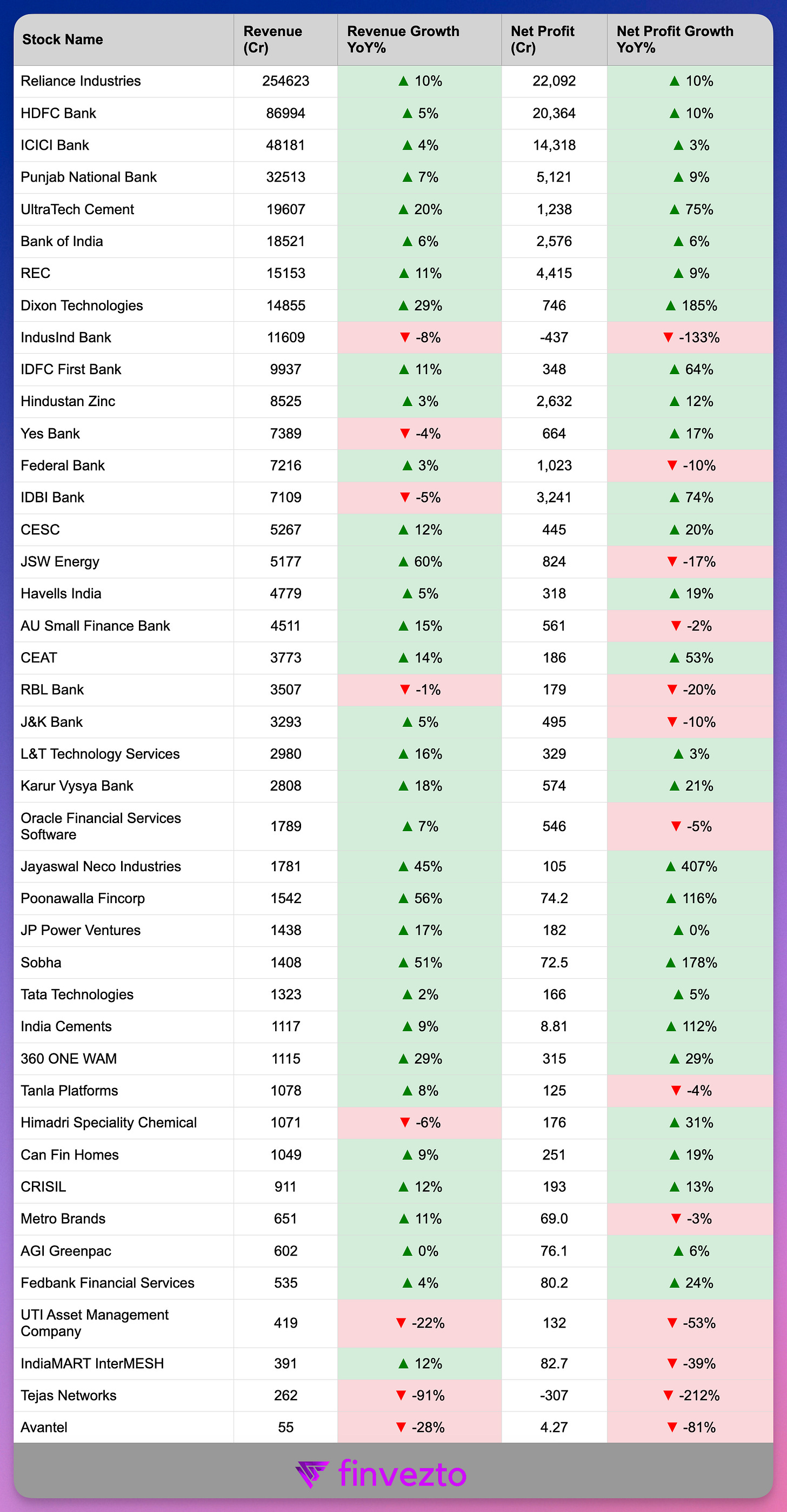

Quarterly Results

New Orders & Projects

🟢 L&T Technology Serv secured record $300 million large deals in AI/Gen AI and sustainability with 18% EBITDA growth.

🟢 Ircon International secured Rs 360 Cr order for civil works from Petronet LNG.

Partnerships & Acquisitions

🟢 Emirates NBD to acquire 60% stake in RBL Bank for Rs 26,853 Cr through primary infusion.

🟢 PTC Industries formed joint venture with Bharat Dynamics for advanced propulsion systems and guided bombs for missiles and UAVs.

🟢 Desco Infratech signed MOUs with KPI Green Hydrogen and Naveriya Gas for hydrogen-natural gas blending projects.

Core Business & Regulatory

🟢 Reliance Retail launched 600 dark stores across India for faster local deliveries.

🟢 UltraTech Cement plans Rs 10,255 Cr capex to expand capacity by 22.8 mtpa by FY28.

🟢 AU Small Finance Bank received RBI approval to transition to Universal Bank within 18 months.

🟢 Hindustan Aeronautics inaugurated third LCA Mk1A and second HTT-40 production lines at Nashik increasing annual capacity to 24 aircraft.

🟢 Alembic Pharma received USFDA approval for Triamcinolone Acetonide Injectable Suspension with $96 million market.

🟢 Manorama Industries raises FY26 guidance to Rs 1,150 Cr revenue on specialty fat demand and global expansion.

🟢 Gujarat Themis Biosyn expanded fermentation capacity from 450 KL to 990 KL at Vapi facility.

🟢 ACME Solar commissioned first phase of 100 MW wind project in Gujarat.

🔴 Glenmark and Dr. Reddys ordered by USFDA to recall products from U.S. market.

Economy, IPOs & Other

🟢 September auto sales hit record high due to festive demand and GST tax cuts.

🟢 India’s office vacancy fell to a 17‑quarter low of 15.7% in Q2FY26, led by strong Global Capability Centre expansion and record leasing in Bengaluru, Mumbai, and NCR.

🟢 India’s gold reserves crossed $100 billion for first time reaching $102.36 billion.

🔴 US senator warns of poor-quality drug imports from India and China calling for tougher FDA inspections.

🟢 Karnataka approved Bengaluru Business Corridor project to decongest traffic.

🟢 Meesho received SEBI approval for $800 million IPO.

🟢 Coca-Cola considering $1 billion IPO for Indian bottling unit.

🟢 House of Hiranandani to invest Rs 500 Cr for premium office tower in Andheri.

🟢 Toshiba to invest Rs 3,200 Cr to expand power transmission and distribution equipment business by FY27.

That’s all for today. Wishing you all a Happy Diwali:)

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Trading Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.