Things I read yesterday as part of my stock research activities.

New Orders Received

🟢 KEC International announces fresh orders worth ₹1,016 Cr across key transmission and distribution segments.

🟢 WPIL won a ₹426 Cr water works contract in South Africa, strengthening its international order book and execution visibility in African water infrastructure projects.

🟢 NBCC reports a new construction order of about ₹498 Cr from Damodar Valley Corporation in Jharkhand, adding to its government project pipeline.

🟢 IRB Infra has bagged a large NHAI project worth about ₹9,270 Cr, boosting future toll and construction revenue visibility.

🟢 Pace Digitek wins a significant energy sector contract worth about ₹930 Cr.

🟢 Saatvik Green secures a renewable energy contract worth about ₹178 Cr

🟢 Paras Defence and Space Technologies receives a ₹71.68 Cr order from IRDE DRDO for 2 optronic periscopes for submarine applications, with execution targeted in August to September 2026.

Core Business & Regulatory

🟢 Puravankara signs a lease agreement with IKEA for retail space at Purva Zentech Park in Bengaluru, anchoring a marquee global tenant for its commercial project.

🟢 Cyient introduces the ARKA GKT 1 chip, India’s first generation IP powered silicon designed with Azimuth AI for edge AI and smart energy applications, supporting semiconductor self reliance.

🟢 Jio Financial Services through the JioFinance app launches a new feature allowing users to link and analyse all bank accounts, mutual funds and stock portfolios in one consolidated dashboard.

🟢 Max Healthcare Institute outlines plans to add over 8,300 beds with about 4,800 beds in the next 3 to 4 years through brownfield, greenfield, asset light models and digital plus AI initiatives.

🟢 Tata Power commissions a 300 MW solar project in Bikaner, adding sizeable green generation capacity

🟢 PTC Industries announces expansion of its Gujarat facility, adding over 50,000 square feet of shop floor area to support future aerospace and defence casting demand.

Partnerships, Investments & Acquisitons

🟢 JSW Infra agrees to acquire a 51% stake in an Oman port special purpose vehicle and commits about $419 million for development, expanding its international ports portfolio.

🟢 HCLTech launches an innovation lab with Nvidia in Santa Clara focused on physical AI and cognitive robotics, aiming to co create advanced AI solutions for global enterprises.

🟢 AstraZeneca Pharma India partners with Sun Pharma to commercialise SZC for hyperkalaemia, to be marketed as Lokelma and Gimliand. AstraZeneca receives ₹26 Cr from Sun Pharma.

🟢 KPIT Technologies raises its stake to 90% in N Dream AG for €2.82 million, deepening its presence in automotive gaming and cockpit experience software.

🟢 Kings Infra signs an MoU with the Andhra Pradesh government to develop a ₹2,500 Cr Kings Maritime Aquaculture Technology Park over 500 acres.

Economy, Sectors & Other

🔴 Government restricts imports of precious metal jewellery until 30 April 2026, tightening controls that may pressure jewellery trade volumes in the near term.

🔴 Commerce ministry data show October gold imports surged to about $14.72 bn and silver imports to about $2.72 bn, sharply higher year on year and adding stress to external balances.

🔴 India trade data show October exports fell 11.8% to $34.38 bn while imports rose 16.63% to $76.06 bn, widening the monthly trade deficit to $41.68 bn and signalling external pressure.

🟢 Indian Railways allows premium single brand outlets such as McDonald’s and KFC at stations, opening regulated retail opportunities on railway premises.

🟢 Supreme Court suggests a phased ban on luxury petrol and diesel cars to accelerate electric vehicle adoption, hinting at future policy direction for auto and fuel markets.

🟢 CBDT indicates new income tax rules will be notified by year end or early next year, signalling an updated framework for taxpayers and advisors.

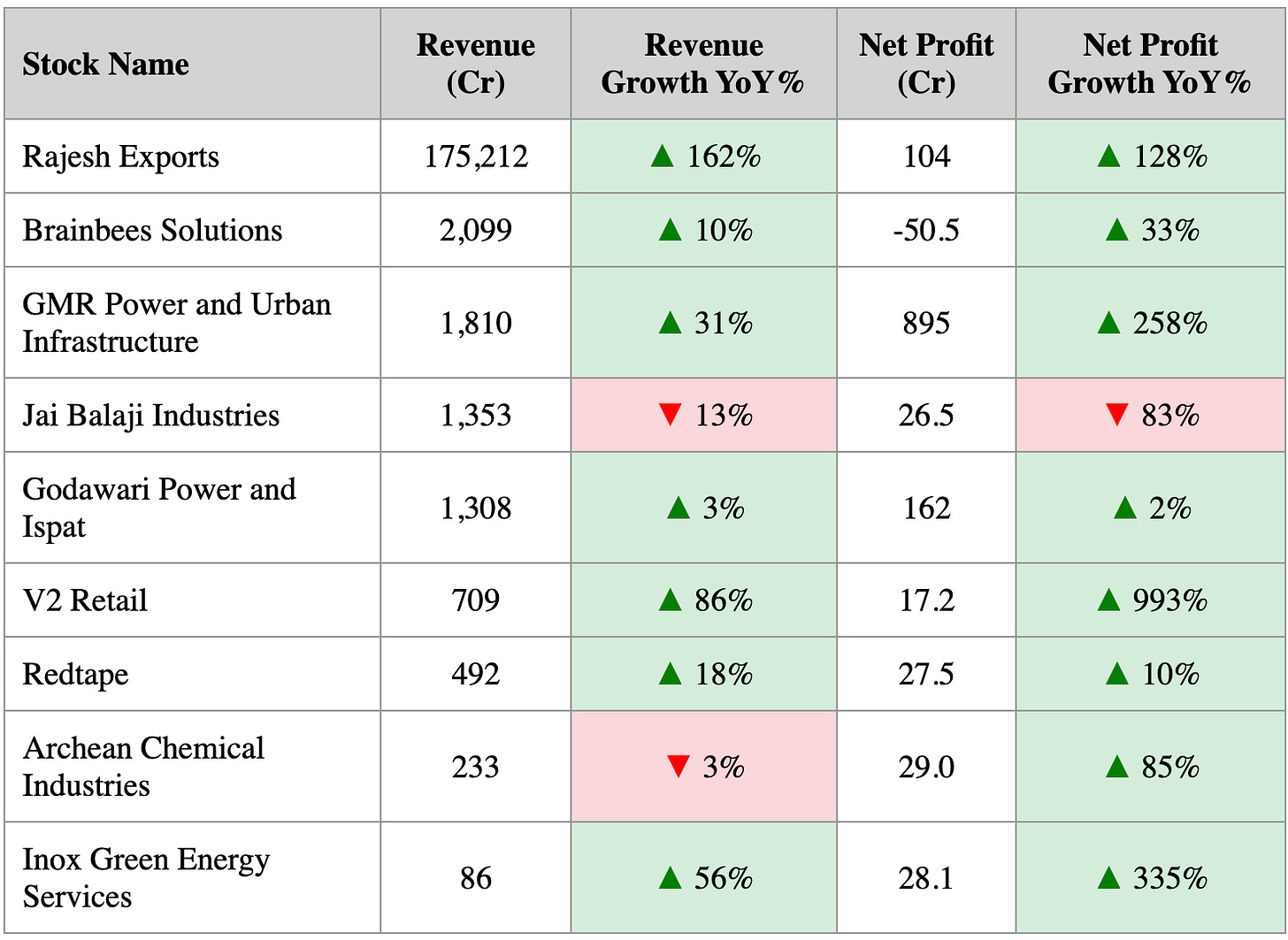

Company Results

Source: Company Filings, Finvezto Toolkit

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.