Things I read yesterday as part of my stock research activities.

New Orders Received

🟢 Tata Motors won its largest-ever Indonesia order to supply 70,000 commercial vehicles.

🟢 BHEL received a Letter of Acceptance from Bharat Coal Gasification and Chemicals Limited (BCGCL) for a ₹2,800 crore contract on the Syngas Purification Plant (LSTK 2 Package).

🟢 Subex secured a $1.25M, 3-year Business Assurance contract from a Tier-1 Middle East telecom operator. It involves deploying its platform for revenue protection, risk management, and operational transparency.

🟢 SEPC secured a ₹314 Cr order from Telecommunications Consultants India.

Partnerships, Investments & Acquisitions

🟢 Reliance Consumer Products Ltd (RCPL), RIL’s FMCG arm, acquired 100% of Tamil Nadu-based Southern Health Foods Pvt Ltd (Manna brand) for ₹156.42 Cr. This bolsters RCPL’s millet-based health foods portfolio alongside Udhaiyam and Independence brands.

🟢 Carlyle will acquire a majority stake in Edelweiss home finance arm Nido for ₹2,100 Cr. Another large private equity bet on Indian housing finance.

Core Business & Regulatory

🔴 Vodafone Idea lost 940,731 wireless subscribers in Dec 2025 per TRAI data. Airtel gained 5.43M and Jio added 2.96M. Wireless base hit 1,258.77M (0.66% MoM growth).

🟢 Vedanta Aluminium increased billet production capacity to 830,000 tonnes per annum, supporting downstream demand.

🟢 Hexaware launched “Zero License,” an agentic AI solution that replaces traditional SaaS systems in months, slashing enterprise licensing costs and manual migration efforts for faster ROI.

🟢 Aurionpro Solutions launched the AurionAi platform and cited major banking wins in Singapore and India.

🟢 Tata Technologies said its WATTSync platform is ready for India’s Battery Aadhaar norms and aligned with EU rules.

Economy, IPO & Other

🔴 Government plans to divest up to 5% stake (17.41 Cr shares) in BHEL via OFS at floor price ₹254/share (~8% discount to CMP ₹276). Opens Wednesday for non-retail, Thursday for retail.

🔴 US-Bangladesh trade pact sets reciprocal tariffs at 19% (vs India’s 18%), but grants quota-based zero tariffs on Bangladesh’s textiles/apparel using US cotton inputs. This may erode India’s edge in US apparel market.

🔴 RBI proposed stringent draft guidelines for de-registration of Type-1 NBFCs, It raises compliance burden and tightens exit pathways for smaller NBFCs.

🔴 Indian solar supply chains face pressure as surging prices of Chinese solar cells disrupt economics.

🟢 NPCI/RuPay got a boost. RuPay On-The-Go cards are now accepted across Pune Metro for daily-use transit payments.

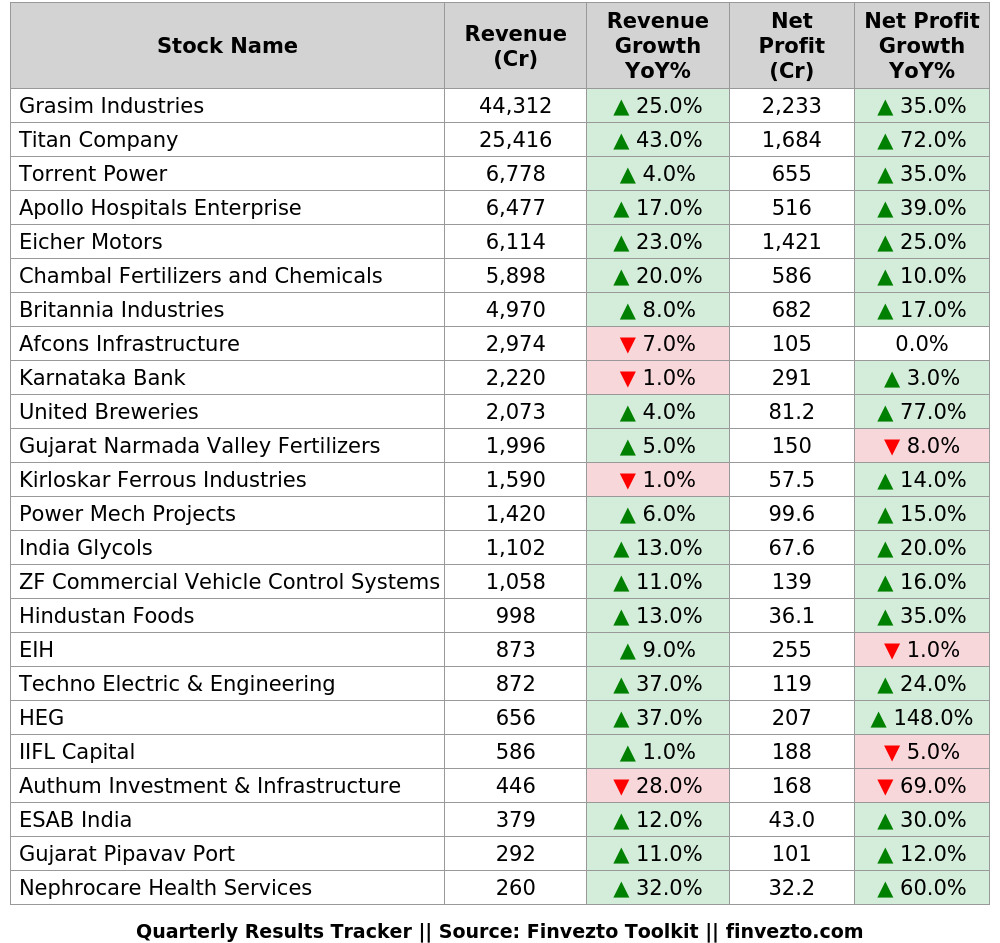

Quarterly Results

That’s it for today.

FINVEZTO.COM | Build Wealth. With Clarity.

We give you a proven system to build a resilient portfolio that works across market cycles, your lifetime & beyond. Make your wealth flexible. Learn more about the system at finvezto.com

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.