Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they are able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Today, we will look at the key fundamentals & business of SKIPPER Ltd

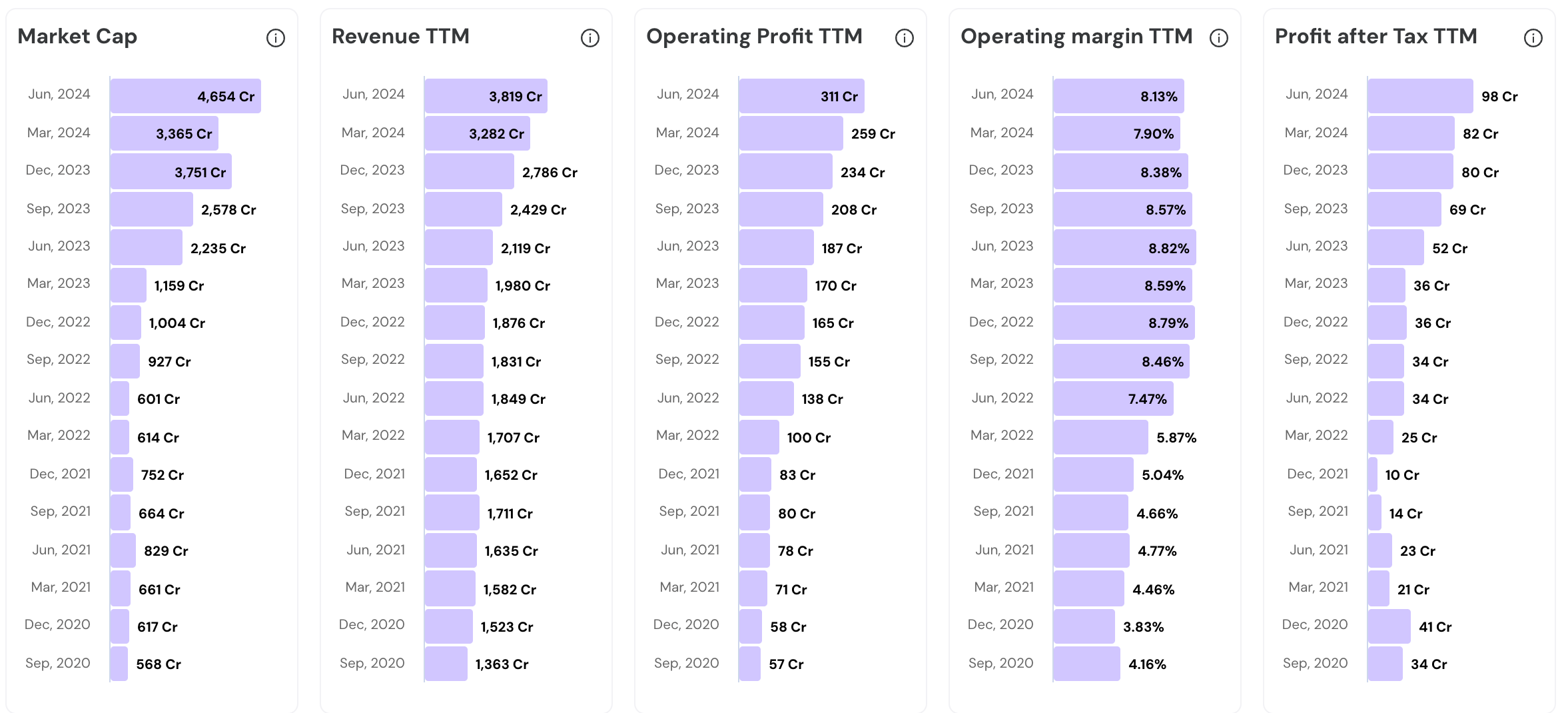

Increasing Revenue, Operating Profit and Net Profit along with steady Operating Margins. How has SKIPPER been able to perform consistently?

Let us explore.

The Keys to Consistency

Overview & Business Model

Founded in 1981, Skipper Limited is a manufacturer of power Transmission & Distribution (T&D) structures, Polymer pipes and fittings.

The company stands out as the world’s only integrated T&D player, covering the entire value chain from steel rolling to full EPC (Engineering, Procurement & Construction) of transmission lines .

Skipper operates through three key segments

Engineering (~70% of revenue )

Infrastructure (turnkey T&D and telecom projects) and

Polymers (PVC/CPVC pipes and fittings).

The engineering segment manufactures transmission towers, distribution poles, telecom towers, railway electrification structures etc.

Polymer division offers a wide range of pipes, tanks, and fittings for plumbing, agriculture, sewage etc.

This broad product portfolio and integration allow Skipper to serve diverse sectors and markets (power, telecom, railways, water, etc.) across 65+ countries, with exports accounting for ~17% of revenue.

Favourable Industry Tailwinds

Skipper is riding a multiyear infrastructure boom, especially in the power sector. The Indian government has committed over ₹9.15 trillion (≈$110 billion) to upgrade and expand the power grid.

With electricity demand surging (projected to reach 458 GW by 2032 ) and an ambitious target to integrate 500 GW of renewables by 2030 into the grid , there is a massive ongoing investment in new transmission lines and substations.

This macro push directly fuels demand for T&D equipment like Skipper’s towers and poles, creating a strong tailwind for the company’s engineering segment.

Beyond power, other sectors are also contributing tailwinds. Indian Railways is moving towards 100% electrification of its broad-gauge network which requires thousands of miles of catenary structures and poles (many supplied by Skipper).

Also, the rollout of 5G telecom networks is driving demand for telecom towers and fiber infrastructure nationwide. Skipper, being a supplier of telecom towers and related EPC services, benefits from this communications infrastructure upgrade.

Government programs in water and urban infrastructure are another tailwind. The Jal Jeevan Mission, which aims to provide piped drinking water to every rural household, is boosting demand for PVC pipes and fittings.

Urban infrastructure initiatives (smart cities, sewage systems, etc.) are expanding the market for polymer products. These policies ensure that Skipper’s polymer business has a strong domestic demand pipeline parallel to its industrial T&D business.

On the global front, aging electrical grids are being upgraded and renewable energy projects are driving new transmission investments . Skipper’s experience in the T&D space positions it to capture some of this international opportunity.

The company’s consistent performance is in part a reflection of being in the right sectors at the right time. Sectors that enjoy strong policy support and secular growth.

Multi-Segment Diversification &Growth

Skipper has grown by firing on multiple cylinders across its segments. The core Engineering segment continues to be the primary revenue driver, but the Polymer division has been growing at ~30% YoY.

Skipper is actively scaling up its polymer segment, which caters to plumbing, irrigation, and agriculture markets. Management has outlined plans for the polymer business to reach ₹1,000 crore in annual revenue within the next three years.

Skipper is also expanding its product range (e.g., recently adding gas pipeline-capable MDPE pipes to its portfolio ) and deepening its distribution network in retail markets. It is aimed at capturing rising demand from housing and irrigation schemes, which adds another pillar to Skipper’s growth.

While smaller in contribution, the Infrastructure segment (EPC projects) has shown the capacity for explosive growth. In FY25, Skipper’s infrastructure EPC revenue shot up to ₹598 crore, a 1085% YoY increase (from a low base) as the company executed several high-value power transmission projects. This shows how Skipper can leverage its engineering expertise in turnkey projects when the market is favorable.

Such parallel growth in separate segments helps stabilize overall performance.

Synergies between Segments

Skipper’s segments don’t just operate in parallel, they reinforce each other.

A clear example is the integration between its manufacturing and EPC arms. About 65–70% of the raw materials required for Skipper’s EPC projects are supplied by its own engineering manufacturing units.

This internal sourcing means that when the company wins an EPC contract, its factories get additional orders, and it captures value at both manufacturing and construction stages.

Similarly, success in the engineering segment (e.g., being a top tower supplier) can lead to EPC opportunities, and vice versa.

Even on the polymer side, the brand presence and distribution network in pipes benefit from the credibility and financial strength earned in the infrastructure business.

This interlinked, synergistic operation of segments amplifies overall performance and has been a factor in Skipper’s consistent growth.

Global Expansion and Export Growth

Skipper has significantly expanded its global footprint in recent years, which has contributed to its growth consistency.

The company now exports to over 60 countries, supplying clients across Africa, the Middle East, South & Southeast Asia, Europe, Australia, and America.

Exports account for roughly ~17% of Skipper’s revenue, and management is actively pushing to increase this to ~25% over the long term by penetrating deeper into developed markets like the United States and Europe.

The focus on exports is visibly paying off. In Q1 FY25, the company’s export revenue nearly doubled to ₹251 Cr from ₹127.4 Cr in the same quarter of the previous year. Overall export order inflows have also accelerated substantially over the past three years.

Notably, SKIPPER became the first Indian manufacturer to design and deliver certain high-spec transmission monopole towers to the North American market.

The global T&D infrastructure is expected to reach ~$432 billion by 2030 , driven by renewable energy rollouts and grid upgrades worldwide. Skipper’s presence in multiple regions means it can participate in this global growth.

Vertical Integration and Operational Excellence

Another core strength enabling Skipper’s consistent growth is its vertically integrated operational model.

Skipper is the only player present across the entire T&D value chain globally, with capabilities ranging from manufacturing key components (like angles and towers) to executing complete EPC projects.

It has its own steel rolling mills, fabrication units, galvanization plants, and even an in-house tower testing station. This end-to-end control allows Skipper to ensure strict quality control and timely delivery at each step, which has made its offerings highly reliable.

Skipper has one of India’s largest Tower & Monopole Load Testing Stations, capable of testing towers up to 1,200 kV and 120m height. Having such an advanced testing facility in-house means the company can design and certify new tower structures quickly to meet client needs, without relying on external parties.

The company has strategically backward-integrated critical parts of its manufacturing. For example, Skipper operates its own hot-rolling mills to produce steel angles used in tower manufacturing . By doing so, it retains the conversion margin in-house that would otherwise go to steel suppliers, thus improving its cost structure.

Moreover, because it rolls its own steel sections, Skipper can customize the length and specifications of materials to exactly suit each project’s requirements. This not only reduces waste and inventory costs but also gives Skipper greater supply chain control.

The tight grip over its supply chain and costs helps the company avoid margin erosion. Over a multi-year span, the firm has managed to keep operating margins in a healthy range (~8-9%) while scaling up its top line.

This consistency in margins indicates that growth is coming through efficient execution and cost management, not by sacrificing profitability. A sign of operational excellence.

Strong Customer Relationships & Network

Over its four-decade history, Skipper has built a strong brand reputation in its sectors, which translates into deep customer relationships.

The company’s client list includes major players like Power Grid Corporation of India, Reliance Jio, Tata Projects, and various state electricity boards .

These blue-chip customers often have rigorous vendor selection processes, and Skipper’s inclusion as a supplier attests to its credibility.

In FY25, for instance, Power Grid (PGCIL) selected Skipper as a preferred supplier and contractor for its highest-voltage transmission projects . Skipper subsequently secured key orders such as the 800 kV Khavda HVDC line and multiple 765 kV/400 kV transmission line projects, which are marquee developments in India’s grid expansion.

Globally, Skipper has also been nurturing strong relationships, leading to repeat orders from foreign utilities. A recent highlight was winning a landmark contract from the Middle East’s largest power utility to design and test transmission towers.

In the polymer segment, Skipper has also established a widespread market presence with a 20,000+ retailer distribution network in eastern India , indicating its brand strength among channel partners and end-users.

Consistency Formula & Strategy

Skipper has several paths that help with consistent growth. I have summarized some of them below.

In-house Capabilities and Vertical integration → Faster execution and on-time delivery → Tight Quality Controls → Competitive pricing with reliability → Repeat orders and preferred partner status → Win complex and time-critical projects → Record order book and bid pipeline → Multi-year visibility → Consistency

Policy tailwinds and sector capex → Robust tendering and wins → High quality backlog across geographies → Predictable revenue conversion → Consistency

Engineering scale and EPC know-how → Internal sourcing for EPC jobs → Dual capture of manufacturing and project value → Higher throughput and learning effects → Stronger bids and margins on the next cycle → Consistency

North America and Middle East wins → Credibility in developed standards → Access to larger RFQs and repeat utilities → Diversified currency and demand base → Reduced domestic cyclicality → Consistency

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.