Shaily Engineering Plastics || Consistently Performing Stocks #42

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they were able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Today, we will look at the key fundamentals & business of Shaily Engineering Plastics

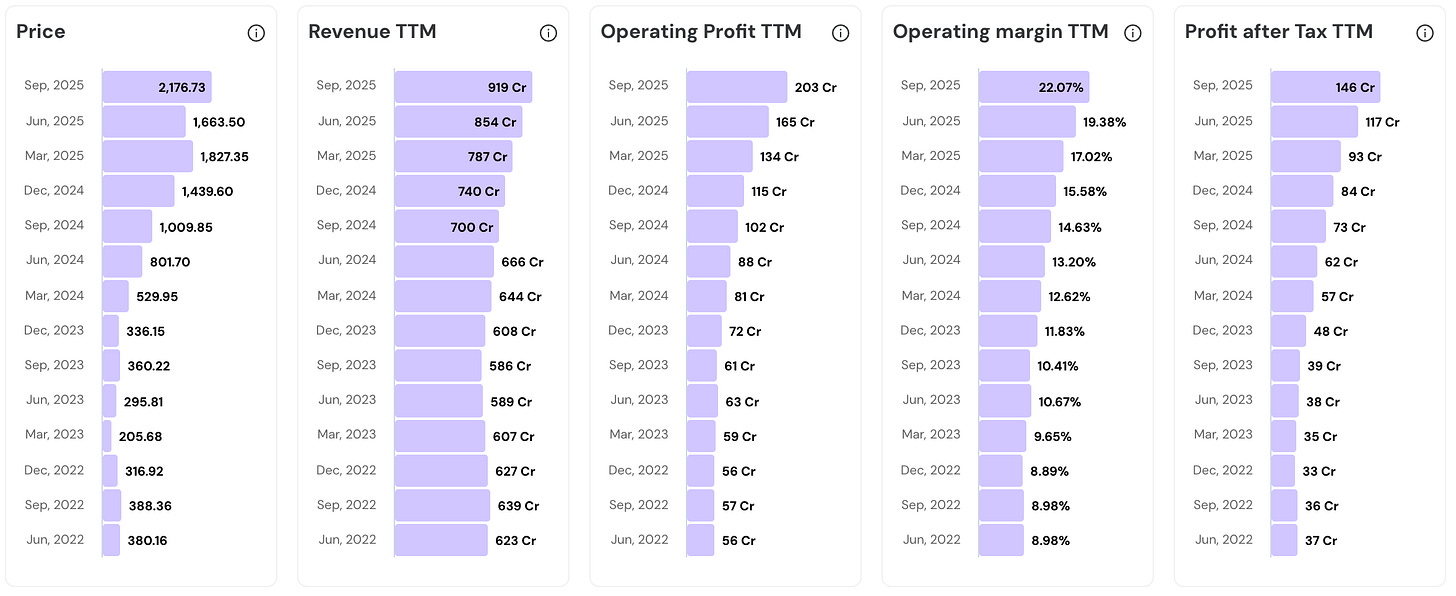

Since June 2022…

Stock price has surged 5.7x.

Revenue has grown at 1.5X (Modest Growth, but consistent).

Operating Profits and Net Profits have surged 4x.

Massive margin expansion (9% to 22%).

How did SHAILY achieve this? Let us explore.

Their Road to Consistency

Contents

Overview & Business Model

Strong Relationships & Love Story with IKEA

Contract Manufacturer to IP-Led Platform (C-to-IP)

Tailwinds

Global Niche & Leadership

Capacity built ahead of the curve

Export Excellence

The Bold Bet & Strategic Discipline

Consistency Strategy

1. Overview & Business Model

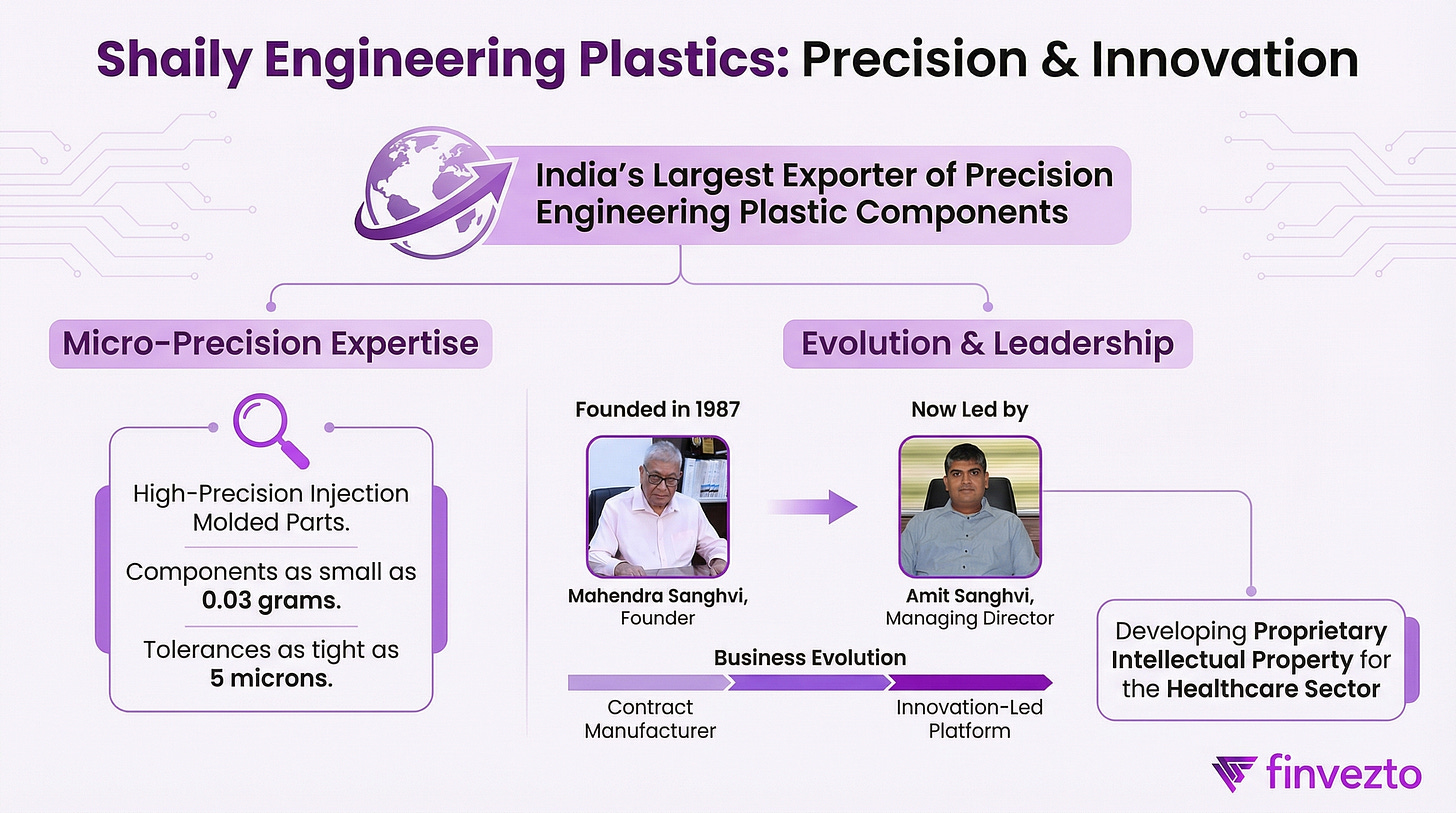

1.a. About SHAILY

1.b. Revenue Mix

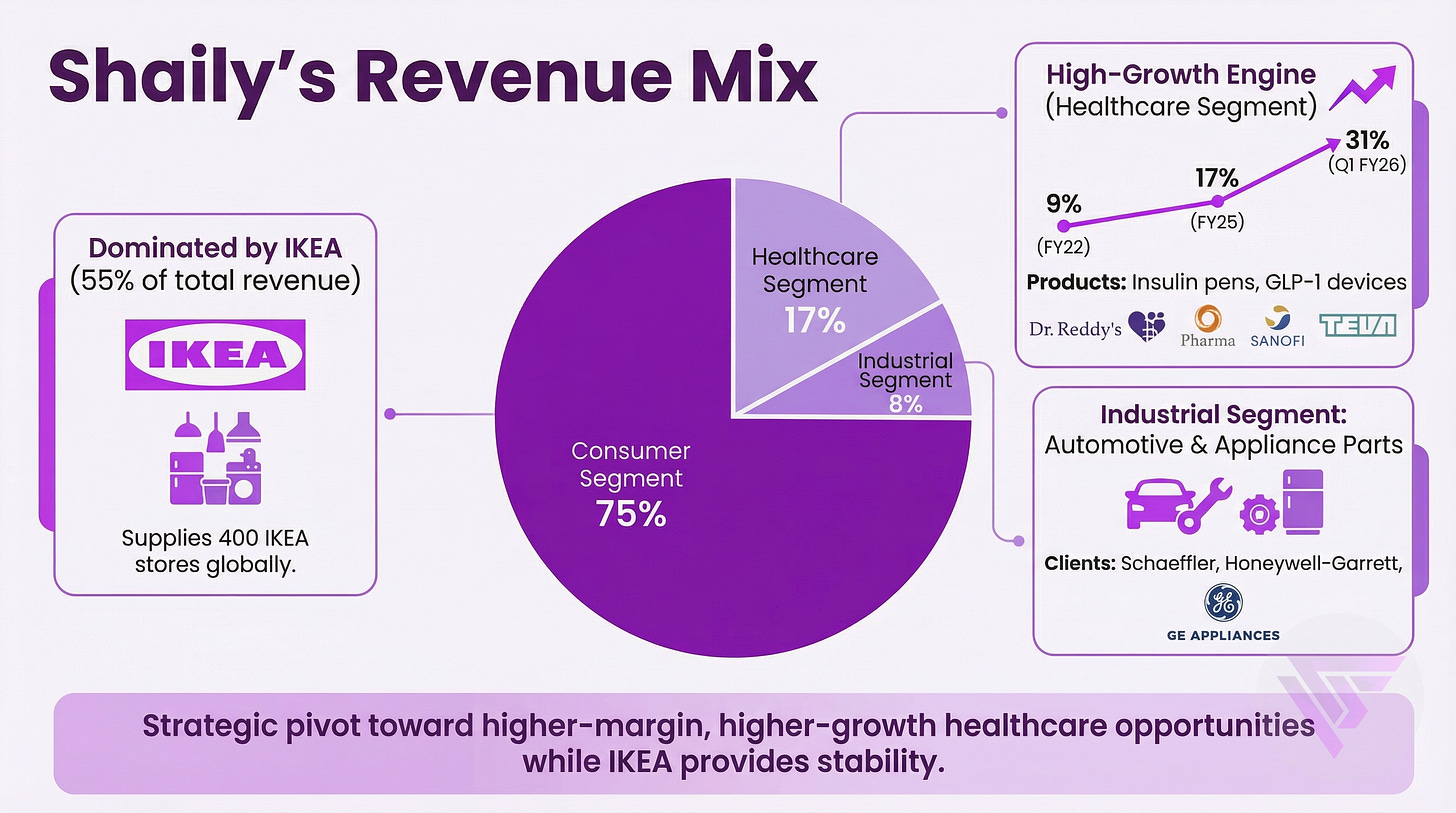

Revenue comes from 3 segments - Consumer, Healthcare and Industrial.

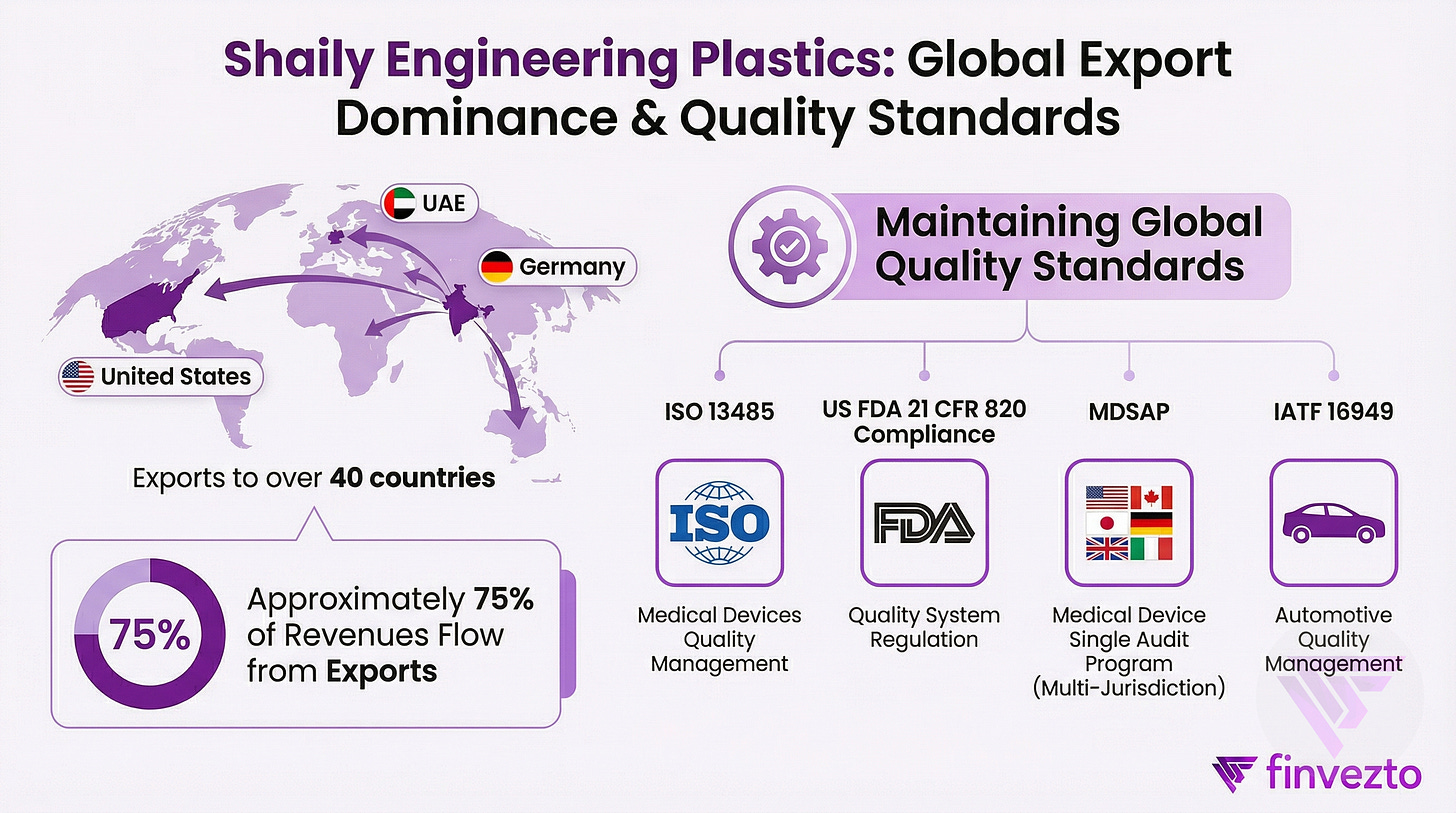

1.c. Location Mix & Global Standards

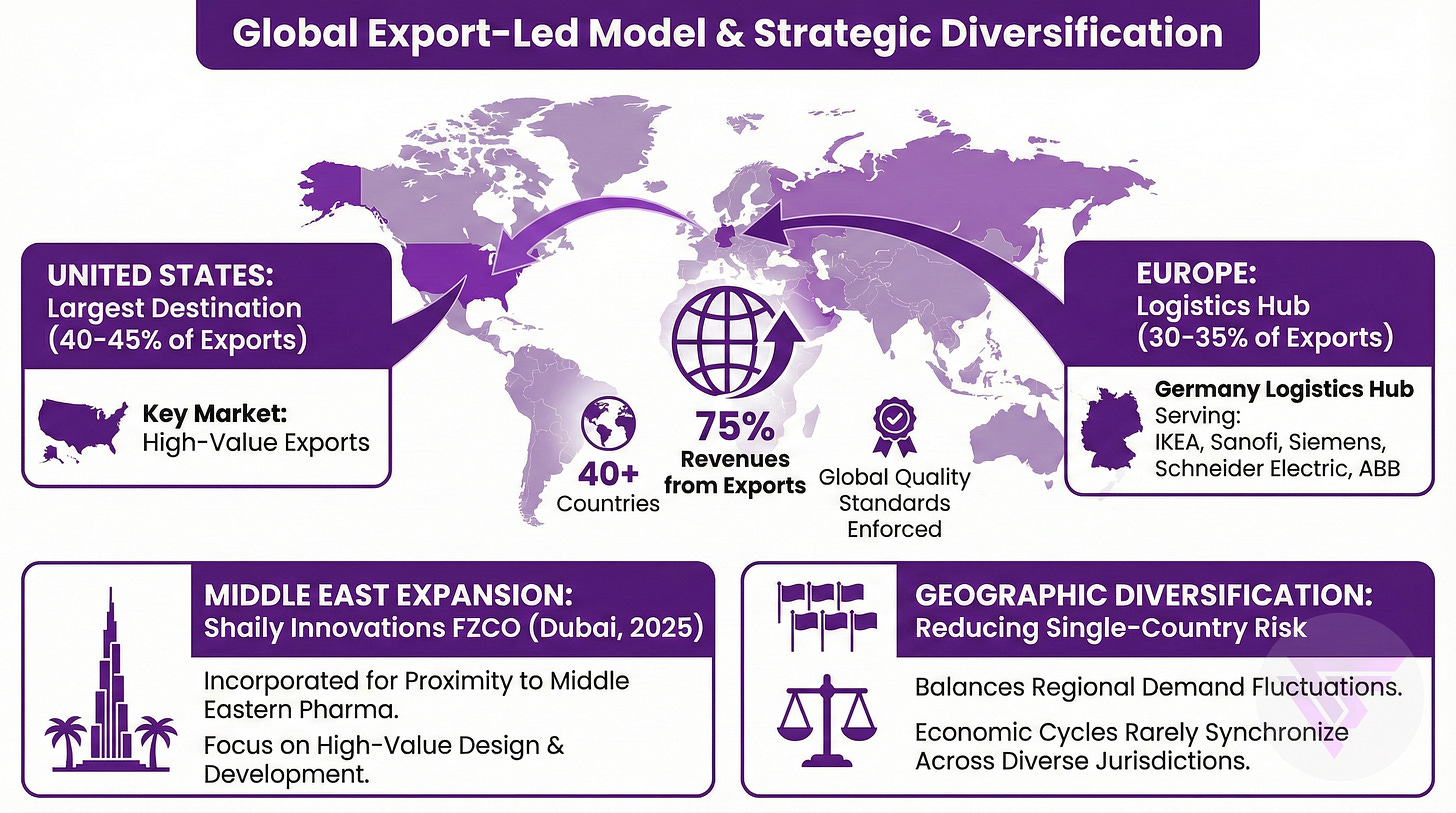

Exports constitute 75% of revenues. USA, UAE and Germany are the top 3 markets.

2. Strong Relationships

2.a. Their love story with IKEA

In 2025, Shaily won business from two additional global retail chains (excluding IKEA) in the home furnishing segment, with commercial supplies expected to begin in Q1 and Q2 of FY2026.

This represents a critical milestone in diversifying beyond IKEA concentration. An attempt to broaden the customer base.

The new retail clients validate that Shaily’s precision manufacturing and other capabilities built through the IKEA relationship are transferable to other Global retailers as well.

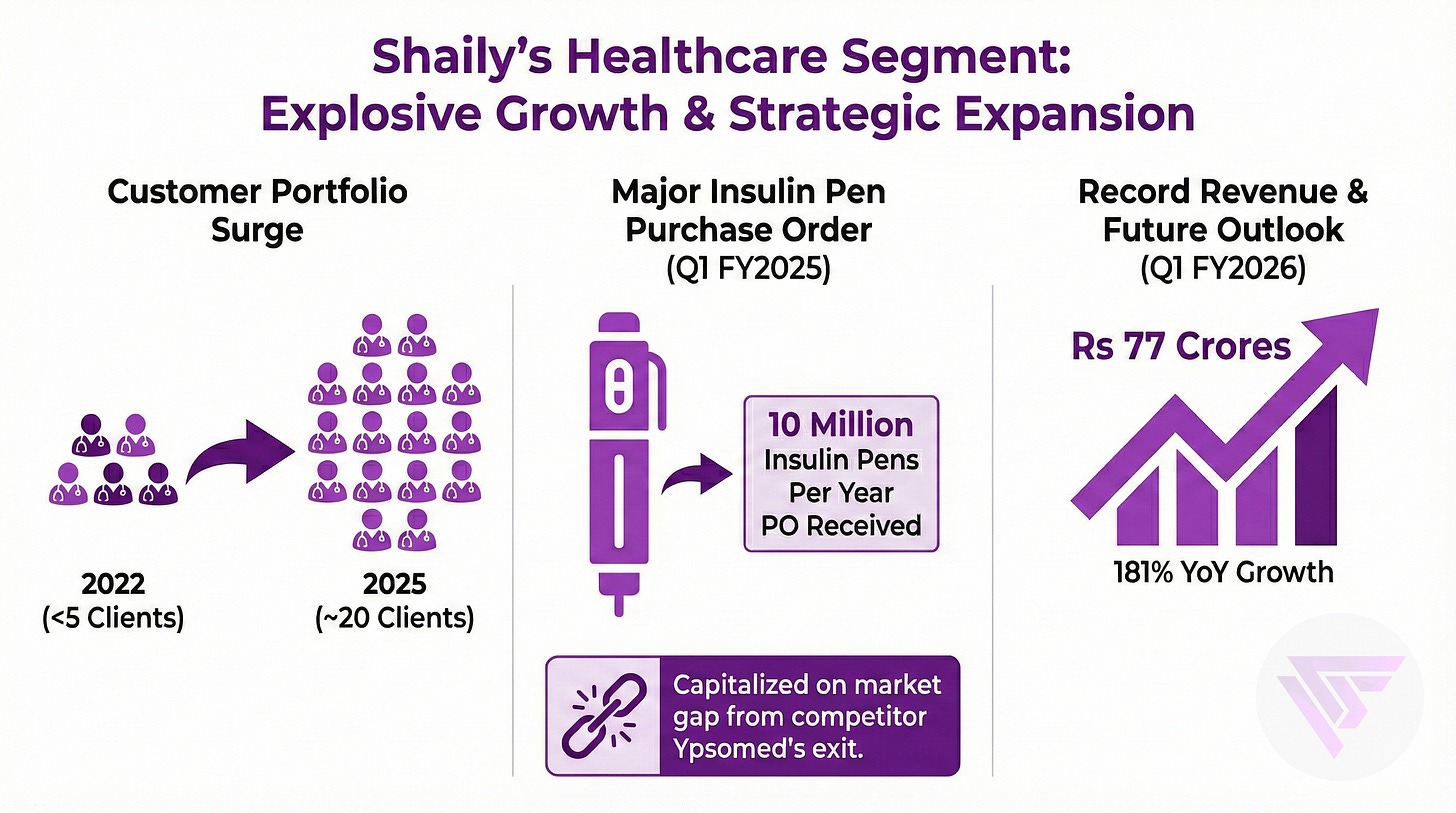

2.b. New relationships in the Healthcare segment

Customer stickiness in the healthcare segment operates through a fundamentally different mechanism than in consumer or industrial businesses.

Once a pharmaceutical company selects Shaily’s device platform and conducts human factors studies, the device specifications get embedded in regulatory filings submitted to agencies like the US FDA.

Changing the device manufacturer after regulatory approval requires repeating expensive clinical studies, resubmitting applications, and waiting months or years for reapproval.

Pharma Clients start losing time to market and incur costs that can exceed millions of dollars.

This regulatory lock-in means that Shaily effectively secures a 5 to 10 year revenue stream if the drug receives approval.

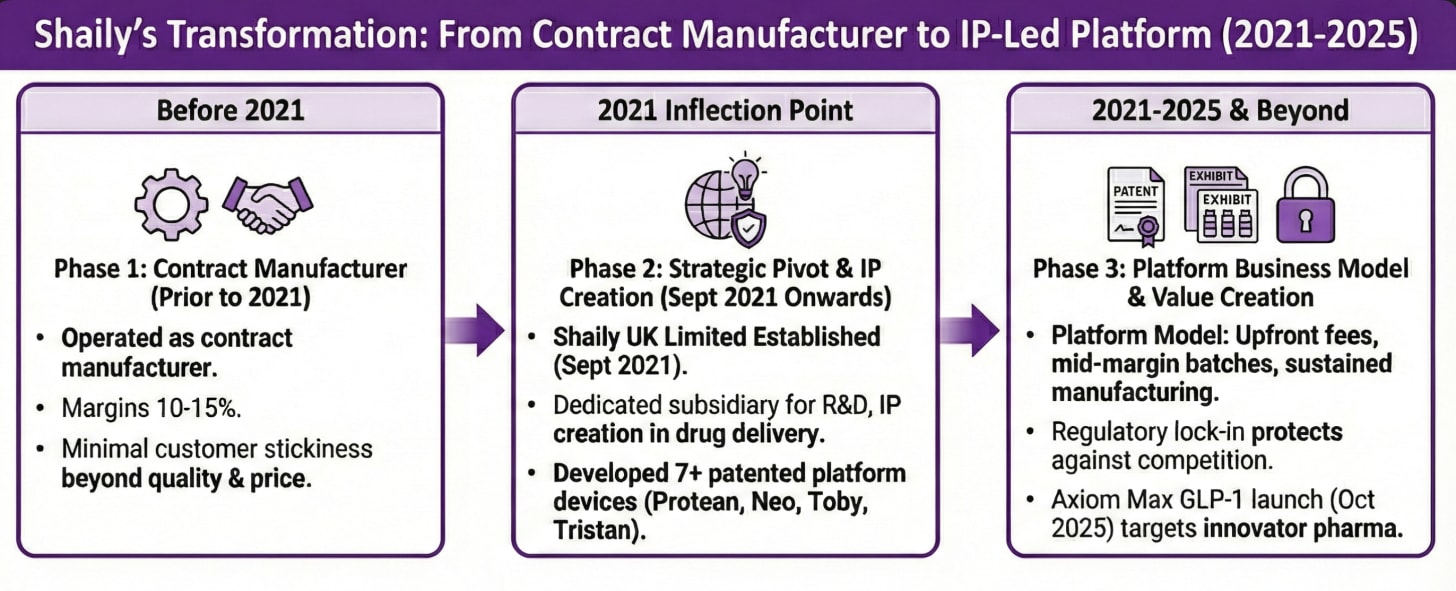

3. Contract Manufacturer to IP-Led Platform (C-to-IP)

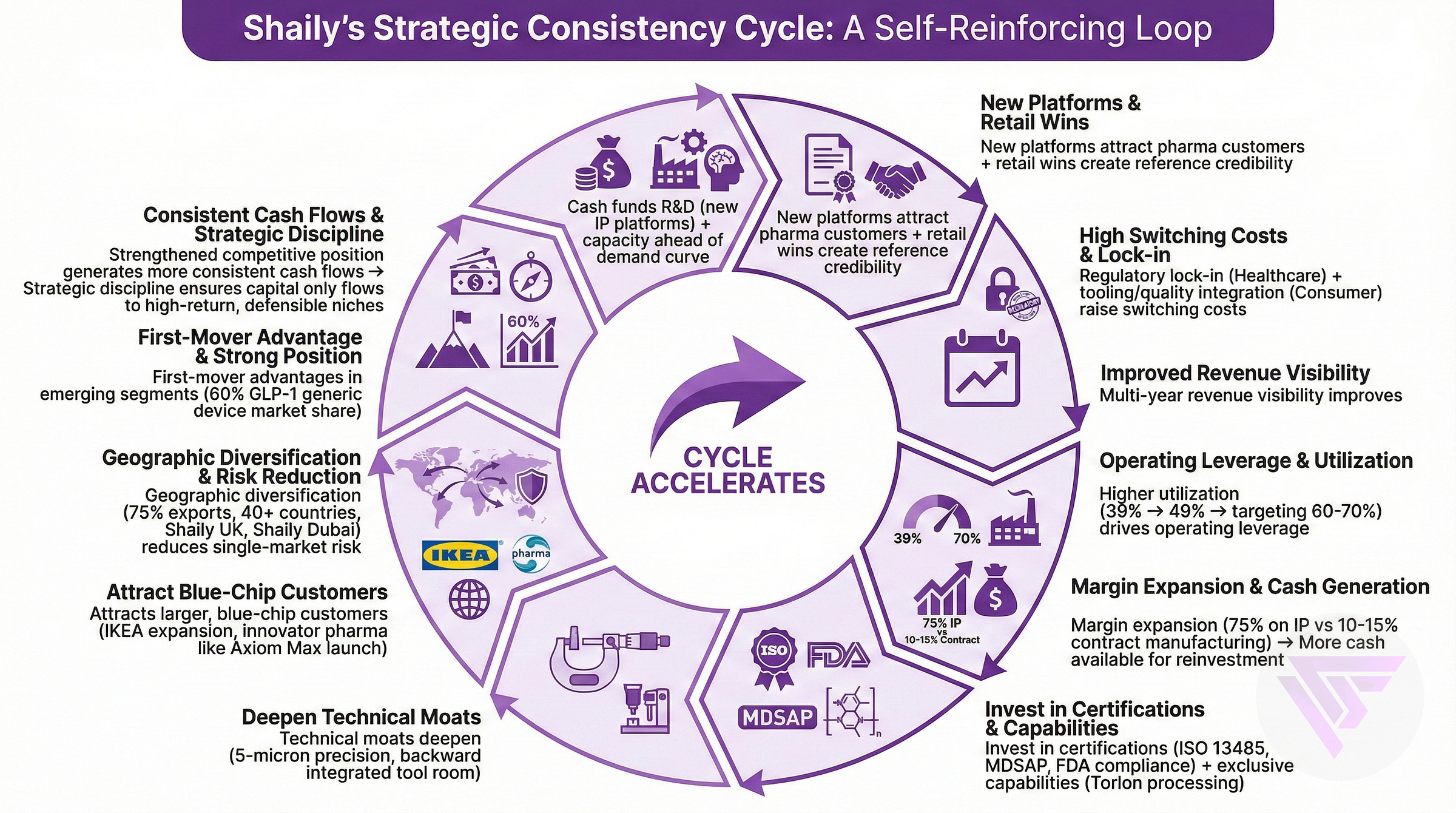

Prior to 2021, Shaily operated as a contract manufacturer earning 10-15% margins with minimal customer stickiness.

Shaily UK Limited establishment in September 2021 marked the inflection point.

Shaily created a dedicated subsidiary for research, development, and intellectual property creation in drug delivery.

The subsidiary developed seven distinct patented platform devices between 2021 and 2024, including Protean for insulin, Neo for GLP-1, and auto-injector platforms Toby and Tristan.

The platform business model generates upfront development fees, mid-margin exhibit batch revenues, then sustained manufacturing contracts with regulatory lock-in protecting against competition.

Shaily UK reported Rs 28 crores revenue with Rs 21 crores PAT in FY2024, achieving remarkable 75% margins enabled by R&D tax credits and IP licensing value.

Axiom Max GLP-1 device launch in October 2025 at CPHI Frankfurt targeted large innovator pharmaceutical companies, signaling ambition to move upstream from generic manufacturers.

4. Tailwinds

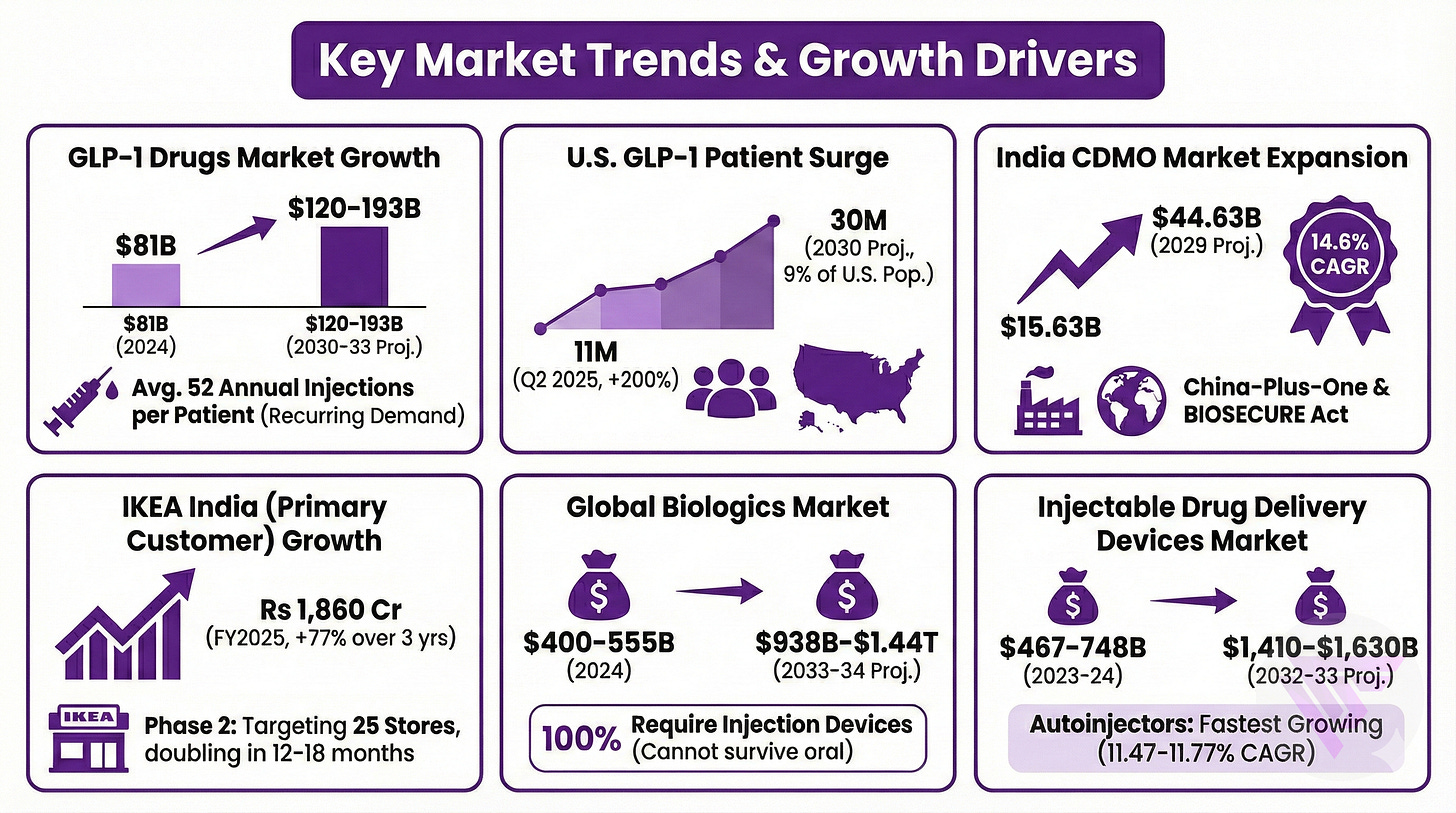

Numbers in Shaily’s favour…

GLP-1 drugs market generated combined $81 billion in 2024 sales, projected to exceed $120-193 billion by 2030-33. With every patient requiring 52 annual injections on average creates recurring demand.

U.S. market reached 11 million GLP-1 patients in Q2 2025, up 200% in 12 months, with projections reaching 30 million by 2030 representing 9% of U.S. population.

India CDMO market is projected to expand from $15.63 billion to $44.63 billion by 2029 at 14.6% CAGR, driven by China-plus-one diversification and BIOSECURE Act implications.

IKEA India (Primary Customer) revenues grew 77% over three years to Rs 1,860 crores in FY2025, with Phase 2 expansion targeting 25 stores initially then doubling count over 12-18 months.

Global biologics market reached $400-555 billion in 2024, projected to grow to $938 billion-$1.44 trillion by 2033-34, with 100% requiring injection devices since molecules cannot survive oral administration.

Injectable drug delivery devices market reached $467-748 billion in 2023-24, growing to projected $1,410-$1,630 billion by 2032-33, with autoinjectors representing fastest growing segment at 11.47% CAGR.

5. Global Niche & Leadership

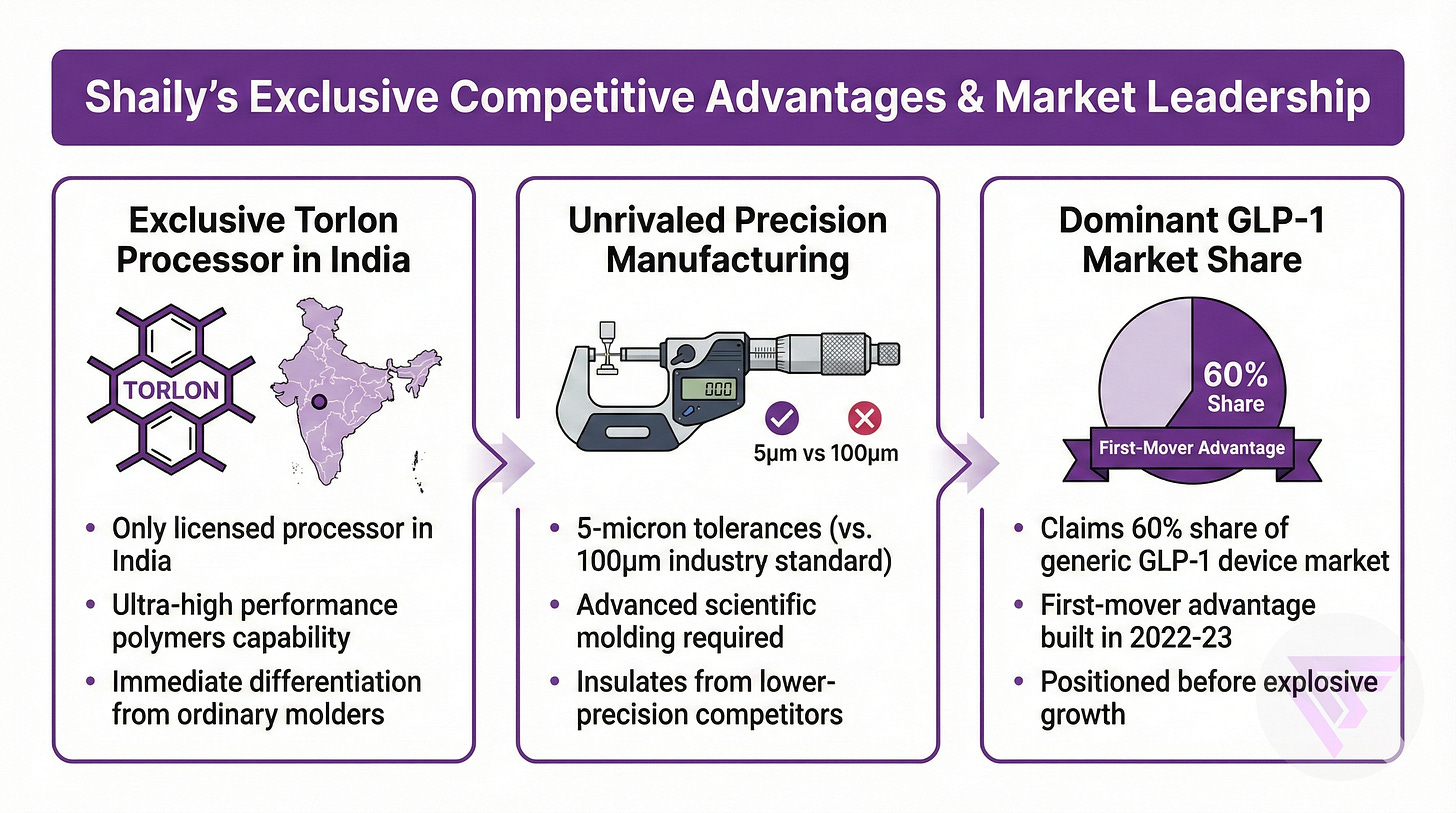

Shaily is the only licensed Torlon processor in India.

This provides exclusive capability in ultra-high performance polymers that immediately differentiates from ordinary injection molders.

Manufacturing with 5-micron tolerances versus industry standard 100 microns requires advanced scientific molding, insulating Shaily from Chinese competitors who cannot demonstrate equivalent precision as of now.

Certifications cascade to reinforce positioning: ISO 13485 for medical devices, MDSAP for multi-jurisdiction access, US FDA compliance, and IATF 16949 for automotive quality.

Western pharmaceutical companies increasingly view China as supply chain security risk. Due to several reasons such as geopolitical tensions, IP concerns, and US BIOSECURE Act etc. This favours Indian firms.

Also, India’s recognition as the world’s pharmacy with 100 US FDA-approved plants versus China’s 28 provide ecosystem advantages that amplify Shaily’s competitive position globally.

Shaily claims 60% market share of generic GLP-1 device market, a first-mover advantage built through positioning during 2022-23.

6. Capacity built ahead of the curve

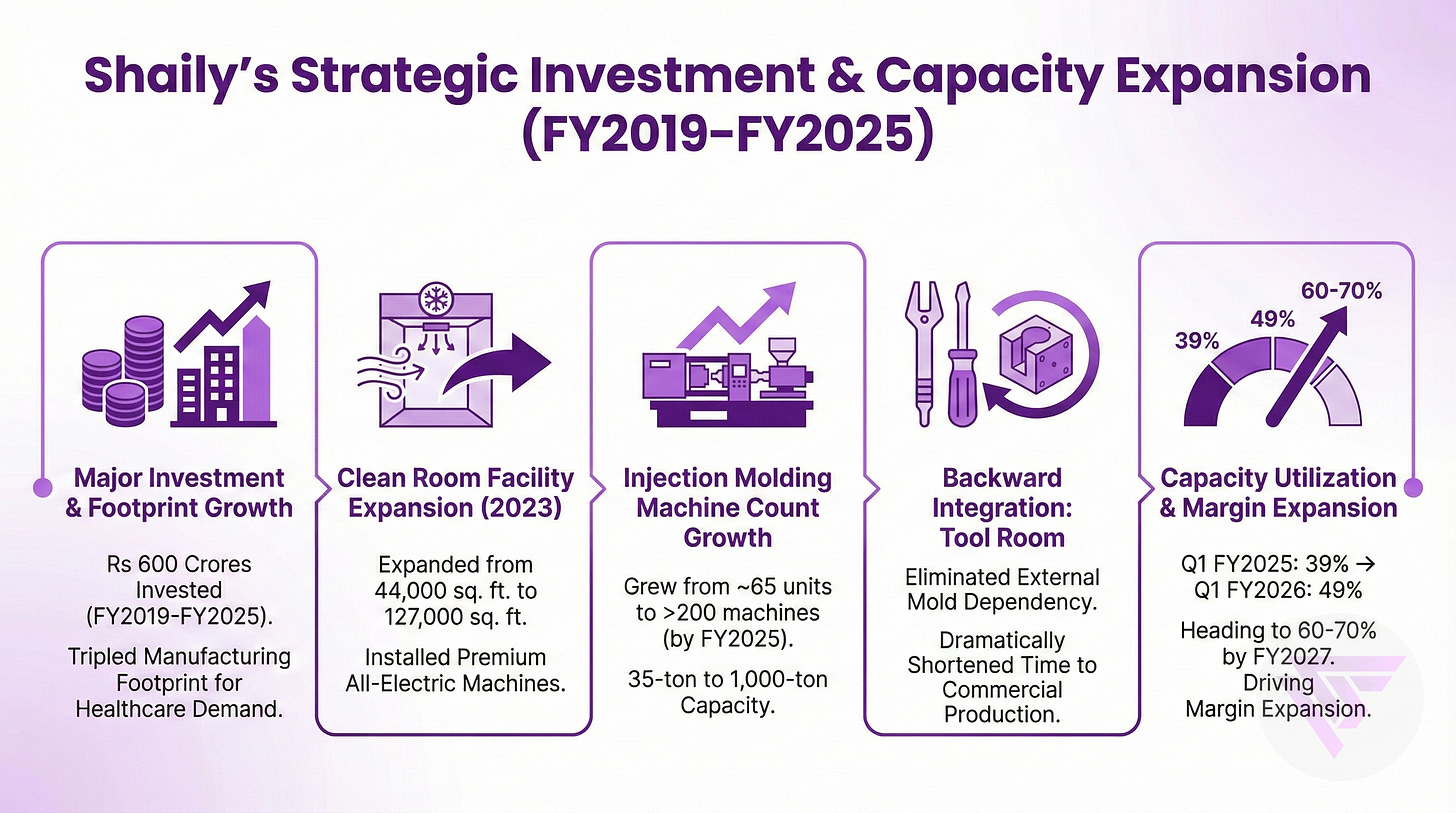

Shaily invested approximately Rs 600 crores between FY2019 and FY2025, effectively tripling manufacturing footprint in anticipation of healthcare segment demand materialization.

The pharmaceutical clean room facility expanded from 44,000 to 127,000 square feet in 2023, installing all-electric premium machines for medical device production.

Injection molding machine count grew from approximately 65 units to over 200 machines by FY2025, spanning 35-ton to 1,000-ton capacity for diverse applications.

Backward integration through a state-of-the-art tool room eliminated external mold dependency, dramatically shortening time from customer inquiry to commercial production for pharmaceuticals.

Capacity utilization improved from 39% in Q1 FY2025 to 49% in Q1 FY2026, heading toward 60-70% by FY2027.

7. Export Excellence

Export-led model with 75% of revenues from 40+ countries forces global quality standards, with United States representing largest single destination at 40-45% of exports.

Europe accounts for 30-35% of exports through Germany logistics hub, serving IKEA operations, Sanofi, and industrial clients like Siemens, Schneider Electric, and ABB.

Shaily Innovations FZCO incorporated in Dubai during 2025 positions the company closer to Middle Eastern pharmaceutical customers for high-value design and development work.

Geographic diversification across 40 countries reduces single-country risk.

8. The Bold Bet & Strategic Discipline

The Bold Bet

The strategic decision to establish Shaily UK Limited in September 2021 as a dedicated R&D and IP development subsidiary represents management’s boldest bet till date.

This required investing approximately Rs 50 crores over multiple years in intangible assets including patent filings, industrial design fees, regulatory documentation.

Also, maintaining a UK-based team without immediate revenue payback.

The conventional path would have been continuing as a contract manufacturer earning steady returns on tangible manufacturing assets, avoiding the risk and uncertainty of developing proprietary devices.

Management chose the harder path.

Recognizing that contract manufacturing offered limited upside as customers could always switch suppliers based purely on price. Owning differentiated IP would create pricing power and customer lock-in.

The validation came within three years as healthcare segment growth accelerated to 87% in FY2024 and 181% in Q1 FY2026.

Strategic Discipline

I was impressed after reading this one.

The company made around 25 to 30 Cr investment to enter the toys segment in 2020.

But, it quickly recognized that the segment suffered from low customer loyalty.

There was also fierce price competition from Chinese manufacturers willing to dump products below cost.

Rather than continuing to invest in a struggling segment, management admitted the strategic error, paused fresh investments in FY2023.

Eventually, shut down the toys business in FY2024, repurposing the Rs 25 to 30 crore investment in machines for other consumer and industrial products.

This willingness to exit unprofitable investments, even after committing capital, reveals a management team prioritizing long-term returns over short-term pride.

Their Consistency Strategy

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.