SCHNEIDER || Consistently Performing Stocks #31

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

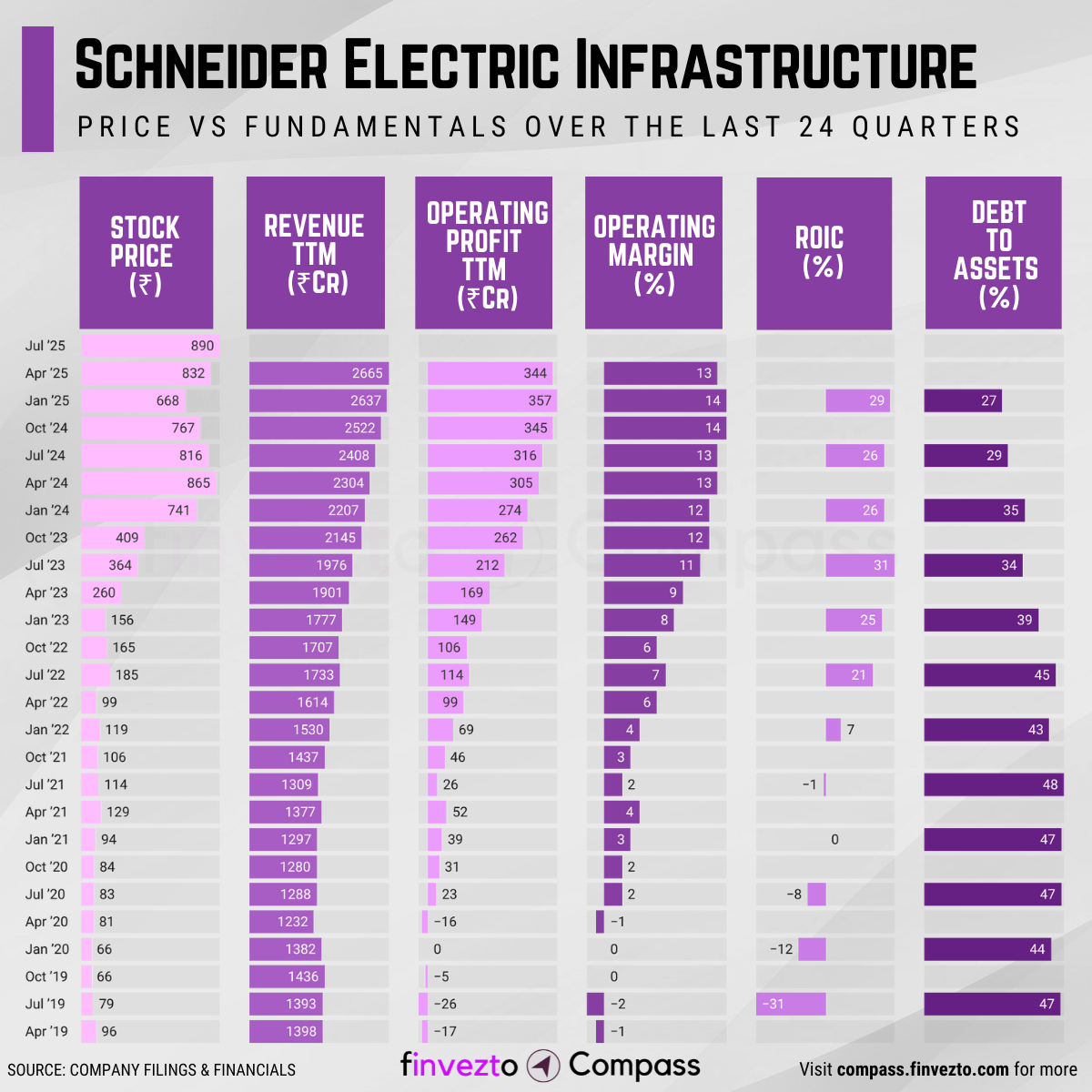

Today, we will look at the key fundamentals & business of Schneider Electric Infrastructure Ltd. Click here to learn more about each of the parameters in the chart below.

What Has Led to This Consistency

Company Overview

Schneider Electric Infrastructure Limited (SEIL) was incorporated in the year 2011. SEIL is engaged in the business of manufacturing, designing, building and servicing technologically advanced products and systems for electricity network.

Schneider Electric Infrastructure Limited emerged from the 2011 AREVA T&D demerger when Schneider Electric acquired the distribution business assets.

The company transformed from "Smartgrid Automation Distribution and Switchgear Limited" into a specialized Indian subsidiary focused on power infrastructure solutions.

Product Segments include:

Transformers and Power Equipment (distribution and power transformers for utilities and industrial applications)

Switchgear and Protection Systems (medium voltage switchgear and protection relays including the recently launched EasySet series)

Grid Automation and Digital Solutions (EcoStruxure platform, SCADA systems, and smart grid software)

Turnkey Solutions and Services (E-House solutions, project engineering, and maintenance services for substations and electrical infrastructure)

Revenue comes from equipment sales, turnkey project execution, and recurring service contracts for smart grid infrastructure maintenance.

Comprehensive grid & power-distribution portfolio

SEIL manufactures transformers, medium-voltage switchgear, protection relays, distribution-management systems, e-Houses, and smart-grid software, enabling end-to-end solutions for utilities and infrastructure.

Its also offers EcoStruxure’s connected products, edge control, and analytics layers, delivering digitally enabled power distribution and operational insights.

EcoStruxure is Schneider Electric's open, IoT-enabled, self-starting architecture and interoperable platform for homes, buildings, data centers, infrastructure and industries.

Key end markets include power generation, transmission and distribution, oil and gas, metro rail, and other electro-intensive segments across India.

Smart Grid Leadership

Schneider Electric Infrastructure dominates India's smart metering market through first-mover advantages and utility relationships.

Smart meter head-end systems integrate with existing utility infrastructure requiring specialized technical expertise and multi-year implementation → System dependencies

Advanced Metering Infrastructure expertise across multiple state electricity boards positions company for India's 250 million smart meter rollout program.

Decade-long utility relationships through pilot projects and successful deployments create institutional knowledge and trust

Regulatory expertise in utility compliance and certification processes enables faster project approvals and execution → Execution advantages

Global Technology Access & Strong Parentage

Parent company technology resources provide capabilities that domestic competitors cannot access or replicate.

SEIL is backed by global powerhouse Schneider Electric, a French multinational specializing in energy management and automation

Access to Schneider Electric's global EcoStruxure platform and IoT solutions developed through €1.5 billion annual R&D investment → Technology superiority

European manufacturing standards and quality processes transferred from parent company operations create premium product differentiation

Global procurement network and component sourcing reduces material costs by 15-20% through volume purchasing power → Cost efficiency

Alignment with CAPEX cycles

SEIL is well positioned for data-centre expansion. Management highlighted multi-gigawatt IT-load additions and Schneider’s energy-efficient solutions for the heavy load segment.

Metro rail and other electro-intensive segments remain core end-markets, supporting sustained project pipelines across states.

Utility modernisation and smart-grid programs provide recurring opportunities for digital upgrades and network automation at scale.

Utility Integration Depth

Deep technical relationships with power utilities create switching costs and procurement advantages.

Custom SCADA systems require extensive utility operator training and certification creating significant switching costs → Customer retention

Long-term service contracts include maintenance guarantees and technical support that ensure ongoing revenue streams → Revenue stability

Tata Power selected Schneider’s SF₆-free RM AirSeT RMUs for Mumbai and Delhi, targeting up to 75% carbon-footprint reduction and lower lifecycle costs.

State utilities like SBPDCL cite EcoStruxure Grid deployments that improved network visibility, reliability, and 24×7 uptime across substations and feeders.

Healthcare and critical-facility case studies demonstrate Schneider’s digital power solutions improving monitoring, operating expenses, and reliability in demanding environments. Critical utility infrastructure certifications require proven track records and take years to obtain → Regulatory barriers

Digital Flywheel

EcoStruxure Transformer Expert provides brand-agnostic sensor-plus-analytics monitoring via subscription, enabling condition-based maintenance and improved transformer reliability → Recurring Revenue

EcoCare service memberships, launched in India, bundle expert support, AI-assisted analytics, and priority interventions to minimise downtime and enhance safety.

Enterprise programs like Capgemini’s Energy Command Center showcase EcoStruxure plus EcoCare delivering unified energy management and resilience.

Consistency Formula

Smart Grid Leadership + Global Technology Access → Market Differentiation

Utility Integration Depth → Customer Trust and Lock-in

Alignment with CAPEX cycles + Digital Flywheel → Sustainable Demand and Revenue

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research