SHARDA MOTOR || Consistently Performing Stocks #44

What has led to the consistency?

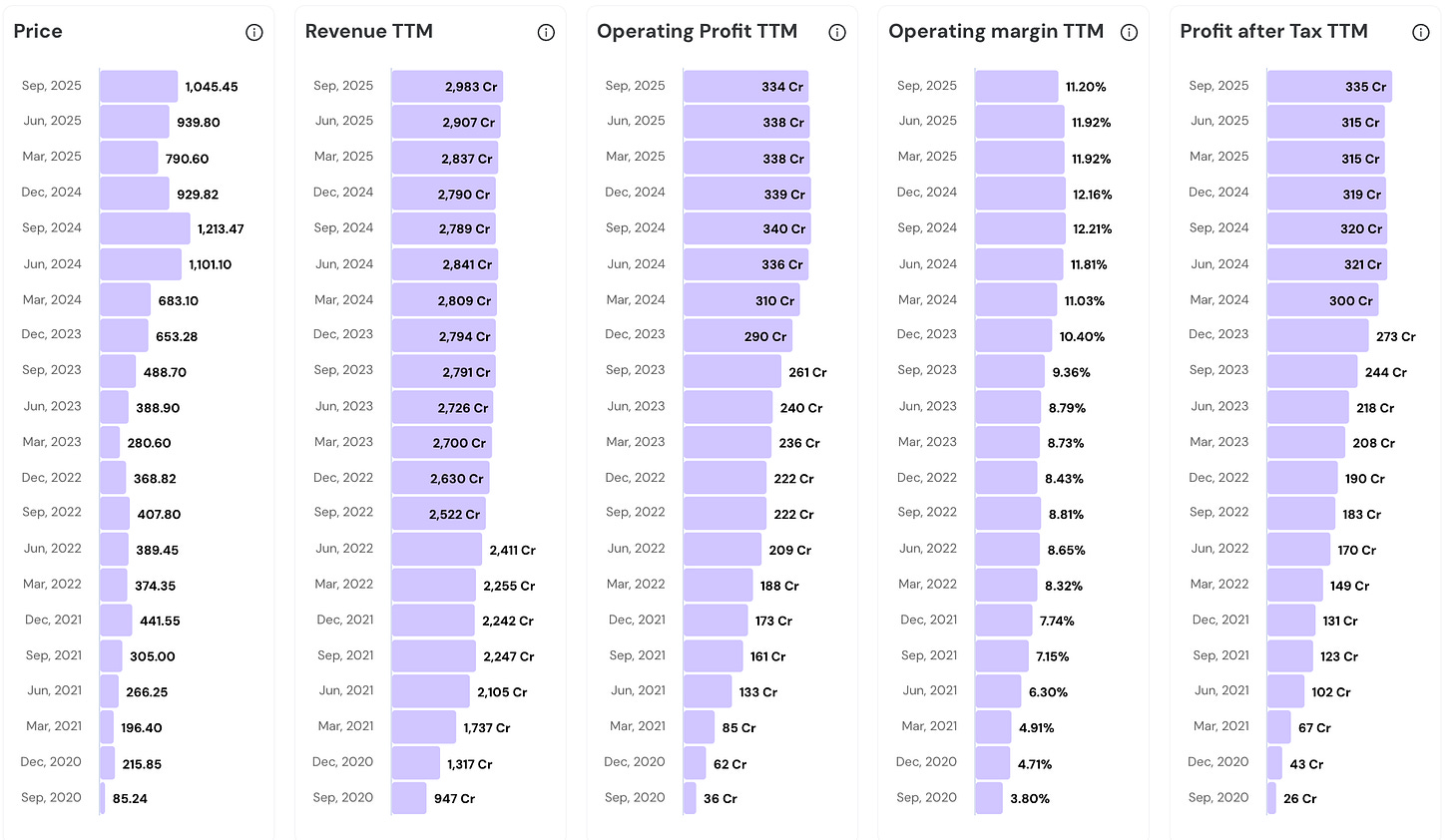

Since Sep 2020…

This Stock’s price has surged 12.3 times

Revenue has grown 3.1 times

Operating profit has grown 9.3 times

PAT has grown 12.9 times

Operating Margins have increased from 3.80% to 11.20%

Take a look at the numbers below. Incredible Consistency.Every time India tightens vehicle pollution norms, this 38-year-old company gets paid to help automakers comply.

Did you guess the stock?

Yes. Let us explore the business of Sharda Motor Industries today.

Their Road to Consistency

Overview & Business Model

Sharda Motor Industries makes money when cars need to breathe cleaner. The company manufactures exhaust systems and catalytic converters for vehicle manufacturers who have to comply with government emission norms.

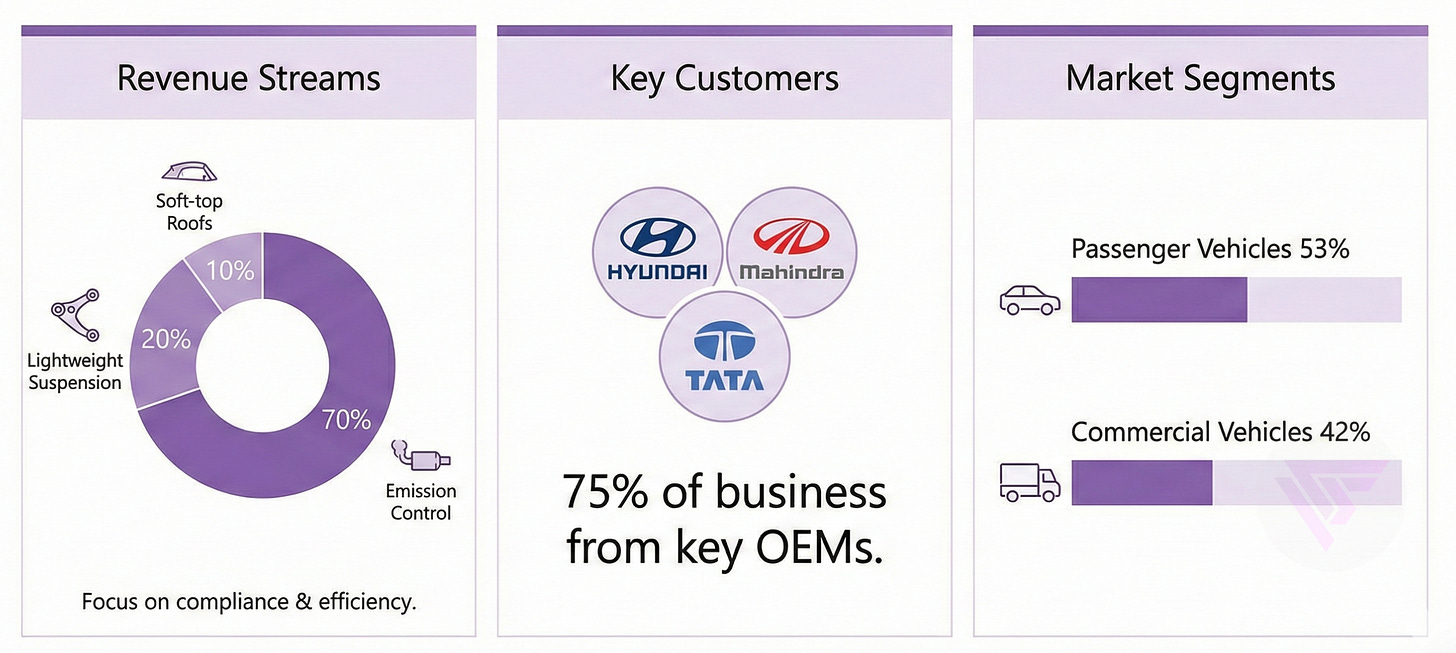

Revenue comes from three streams.

Emission control systems contribute 70% by supplying complete exhaust systems.

Lightweight suspension adds 20% through control arms that help meet fuel efficiency norms.

The remaining 10% comes from soft-top roofs and related components.

Three customers drive 75% of business: Hyundai Motor India, Mahindra and Mahindra, and Tata Motors.

Passenger vehicles account for 53% of sales and Commercial vehicles 42%.

The company operates 13 manufacturing plants across 4 states, each strategically placed near customer facilities. This proximity enables just-in-time delivery.

This location-based model has allowed Sharda to capture business whenever emission norms tighten, turning regulatory pressure into predictable revenue growth.

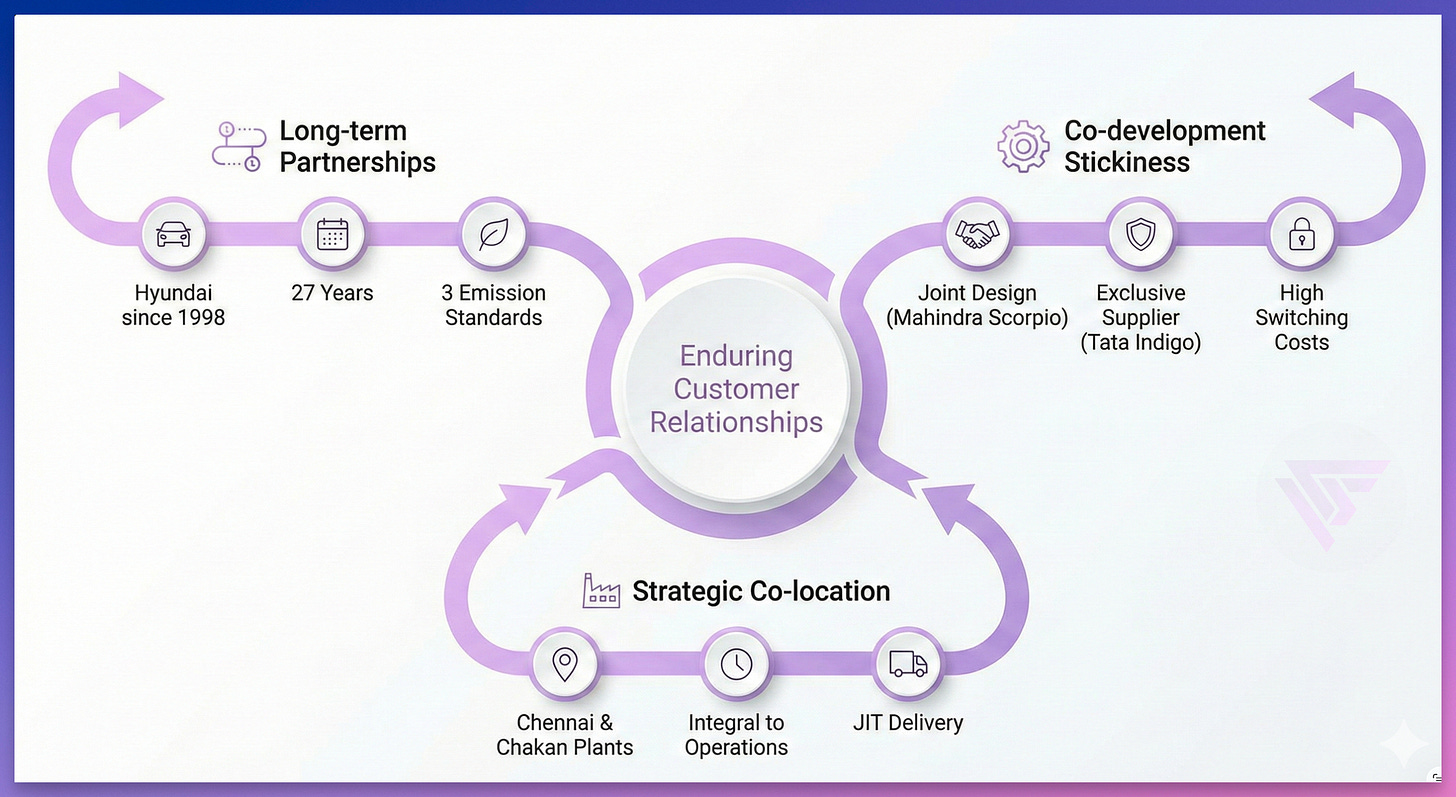

Customer relationships over decades

The Hyundai partnership began in 1998 when Sharda built a Chennai plant specifically to serve Hyundai. That relationship has now lasted 27 years through three generations of emission standards.

Customer loyalty emerges from co-development partnerships that make switching costly. Sharda jointly developed the Scorpio exhaust system with Mahindra’s engineering team.

The Indigo exhaust system was designed entirely in-house for Tata Motors, establishing exclusive supplier status.

The geographic strategy also reinforces customer stickiness. The Chennai plant sits adjacent to Hyundai’s manufacturing complex. The Chakan facility operate inside Mahindra’s supplier park.

This co-location enables daily deliveries and quick response to production changes, making Sharda integral to customer operations.

Product portfolio designed for Regulatory waves

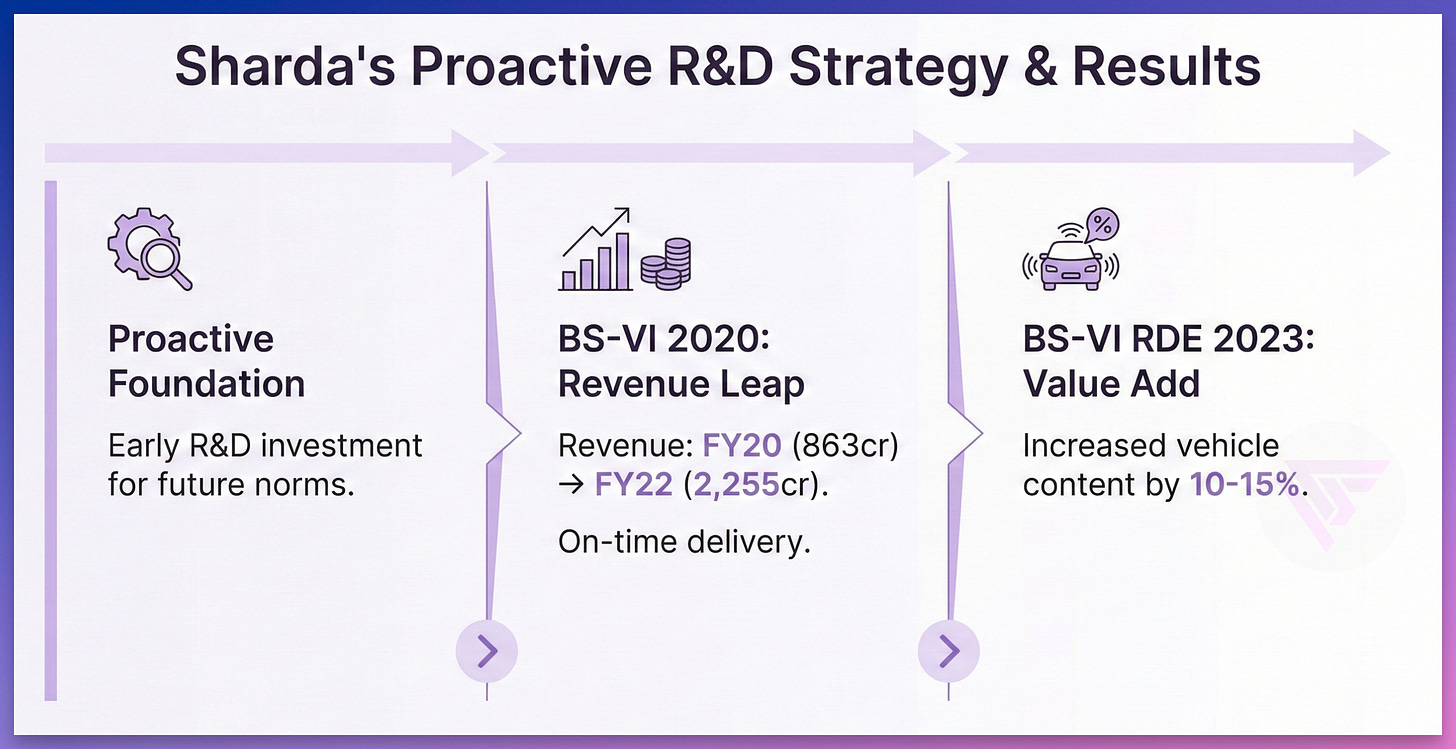

Sharda recognized early that India would follow global patterns of progressively stricter emission requirements. The company invested in R&D capabilities to have products ready before each regulatory deadline arrives.

The BS-VI transition in April 2020 demonstrated this strategy perfectly. Revenue jumped from 863 crore in FY20 to 2,255 crore by FY22 in just 3 years as customers awarded business to suppliers that could deliver on time.

The BS-VI RDE upgrade in April 2023 added another revenue layer without requiring major customer acquisition. Compliance required additional sensors and more sophisticated designs, increasing content per vehicle by 10 to 15 percent.

The lightweighting vertical provides diversification into products that serve both internal combustion and electric vehicles. This segment has grown at ~40% annually between FY21 and FY25.

The October 2025 technology license agreement with Donghee Industries of Korea will add torsion beams and sub-frames to this portfolio, creating a hedge against eventual electric vehicle adoption.

Manufacturing Footprint that delivers Reliability

Sharda operates plants in 4 states with deliberate redundancy that protects against regional disruptions. It enables just-in-time service to customers spread across India’s major automotive clusters.

Backward integration provides cost stability competitors cannot match. The company operates its own tube mills at Chennai, producing specialized steel tubes that form exhaust system backbones. The 53 stamping machines handle all critical component production internally.

Capital investment follows a disciplined 75 crore annual pattern tied to customer awards and regulatory deadlines. Chakan Plant II opened in March 2023 with 5.25 lakh units of capacity funded by 11 crore.

Their debt-free balance sheet enables investment discipline without financial pressure.

Sharda ended FY25 with over ~900 crore in cash, funding expansions from internal accruals rather than borrowing.

Manufacturing modernization continues incrementally through automation.

Technology & Partnerships

The Chennai R&D center employs over 100 engineers specializing in design, computational fluid dynamics, and acoustic testing. This team has filed 13 patents with 3 granted in the last 3 years.

Global partnerships provide access to technologies that would take years to develop independently. The joint venture with Purem of Germany gave Sharda immediate capability in the heavy commercial vehicle segment where it had limited presence.

The South Korea design center established in 2011 employs four engineers with over 20 years of experience each. They work directly with Korean automaker development teams near Hyundai and Kia’s research headquarters.

Technical collaborations extend beyond exhaust systems. The partnership with IIT Madras provides battery technology expertise for the Kinetic Green joint venture focused on lithium-ion battery packs.

Testing infrastructure validates designs before customer shipments begin. The Chennai facility houses hot vibration lab, flow testing laboratory, semi-anechoic chamber, thermal laboratory, and engine testing capabilities.

Strong Market Position

India’s passenger vehicle exhaust market effectively operates as a three-player oligopoly with Sharda holding roughly 30% share. The only competitors are Indian subsidiaries of global multinationals Tenneco and Faurecia.

Technical qualification processes protect existing supplier relationships. OEMs require extensive testing and validation before approving new exhaust system suppliers. Each vehicle platform requires separate qualification taking 18 to 24 months.

The domestic technology provider status provides Sharda a unique positioning. Foreign competitors must import technology and often key components from parent companies, creating lead time and cost disadvantages.

Scale advantages in tube manufacturing and stamping reinforce Sharda’s cost position. The captive facilities spread fixed costs across larger volume, creating roughly 200 to 300 basis points of cost advantage.

Management Execution with Discipline

Ajay Relan founded the company in 1986 and remains Managing Director, providing continuity of vision over nearly four decades. His son Aashim Relan serves as CEO, managing operations.

Capital allocation follows a stated hierarchy.

Organic growth capex receives first priority at the disciplined 75 crore annual run rate.

M&A opportunities focused on powertrain-agnostic products receive second priority.

Shareholder returns come third, demonstrated by the June 2024 buyback.

Succession planning has also progressed without disruption to operations.

Industry Timing & Preparedness

India’s auto component industry grew to 6.14 lakh Crore in FY24 with 9.8% annual growth. Government projections target industry expansion to 18 lakh Crore by 2030.

Emission norm transitions represent regulatory tailwinds that arrive on predictable schedules. The BS-VI implementation in April 2020 drove Sharda’s revenue from 863 crore to 2,700 crore over three years.

TREM V implementation for tractors scheduled for April 2026 will create an entirely new market segment roughly equal to the current commercial vehicle opportunity.

The China-plus-one sourcing trend creates export opportunities that did not exist five years ago. Sharda’s existing relationships with Indian subsidiaries of global automakers provide introduction pathways to international procurement teams.

Electric vehicle transition risk appears more limited than initial concerns suggested. Management estimates EV penetration in commercial vehicles will reach only 1 to 8 percent by 2028, giving the exhaust system business a longer runway.

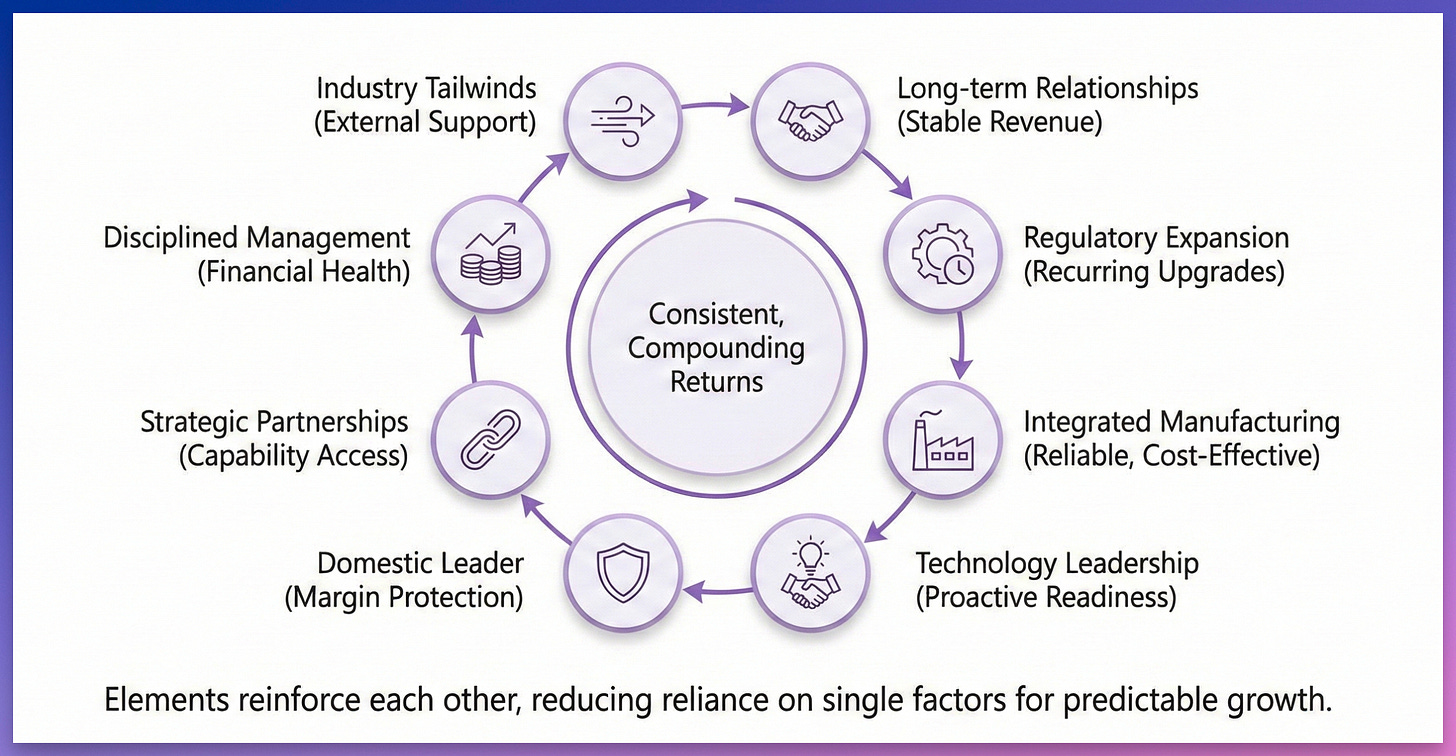

Their Consistency Strategy

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Advanced Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

The regulatory tailwind angle makes sense but you're betting heavily on ICE vehicle longevity here. Their 75 crore annual capex discipline is smart, but what happens when that TREM V tractor cycle peaks? Operating leverage can work both ways when volume drops.