The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

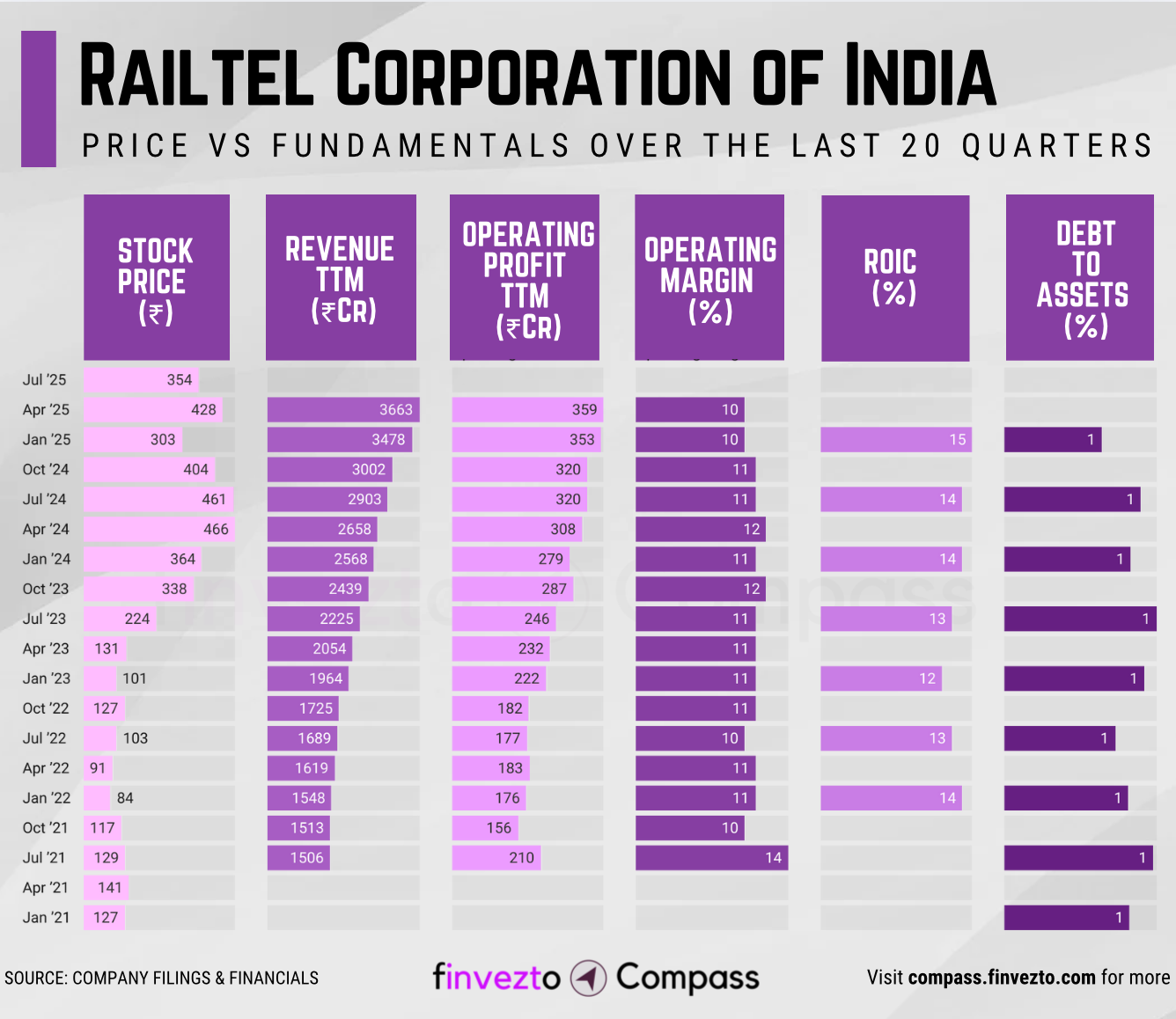

Today, we will look at the key fundamentals & business of Railtel Corporation of India Ltd. Click here to learn more about each of the parameters in the chart below.

What Has Led to This Consistency

Company Overview

RailTel Corporation, founded in 2000 under the Ministry of Railways, began as a public sector enterprise focused on railway telecom needs.

Leveraging access to the extensive railway network, RailTel has built a robust nationwide digital infrastructure.

Railtel is one of India’s leading neutral telecom infrastructure provider. A neutral telecom infrastructure provider basically builds, owns, and operates telecom infrastructure (like towers, fiber, data centers, etc.) without favoring any one telecom operator, and offers shared access to multiple operators on a non-discriminatory basis.

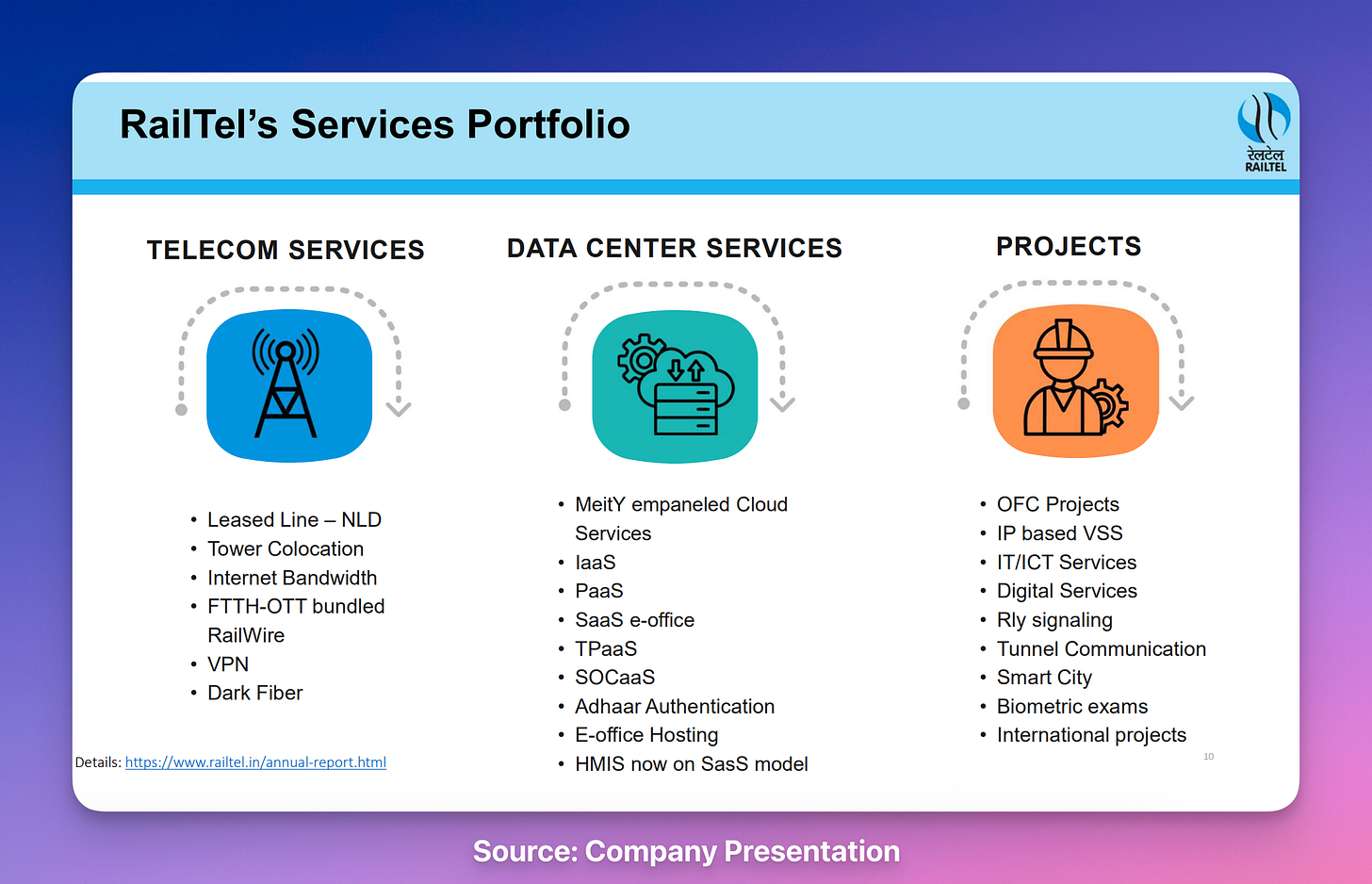

Railtel’s Product Segments include:

Telecom Services - MPLS VPN, leased lines, internet connectivity, tower colocation

Project Implementation - ICT deployment, railway signaling, digital infrastructure development

Data Center Operations - Cloud computing, cybersecurity solutions, enterprise hosting

Consumer Broadband - RailWire retail service with residential and SME focus

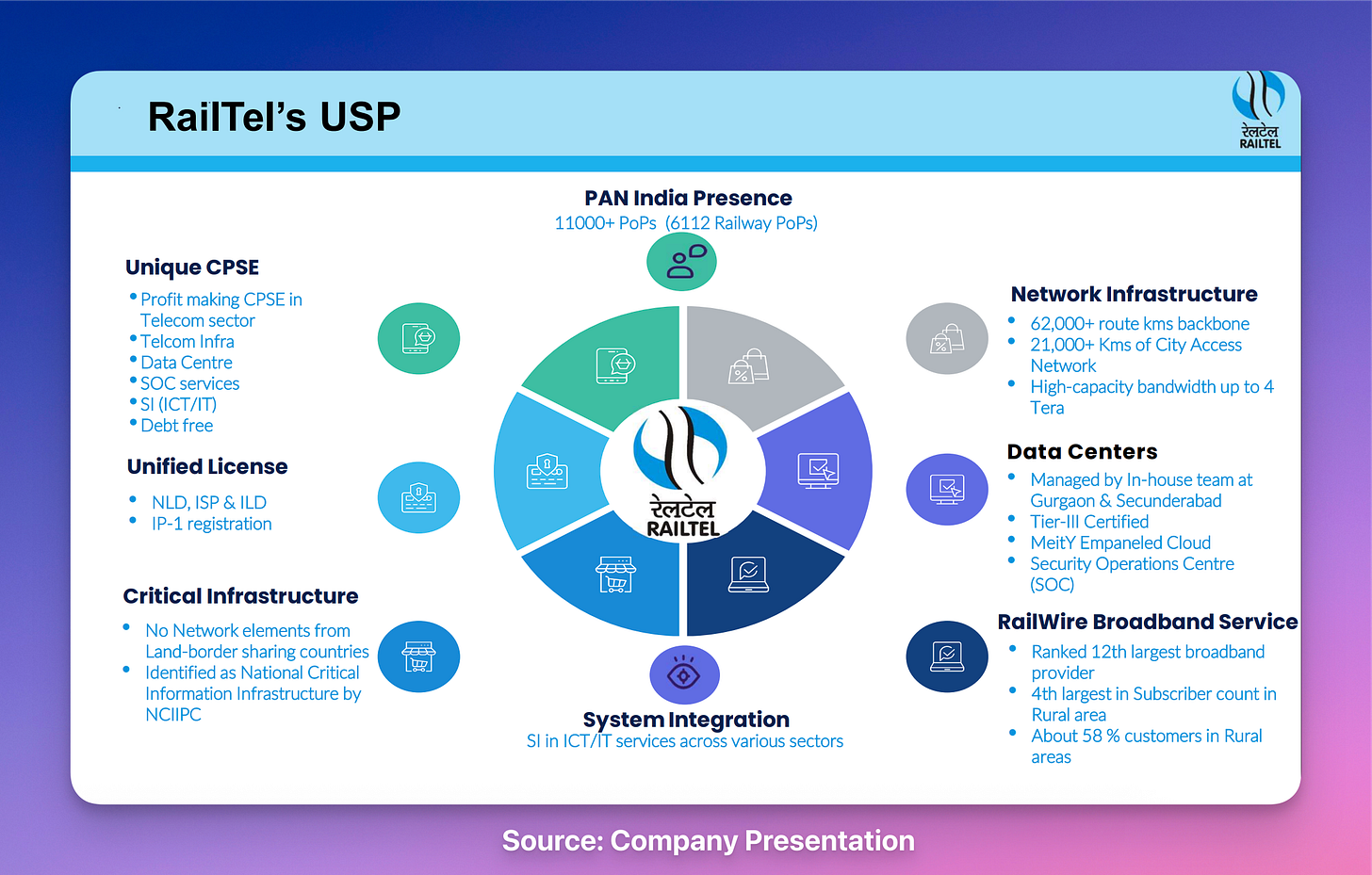

The company serves regulated market segments through institutional relationships and commercial service portfolio with specialized connectivity solutions. The key highlights of Railtel are mentioned in the slide below.

Infrastructure Monopoly

Exclusive 67,956 km railway corridor access provides unmatched deployment capabilities that private operators cannot replicate easily → Unmatched reach

Comprehensive fiber backbone spans urban centers to rural territories via cost-effective railway track deployment. RailTel leverages existing railway tracks to lay fiber, avoiding costly land acquisition and digging. → Cost advantages

Railway stations create natural telecom hubs at key transportation and commercial intersection points nationwide.

RailTel holds exclusive Right of Way (RoW) along railway tracks— a government-granted monopoly. Competitors can’t replicate this through buying land, creating a natural entry barrier and long-term strategic advantage.

Government Backing

Institutional relationships unlock preferential access to high-value project opportunities.

Navratna PSU status grants operational autonomy and direct access to high-value government telecommunications projects.

Ministry of Railways ownership provides preferential access to modernization budgets and infrastructure development projects.

Government's Digital India initiative and rural connectivity mandates create sustained infrastructure demand.

Network Effects

Points of Presence exceeding 11,000 locations create interconnection value. Each additional node increases network utility.

BharatNet fiber deployment spans 26,000+ kilometers connecting rural panchayats to digital economy. This network establishes RailTel as rural connectivity infrastructure backbone.

Railway station WiFi operations across 6,112 locations constitute world's largest public WiFi network. Network generates 50 lakh monthly user engagements. Advertising revenue opportunities could emerge from scale.

Customer acquisition costs decrease with network density. Expanded infrastructure creates self-reinforcing value proposition for enterprise clients.

Economies of scale

Single fiber optic network infrastructure supports telecom services, government projects, data center connectivity. Multiple revenue streams from shared infrastructure assets reduce per-unit costs → Asset leverage

Government project scale enables procurement advantages that reduce operational costs across all business segments → Procurement power

Network density of 11,000+ Points of Presence creates operational efficiencies for maintenance, monitoring, service delivery. Shared operational overhead across expanding customer base improves unit economics → Operational leverage

Fixed infrastructure investment amortized across growing revenue base from telecom services, project work, data centers. Higher utilization rates drive margin expansion without proportional cost increases → Cost optimization

Strategic Partnerships

Microsoft 5-year AI partnership positions RailTel at forefront of railway artificial intelligence adoption.

RailTel’s exclusive RDSO‑cleared system integration rights for Kavach safety systems entitle it to a technology monopoly. It is part of India’s ₹50,000‑crore rail modernization program.

Consistency Formula

Infrastructure Monopoly + Government Backing + Strategic Partnerships → Sustained Growth

Economies of scale + Network Effects → Pricing Power

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research