Precision Wires India || Consistently Performing Stocks #55

What has led to the consistency?

Each week I analyze one company's fundamentals as part of my research work. My goal is to understand what drives their consistent performance. This is an educational post to understand the business and not a recommendation to buy the stock.This week, Let’s explore the business & fundamentals of Precision Wires India

In the last 5 years…

- Stock price has grown 11.3 times (from 21.03 to 237.10)

- Revenue has grown 3.3 times (from 1,442 Cr to 4,713 Cr)

- Operating profit has surged 4.1 times (from 47 Cr to 195 Cr)

- PAT has surged 4.3 times (from 30 Cr to 130 Cr)

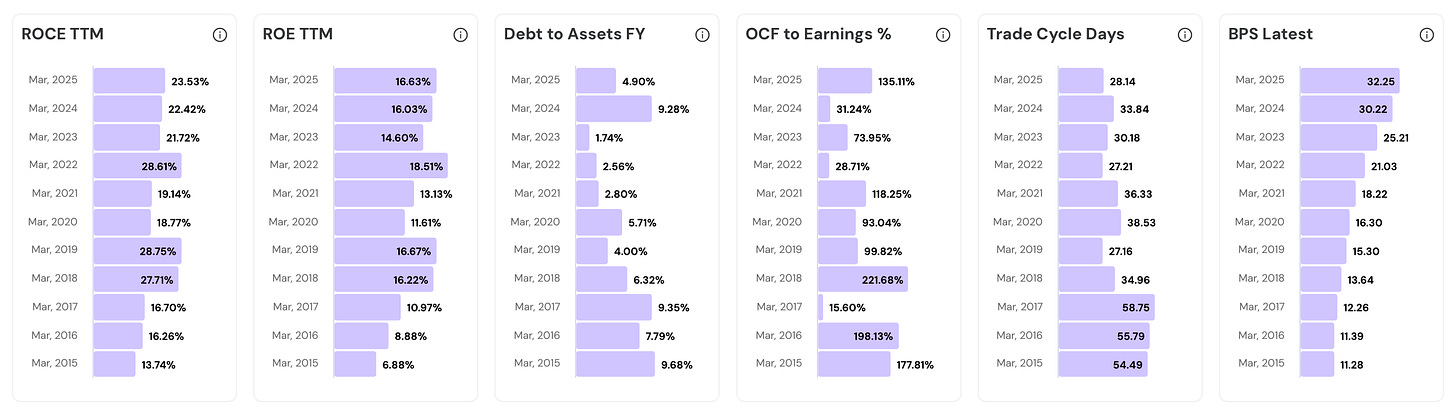

Take a look at the fundamentals chart below.Their Road to Consistency

1. Overview & Business Model

Precision Wires India Ltd. is South Asia’s largest copper winding wire manufacturer. Incorporated in 1989 and headquartered in Mumbai, it converts copper into specialized enamelled conductors that power transformers, motors, and EV drivetrains.

PWIL sits in the middle of India’s electrical supply chain. It buys copper rods and converts them into precision winding wires. It does not mine copper or build the final equipment.

Revenue Mix

Enamelled round copper winding wires form ~75% of revenue. They serve motors, generators, fans, compressors, and distribution transformers. This is the bread-and-butter segment.

Continuously Transposed Conductors (CTC) and Paper Insulated Copper Conductors (PICC) together contribute ~20% of revenue. Realisations here reach ₹8.3 to 8.5 lakh per MT, versus ₹7.9 lakh for round wire. These are higher-margin businesses.

The remaining ~5% comes from submersible winding wires for agricultural and industrial pumps.

Marquee Clientele

Their customers include CG Power, Hitachi Energy, Siemens, Lucas TVS and Mitsuba India. Marquee List of OEMs.

PWIL offers wire diameters from 0.018mm to 4.876mm, the widest range in India. This makes them a one-stop shop. No OEM needs to split its order across multiple suppliers.

Location Mix

Domestic sales at 85-88% of revenue are directly tied to India’s infrastructure capex cycle. Every new transformer or motor is a sale for PWIL.

Exports account for ~12% of revenue.

2. Grid Upgrade Tailwinds

India’s power infrastructure buildout is the single largest structural driver behind PWIL’s volume growth. India plans to double power sector capex by 2030. Every transformer, substation, and renewable energy installation in this buildout requires copper winding wire.

India added 86,433 MVA of transformation capacity in FY25, up 22% from the previous year.

The National Electricity Plan calls for 1,270 GVA of transformation capacity by 2032. PWIL is a preferred supplier to transformer OEMs serving this pipeline.

India’s renewable installed base reached 226.79 GW in Jun 2025 and is estimated to reach 500 GW by 2030.

Every solar park and wind farm requires step-up transformers. Substation construction is growing at 14% CAGR as per the National Electricity Plan. Renewable targets create transformer demand. Transformers create PWIL demand.

New BEE energy efficiency norms require 10 to 15% more copper per transformer to reduce no-load losses. Stricter standards upgrade every new transformer order to use more wire. Regulation is directly expanding PWIL’s volume per sale.

PWIL’s CTC product is specifically engineered for large high-voltage power transformers. CTC reduces electrical losses and is mandatory for 765 kV equipment. This segment has fewer competitors and healthier margins.

The Indian Railways has committed to 100% electrification. Traction motors and substations require copper winding wires. PWIL is an approved railway vendor, adding government spending as a revenue stream.

The data center boom in India is creating a new demand vertical. AI infrastructure requires massive backup generators and distinct power infrastructure. Every new data center cluster is a new category of industrial winding wire customer.

3. Copper Risk Neutralization

The single biggest risk in the wire business is copper price volatility. PWIL has structurally eliminated this risk through a back-to-back procurement model. Copper constitutes ~90% of operating costs, but none of that exposure flows through to margins.

PWIL purchases copper only after a confirmed customer order is placed. The purchase price and selling price are locked simultaneously at LME rates. Whether copper is at $8,000 or $11,000 per tonne, the margin is unaffected.

The model prevents speculative inventory buildup. PWIL does not hold large unallocated copper stocks hoping for price appreciation. Inventory days stayed tight at 30 in FY25. No problem when copper price corrects.

During the copper price spikes of 2024 and 2025, smaller unorganized players faced liquidity stress. PWIL kept producing uninterrupted.

Forex risk is managed through natural hedges and forward contracts. Copper is dollar-denominated globally. Even domestic purchases from Hindalco or Vedanta are priced to international benchmarks. Currency risk is actively managed.

OEM customers appreciate the pricing transparency. They pay LME average plus a conversion fee. No disruption during shortages.

4. Capacity Addition

Precision Wires has been adding capacity almost every year for the last decade. This is deliberate forward planning. The company builds ahead of demand, ensuring they never have to turn away an order.

Installed capacity grew from ~39,400 MTPA in FY23 to ~55,000 MTPA by December 2025. A ~6,000 MTPA expansion at Silvassa was completed on schedule. This indicates execution competence.

In Feb 2026, the board approved two additional Silvassa projects totaling 7,870 MTPA at ₹77 crore. This would push total capacity to ~68,500 MTPA. That is a 40% increase from just two years ago.

The Silvassa facility is the crown jewel. Recent modernizations increased production speed and quality. Being close to Mumbai port and Gujarat’s industrial belt is a logistical advantage. The location has been chosen with purpose.

Capital expenditure is largely funded through internal accruals. The ₹77 crore Silvassa approval uses a 50:50 mix of debt and internal cash. No equity dilution.

Economies of scale lower the fixed cost per tonne as capacity grows. Overheads of a 65,000 MT plant do not double those of a 30,000 MT plant. Operating leverage slowly widens.

5. Backward Integration Catalyst

The most significant strategic move in PWIL’s history is underway right now. The company is building copper refining and recycling capacity at Zaroli and Valvada in Gujarat. This shifts them from pure converter to partially integrated manufacturer. It changes their margin structure quite a lot in a good way.

PWIL is investing ₹220 to 240 crore to set up a copper refining and recycling unit at Zaroli, Gujarat. The plant processes copper scrap and blister copper into 99.99% pure cathodes and rods. Commercial production targets Q2 FY27. A step to move up in the value chain.

A copper rod manufacturing facility at Valvada, Gujarat is expected to start commercial production in Q1 FY27. Together, these two plants represent a complete backward integration into PWIL’s primary raw material. Aiming for supply chain control

At full utilization by FY28, these plants will supply 20% to 35% of total raw material requirements. This effectively gives PWIL a structural cost discount on up to 1/3rd of its production.

The economics work through the scrap spread. PWIL currently buys premium copper rods from Hindalco or Vedanta. Zaroli allows them to buy cheaper copper scrap instead. The refining margin that was paid to a supplier will now be retained internally.

Recycling copper is far less energy-intensive than refining virgin ore. This positions PWIL as a low-carbon supplier. European and American OEMs increasingly demand green supply chains, and Zaroli is a perfect ESG fit.

6. Value Chain Climb

Precision Wires is systematically replacing lower-margin standard wires with specialized, high-margin products. Every 1 Kg of copper processed earns more as the product mix tilts upward. This is the multiplier layered on top of volume growth.

Continuously Transposed Conductors (CTC) are the highest-value product in the portfolio. Multiple strands of enamelled wire are transposed to reduce electrical losses in giant transformers. Manufacturing CTC requires sophisticated machinery and precision expertise.

Paper Insulated Copper Conductors (PICC) target large power transformers with realisations of ₹8.3 to 8.5 lakh per MT. CTC and PICC together represent ~20% of revenue today. As transformer sizes grow, this share is set to expand.

Enamelled Rectangular Wires serve EV motors and high-efficiency industrial motors. Rectangular wire packs more copper into the same space, improving motor efficiency.

High-Thermal Class wires withstand temperatures of 200°C and above. Modern compact motors run hotter as they get smaller and more powerful.

Self-Solderable wires allow faster assembly at the customer’s end without stripping insulation. Electronics and appliance manufacturers pay a premium for this convenience.

Many of these specialized wires were historically imported. PWIL offers OEMs a domestic alternative with shorter lead times and no customs duty.

Realization per tonne has increased over the last five years, reflecting this mix improvement. Revenue has grown slightly faster than volumes. The shift is gradual but compounding.

7. EV Copper Multiplier

The electric vehicle transition is a volume multiplier for PWIL. Each vehicle switching from internal combustion to electric triples the copper winding wire content per car.

A battery electric vehicle uses 60 to 91 kg of copper versus 24 kg in a conventional petrol car. Motor windings account for the bulk of this jump. For every car switching to EV, PWIL’s revenue potential per vehicle triples.

EV motors require rectangular (flat) wires for high power density. Round wires leave gaps when wound into tight spaces. PWIL is aggressively expanding enamelled rectangular wire capacity to serve this specific demand.

PWIL has already secured OEM approvals from leading EV and hybrid vehicle manufacturers. Once a wire is designed into a vehicle platform, the supplier relationship typically lasts the full model lifecycle of 5 to 7 years.

India’s EV revolution is led by two-wheelers. TVS, Bajaj, and a wave of EV startups are powering hub and mid-drive motors with PWIL wires. This is a high-volume, fast-growing segment.

Hybrid vehicles also require substantial electric motors. The current surge in hybrid popularity led by Toyota and Maruti benefits PWIL just as much as pure EVs.

EV motors spin at up to 20,000 RPM and run extremely hot. Only high-temperature-index wires rated at 200°C and above can handle the stress. PWIL’s thermal capability solves these problems.

Fast chargers contain transformers and inductors that also use winding wires. Every new highway charging station adds to demand.

The build-out of the charging infrastructure creates a demand layer that exists separately from vehicle sales.

Lucas TVS and Mitsuba India, two major auto-component manufacturers, are PWIL’s top clients. These Tier-1 suppliers build alternators, starters, and motors for the broader auto industry. They funnel growth directly to PWIL.

8. Appliance Market Base

The consumer durables sector provides a steady, high-volume revenue base that balances the lumpy timing of infrastructure projects. India’s rising middle class is the fuel. Every new AC, washing machine, or refrigerator sold contains copper motors wound with wires.

India’s AC market is growing rapidly as summers intensify and incomes rise. Every AC compressor contains a motor requiring high-quality copper wire. PWIL is a key supplier to compressor manufacturers.

Global compressor giants have stringent quality approval processes because a sealed compressor failure destroys the entire unit. PWIL has cleared these approvals.

The shift to Inverter ACs requires more sophisticated motors and drives. Higher-grade enamelled wires handle variable frequencies better. Technology upgrades in appliances naturally pull the product mix toward PWIL’s premium offerings.

The Government’s PLI scheme for White Goods, covering ACs and LEDs, is encouraging global brands to source components domestically. The government is effectively subsidizing PWIL’s customer base.

Beyond ACs, motors in washing machines, refrigerator compressors, and fans are constant wire consumers. Rural penetration of these appliances is still expanding.

Ceiling fans alone represent a massive winding wire market in India. Microwave transformers add another layer. PWIL covers this entire appliance spectrum.

Consumer durables offer predictable seasonality. Demand surges in Q4 and Q1 before summer. PWIL can run production at full tilt precisely when demand peaks, maximizing capacity utilization during the most profitable periods.

Large appliance brands prefer fewer, larger vendors to simplify procurement. PWIL’s scale makes them the default choice for OEMs consolidating wire suppliers.

9. Risks

Several structural and operational risks deserve attention.

PWIL’s Operating margins have ranged between 4% and 6% for 5 years. This is inherent to the copper conversion model. Any competitive price war or efficiency disruption can wipe out a quarter’s profit quickly.

Interest expense has been rising steadily. It moved from ₹25 crore in FY22 to ₹47 crore in FY25 and ₹56 crore in trailing twelve months. Higher copper prices inflate working capital finance costs.

In Feb 2026, the borrowing limit was raised from ₹2,500 crore to ₹4,000 crore with ₹460 crore in new banking facilities.

All manufacturing is concentrated in the Silvassa-Gujarat corridor. Any regional disruption, natural disaster, or regulatory change could impact company-wide production. Single geography concentration.

BIS certification for winding wires is not mandatory in India. Substandard unorganized producers can undercut on price, especially in the round wire segment. Chinese manufacturers hold ~45% of global manufacturing capacity and 38 to 42% of global enamelled wire trade.

The backward integration plan is the biggest near-term catalyst, but it is also unproven. Copper refining involves complex chemical and metallurgical processes. The Zaroli plant has never operated. Execution risk is real.

There is also the succession question. The founder generation is transitioning to the second and third generation. Whether they maintain the same financial discipline under scale remains to be seen.

In the very long run, aluminum winding wires or advanced composite materials could challenge copper’s dominance in certain applications. The future of copper is not guaranteed forever.

10. Summary: Consistency Formula and Drivers

Precision Wires India’s consistency rests on 3 pillars.

Their copper procurement model removes the largest variable in the business.

Volume growth through rigorous capacity expansion.

And the slow tilt toward higher-value products (CTC, PICC, rectangular wires) ensures profits grow slightly faster than tonnage.

The business is now entering a new phase. Backward integration into copper refining at Zaroli and Valvada adds a margin expansion layer.

That’s it for today.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes. I do not recommend buying or selling stocks mentioned in this newsletter. I do not hold any positions in the stock discussed. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Build Wealth. With Clarity.

We give you a proven Flexi-Wealth System to build a Resilient Portfolio that works across market cycles. We believe your Wealth should be flexible enough to give you more options throughout your life. Learn more about the system at finvezto.com