POWER MECH PROJECTS || Consistently Performing Stocks #10

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business a little bit more, figure out the key growth drivers and identify broader industry trends & patterns. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

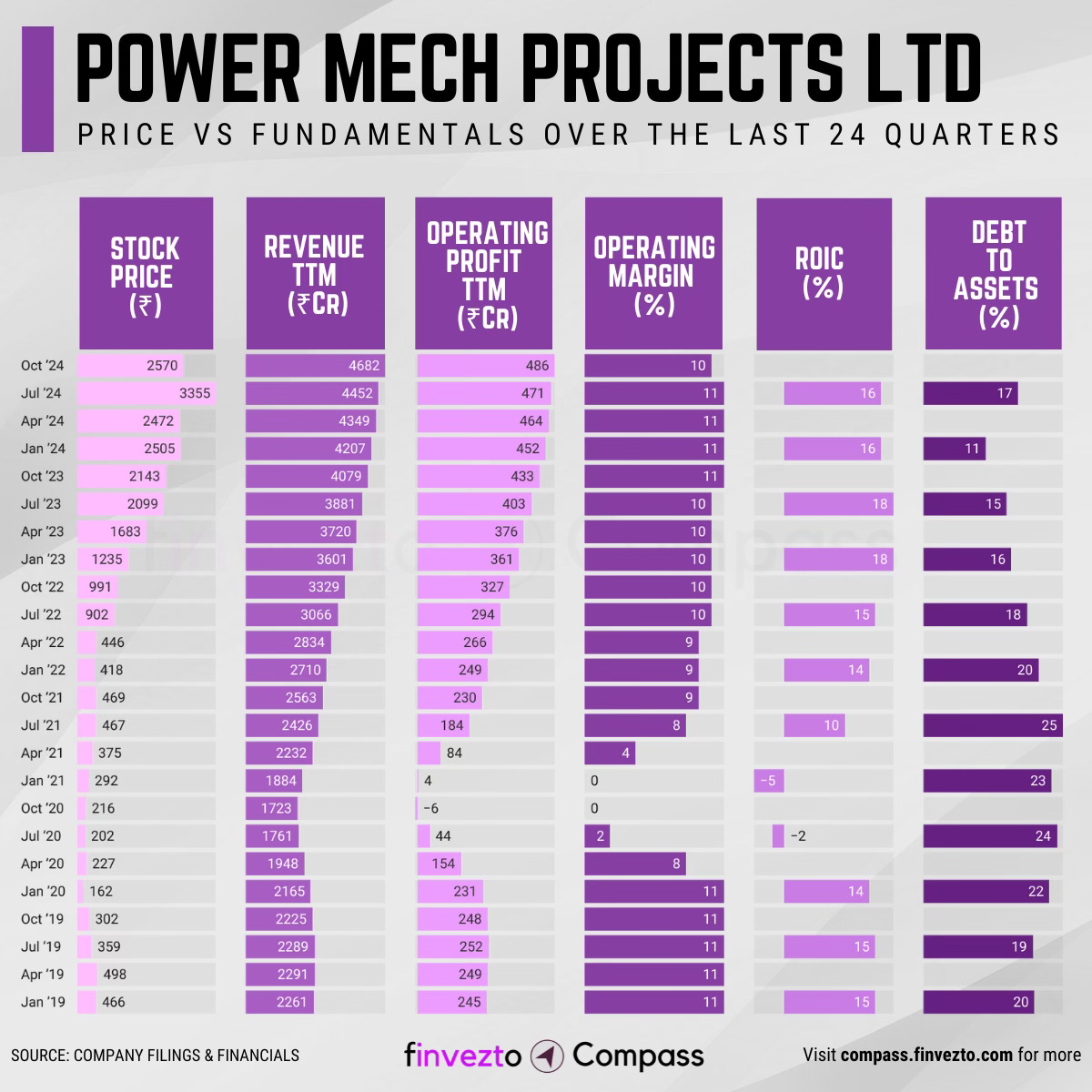

Today, we will look at the key fundamentals & business of Power Mech Projects Ltd.

What Has Led to This Consistency

Company Overview

Power Mech Projects Ltd. is an engineering, procurement, and construction (EPC) company in India, focusing on power, infrastructure, and industrial services. They handle entire project lifecycles, which includes tasks like erection, testing, commissioning, operation and maintenance, as well as civil works. The company operates across multiple business segments:

ETC: Power plant setup

O&M: Plant maintenance

Civil: Infrastructure construction

MDO: Mining operations

Water: Pipeline construction

Industrial: Cross-sector services

With a market share of about 3.5%, Power Mech is a prominent player in the EPC sector, managing over 4 lakh metric tonnes of work each year across 55 sites at once. Their success stems from strong execution skills, a skilled workforce, and solid relationships with key government organizations like NTPC and BHEL.

Sector Diversification

Power Mech has expanded beyond its initial power sector focus to establish a balanced portfolio across multiple industries including infrastructure (civil works, structural construction), mining (overburden removal, coal extraction), railways (electrified broad-gauge line construction), water projects (tube wells, pipelines, water tanks), and urban infrastructure (roads, industrial parks, buildings).

The company's expansion into non-power sectors leverages existing engineering expertise and opens new revenue streams. A significant development has been the growth of Mining Development Operations (MDO), which has emerged as a stable revenue driver through long-term contracts with Central Coalfields Ltd (CCL) and Steel Authority of India Ltd (SAIL), providing predictable income from open-cast mines with a capacity of 9 million tonnes per annum.

Execution Excellence

It handles complex projects with steep quality and safety requirements, as shown by its execution of the Kaiga Atomic Power Project in the nuclear sector.

Power Mech maintains a 98% project completion rate within quality benchmarks and a low incident rate of 0.2 compared to the industry average of 3.0.

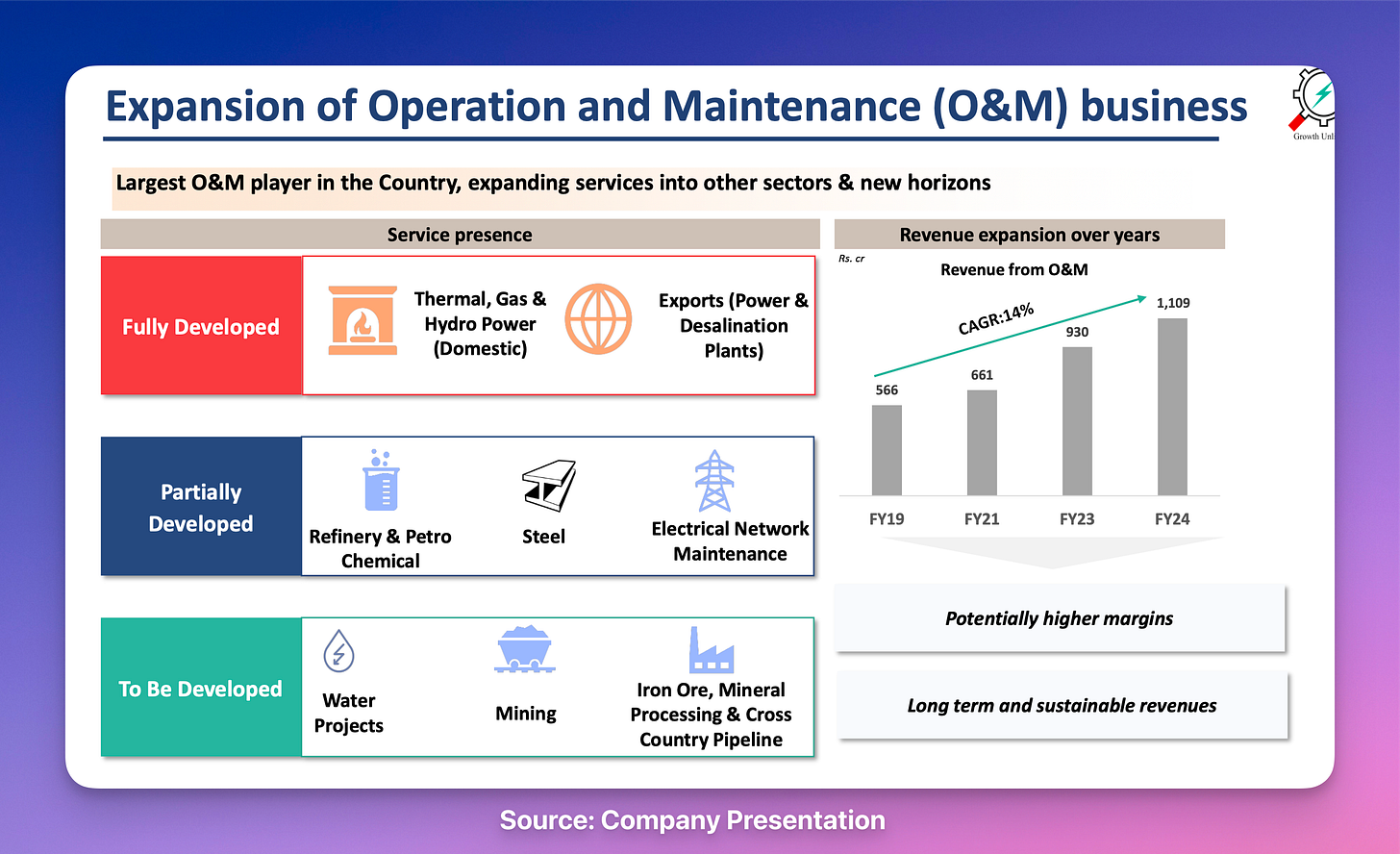

Recurring Revenue

Power Mech's Operations & Maintenance (O&M) services and Mining Development Operations provide recurring revenue streams with higher margins than traditional EPC contracts. O&M services have become the largest revenue contributor, covering power plants, petrochemicals, and process industries.

MDO projects generate income over decades with stable profit margins. This recurring revenue enhances financial stability and provides more predictable cash flows, reducing dependence on one-time project revenues.

Global Reach

Power Mech operates in over ten countries, including Saudi Arabia, Oman, Nigeria, and Bangladesh. This reduces dependence on domestic markets.

The company works through regional subsidiaries like MAS Powermech Arabia in Saudi Arabia and GTA Powermech Nigeria Ltd. International projects include O&M services for Dubai Electricity and Water Authority (DEWA) and Sharjah Electricity and Water Authority (SEWA).

Tech Integration

Power Mech uses IoT systems for real-time project monitoring, AI-driven predictive maintenance to reduce downtime in O&M operations, and modular construction techniques to accelerate project timelines.

Government Alignment

Power Mech benefits from India's infrastructure development under the National Infrastructure Pipeline (NIP) with its ₹109 trillion outlay.

The government's focus on sustainable energy projects aligns with Power Mech's expertise in thermal power plants and emerging sectors like nuclear energy.

The company will benefit from India's push for renewable energy (targeting 500 GW by 2030) and rural electrification programs worth ₹400 billion.

This alignment with national priorities ensures a steady pipeline of projects.

Client Relationships

Power Mech's focus on building long-term client relationships has resulted in a high proportion of repeat business:

Power Mech has a 90% client satisfaction rate. The company provides end-to-end solutions across multiple sectors, which leads to high client retention.

Feedback mechanisms track customer satisfaction with a target of 10% annual improvement. Effective communication and project management are frequently cited by clients as key strengths.

The company's ability to provide end-to-end solutions tailored to diverse client requirements ensures relevance to a wide range of industries.

Market Adaptability

Power Mech has expanded into emerging areas like Flue Gas Desulphurization (FGD) systems for thermal plants, keeping pace with environmental regulations.

The company has reduced carbon emissions by 25% over five years and aims for net-zero emissions by 2030.

Power Mech leverages emerging technological trends, implementing smart grid technologies and advanced construction methodologies.

Consistency Formula

Diversified Portfolio + Strong Order Book → Business Stability

Execution Excellence + Recurring Revenue → Predictable Financial Performance

Global Reach + Government Alignment → Market Access

Tech Integration + Market Adaptability → Competitive Edge

Client Relationships + Quality Delivery → Repeat Business

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services.

Conceptual Lessons & Deep Dives

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Useful & Actionable Stock Market Tools